Key Notes

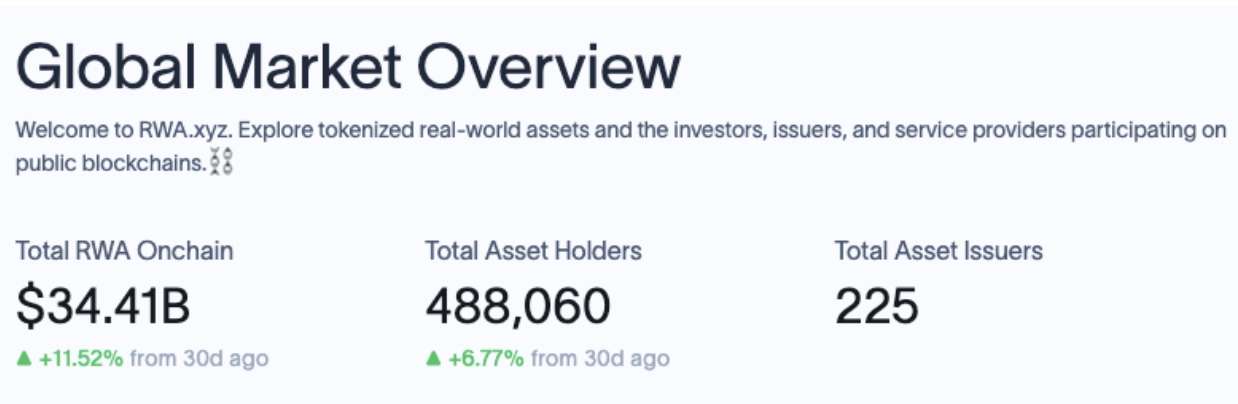

- RWA sector valuation jumped 11.6% to $34.4 billion, adding $3.9 billion in new deposits over the past month.

- Gold’s record-breaking rally to $4,200 and the US government shutdown spurred inflows into tokenized treasuries and commodities.

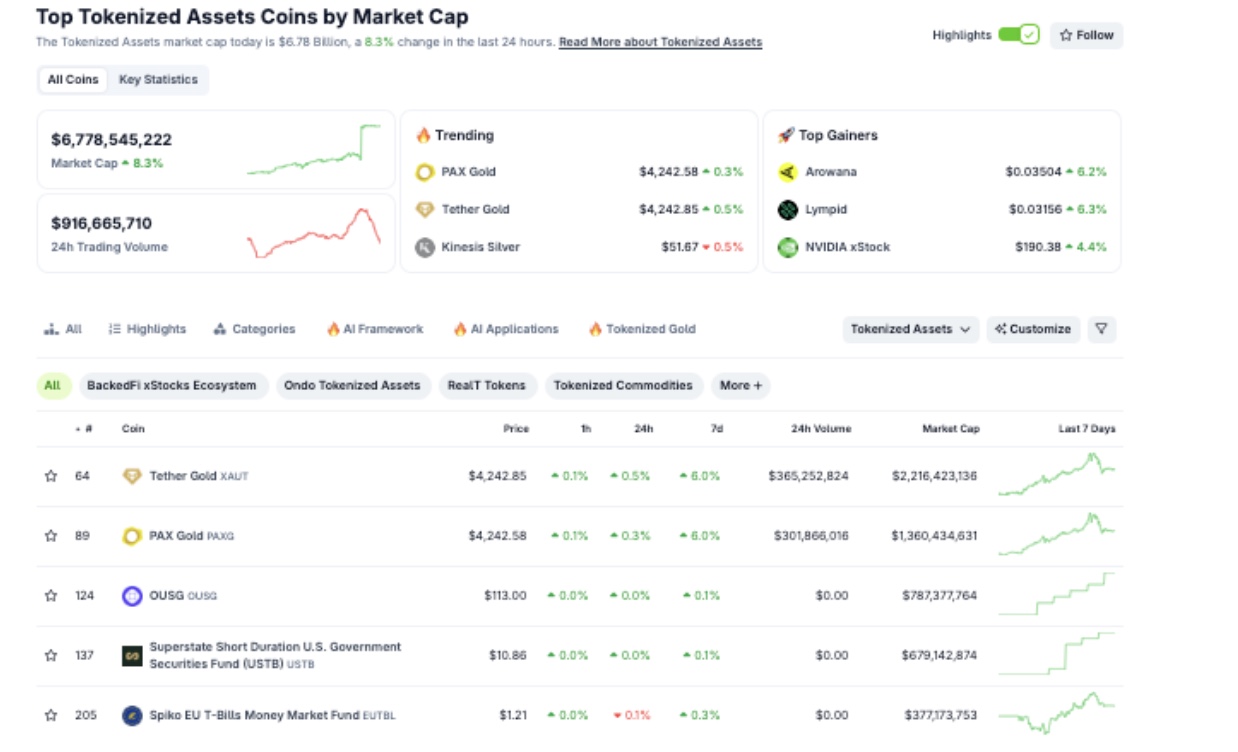

- Tokenized RWA projects outperformed the wider crypto market, rising 8.3% intraday as Bitcoin sank below $104,000.

Real World Asset (RWA) sector valuation hit $34.4 billion on Saturday, October 18, marking an 11.6% increase and a $3.9 billion rise in total deposits over the last 30 days, according to RWA.xyz data.

RWA Market Overview | Source: RWA.xyz, Oct 18, 2025

The ongoing U.S. government shutdown, combined with Gold’s record-setting rally above $4,200, has created a flight-to-safety narrative that boosted RWA inflows despite broader crypto weakness.

The crypto market suffered its worst month since May after President Donald Trump’s tariff call on China triggered a $19 billion liquidation event on October 10 . Another $1.2 billion wipeout followed on October 17, pushing Bitcoin below $104,000, its lowest level since July.

However, the Real-World Assets sector remained resilient. Tokenized debt, commodities, and private credit products continued attracting inflows as investors sought yield stability amid macro uncertainty.

U.S. Treasuries and Gold-Backed Assets Lead Inflows

Private credit remains the largest RWA category, representing 51.4% of the total market at $17.3 billion. Data from RWA.xyz shows U.S. public debt and commodities accounted for nearly half of the $3.9 billion in new deposits.

Total RWA Value | Source: RWA.xyz October 18, 2025

Since the start of October, Tokenized U.S. debt instruments rose from $7.5 billion to $8.3 billion, reflecting accelerated tokenization of U.S. securities following the US government shutdown. Gold’s historic rally to $4,200 last week also impacted on-chain movements, with Commodities-backed RWAs rising from $2.1 billion to $3.2 billion.

Combined, U.S. Treasuries and Commodities saw $1.9 billion in inflows, accounting for 51% of all newly tokenized assets in the last 30 days.

Tokenised Assets by Market Cap | Coingecko: Oct 18, 2025

Increased liquidity in the sector has generated significant gains for token holders, defying recent crypto market turbulence.

CoinGecko data shows the aggregate market cap of tokenized projects rose to $6.78 billion, gaining 8.3% intraday, compared to the broader crypto market’s 0.6% uptick.

next