Tokenized Gold Soars as Metal Hits Record Highs

Tokenized gold assets are surging as bullion prices hit record highs, driving $3 billion in market value. Tether’s XAUT0 and Paxos’ PAXG lead the rally, gaining over 60% year-over-year amid rising institutional demand.

Gold-linked digital assets are surging as the metal’s price climbs above $4,370 per ounce. The rally has prompted issuers to launch new blockchain-based products, turning gold into an on-chain financial instrument.

The surge reflects a wider convergence between traditional commodities and digital assets. As inflation concerns and geopolitical uncertainty persist, investors are turning to tokenized versions of gold as a stable, transparent, and easily transferable hedge against volatility.

Tether Launches XAUT0 as Gold Tokens Near $3.4B

The tokenized gold sector has grown rapidly in 2025, with total capitalization nearing $3.4 billion, up from $500 million early this year. It is one of the fastest-growing categories in the tokenization ecosystem, fueled by institutional demand for stable, asset-backed instruments.

In particular, Tether expanded its lineup with XAUT0, an omnichain gold token launched on October 15 through the Legacy Mesh interoperability framework on Solana. The system links Solana to Tether’s $175 billion cross-chain liquidity base across Ethereum, Tron, and other blockchains. As a result, each XAUT0 represents a fraction of a troy ounce of physical gold held in audited vaults.

The Legacy Mesh and XAUt0 are live on @solana.The largest stablecoin and the most trusted store of value, enabling internet capital markets, payments, and crypto applications on one of the largest blockchains in the world.Your USDT and XAUt, now on Solana.

— USDT0 (@USDT0_to) October 15, 2025

More than 7,300 XAUT0 tokens are now in circulation, processing over $25 billion in total bridge volume, according to Everdawn Labs.

“Gold-backed tokens are becoming the fastest-growing segment of tokenized assets,” said Alex Tapscott, CEO of CMCC Global Capital Markets.

He noted that daily trading in tokenized gold now exceeds $600 million, mirroring strong demand for physical bullion.

Surging Prices and Expanding Market Share

Analysts say tokenized gold bridges traditional finance and digital liquidity. Unlike physical bars, these tokens settle instantly and integrate into decentralized-finance platforms.

“Gold has a 5,000-year record as a store of value,” said Alex Melikhov, co-founder of BrettonWoods Labs. “Tokenization brings that reliability into a verifiable digital format.”

PAX Gold (PAXG)—trading around $4,413—has surged more than 65% year-over-year, while Tether Gold (XAUT)—priced near $4,360—has gained 63%. Their combined market capitalization is now approaching $3.0 billion, showing how physical value stores are shifting onto blockchains.

