Research Report|In-Depth Analysis and Market Cap of Meteora(MET)

Bitget2025/10/17 10:24

By:Bitget

I. Project Overview

Meteora is a next-generation liquidity infrastructure protocol deployed on the Solana ecosystem. Its core goal is to overcome the capital efficiency limitations of traditional AMM/liquidity pool models, providing more flexible, composable, and efficient mechanisms for liquidity providers (LPs) and token issuers. One of its flagship products is the DLMM (Dynamic Liquidity Market Maker) model. Additionally, the ecosystem includes DAMM v2, Vaults, dynamic fee mechanisms, and Launch Pools. The official website positions it as: “DLMM Pools — enabling LPs to earn more through dynamic fees, precise liquidity concentration, and flexible strategies.”

Core architecture and business modules of Meteora include:

DLMM (Dynamic Liquidity Market Maker): According to DeFiLlama, Meteora’s DLMM is described as a “zero-slippage, bin-based concentrated liquidity AMM,” meaning liquidity is divided into multiple price “bins” and combined with a dynamic fee mechanism to enhance LP returns. Compared with traditional AMM or concentrated liquidity models, DLMM adjusts bins and fees automatically to adapt to active or volatile markets, improving capital efficiency and yield.Single-Sided DAMM v2 Launch Pools: This feature allows projects to launch pools with a single asset by specifying initial/minimum/maximum price ranges, significantly reducing launch costs.

Dynamic AMM / Vault / Multi-Strategy Mechanism: Beyond DLMM, Meteora includes Dynamic AMM Pools and Vaults, which handle idle liquidity assets by lending them to lending markets to earn additional interest, thereby improving overall asset utilization. Solana Compass emphasizes these products as part of Meteora’s portfolio. SimpleSwap notes that Meteora also supports MemeCoin-specific pools, new token launches/liquidity lock mechanisms, and dynamic rebalancing strategies.

Launch / Issuance Mechanism / Liquidity Distribution: The “DAMM v2: Single-Sided Launch Pools” mechanism simplifies project launches on the DLMM model. Projects can specify initial/minimum/maximum price ranges and launch pools with a single asset, reducing SOL leasing costs and complexity. During token issuance (TGE), Meteora uses a Liquidity Distributor mechanism: a portion of tokens is distributed in the form of LP positions rather than a one-time airdrop, turning early recipients into liquidity providers who earn trading fees. According to The Defiant, this is a key feature of Meteora’s tokenomics.

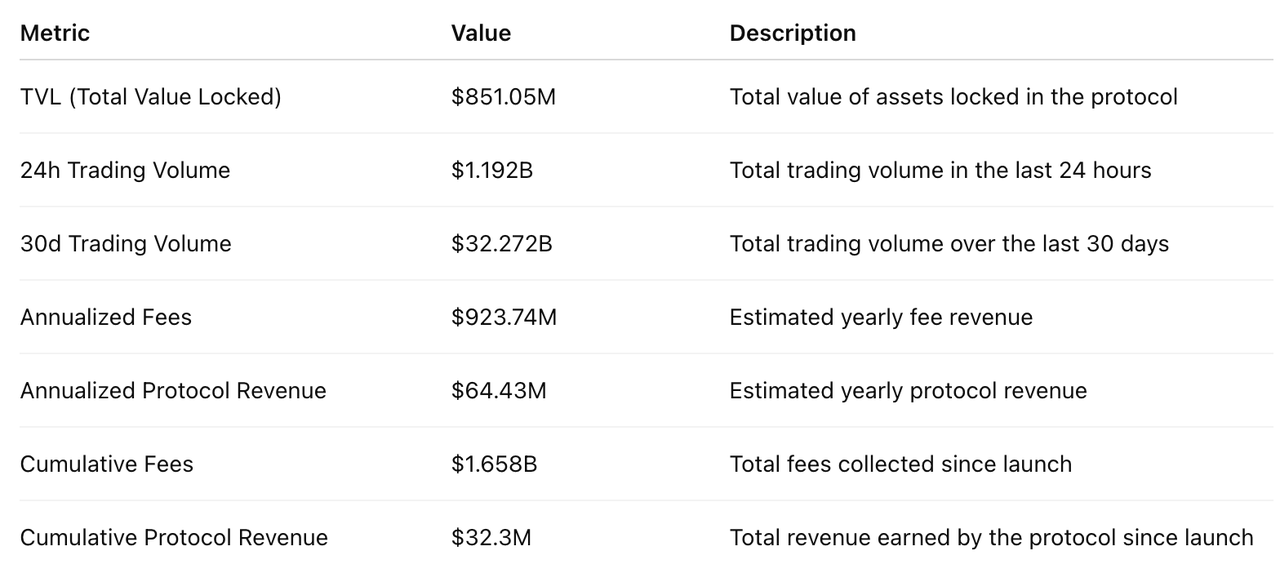

Current Core Metrics: According to DeFiLlama, Meteora’s TVL increased by 252% over the past 7 days, reaching $804M (manually verified with the official site). The TVL mainly comes from its innovative DLMM pools and AMM pools, supporting multiple assets including Wrapped Solana (wSOL), Wrapped Bitcoin (wBTC), and popular MemeCoins such as Official Trump and Popcat.

