Crypto Markets Today: Crypto Lags Behind Stocks and Gold as Traders Turn Defensive

Cryptocurrencies struggled to mirror bullish moves in equities and precious metals on Wednesday, with BTC posting a modest gain while trading at $112,000, the lower side of its range.

Altcoins performed even worse as FET dropped by 6.2% after Ocean Protocol decided to leave the ASI Alliance and reportedly offload its tokens on Binance. There was also a 10% decline for MYX and a 4% move to the downside for CAKE as as "altcoin season" index on CoinMarketCap slumped to 38/100, despite being at 67/100 earlier this month.

Derivatives Positioning

- XPL, ASTER, SUI, and LINK have experienced a notable rise in futures open interest, while the top 10 tokens present a mixed performance overall.

- A whale address, labeled 0xc2a3, opened a 5x short in BTC worth $140 million on Hyperliquid.

- BTC futures open interest on Binance jumped by $510 million during the Asian hours as a trader moved $89 million in USDC to the exchange, possibly to short futures.

- Perpetual funding rates for majors, including bitcoin and ether, held flat-to-negative, implying a cautious sentiment.

- BTC futures activity on the CME remains subdued while open interest in options zoomed to a record high of 61.44K BTC. Positioning in ether futures and options remained elevated near lifetime peaks.

- On Deribit, put skew in short- and near-dated BTC options increased slightly during the overnight trade. Flows over OTC desk Paradigm featured a long position in the Oct 18 expiry $108K BTC put.

Token Talk

By Oliver Knight

- FET$0.3113, formerly fetch.ai, has suffered a grueling week; losing 43% of its value during a sell-off spurred by Ocean Protocol's decision to leave the Alliance.

- "As many of you have seen, Ocean Protocol has chosen to step away from the ASI Alliance," the company wrote on X. "In parallel, there’s been noticeable market activity involving large transfers of FET tokens from wallets associated with Ocean Protocol to Binance."

- The token suffered a flash crash on Oct. 10 along with the wider crypto market, but since then the price action has been exhibiting behavior of persistent selling, with little to no respite for buyers.

- FET is now trading at $0.31, its lowest point in two years having eroded all of the bullish gains over the recent bull market.

- At one point in 2024 it had topped $3.11 amid a wave of AI-related bullish sentiment, but it has lacked a spark ever since.

- The move is reflective of the bubbling nature of AI, with the IMF warning on Wednesday that if the AI bubble burst it could rival the infamous dotcom crash.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

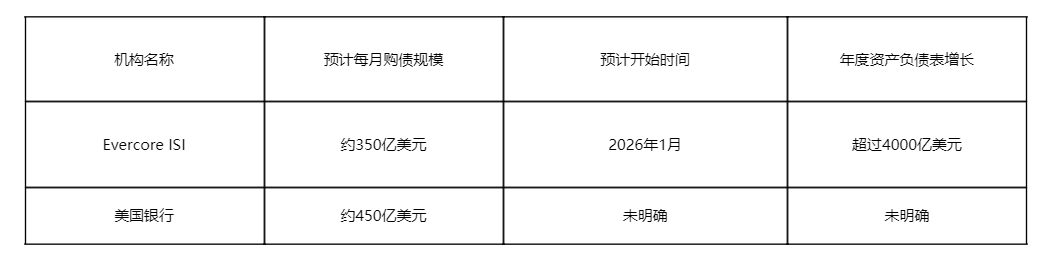

Trump Takes Control of the Federal Reserve: The Impact on Bitcoin in the Coming Months

The U.S. financial system is undergoing its most significant transformation in a century.

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

Move forward with pragmatic optimism.

Undercurrents Surge: Crypto Whales Spark Another Wave of Accumulation

Fed Decision Preview: Balance Sheet Expansion Signals Are More Important Than Rate Cuts