Date: Thu, Oct 16, 2025 | 05:25 PM GMT

The cryptocurrency market is struggling to stage a meaningful V-shaped recovery after the October 10 crash, which triggered over $19 billion in liquidations. Ethereum (ETH) continues to trade choppy, adding further pressure on major altcoins , including Solana (SOL).

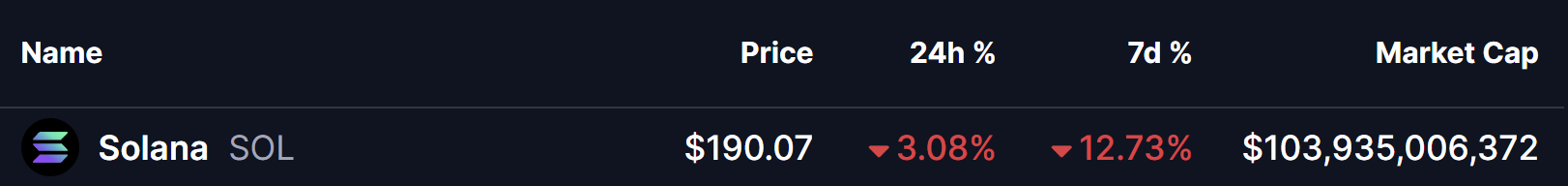

SOL is currently trading in red with a 12% weekly drop, but beyond the short-term weakness, its technical structure is beginning to resemble a key bullish fractal seen earlier in Bitcoin’s (BTC) chart — a pattern that previously signaled a major rebound.

Source: Coinmarketcap

Source: Coinmarketcap

SOL Mirrors BTC’s Past Price Behavior

According to our ongoing fractal chart analysis, SOL’s current price structure and correction phase closely mirror Bitcoin’s late 2024 cycle.

Back in September 2024, BTC went through three consecutive corrections of roughly 25%, 29%, and 24%, before breaking out from its descending resistance trendline and reclaiming both the 50-day and 100-day moving averages. This breakout (marked in the chart’s green circle) triggered a strong 80% rally, taking Bitcoin into a sustained bullish phase.

BTC and SOL Fractal Chart/Coinsprobe (Source: Tradingview)

BTC and SOL Fractal Chart/Coinsprobe (Source: Tradingview)

Now, fast-forward to October 2025, Solana appears to be following the same path. After completing two major corrections — 25% and 28%, almost identical to BTC’s — SOL is now in the midst of its third and possibly final correction, trading below its descending resistance and key moving averages (50 MA and 100 MA).

What’s Next for SOL?

If the BTC fractal continues to guide this setup, SOL may experience one more minor leg down toward the $180 region, which would align with BTC’s final 24% dip before its breakout phase.

Once this correction phase completes, a potential rebound could take shape. A confirmed breakout above the descending resistance line and key moving averages could trigger a bullish rally, with targets pointing toward the $350 zone — mirroring the scale of BTC’s 80% rebound move.

However, it’s important to remember that fractals aren’t guaranteed. They often highlight historical symmetry but don’t ensure identical outcomes. Still, given the technical alignment and market structure, this setup is one to keep a close eye on in the coming days.