You Could Soon Pay For Your Favorite Subscriptions In Stablecoins Via Stripe

Stripe’s quiet move to enable stablecoin subscription payments could revolutionize crypto usability, making Web3 and stablecoins a seamless part of everyday transactions.

Stripe surreptitiously revealed that it will allow stablecoin payments for subscriptions and other recurring transactions, not just one-offs. This signals its increasing commitment to crypto.

Such a feature could provide a major onramp for crypto functionality, making all of Web3 that much more mainstream.

Stripe’s Stablecoin Subscriptions

Stripe, a global leader in payments processing, has been incorporating stablecoins for the past few months now. This took place after major acquisitions as part of a broader strategy to re-enter the crypto space.

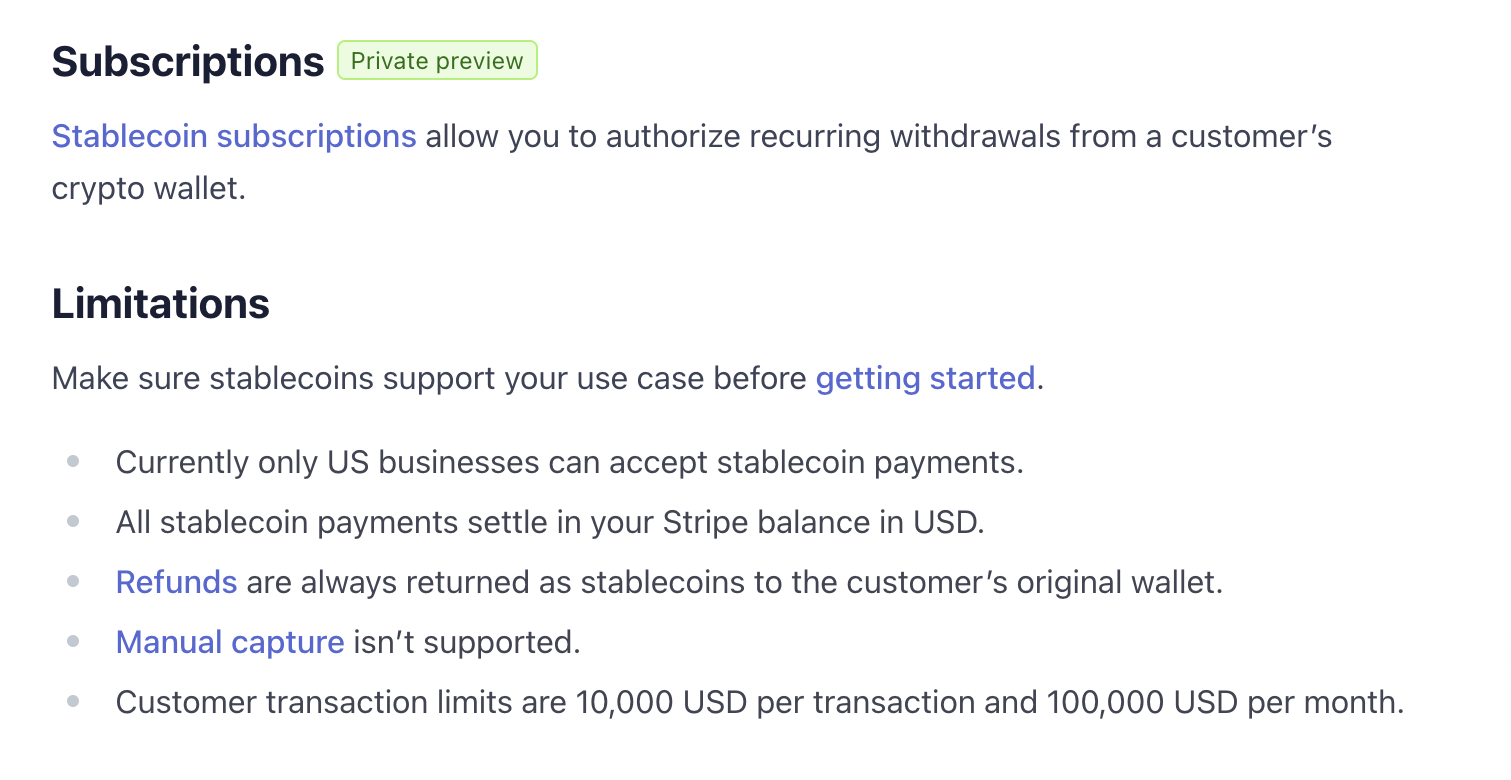

Today, unverified rumors have been circulating that Stripe would begin allowing stablecoins for subscription payments. Although the company hasn’t evidently announced it outright, a key clue corroborates these claims: a section labeled “private preview” on an FAQ page.

Stablecoin Subscription Payments. Source:

Stripe

Stablecoin Subscription Payments. Source:

Stripe

The line about subscription payments is very small, but still confirms that Stripe is adding or has already added this stablecoin functionality.

Such a move could have huge implications for crypto, enabling a major new onramp and functionality for stablecoins.

So far, it seems likely that USDC will continue being Stripe’s main stablecoin for this feature, but a lot is unclear. Either way, recurring payment functionality would fully cement this corporate giant’s interest in Web3.

Slack, Squarespace, Notion, and Shopify are just some of the big names that use Stripe’s payment module for subscriptions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Markets Today: Bitcoin Slips Below $90000, Yen Eyes Recovery, Gold Hits 1-Week Lows as Markets Brace for US Data

While broader markets fluctuate, specialized crypto-gaming projects are steadily gaining momentum

- Kamirai bridges DeFi and gaming via Kamirex Exchange, a high-speed DEX for Asia's crypto demand, and a PlayStation/Xbox RPG using its token for transactions and governance. - $HUGS meme coin leverages Milk Mocha IP with 60% APY staking, deflationary token burns, and charity-linked revenue, combining viral branding with blockchain utility. - Mutuum Finance's Ethereum-based lending protocol raised $18.7M in presale, offering institutional-grade DeFi solutions with 250% token price growth and 18,000+ holder

Bitcoin News Today: 95% of Bitcoin's Supply Reached—A Powerful Symbol of Scarcity Triumphing Over Fiat Currency Devaluation

- Bitcoin's supply now exceeds 95% of its 21 million cap, with 2.05 million remaining to be mined by 2140 via halving mechanisms. - The 2024 halving reduced block rewards to 3.125 BTC, intensifying miner reliance on fees as output halves every four years. - Experts highlight Bitcoin's scarcity as a hedge against fiat debasement, though price impacts remain limited as adoption and regulation gain priority. - New projects like Bitcoin Munari aim to replicate Bitcoin's capped supply model while adding program

AI Industry's Contrasting Approaches: C3.ai Faces Downturn While SoundHound Rises on Strong Cash Flow

- C3.ai faces declining revenue (-20% YoY) and widening net losses ($117M Q1 FY2026), driven by margin compression from IPD sales and operational reorganization risks. - SoundHound AI leverages $269M cash reserves to expand conversational AI, achieving 68% YoY revenue growth and strategic acquisitions like Interactions. - Citigroup's strong Q4 earnings ($2.24/share) and dividend hike attract institutional investors, contrasting with AI sector's fragmented performance and valuation challenges. - Divergent A