Dogecoin Price Set To Go On A 2,000% Cyclical Surge To $4

The Dogecoin price could be gearing up for an explosive move soon, as technical analysts suggest that the popular meme coin may be entering another parabolic cycle. While the broader crypto market declines, analysts believe Dogecoin’s historical patterns and price structures are setting the stage for a potential 2,000% rally that could see it soar as high as $4 by next year.

Dogecoin Price To Mirror Pre-2017 Explosive Surge

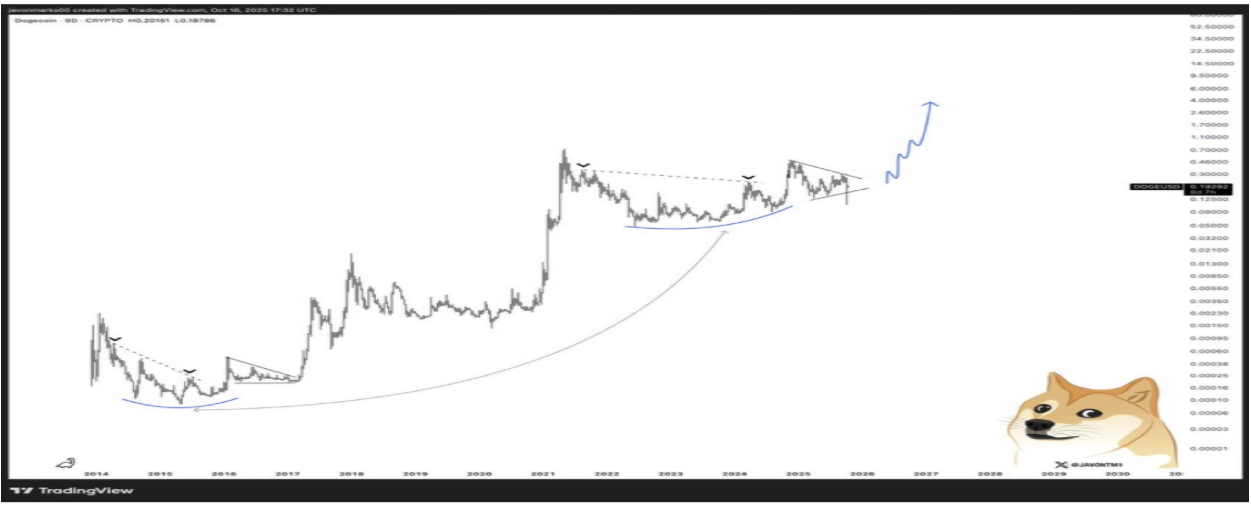

Crypto analyst Javon Marks has indicated that Dogecoin’s price action is closely mirroring the bullish setup that preceded its historic price rally in 2017. If this pattern continues, he predicts that the cryptocurrency may be preparing for its next cyclical surge to new all-time highs and beyond.

Marks points out that Dogecoin’s long-term structure is forming a massive cup-shaped base, which historically has paved the way for significant bull runs. His analysis forecasts a minimum 251% increase in the near term, with a potential 2,000% surge over a longer timeframe, should the historical pattern unfold as it did in the past.

The analyst’s accompanying chart illustrates a recurring accumulation pattern where Dogecoin consolidates for years before breaking out sharply. The price history between 2014 and 2017 is being mirrored by the 2022 – 2025 formation, where the meme coin appears to be carving out a rounded bottom and a consolidation triangle. Once price action completes this structure, Marks predicts that a breakout toward $4 is technically possible.

Notably, Dogecoin’s resilience between its current price at $0.18 and $0.3 may act as a launchpad for the next parabolic phase, especially if the overall market sentiment turns bullish in 2026. As of the time of writing, CoinMarketCap’s data indicates that the meme coin’s price has increased by 5.53% over the past 24 hours, marking a slight recovery from its monthly decline of over 33%.

