Key Notes

- Over 40% of all Ether is now out of circulation amid record institutional demand.

- Supply locked in staking, ETFs, and treasuries has created a major supply vacuum.

- Ether exchange reserves continue to fall, with analysts eyeing a bullish trajectory.

The price of Ethereum ETH $4 069 24h volatility: 2.7% Market cap: $491.29 B Vol. 24h: $52.52 B may be getting ready for a major breakout as available supply drops sharply amid a surge in institutional accumulation.

According to analyst “Crypto Gucci,” Ethereum has never experienced a market cycle with so many simultaneous “supply vacuums.”

ETH’s supply is disappearing faster than ever 🔥

Over 40% of all $ETH is currently locked out of circulation and is continues to climb rapidly

Ethereum has never experienced a market cycle with all three supply vacuums active at once:

– DATs didn’t exist last cycle

– Spot ETFs… https://t.co/Y4FtW7Rmzg— Crypto-Gucci.eth ᵍᵐ🦇🔊 (@CryptoGucci) October 14, 2025

Digital asset treasuries (DATs), like Bitmine and Bit Digital , have accumulated nearly 5.9 million ETH, worth around $24 billion. This represents 4.9% of total ETH token supply.

At the same time, U.S. spot Ether ETFs have absorbed $28 billion in ETH since their launch in July last year. This massive inflow could grow even further once staking receives regulatory approval , according to experts.

Ether staking activity has also reached record levels. Currently, 35.7 million ETH, almost 30% of the total supply, is locked in staking contracts, with much of it illiquid due to the 40-day withdrawal queue.

“When demand meets a shrinking supply like this, price doesn’t just go up, it goes nuclear,” the analyst writes.

Ether Exchange Balance Drops to Multi-Month Low

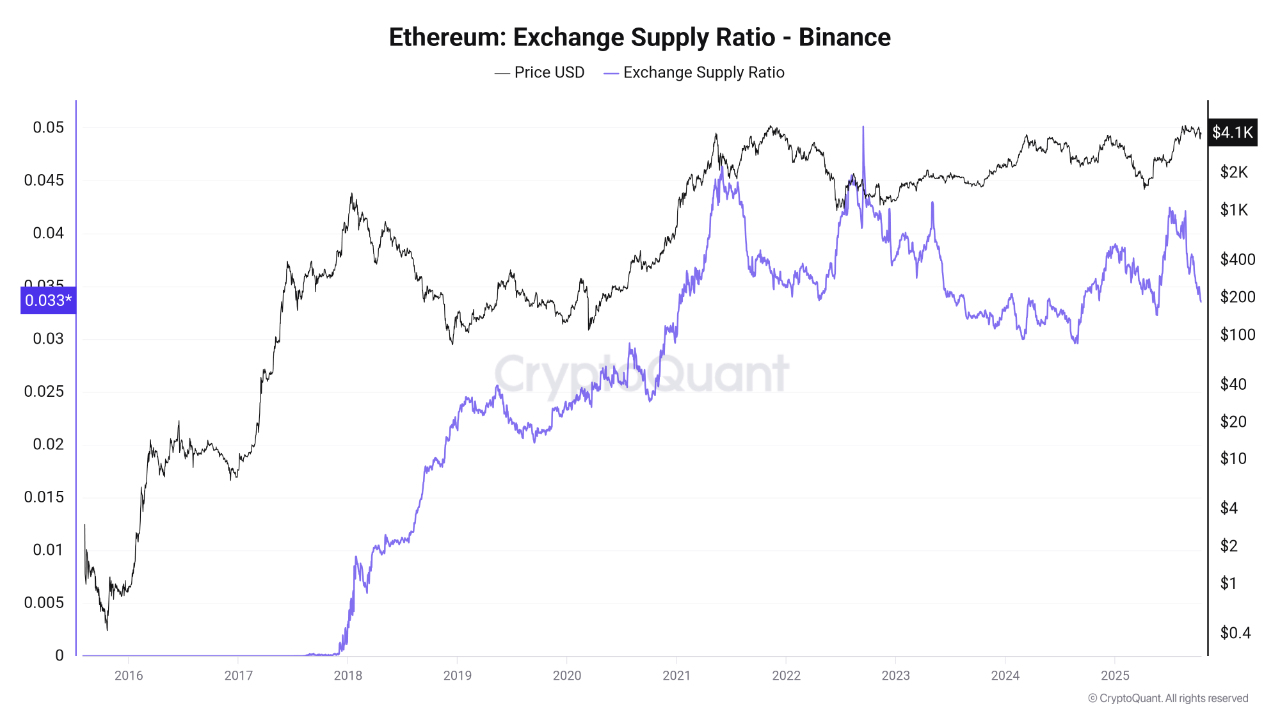

Meanwhile, data from CryptoQuant shows the Ethereum supply ratio on Binance has fallen sharply to 0.33, the lowest level since May last year.

This decline suggests investors are moving their ETH into self-custody wallets, a sign of long-term confidence and reduced selling pressure.

At the time of writing, Ether trades near $4,150, recovering from a recent dip to $3,900. The crypto’s 24-hour trading volume has jumped 13%, reaching $63 billion.

Analyst Crypto Ceaser noted that ETH is currently around a strong support zone around $4,000, a good buying opportunity for traders looking for the next crypto to explode .

He added that the “real fun will start” after the second largest cryptocurrency breaks the weekly resistance level of $4,874 with full conviction.

$ETH – #Ethereum : The real fun will start once we are breaking the red zone with full conviction. pic.twitter.com/CTA12FQ5p3

— Crypto Caesar (@CryptoCaesarTA) October 15, 2025

BitMine chair Tom Lee recently reaffirmed his year-end target of $10,000 for ETH . Historical data from CoinGlass also supports this optimism as the fourth quarter has delivered average returns of 21.36% for Ether since 2016.

A similar gain could push ETH close to $5,000 by the end of this year.