SEC Chair Atkins charts pro-innovation path for crypto and tokenization regulation

Quick Take Crypto and tokenization are “job one” for the SEC, SEC Chair Atkins said on Wednesday at DC Fintech Week. “I’d like to say that we’re the Securities and Innovation Commission,” he added jokingly.

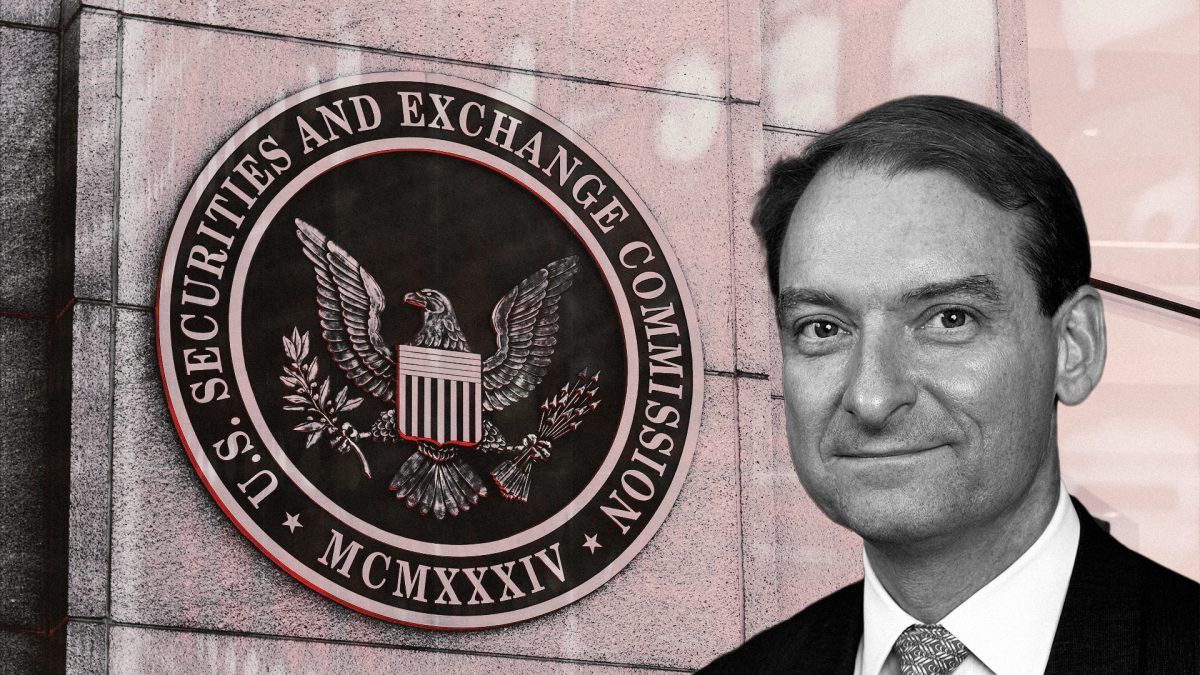

Securities and Exchange Commission Chair Paul Atkins is looking for cryptocurrency innovation to thrive as the agency forges its path in prioritizing the industry.

Crypto and tokenization are "job one" for the SEC, Atkins reiterated on Wednesday at DC Fintech Week.

"We want to make sure that we build a strong framework to actually attract people back into the United States who may have fled, but then also be able to build a framework that makes sense for the future, so that innovation can thrive," he said.

"I'd like to say that we're the Securities and Innovation Commission," he added jokingly.

Breaking from Gensler

Atkins has taken a starkly different approach to regulating crypto following his predecessor, Gary Gensler, since becoming chair in April. Gensler took a cautious approach to crypto and brought several cases against large crypto firms, saying that most cryptocurrencies were securities, while being criticized for his regulation-by-enforcement approach.

Since April, Atkins has taken several steps toward being friendly toward digital assets. On Wednesday, Atkins also said distributed ledger technology is the most exciting part of crypto.

In June, Atkins said he had directed his staff to consider an "innovation exemption" that he said would quickly allow firms to "bring on-chain products and services to market." He has also said, he planned to put that exemption in place by the end of the year.

"We'll be bringing various types of solutions here to the fore, like I've been talking about an innovation exemption, and with a goal of having like a super app where there are many different agencies that are concerned about crypto," Atkins said on Wednesday. "But why should you have to go and register at multiple agencies if we are all focused on the same kind of goal?"

Currently, the SEC is in a standstill as the government shutdown moves into its second week. At the beginning of this month, Congress failed to reach a deal on funding, furloughing employees, and significantly limiting what federal agencies can do.

As for the SEC, that means it is currently working under an operations plan whereby it has an "extremely limited number of staff members available to respond to emergency situations," according to guidance .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Growing Optimism Faces ETF Withdrawals: The Delicate Balance of Crypto Stability

- Crypto markets show fragile stabilization as Fear & Greed Index rises to 20, but Bitcoin remains 30% below October peaks amid $3.5B ETF outflows. - Stablecoin market cap drops $4.6B and on-chain volumes fall below $25B/day, weakening Bitcoin's liquidity absorption capacity. - Select altcoins like Kaspa (22%) and Ethena (16%) gain traction while BlackRock's IBIT returns $3.2B profits, signaling mixed institutional confidence. - Technical indicators suggest tentative support at $100,937 for Bitcoin, but So

BCH Rises 0.09% as Momentum Fuels Outperformance

- BCH rose 0.09% in 24 hours but fell 4.22% in seven days, yet gained 22.72% annually. - It outperformed its Zacks Banks - Foreign sector with 0.66% weekly gains vs. -2.46% industry decline. - Earnings estimates rose twice in two months, boosting consensus from $2.54 to $2.56. - With a Zacks Rank #2 (Buy) and Momentum Score B, BCH shows strong momentum potential. - Annual 63.46% gains and positive revisions solidify its position as a top momentum stock.

DOGE drops 1.36% as Bitwise ETF debuts

- Bitwise launched the first Dogecoin ETF (BWOW) on NYSE, offering institutional-grade exposure to the memecoin. - DOGE fell 1.36% in 24 hours but rose 7.34% weekly, reflecting mixed short-term market sentiment. - The ETF aligns with growing institutional adoption and regulatory momentum for altcoins, despite a 52.35% annual decline. - Similar products like Bonk’s ETP and Ethereum upgrades highlight maturing crypto infrastructure and investor demand.

ZEC Falls 4.01% After Grayscale Submits Zcash ETF Conversion Application

- Zcash (ZEC) fell 4.01% in 24 hours as Grayscale files to convert its Zcash Trust into an ETF. - The ETF conversion aims to boost institutional exposure and regulated market access for ZEC. - ZEC shows 16.26% monthly gain and 736.04% annual rise despite recent 17.89% weekly drop. - Analysts highlight ETF approval could stabilize ZEC’s price and attract diversified investors. - The SEC’s decision on the ETF remains pending, shaping market perceptions and ZEC’s adoption trajectory.