Modest Solana Investment Can Double Portfolio Returns, Study Finds

The new Capital Markets report attributes this edge to Solana’s robust ecosystem growth, efficiency, and increasing institutional adoption.

Bitcoin may dominate institutional attention as the cornerstone of digital assets. However, new research suggests that modest exposure to Solana (SOL) could significantly improve portfolio efficiency.

A study by Capital Markets, drawing on Bitwise data, found that even a small Solana allocation enhances risk-adjusted returns in a traditional 60/40 portfolio of equities and bonds.

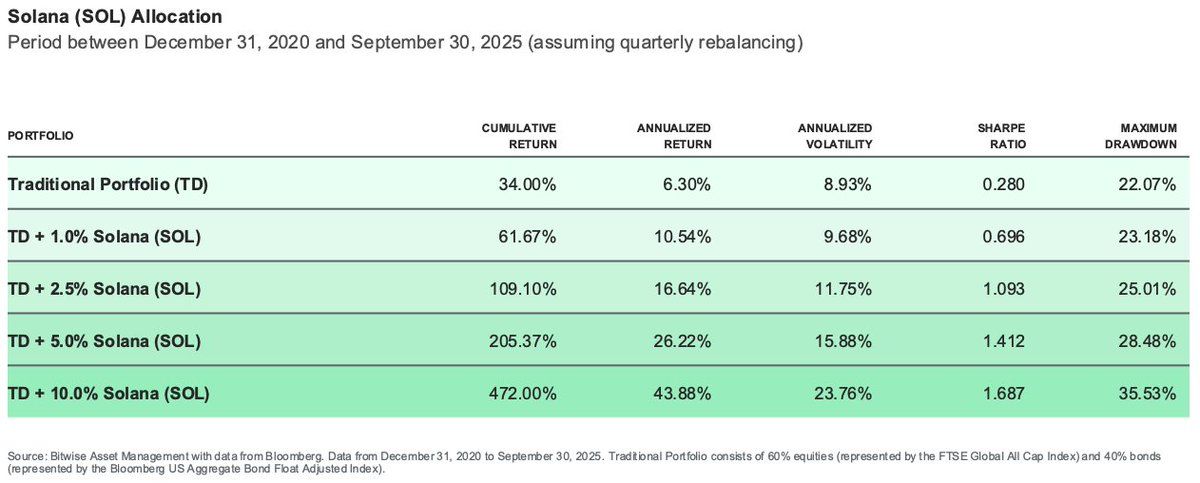

How Solana Allocations Produce Strong Returns

The analysis revealed that adding just 1% SOL exposure lifted annualized returns to 10.54%, with a Sharpe ratio of 0.696.

According to the report, increasing that share to 2.5% boosted returns to 16.64% and produced a Sharpe ratio of 1.093. A 5% weighting, meanwhile, generated 26.22% returns with a Sharpe ratio of 1.412.

Solana Portfolio Allocation. Source:

Capital Markets

Solana Portfolio Allocation. Source:

Capital Markets

Capital Markets also pointed out that a 10% higher-risk allocation will push the portfolio’s annualized returns to 43.88%, with a Sharpe ratio of 1.687.

Capital Markets said these results demonstrate how measured SOL exposure can strengthen long-term portfolio performance. However, diversification altered the outcome.

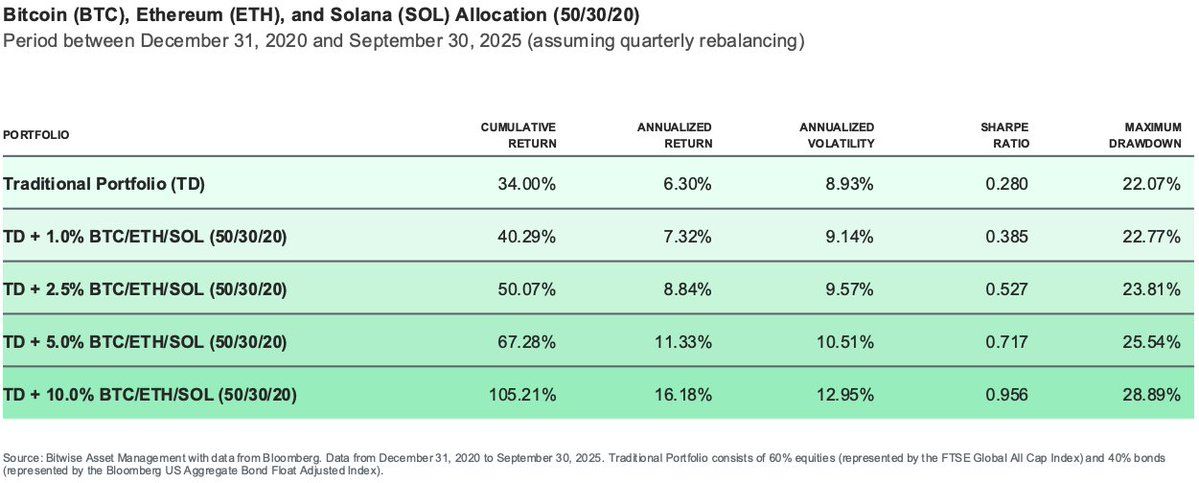

When a 10% crypto allocation was split equally among Bitcoin, Ethereum, and Solana, annualized returns dropped to 19.87%. Notably, this is significantly less than half of Solana’s solo performance.