Analysts Share Different Outlooks For Dogecoin

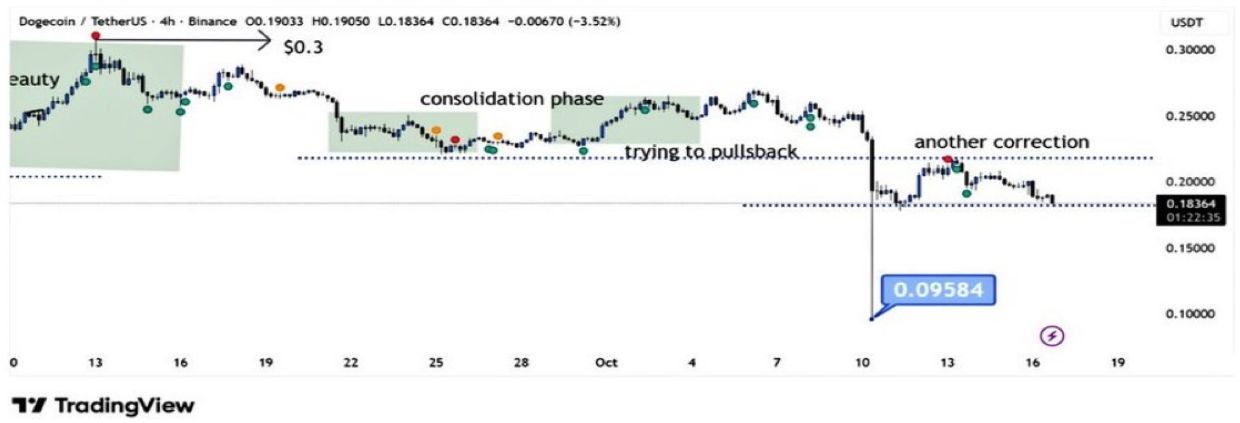

A separate analysis by market experts presents a slightly different outlook for Dogecoin, with one expert expecting a moderate price surge and another predicting a potential breakdown. Crypto analyst Ali Martinez views Dogecoin’s current structure as part of a steady, upward-trending price channel. He highlighted that DOGE continues to trade within an ascending range established since early 2023. This framework implies that the meme coin remains technically bullish despite short-term corrections.

In his analysis, Martinez identifies moderate but critical upside checkpoints at $0.29, $0.45, and $0.86, based on the Fibonacci retracement and extension levels. His chart illustrates how Dogecoin has repeatedly bounced off the lower boundary of the channel, mostly near $0.18, indicating strong buyer interest in that zone. Notably, the analyst forecasts that a rebound from this area could set the stage for gradual advances toward $1 in the coming months.

Market expert Bitguru adds a note of caution, observing that the $0.18 – $0.19 region is acting as a make-or-break level for bulls. A decisive drop below it could expose Dogecoin’s price to a deeper retracement toward $0.095. The analyst advises traders to remain vigilant, noting that DOGE still appears to be in a corrective phase.

Featured image from Unsplash, chart from TradingView

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC Faces Deadline for Grayscale XRP ETF Decision

Ethereum Bulls Remain Unfazed: Analyzing Market Confidence After $232 Million Liquidation

Ethereum’s price is fluctuating around $3,700, influenced by US credit and labor data, with traders cautiously avoiding high leverage. Whale activity indicates limited bearish sentiment, but there is insufficient confidence in a rapid rebound. No warning signals have been observed in the derivatives market, and a recovery will require clearer macroeconomic signals. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

BNY Mellon Empowers Crypto Ecosystem with Robust Infrastructure

In Brief BNY Mellon enhances its crypto ecosystem role through infrastructure services, not its own coin. The bank supports stablecoin projects instead of launching an altcoin amid positive market conditions. BNY Mellon prioritizes infrastructure over token issuance, promoting collaboration and ecosystem strength.

Crypto Surge Revives Investor Optimism

In Brief The crypto market exhibits signs of recovery post-major liquidations. Ethereum, Dogecoin, Cardano, and XRP have shown significant gains. Technological innovations and ETF expectations contribute to market optimism.