$36.5M in BNB Donated to Maltese Cancer Patients Unclaimed After 7 Years—Here's Why

Coinbase executive Conor Grogan has called for an old fund for Maltese cancer patients on Binance to finally be transferred to and used in the European island nation.

In a tweet Monday, Grogan said the fund, originally worth $200,000 in BNB, was now valued at some $36.5 million. The funds were never withdrawn and remain in the original donation wallet.

In 2018, Binance and crypto users donated $200,000 in BNB to Malta Terminal Cancer Patients.

The funds were never withdrawn and remain untouched, now worth $39M due to the appreciation of BNB!

Any Malta citizens, please let your government know that these funds are accessible pic.twitter.com/jRqLz7vy4M

— Conor (@jconorgrogan) October 13, 2025

“Any Malta citizens, please let your government know that these funds are accessible,” Grogan said.

But while it may sound like a simple case of unclaimed charity funds waiting for transfer, the history of the Binance cancer patient funds is a tangle of bureaucracy and conflicting legal arguments.

Malta and Binance

In 2018, Malta became one of the first countries to introduce comprehensive cryptocurrency legislation, loudly branding itself the “Blockchain Island.” The laws were hailed as forward-thinking, and the announcement triggered a rush of crypto companies eager to base themselves there.

Binance, the world’s largest crypto exchange, was among the first to publicly throw its weight behind Malta’s vision, pledging support for developing its blockchain industry. It also announced a charitable donation plan for Maltese cancer patients through its Binance Charity Foundation, then called the Blockchain Charity Foundation, which was set up in Malta in 2018. The donations came from both Binance itself and crypto users.

But the supposed pro-crypto environment wasn't what the industry had hoped for. Malta’s regulations turned out to be highly restrictive, and very few licenses were granted. In 2020, the Maltese Financial Services Authority issued a public warning stating Binance was not licensed to operate in Malta at all, despite having implied to users that it was based there, according to a Reuters report.

Local observers later argued that much of Binance’s activity on the island appeared to be part of a “PR drive.” Pseudo-anonymous Maltese blogger Bug M told Decrypt in 2021 that the donations and announcements gave “people (and regulators) the perception that Binance were setting up something material in Malta but in reality they never actually applied.”

At the same time, the broader backdrop was one of deepening political turmoil. Malta was reeling from the fallout of the Panama Papers and the 2017 murder of investigative journalist Daphne Caruana Galizia, who had been probing links between government officials and corruption. Prime Minister Joseph Muscat resigned in 2019 amid scandal, and in 2021 Malta was greylisted by the Financial Action Task Force for deficiencies in its financial oversight (it was subsequently removed from the list in 2022).

Amid this upheaval, Binance’s pledged donation, which it had agreed with Malta Community Chest Fund Foundation (MCCFF)—a government-run charity chaired by President George Vella—remained in limbo.

In 2020, the MCCFF filed court documents accusing the BCF of failing to transfer the promised funds despite multiple requests. The MCCFF also alleged that Binance was trying to liquidate its Maltese foundation and move assets to the U.S., effectively putting the donation beyond the reach of Maltese courts.

“[Binance’s Blockchain Charity Foundation] is trying not only to renege on the agreement and escape its obligations, but it is also attempting to relocate its assets outside of Malta, to the U.S., where the Maltese courts have no jurisdiction,” the MCCFF wrote in its filings, according to the 2021 Decrypt article.

A Binance representative countered that the liquidation was a cost-saving move and denied any bad faith.

In 2021, the BCF issued what appears to be its last public statement on the matter, saying it was pleased the donation’s value had grown and remained dedicated to its original purpose. “This dedicated fund will always belong to the citizens of Malta,” it said.

This asset has been safely and transparently kept on chain at this address:

0x480234599362dc7a76cd99d09738a626f6d77e5f.We are happy that the appreciated BNB crypto asset now is able to help more people - this dedicated fund will always belong to the citizens of Malta. pic.twitter.com/KmmfUjkJfh

— Binance Charity (@BinanceBCF) July 29, 2021

The $36 million dollar question

So why were the funds not transferred?

The sticking point between the BCF and the MCCFF centers around how the money was to be disbursed. In a 2022 court session, the BCF said it intended for the donations to go directly to cancer patients, with the MCCFF merely providing their information. The MCCFF had then refused, arguing it wouldn't share patients’ personal data or force them to handle crypto wallets and token conversions.

“Not only was this not in the agreement but MCCFF never did this and will never do it for any donor,” an MCCFF official, John Huber, told the courts, stressing that most beneficiaries were vulnerable families unable to navigate crypto finance.

BCF head Helen Hai said it had been Binance’s intention to only send a small amount of money to the MCCFF and the bulk directly to the patients themselves, but admitted this was not in the original agreement with the organization. The case was adjourned and Decrypt was unable to find any further updates in the proceedings.

