Not Cooling Down After the Election? Prediction Markets Make a Comeback with $2.3 Billion in Funding

Sports has become a lifeline.

Sports have become a lifeline.

Written by: Prathik Desai

Translated by: Chopper, Foresight News

Over the past week, the two giants of the prediction market have both secured new funding.

The US-regulated prediction market Kalshi announced it has raised over $300 million in new funding, reaching a valuation of $5 billion, led by Sequoia Capital with participation from a16z. This valuation is about 2.5 times higher than three months ago. The funding comes as Kalshi is undergoing significant business expansion: its services now cover 140 countries, and internal data shows its annual trading volume is moving towards several billions of dollars, marking a significant leap from its early stage last year.

Meanwhile, the crypto-native prediction market Polymarket revealed it has received a strategic investment of up to $2 billion from Intercontinental Exchange, the parent company of the New York Stock Exchange, bringing its post-investment valuation to $9 billion.

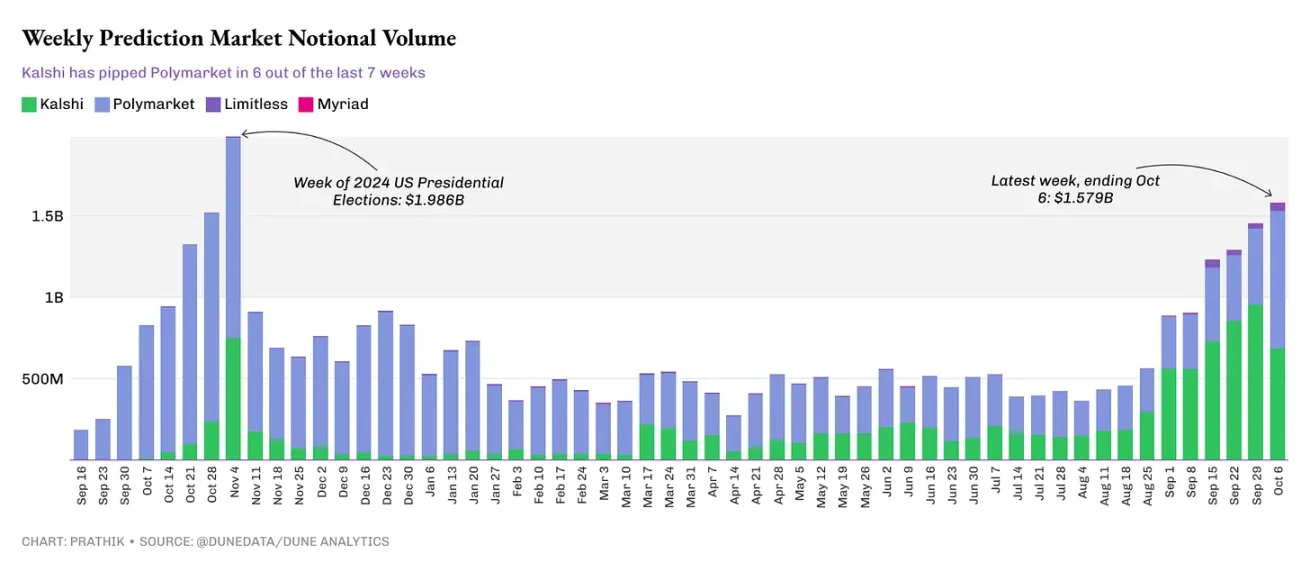

In recent months, Kalshi's trading volume has surpassed that of Polymarket. In six out of the past seven weeks, Kalshi's notional trading volume (the total value of all contracts in the prediction market) has led Polymarket.

Since September, weekly notional trading volume in the prediction market has steadily increased, with weekly volumes exceeding $1.2 billion for the past four weeks. Although it has not yet reached the peak seen during last year's election period, the overall trend is steadily approaching the $2 billion mark.

Currently, Kalshi and Polymarket account for 96% of the total notional trading volume, holding an absolute dominant position; meanwhile, smaller platforms such as Limitless and Myriad Markets are also gradually developing.

In the week ending October 6, Limitless's trading volume exceeded $44 million, while Myriad Markets reached $6 million, more than six times higher than a month ago.

Where does the heat come from?

After the election frenzy faded, prediction market traders shifted their focus to other events that people pay attention to in daily life.

