Crypto Markets React as Trump Says High China Tariffs ‘Not Sustainable’

US President Donald Trump clarified on Friday that proposed 100% tariffs on Chinese goods “won’t stand”, suggesting a softer stance than initially feared. The statement comes amid rising global trade tensions and has already stirred speculation in traditional and crypto markets alike. Bitcoin Reacts as Trump Softens on China Tariffs While the initial threat of

US President Donald Trump clarified on Friday that proposed 100% tariffs on Chinese goods “won’t stand”, suggesting a softer stance than initially feared.

The statement comes amid rising global trade tensions and has already stirred speculation in traditional and crypto markets alike.

Bitcoin Reacts as Trump Softens on China Tariffs

While the initial threat of aggressive tariffs raised concerns over global risk sentiment and capital flight, Trump’s latest comments signal a potential easing in trade policy.

In an interview with Fox News, President Trump discussed trade tensions with China and his upcoming meeting with Xi Jinping in South Korea in two weeks.

“They’re always looking for an edge. They ripped off our country for years,” Trump said.

He further added that China really hurt the US economy in the past, but now that has changed.

When asked whether a 100% tariff on top of existing China tariffs could be upheld, Trump said no, adding that such a move wouldn’t be sustainable.

“I think we are gonna do great with China,” Trump noted.

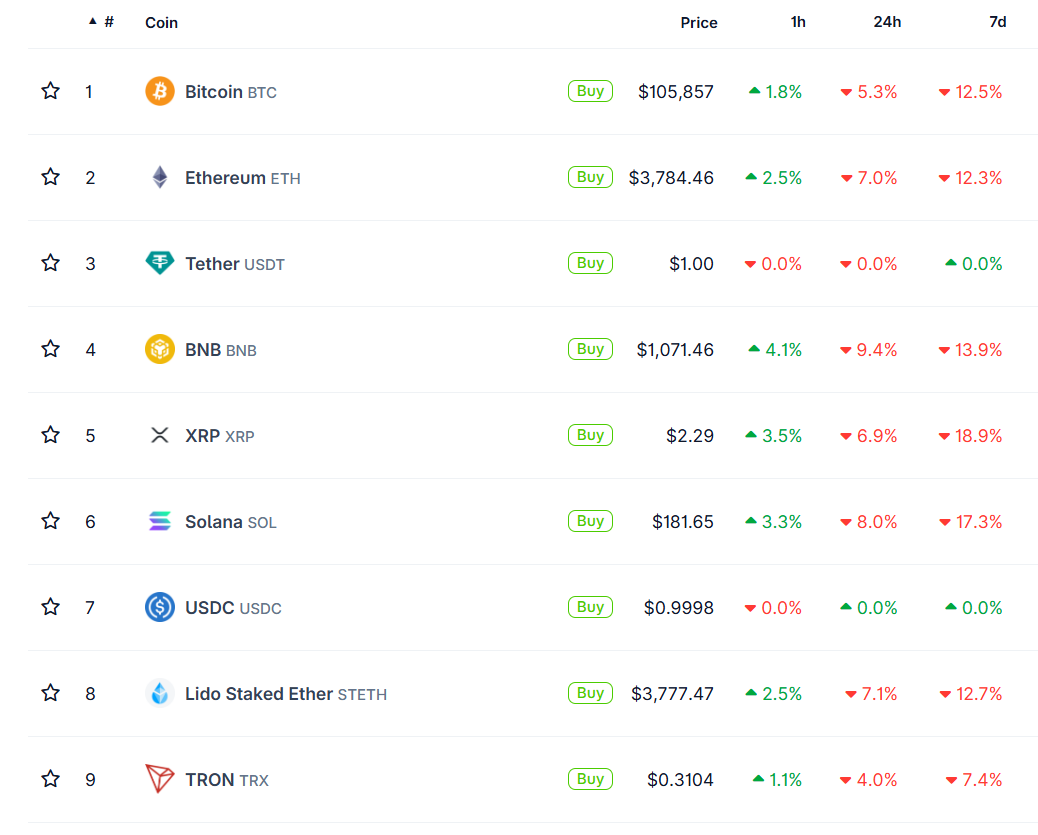

This shift has been interpreted as a relief signal for risk-on assets. In response, Bitcoin price showed a slight uptick, up nearly 2% on the 1-hour chart. Top cryptocurrencies followed suit, showing positive momentum after Trump softened his stance.

Price Performance of Top Cryptocurrencies. Source:

Coingecko

Price Performance of Top Cryptocurrencies. Source:

Coingecko

The change in stance comes as global markets plunged late last week after Donald Trump announced sweeping new tariffs and export controls on China, escalating trade tensions to their highest level since 2019. The aggressive move sent shockwaves through global markets, with risk assets like Bitcoin and Ethereum tumbling in response.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.