Dogecoin vs Shiba Inu: Who Will Crash to Zero First?

The meme coin war has taken an unexpected turn. A few months ago, people were debating who would reach one dollar first . Now, the conversation has flipped to who might hit zero first. Both Dogecoin and Shiba Inu are sliding down the charts, and the timing couldn’t be worse. The U.S. government shutdown is eating away at economic stability, bleeding roughly 15 billion dollars a week from productivity and investor confidence. When macro uncertainty hits, liquidity exits the riskiest corners first—and meme coins are often the first victims.

Dogecoin vs Shiba Inu: How the U.S. Shutdown Is Crushing Risk Appetite?

Let’s start with the bigger picture. Treasury officials admit the shutdown is cutting into the “muscle” of the U.S. economy, stalling spending and reducing investor risk tolerance. Even with a shrinking deficit and strong investment in AI and tech, retail sentiment is weakening. For cryptocurrencies driven by hype and emotion, that’s fatal. Meme coins rely on optimism, social momentum, and speculative flows—all of which vanish in fear-driven markets. Every extra week of shutdown drains liquidity, tightening the noose on speculative assets.

Dogecoin: Slipping Into the Danger Zone

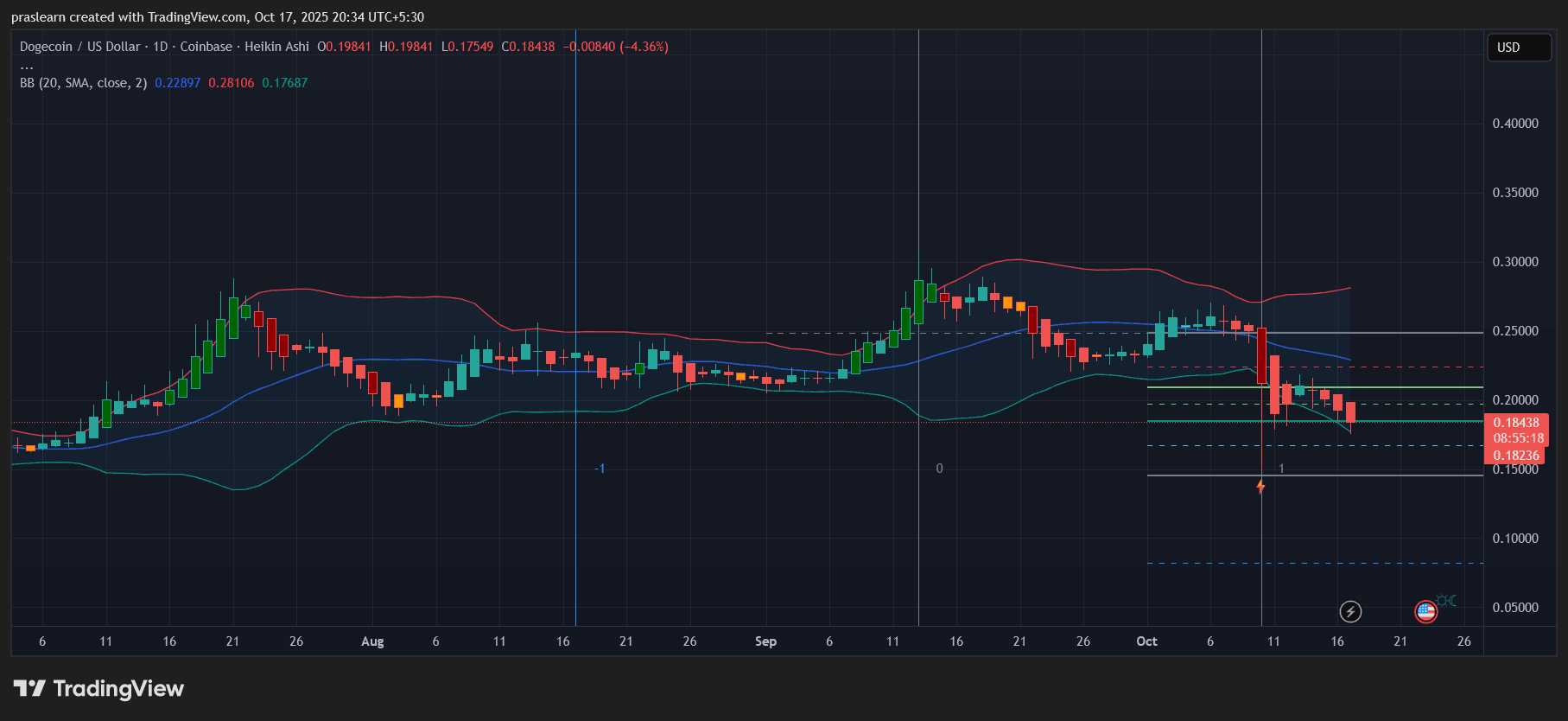

DOGE/USD Daily Chart- TradingView

DOGE/USD Daily Chart- TradingView

On the daily chart, Dogecoin (DOGE/USD) is flashing textbook weakness. Heikin Ashi candles show a series of long-bodied reds without lower shadows—a strong continuation of bearish momentum. The Bollinger Bands are widening, suggesting volatility expansion, but the price is sliding near the lower band at around 0.176. The mid-band, sitting close to 0.228, has now turned into firm resistance.

If the next few sessions fail to reclaim 0.20, DOGE could tumble toward the 0.15 zone. The broader issue isn’t just price—it’s structure. The coin is failing to form higher lows, showing a lack of buying conviction. Even Elon Musk’s occasional engagement no longer sparks sustained rallies. Dogecoin’s market now feels tired , more reactive than revolutionary, and that’s dangerous in a macro climate that rewards fundamentals over memes.