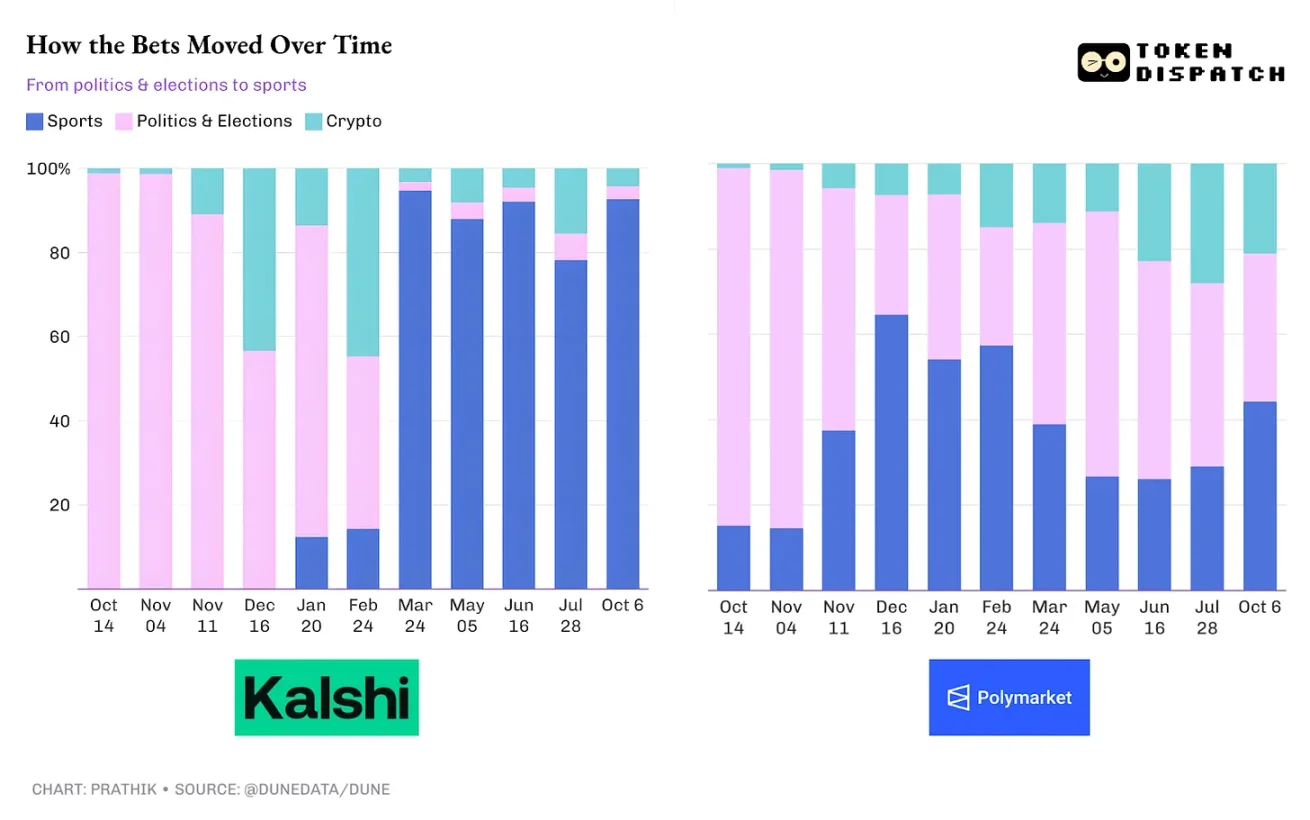

In October 2024, over 95% and 83% of trading volume on Kalshi and Polymarket, respectively, were related to politics and elections; now, this structure has gradually shifted towards sports.

Sports betting now dominates trading volume on both platforms. This shift stems from human behavioral traits: people tend to focus on high-frequency, short-cycle events.

The sports field offers a large number of short-cycle events: match outcomes, player lineups, injuries, individual performances, etc., all of which can generate countless micro-events, providing a wealth of scenarios for betting.

This shift is most evident on Kalshi: in December 2024, sports trading accounted for less than 5% of Kalshi's weekly notional trading volume; by February 2025, it had risen to 15%; in March, it surpassed 90%; and in most weeks since then, this proportion has remained above 80%.

On the other hand, Polymarket's sports trading share has also doubled, rising from about 15% last year to 40% now.

Cryptocurrencies still hold a place in the prediction market. Although they do not account for a large share of trading volume, events related to cryptocurrency prices and ETF issuance timing still provide ample opportunities for speculation, which is particularly evident on Polymarket. However, on Kalshi, crypto-related trading rarely exceeds 15% of the total in most months.

