Ethereum Foundation deposits 2,400 ETH and $6 million in stablecoins into Morpho vaults

Key Takeaways

- The Ethereum Foundation deposited 2,400 ETH and $6 million in stablecoins into Morpho's DeFi vaults.

- Morpho protocol utilizes open-source FLOSS licensing, enabling greater developer participation and ecosystem resilience.

The Ethereum Foundation disclosed on Wednesday that it had deposited 2,400 ETH and approximately $6 million in stablecoins into Morpho’s yield-bearing vaults.

Morpho, which operates as a permissionless DeFi protocol, is known for its commitment to open-source development. Its flagship products, including MetaMorpho and Morpho Vault v2, are licensed under GPL2.0.

The move reflects the Foundation’s growing support for DeFi and ecosystem development in 2025, marked by major treasury actions and a shift in funding priorities. In February, the Ethereum Foundation injected approximately $120 million worth of Ether into various DeFi lending protocols to generate yield and augment its treasury funds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

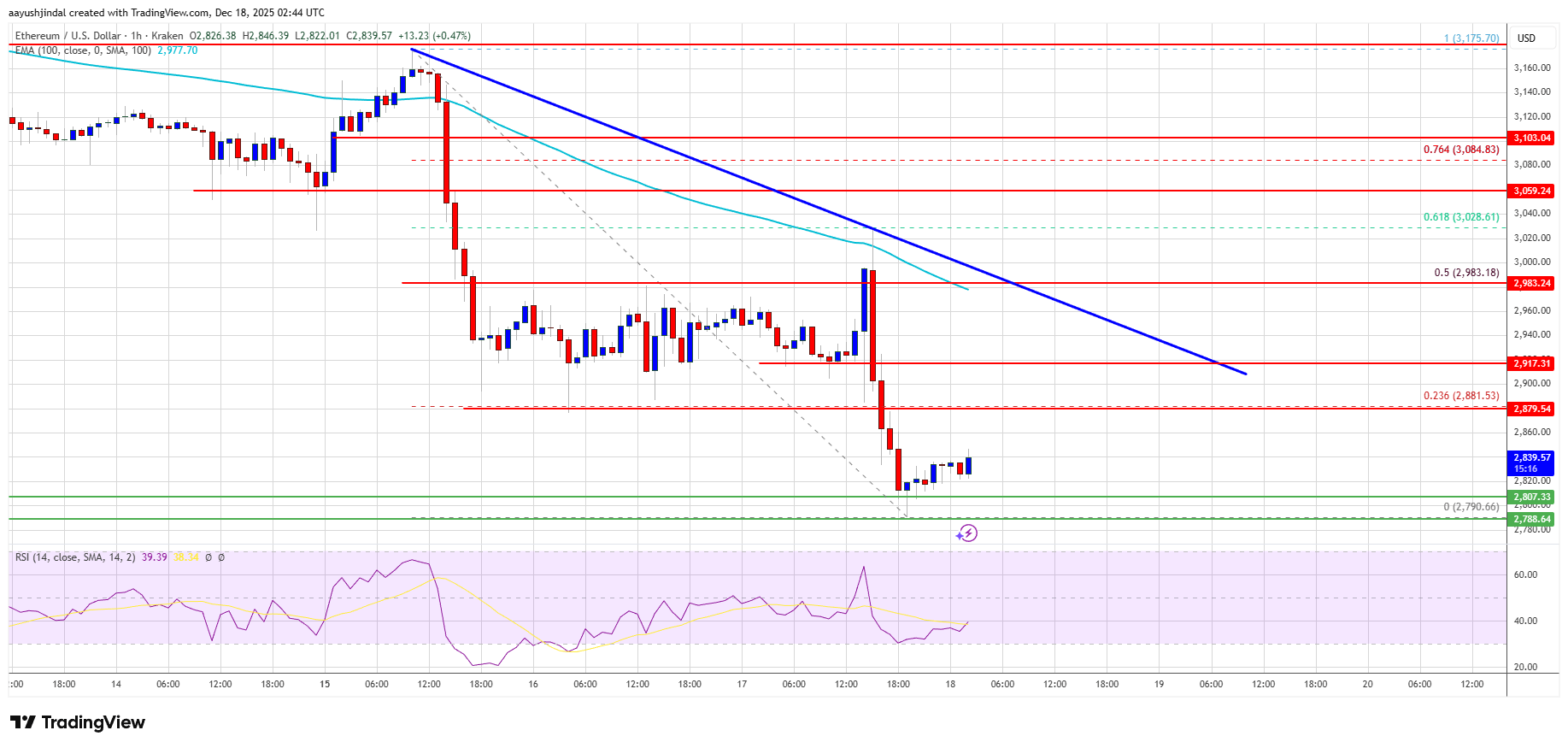

Ethereum Price Continues to Slide—Where Is the Next Support?

Ethereum Whale Sells Entire ETH Position After 1127-Day Hold, Realizes $4.245 Million Profit

Tether’s USDT Payment Stats Show the Real State of Crypto Adoption in 2025

Circle Launches Arc Developer Fund to Accelerate Real-World Finance Apps on Arc Network