Bitcoin (BTC) Price Analysis for October 19

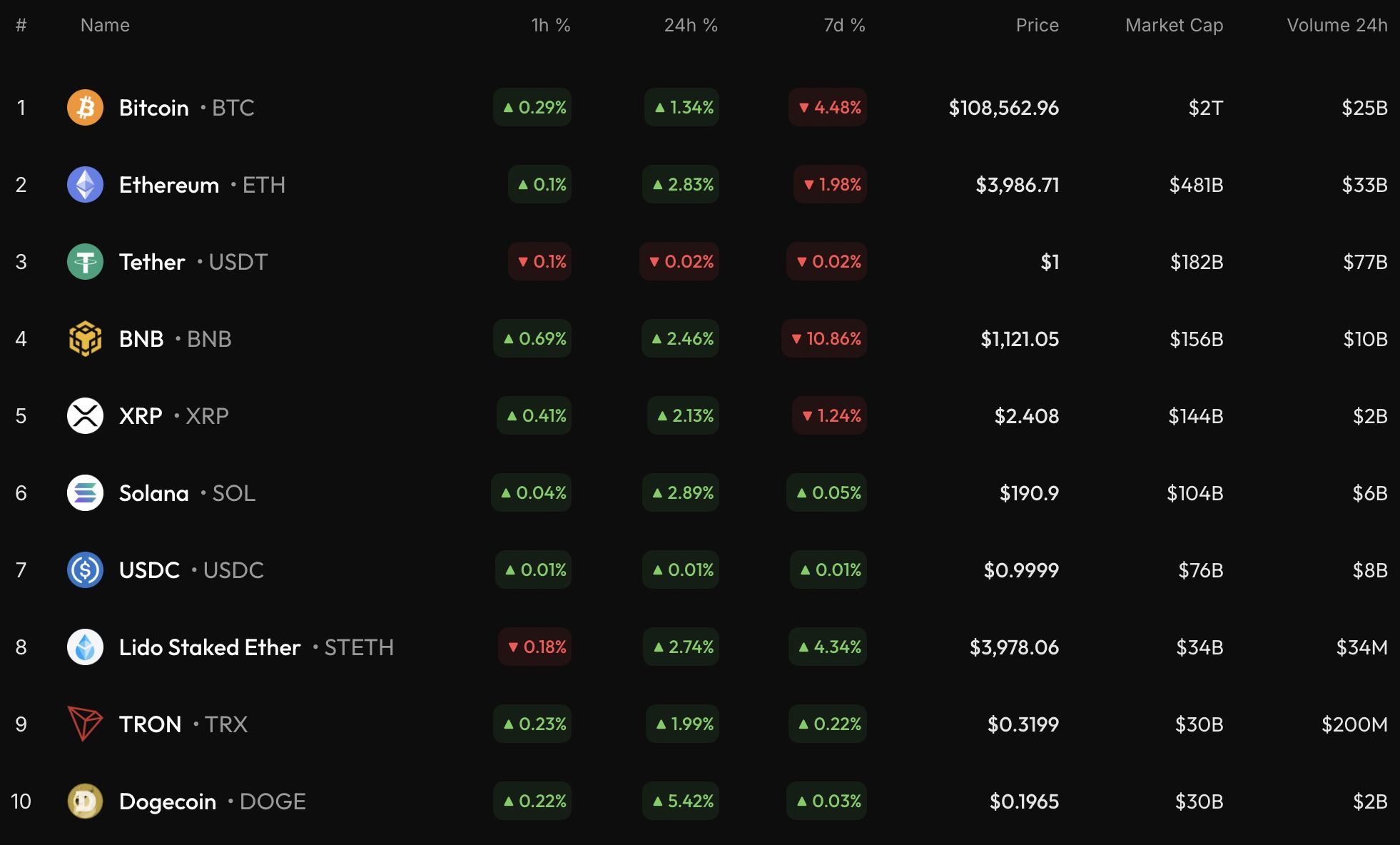

The rates of most coins keep rising on the last day of the week, according to CoinStats.

BTC/USD

The price of Bitcoin (BTC) has gone up by 1.34% over the last 24 hours.

On the hourly chart, the rate of BTC has broken the local resistance of $108,234. If the daily bar closes above that mark, the upward move is likely to continue to the $109,000 range.

On the bigger time frame, the price of the main crypto is going up after yesterday's bullish closure. However, the volume is low, which means bulls might need more time to get strength for a continued move.

In this regard, consolidation in the narrow range of $108,000-$110,000 is the more likely scenario.

From the midterm point of view, the situation is less positive for buyers. If the weekly bar closes near its low, there is a high chance of a test of the support of $100,426 by the end of the month.

Bitcoin is trading at $108,455 at press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI Token Price Fluctuations and Investor Prudence: Insights from the ChainOpera Collapse and Strategies for Building Resilience

- ChainOpera AI's 2025 collapse exposed systemic risks in centralized crypto projects with opaque AI models and governance. - The token lost 90% of value due to liquidity imbalances, unaudited algorithms, and regulatory uncertainty under the U.S. CLARITY Act. - Post-crash lessons emphasize transparent governance, real-world utility, and compliance with frameworks like NIST AI RMF and ISO/IEC 42001. - Projects like ASI and Ocean Protocol demonstrate resilience through decentralized models, auditable systems

The Critical Importance of Financial Education in Young Adulthood: Building Knowledge to Avoid Future Economic Instability

- Gen Z's 38% average score on financial literacy tests highlights a crisis in foundational economic knowledge among U.S. youth. - Low financial literacy doubles debt risk and triples financial instability, with 87% of uneducated graduates feeling unprepared for real-world money management. - Global studies show financial education increases wealth accumulation, retirement confidence, and stock market participation across age groups. - Only 27 U.S. states mandate personal finance education, despite 70% of

ALGO Rises 0.6% as Price Fluctuations Decrease Following a Year of Decline

- Algorand (ALGO) rose 0.6% on Dec 8, 2025, but remains down 60% year-to-date amid prolonged bearish trends. - BitGo filed for a NYSE IPO (ticker BTGO) in Sept 2025, reporting $4.19B H1 2025 revenue and $12.6M net income. - The crypto custodian oversees $90B+ in assets, signaling maturing infrastructure that may indirectly support blockchain ecosystems like Algorand. - Analysts caution ALGO's short-term stability does not indicate a reversal, urging investors to monitor macroeconomic and regulatory risks.

Aster Increases Daily Buybacks to Strengthen Holder Support