Shiba Inu: The Silent Bleeder

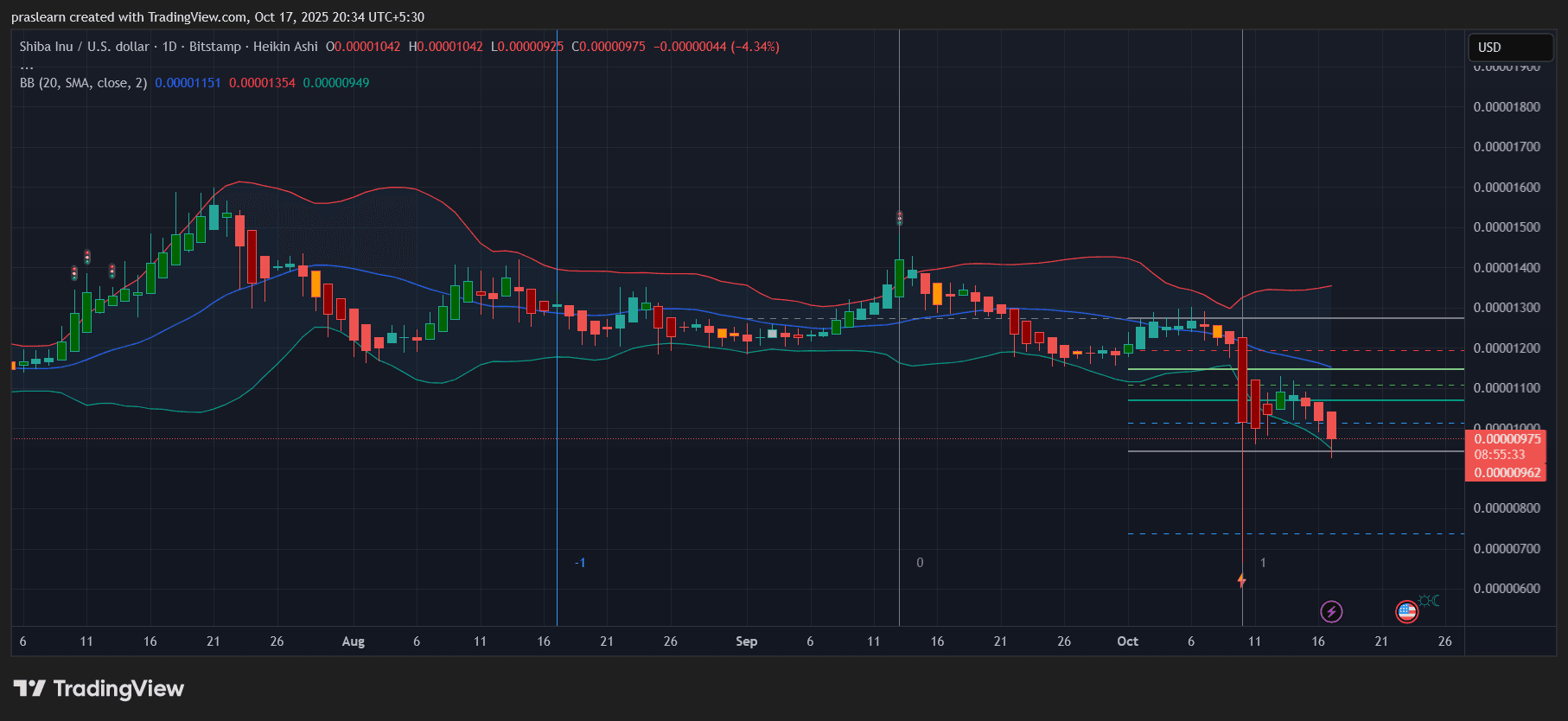

SHIB/USD Daily Chart- TradingView

SHIB/USD Daily Chart- TradingView

Shiba Inu (SHIB/USD) looks slightly worse. Its chart mirrors Dogecoin’s decline, but with sharper breakdowns and thinner liquidity. The daily Heikin Ashi candles hover below the Bollinger midline at 0.0000115, while the price keeps pressing the lower band near 0.0000095. Support around 0.0000092 is critical—if that level fails, the next stop is 0.0000075 or even lower.

The problem is volume collapse. SHIB’s burn narratives and ecosystem expansions have lost traction , and traders are shifting focus toward newer AI and DeFi coins. Without a strong catalyst or whale intervention, the token risks drifting into irrelevance. The technicals alone show no signs of reversal: weak momentum, declining volatility, and continuous lower highs.

Dogecoin vs Shiba Inu: Which One Is More at Risk?

Between the two, Shiba Inu looks technically more fragile. Its lower price structure and thin liquidity make it more susceptible to panic selling. Dogecoin , while in decline, still holds some institutional presence through payment integrations and exchange listings. In other words, DOGE might bleed slower—but it’s still bleeding.

If the U.S. shutdown drags into another few weeks, expect risk-off sentiment to deepen across all meme coins. The combination of poor macro signals and collapsing technicals could trigger a capitulation wave.

The Bottom Line

Dogecoin vs Shiba Inu meme coin era isn’t over, but it’s entering a brutal reset phase. Traders who once chased dreams of $1 DOGE or SHIB now face the question of survival. If macro conditions worsen, these assets could retest multi-month lows before any meaningful rebound.

Right now, Dogecoin’s 0.15 and Shiba Inu’s 0.0000092 levels are the last lines of defense. Lose those, and both could spiral into new lows—possibly setting the stage for that dreaded zero conversation.

What this really means is simple: in a market driven by liquidity and sentiment, fundamentals matter again. And in that reality, neither $DOGE nor $SHIB is safe.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.

Alphabet’s TPUs Emerge as a Potential $900 Billion Chip Business

Ethereum Loses 25% of Validators After Fusaka: The Network Nears a Critical Failure

US Stablecoin Rules Are Splitting Global Liquidity, CertiK Warns