Bitcoin Price’s Last Line Of Defense Could Prevent Structural Weakness

Bitcoin hovers near a critical support range between $108,000 and $117,000. Sustaining this zone is essential to avoid structural weakness and potential long-term correction.

Bitcoin is currently facing one of its most critical tests in months as its price hovers near a key support level that has repeatedly prevented deeper declines.

However, investor sentiment and market conditions will now determine whether Bitcoin can sustain this level or risk entering a prolonged correction phase.

Bitcoin Is Vulnerable

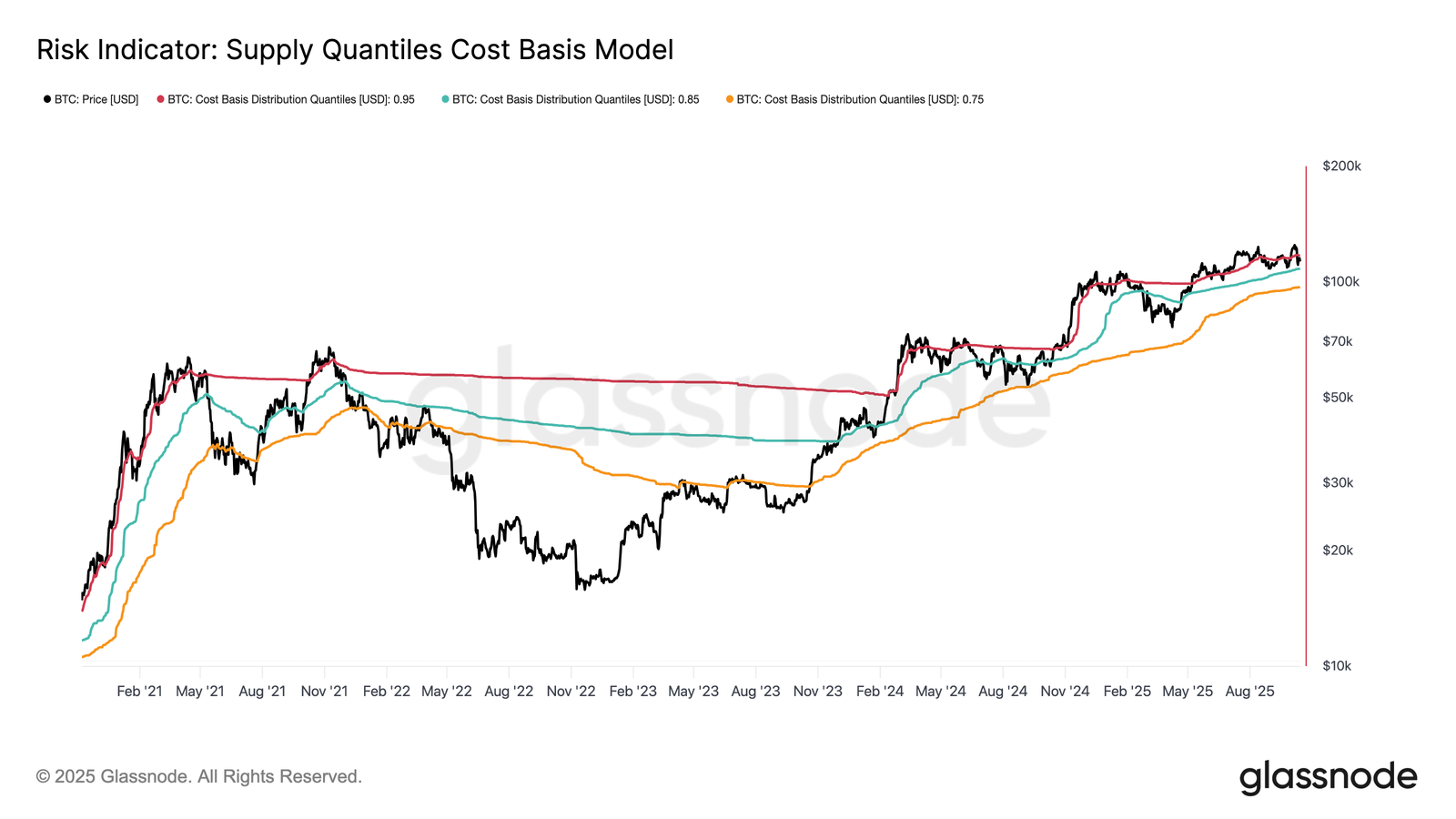

Bitcoin’s supply quantiles show that the asset has entered its third instance since late August, where spot prices dipped below the 0.95-quantile price model ($117,100). This level represents holdings where roughly 5% of supply, primarily owned by top buyers, sits at a loss. BTC currently trades within the 0.85–0.95 quantile range ($108,400–$117,100), reflecting a significant retracement from the euphoric phase of recent months.

Without renewed momentum to lift prices back above $117,100, Bitcoin risks sliding toward the lower boundary of this range. Historically, when BTC failed to sustain this critical support zone, extended mid- to long-term corrections followed. A drop below $108,000 would likely signal structural weakness, potentially leading to greater losses as investor confidence wavers.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Bitcoin Supply Quantiles. Source:

Glassnode

Bitcoin Supply Quantiles. Source:

Glassnode

The broader macro environment remains challenging for Bitcoin. Since July 2025, persistent long-term holder (LTH) distribution has restricted upside potential. Data shows that approximately 0.3 million BTC have been offloaded by mature investors over this period, indicating steady profit-taking. This sustained sell-side pressure has limited demand growth and kept volatility elevated.

If the distribution trend continues without new inflows from institutions or retail buyers, Bitcoin could face further consolidation. Demand exhaustion may lead to localized capitulation events or temporary market pullbacks before long-term equilibrium returns.

Bitcoin LTH Supply. Source:

Glassnode

Bitcoin LTH Supply. Source:

Glassnode

BTC Price Holds Strong

Bitcoin’s price has remained volatile since July 2025 due to macroeconomic pressure and shifting investor sentiment. Even so, BTC has repeatedly found stability around $110,000, signaling potential resilience.

The next major support lies at $108,000, a historically strong level that has been tested several times before. Holding above this zone could enable a rebound toward $112,500 in the short term, especially if macro conditions improve.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, if bearish pressure intensifies and selling accelerates, Bitcoin could fall below $110,000. A breakdown under $108,000 would invalidate the bullish-neutral outlook and expose BTC to deeper structural weakness.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How do 8 top investment banks view 2026? Gemini has summarized the key points for you

2026 will not be a year suitable for passive investing; instead, it will belong to investors who are skilled at interpreting market signals.

Valuation Soars to 11 Billions: How Is Kalshi Defying Regulatory Pressure to Surge Ahead?

While Kalshi faces lawsuits and regulatory classification as gambling in multiple states, its trading volume is surging and its valuation has soared to 11 billion dollars, revealing the structural contradictions of prediction markets rapidly growing in the legal gray areas of the United States.

How will the Federal Reserve in 2026 impact the crypto industry?

Shifting from the technocratic caution of the Powell era, the policy framework is moving towards a more explicit goal of reducing borrowing costs and serving the president's economic agenda.

Babylon partners with Aave Labs to launch native Bitcoin-backed lending services on Aave V4

Babylon Labs, the team behind the leading Bitcoin infrastructure protocol Babylon, today announced the establishment of a strategic partnership with Aave Labs. Both parties will collaborate to build a native Bitcoin-backed Spoke on Aave V4 (the next-generation lending architecture developed by Aave Labs). This architecture adopts a Hub and Spoke model, aiming to support markets built for specific scenarios.