Since then, the situation seems to have settled into a stalemate and attempts to rectify it have stalled. The MCCFF did not respond to requests for comment or to provide an update on the case.

A listing on the BCF website lists the campaign as holding $36.4 million, the disbursement of which is pending. Information on the page says the MCCFF “seeks crypto donation to support its work that [sic] providing financial, material and professional support to people experiencing difficulties because of cancer or severe chronic diseases, persons with disability and people in vulnerability and precarity.”

“The targeting population are patients in Malta and Gozo. The expected number of beneficiaries is 15,000,” it stated.

Asked what would happen to the funds, a BCF spokesperson told Decrypt in a statement that, “We will ensure these funds are spent in Malta, and we thank Malta for its past support of Binance.”

Seven years on, the wallet remains untouched.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

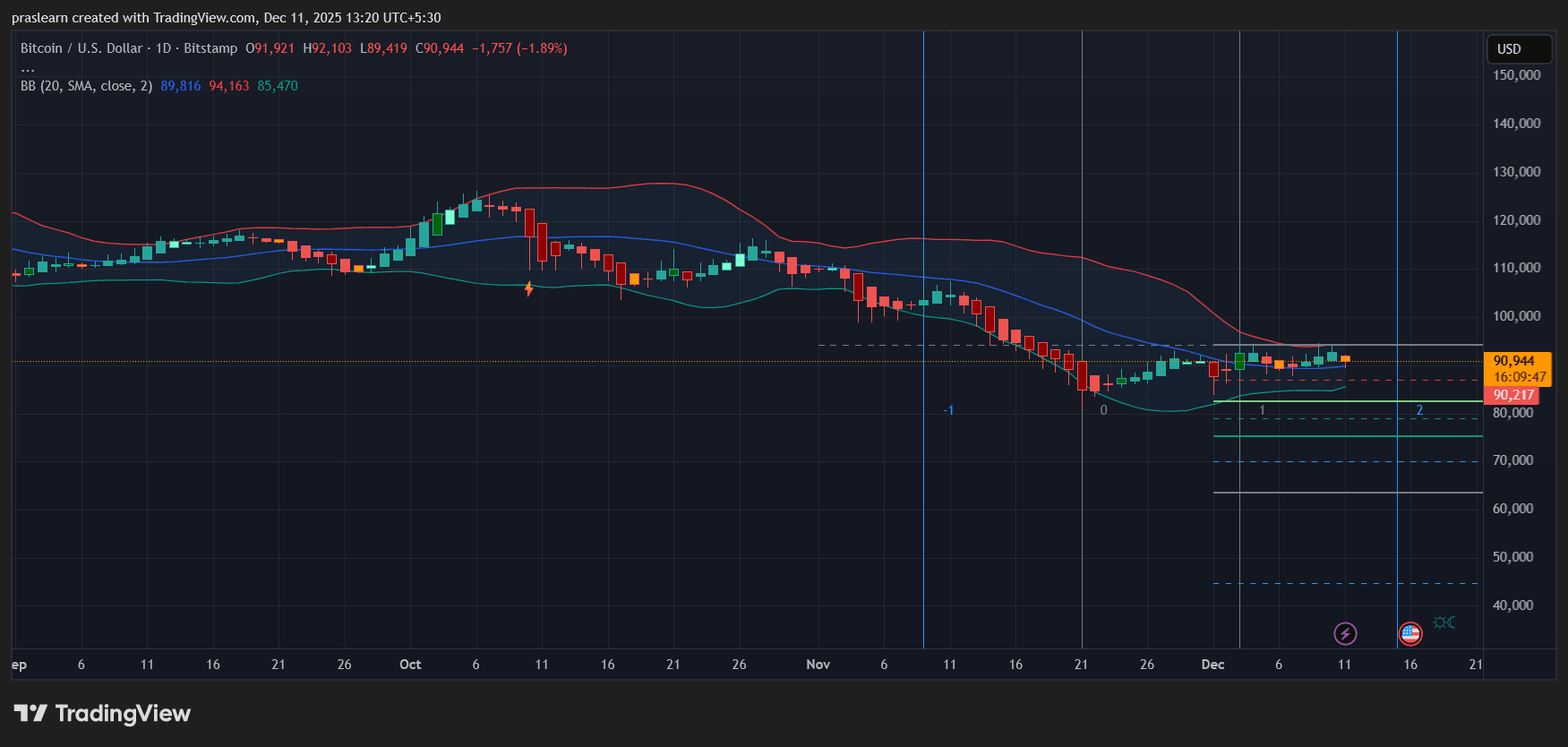

SpaceX’s Quiet $95M Bitcoin Transfer Hints at Big IPO Steps Ahead

Will Bitcoin Price Rise or Drop After the Fed’s Third Rate Cut?

Fed Cuts Rates to 3.5% - 3.75%: What It Means for Bitcoin and the Entire Crypto Market