Key Market Information Discrepancy on October 15th - A Must-Read! | Alpha Morning Report

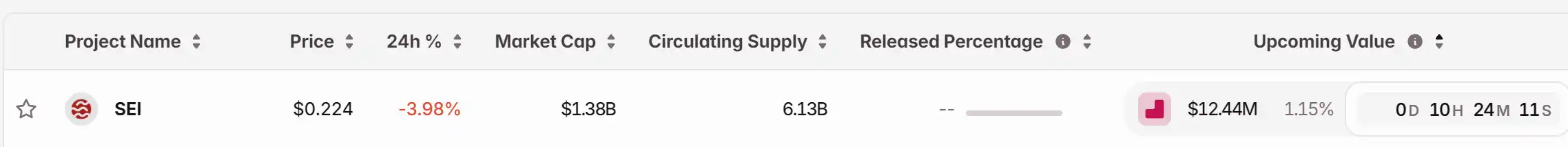

1.Top新闻:鲍威尔暗示支持进一步降息,因美国就业市场降温 2.代币解锁:$SEI

Top News

1.Powell Suggests Support for Further Rate Cuts as U.S. Job Market Cools

2.BNB Chain and Four.Meme's First Batch of "Rebirth Support" Airdrop Has Been Successfully Distributed

3.Farcaster Announces Suspension of Deposit Bonus Event Registration

4.Binance Denies Allegations of Charging Listing Fees and Dumping Tokens

5.Over $697 Million Liquidated Across the Network in the Past 24 Hours, Over 200,000 People Liquidated

Articles & Threads

1. "The Enrichment of Those Who Quietly Get Rich Through Arbitrage on Polymarket"

After receiving a $2 billion investment, Polymarket is valued at $9 billion, one of the highest funding amounts a project in the Crypto space has received in recent years. For those who know how to truly make money on Polymarket, this is a golden age. While most people treat Polymarket as a gambling den, smart money sees it as an arbitrage tool. In the following in-depth article, BlockBeats interviewed three seasoned Polymarket players to dissect their money-making strategies.

2. "Can We Still Call the Coins We Are Speculating on Meme Coins?"

The "1011" flash crash came so suddenly that upon waking up, everyone's attention followed the market's bloodbath. Nevertheless, despite this, with the market quickly recovering, especially with $BNB hitting an all-time high, the BSC meme market remains very active. The various discussions about the BSC meme coin market, although no longer the top hot topic where "gods are fighting", are still worth further consideration.

Market Data

Daily Market Overall Capital Heat (reflected by funding rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Privacy Coins and Market Fluctuations: Uncovering the Factors Behind ZEC's Latest Price Jump

- Zcash (ZEC) surged 700% in late 2025 driven by institutional backing and network upgrades like the Zashi wallet. - Regulatory pressures and market fragmentation intensified as exchanges delisted privacy coins and liquidity shifted to decentralized platforms. - ZEC's volatility reflects macroeconomic tailwinds and speculative demand, but its long-term viability hinges on balancing privacy with regulatory compliance. - Institutional adoption of privacy coins accelerated in 2025, yet fragmented markets and

Why Dash (DASH) Is Soaring as Institutions Embrace It and Privacy Concerns Fuel Demand

- Dash (DASH) surged 150% in June 2025, driven by institutional adoption and privacy-focused demand. - Institutional ownership reached 90.64% after AGF Management's $7.79M investment and DoorDash's $450M partnership. - Dash Platform 2.0 enhanced scalability while PrivateSend usage grew 25% YoY amid rising privacy needs. - Regulatory challenges persist under EU MiCA and SEC scrutiny, prompting multi-jurisdictional compliance strategies. - DeFi integration and Latin American adoption expanded DASH's utility

ZK Atlas Upgrade: Pioneering the Future of Blockchain Infrastructure for Enhanced DeFi Scalability

- ZKsync's 2025 Atlas Upgrade revolutionizes DeFi scalability via zero-knowledge rollups, boosting transaction throughput to 43,000 TPS and slashing costs to $0.0001 per transfer. - Modular architecture with Atlas Sequencer and Airbender Prover enables real-time execution, while zkSync OS supports EVM/WASM compatibility and cross-chain liquidity unification. - Post-upgrade DeFi metrics show 300% transaction volume growth and $0.28–$1.32 ZK token price projections, positioning ZKsync as a key Layer 2 infras

Bloomberg: Power Theft Exceeds $1 Billion as Malaysia Bitcoin Mining Rigs Overwhelm

Malaysia has uncovered approximately 14,000 illegal cryptocurrency mining sites in the past five years, causing the state-owned power company losses of over $1.1 billion. In response, the local government established a special committee in November 2025 to consider a total ban on mining,