II. Project Highlights

Meteora’s advantages include:

Higher Capital Efficiency & Low Slippage: DLMM’s bin-based concentrated liquidity mechanism enables near-zero slippage execution in active trading ranges if liquidity is dense enough.

Dynamic Fee Mechanism: Trading fees adjust dynamically based on market volatility and trading volume, allowing LPs to earn higher returns during high-volatility periods.

Simplified Pool Launch / Listing: DAMM v2 single-sided launch pools with min/max price ranges lower the barrier and cost for projects to list tokens.

Liquidity /

Token

Distribution Coupling & Sell Pressure Mitigation: The Liquidity Distributor distributes tokens as LP positions, automatically turning recipients into LPs, which helps reduce early sell pressure and strengthens initial ecosystem liquidity.

Audits / Code Ecosystem / SDK Support: Meteora provides an npm package (@meteora-ag/dlmm) for developers to integrate DLMM modules, and its documentation includes audit lists for major modules.

Meteora addresses market pain points such as:

Low capital efficiency and idle liquidity in traditional AMMs.

High slippage and insufficient depth for large or volatile trades.

High costs and sell pressure for new token launches.

Low yield on idle assets in AMM/DEX models.

Fragmented liquidity across multiple Solana DEXs.

III. Economic Model

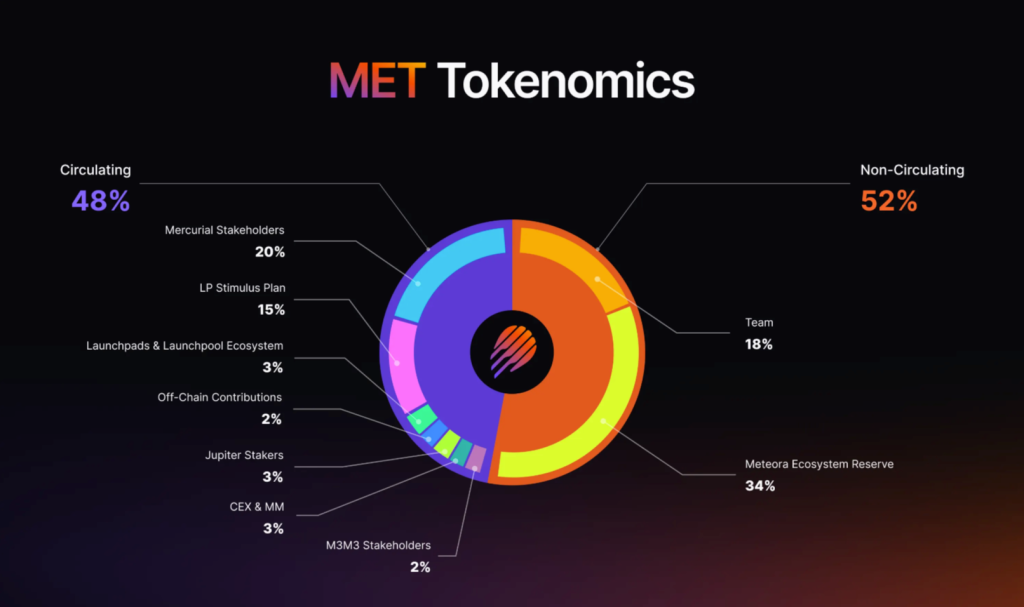

Total

Token

Supply: 1 billion MET, including:

1)TGE Circulating Supply (48%):

20% allocated to Mercurial stakeholders

15% for LP incentives for Meteora users

3% for Launchpads and Launchpool ecosystem

2% for off-chain contributor distribution

3% for Jupiter staking incentives (from TGE reserve)

3% reserved for centralized exchanges/market makers

2% for M3M3 stakeholders

2)Team: 18%, vested linearly over 6 years

3)Meteora Reserve: 34%, vested linearly over 6 years, with potential inflation from team unlocks and reserve incentives

Token

Use Cases:

Governance & Protocol Decisions: MET holders can vote on protocol upgrades, fee parameters, and ecosystem collaborations.

Staking & Revenue Distribution: 10–20% of trading fees are distributed to MET stakers as rewards.

Liquidity Incentives & Ecosystem Support: Meteora DAO can use reserve tokens to reward LPs and fund ecosystem growth.

Trading & Arbitrage: MET can be bought and sold on exchanges for profit or cross-platform trading.

Payments & Transfers: MET can be used for sending funds or donations.

Airdrops & Community Engagement: The “Phoenix Rising Plan” allocates 48% of total supply to community distribution, including early supporters and MER holders.

