Powell Signals QT May End — Is This the Liquidity Boost Crypto Needs?

Recent comments from Federal Reserve Chair Jerome Powell have sparked intense debate about whether the crypto market could soon enter a new bull cycle fueled by quantitative easing (QE).

What do analysts say about this possibility? Here’s a closer look.

Could the Fed Restart QE in the Coming Months?

During his speech at the National Association for Business Economics (NABE) conference on October 14, 2025, Powell revealed that the Fed is considering ending its quantitative tightening (QT) program.

He emphasized that bank reserves are approaching an adequate level. According to Powell, QT could end soon to avoid excessive liquidity tightening, which might hurt economic growth.

Analysts noted that halting QT could pave the way for QE, meaning the Fed could inject liquidity back into the market, similar to what it did during the COVID-19 pandemic.

If QE begins, Bitcoin could be one of the biggest beneficiaries. Historically, QE has driven risk assets higher, as seen in 2020–2021 when Bitcoin surged from below $10,000 to over $60,000.

The Fed could restart QE in the coming months https://t.co/VVBpQsd1GY pic.twitter.com/Y2sBpa5E1v

— zerohedge (@zerohedge) October 14, 2025

This shift would also affect altcoins. Arthur Hayes, co-founder of BitMEX, declared that QT has effectively ended and called it a major buying opportunity.

“There you have it, QT is over. Back up the fucking truck and buy everything,” Arthur Hayes, Co-Founder of BitMEX, said.

Some analysts believe the market will start seeing the effects of this decision within the next six months.

What Happens to Bitcoin If QT Ends but QE Doesn’t Start?

Not everyone shares the same optimism.

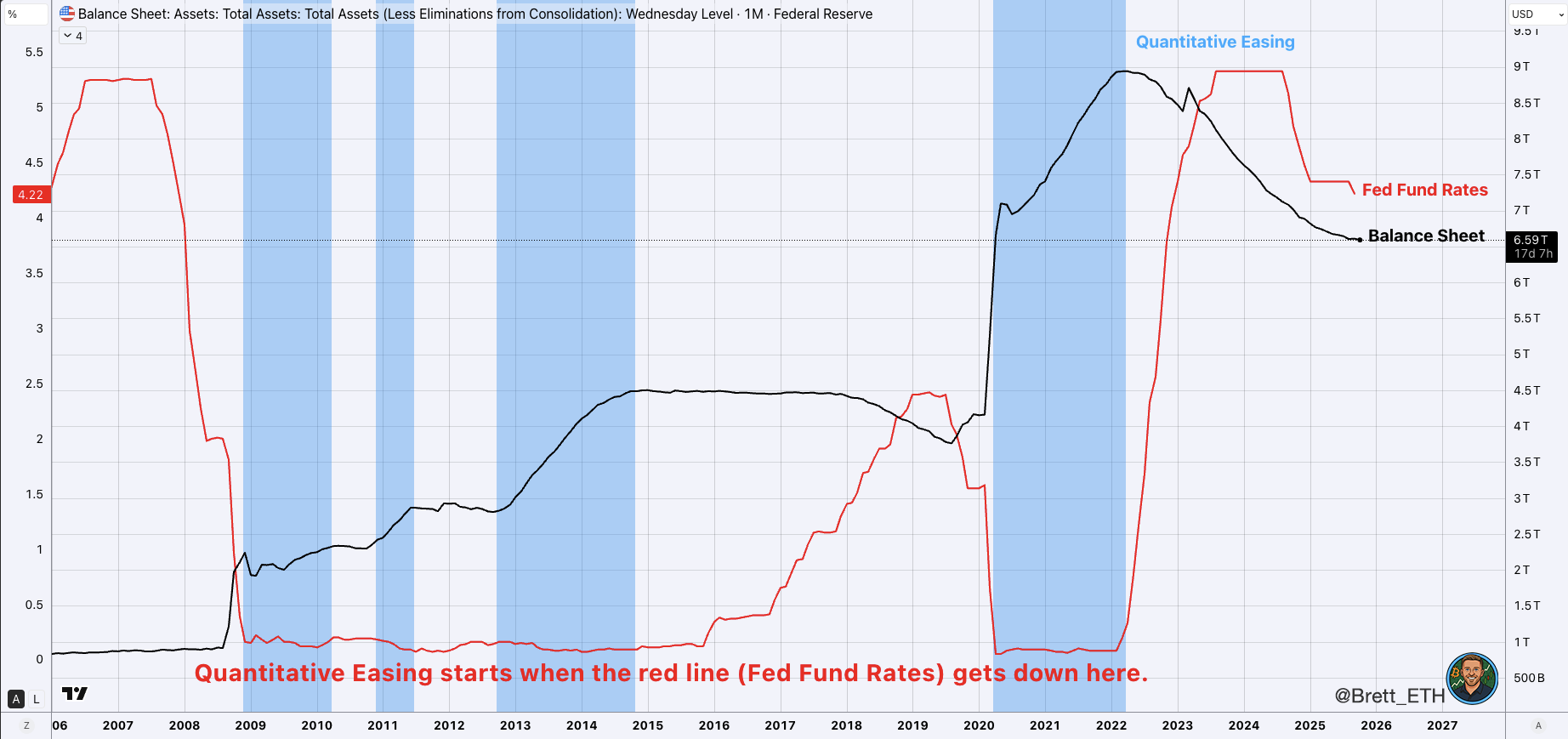

For example, analyst Brett argued that many interpretations of Powell’s remarks have gone too far. He pointed out that QE typically occurs only when the federal funds rate is near zero, while it currently remains at 4.2%.

Powell merely suggested that the Fed might soon finish shrinking its balance sheet. Ending QT does not automatically mean QE will begin.

“Notice how QE (blue shaded area) does not start until the fed funds rate is near 0. We’re still at 4.2. It would take an economic disaster and likely 12 months of cuts to get to that level before QE was introduced,” Brett explained.

Regarding Bitcoin’s reaction, Brett believes the asset tends to move in cycles rather than directly responding to QE or QT. In his view, Bitcoin’s long-term trends operate somewhat independently from monetary policy.

Bitcoin tends to care more about cycles than QE & QT.

— ₿rett (@brett_eth) October 14, 2025

🟪 = Fed ending QT or QE (the phase we're entering in a few months, per Powell.)

🟥 = QT

🟦 = QE

Notice how Bitcoin goes up and down in both QT and QE. Bitcoin is much more cyclical than people want to admit.

Is QE… pic.twitter.com/cZIJ8LcSLu

However, historical data since 2011 shows that Bitcoin usually declines for several months after each QE or QT phase ends. This raises the question of whether this time will be any different.

In short, if the Fed restarts QE, Bitcoin could surge as liquidity floods the market. But if the Fed merely ends QT without introducing new money, the outlook becomes riskier.

The market now awaits upcoming data on the Producer Price Index (PPI) and unemployment rates, which could offer clearer clues about the future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin due 2026 bottom as exchange volumes grind lower: Analysis

samczsun: The Key to Crypto Protocol Security Lies in Proactive Re-Auditing

Bug bounty programs are passive measures, while security protection requires proactive advancement.

Millennials with the most cryptocurrency holdings are reaching the peak of divorce, but the law is not yet prepared.

The biggest problem faced by most parties is that they have no idea their spouse holds cryptocurrency.

Using "zero fees" as a gimmick, is Lighter's actual cost 5–10 times higher?

What standard accounts receive from Lighter is not free trading, but rather slower transactions. This delay is turned into a source of profit by faster participants.