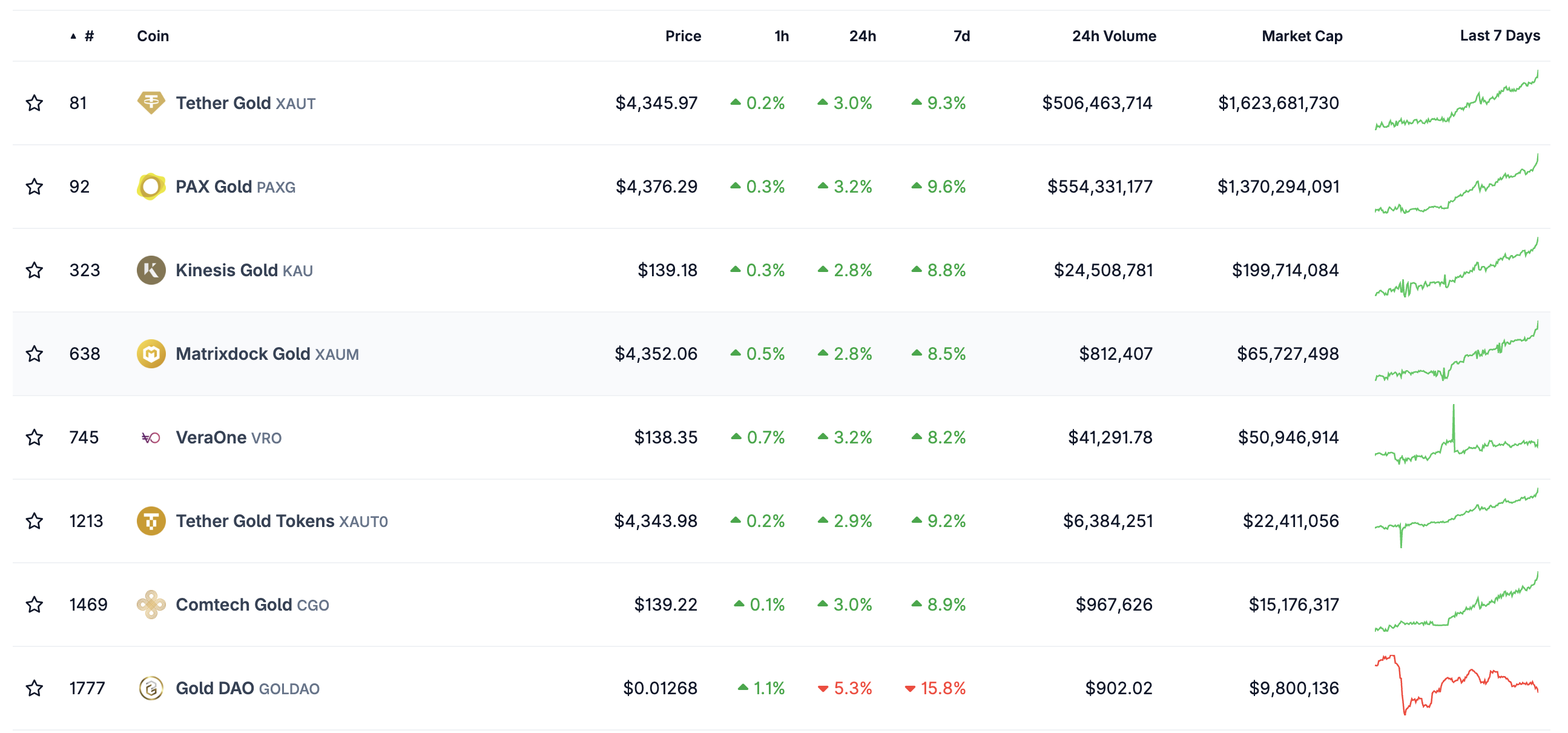

Leading Gold-Linked Tokens / Source:

Coingecko

Leading Gold-Linked Tokens / Source:

Coingecko

Moreover, average daily trading for PAXG has doubled over the past year, surpassing $300 million, CoinGecko data show. Analysts link this momentum to institutional inflows from funds and family offices seeking digital exposure to gold.

Regulators are slowly warming to tokenization. US SEC Chair Paul Atkins recently said, “If it can be tokenized, it should be tokenized,” calling it a key modernization priority.

Still, oversight and reserve transparency remain essential for investor trust.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Breaking: Crypto Market Maintains Downward Trend this October 31st

Follow Our Real-Time Updates as Cryptocurrency Values Keep Falling This Halloween

Bitcoin News Update: Galaxy Enhances Staking Platform as Institutions Turn to Bitcoin During Altcoin Market Volatility

- Galaxy Digital expands staking infrastructure with Coinbase Prime, its fourth custodial partner in 2025, aiming to lead institutional crypto solutions. - Jump Crypto's $205M Solana-to-Bitcoin swap via Galaxy highlights institutions shifting to Bitcoin amid altcoin volatility and ETF underperformance. - Galaxy's $443M staked assets and Texas data center expansion reflect growing institutional demand for crypto custody amid regulatory and liquidity challenges.

Ethereum Updates: Bulls and Bears Clash at $3,800 While Ethereum's Future Remains Uncertain

- Ethereum hovers near $3,800 support, with analysts split between caution over bearish momentum and optimism about short-term holder resilience. - Upcoming Fusaka upgrade (Dec 3) aims to boost scalability via EIP-7594 and blob capacity expansion, though immediate price impact remains uncertain. - Ethereum ETFs lost $184M in 48 hours, reflecting growing risk aversion as Bitcoin and altcoins face combined outflows amid weak buying activity. - On-chain data shows diverging MVRV ratios and rising short positi

Singapore Seizes $115 Million Amid Anti-Corruption Campaign

- Singapore police seized $115M in assets from Chinese entrepreneur Chen Zhi under anti-corruption and money laundering laws. - Seized assets include real estate, luxury vehicles, and offshore accounts via a multi-agency investigation involving MAS and other agencies. - The move highlights Singapore's intensified scrutiny of cross-border financial crimes and alignment with global regulatory standards. - Authorities emphasized maintaining ethical business practices amid geopolitical tensions over financial