IV. Team & Funding

Team

Members:Zhen Hoe Yong: Co-founder & Project Lead, responsible for overall strategy and sustainable innovation.

TRAV: CTO, former contributor to Uniswap v3 and Curve, designed DLMM and dynamic fee system.

ROOK: COO, ex-investment banker, manages operations, partnerships, and Solana integration.

Ben Chow: Co-founder, former CEO, guided brand redesign and “Phoenix Rising Plan,” resigned in early 2025.

0xM: Advisor/Founder, early contributor influential in liquidity model design.

Funding: Meteora has raised approximately $3.5M through multiple funding rounds, supported by:

Alliance (accelerator)

Arche Fund (investment fund)

ArkStream Capital (VC)

Other investors: Delphi Digital, Signum Capital, DeFiance Capital, Gate Labs, Solana Foundation

V. Potential Risks

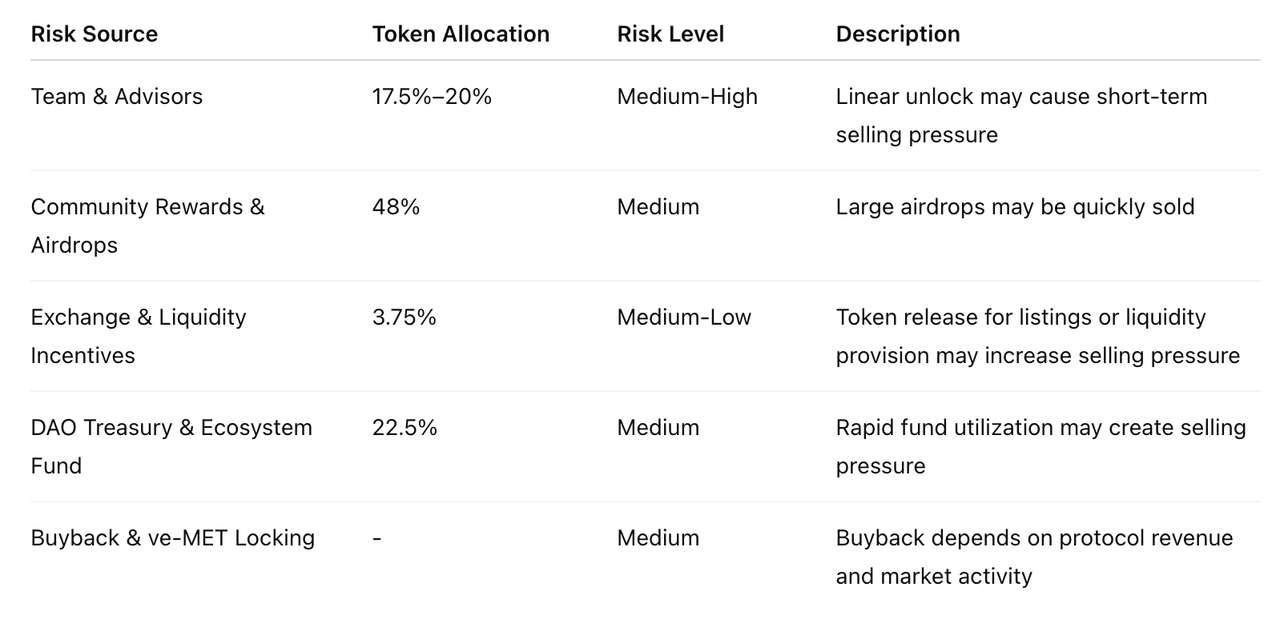

MET sell pressure mainly comes from team/advisor token unlocks, community rewards/airdrops, exchange and ecosystem fund releases. Long-term vesting and buyback mechanisms can mitigate some sell pressure, but short-term impacts depend on release schedules and market activity. Sell pressure is most noticeable during early listing or low market activity, while long-term vesting and buybacks help stabilize price.

VI. Official Links

Website:

https://www.meteora.ag/

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.

2

2

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Google Translate now enables you to listen to live translations directly through your headphones

Bitget-RWA•2025/12/12 23:15

Data leak at major credit reporting firm 700Credit impacts no fewer than 5.6 million individuals

Bitget-RWA•2025/12/12 23:15

Microsoft purchases 3.6 million metric tons of carbon removal from a bioenergy facility

Bitget-RWA•2025/12/12 23:15

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$90,398.02

-2.34%

Ethereum

ETH

$3,094.97

-4.17%

Tether USDt

USDT

$1

+0.03%

XRP

XRP

$2.02

-1.00%

BNB

BNB

$882.31

-0.31%

USDC

USDC

$1

+0.03%

Solana

SOL

$132.83

-2.45%

TRON

TRX

$0.2742

-2.37%

Dogecoin

DOGE

$0.1372

-2.29%

Cardano

ADA

$0.4108

-2.77%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now