Differentiation Strategies of Leading Platforms

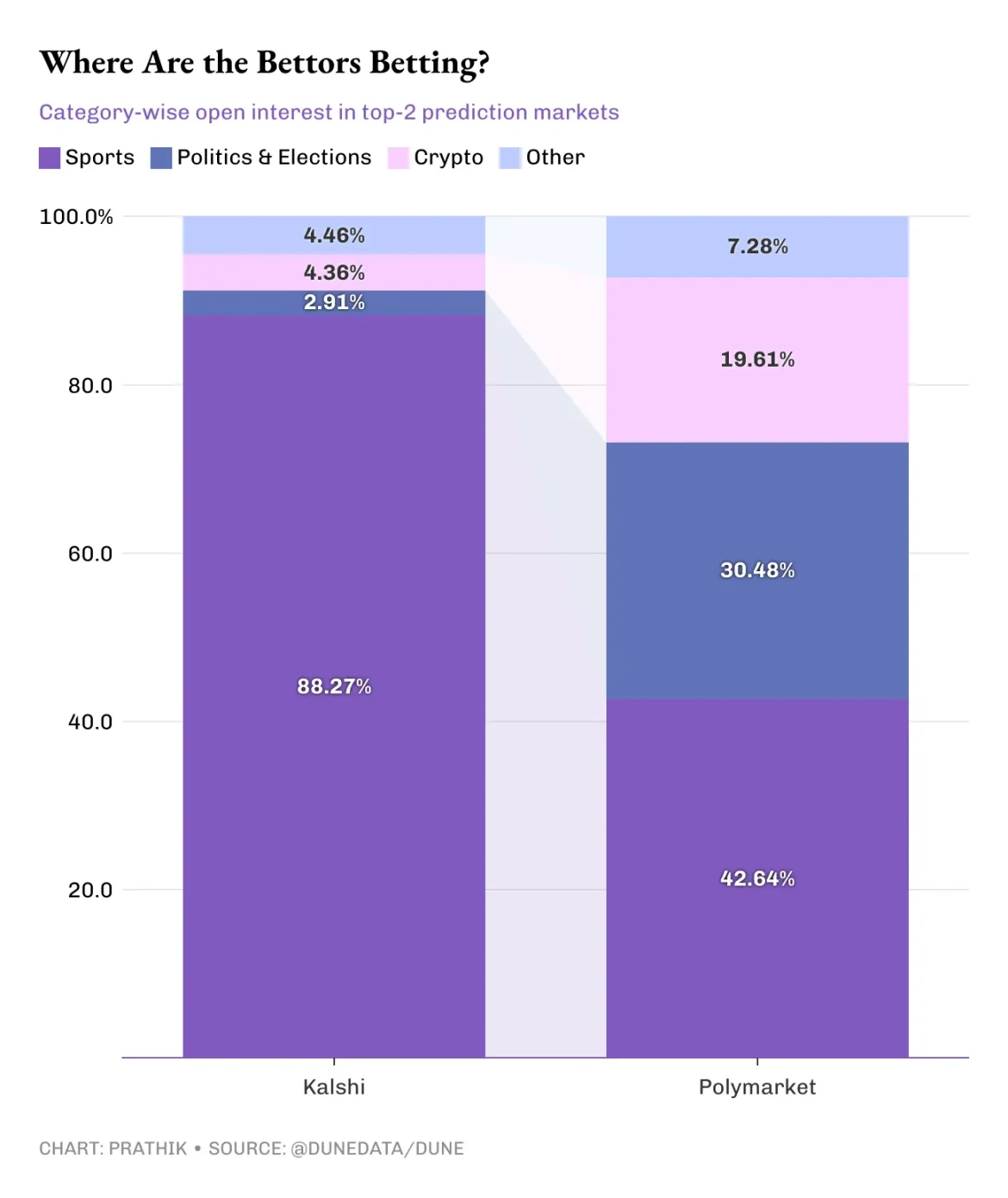

Judging from the latest trading category proportions of Kalshi and Polymarket, the two leading platforms are following distinctly different strategies.

Kalshi's trading core is heavily skewed towards sports, followed by politics and cryptocurrencies. This reflects the platform's positioning: focusing on retail speculative demand, which requires standardized, rules-driven markets. For example, in addition to sports, events such as weather, energy, and interest rate cuts are added to ensure continuous betting opportunities every week.

In contrast, Polymarket builds its trading categories around three pillars: sports, politics, and cryptocurrencies. The proportions of these three adjust according to current news events and industry trends to fit mainstream market narratives.

It is clear from the chart data that after last year's election frenzy, liquidity in the prediction market did not disappear but was instead redistributed into categories that traders found valuable.

These categories help platforms build sustainable business models, maintaining activity even during off-seasons. However, politics may still remain a core area, as events such as elections, debates, and government policies, even if seasonal, can still trigger sudden surges in trading volume.

Cryptocurrency, economic, and financial-related markets play an important supplementary role. Trading around price fluctuations, ETF announcements, Federal Reserve meetings, and policy-making events attracts both aggressive traders who favor fast-paced markets and macro enthusiasts who want to price economic narratives.

When different types of traders coexist in the speculative market, the range of betting categories becomes richer and deeper. Imagine: Sunday NFL bets can be paired with weather forecasts and natural gas price trades; NBA player injury odds can be paired with CPI range predictions and campaign fundraising forecasts.

If prediction markets can make checking prices as habitual as checking sports scores, platform user retention rates will increase significantly. Whether in crypto or traditional markets, retention is key to breaking dependence on seasonal cycles.

If this goal can be achieved, public perception of prediction markets will change. They will no longer be seen as platforms focused only on special events, but rather as barometers reflecting the probabilities of everyday events.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?