Meanwhile, a 50:30:20 split between Bitcoin, Ethereum, and Solana yielded 16.18% returns. Smaller allocations of 5% and 2.5% produced steady but moderate improvements of 11.33% and 8.84%, respectively.

Bitcoin, Ethereum, and Solana Allocation. Source: Capital Market

Bitcoin, Ethereum, and Solana Allocation. Source: Capital Market

“Maximum drawdowns remained relatively contained across allocations, even as returns increased sharply,” Capital Markets stated.

Considering this, the firm concluded that a concentrated Solana exposure delivered higher gains. However, a diversified portfolio offered smoother, more consistent growth.

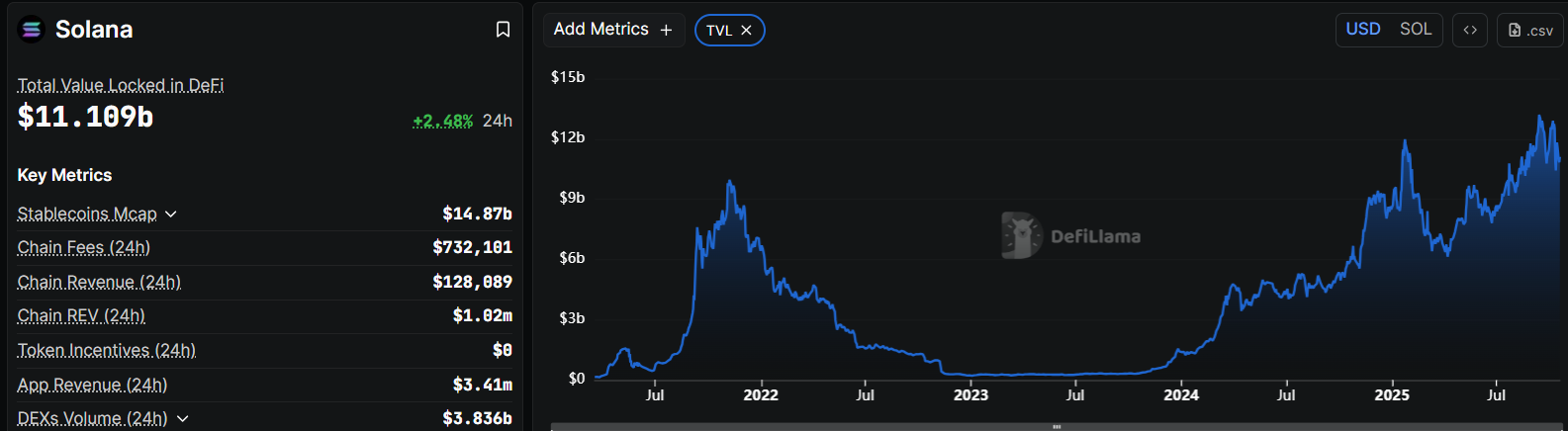

Solana’s on-chain fundamentals help explain its performance edge.

The network, known for low transaction fees and high throughput, processed roughly 96 million daily transactions in the first quarter of 2025 amid the fervor for meme coins.

At the same time, the blockchain network has scored significant institutional adoption and user growth across payments, gaming, and consumer applications. Notably, Solana is the second-largest decentralized finance ecosystem with more than $11 billion in value locked.

Solan DeFi Ecosystem. Source:

DeFiLlama

Solan DeFi Ecosystem. Source:

DeFiLlama

This expanding ecosystem continues to reinforce SOL’s investment appeal. Its efficiency and scalability position it as a credible next-generation blockchain for decentralized applications.

Moreover, with speculation growing around a potential US spot Solana ETF, the asset now dominates discussions about crypto’s evolving role in modern portfolio theory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BREAKING: Why Tether’s USDT Is One Bitcoin Crash From Breaking

Ethereum News Today: Ethereum’s Fusaka Update: Scaling Goals Face Challenges From Validator Compromises

- Ethereum's Fusaka upgrade (Dec 3, 2025) introduces PeerDAS to enhance scalability by verifying rollup data without full dataset downloads. - BPO forks enable incremental blob capacity increases (e.g., 14 blobs/block by Jan 7, 2026), avoiding disruptive hard forks while supporting 100k+ TPS via L2 solutions. - L2 data fees may drop 40%-60% with PeerDAS, but validators face trade-offs between reduced storage demands and increased upload requirements as blob capacity grows. - Market reactions remain mixed:

Bitcoin Updates: Challenges in Blockchain Infrastructure Drive Growth of Mixed Sustainability Approaches

- Blockchain networks show mixed fee revenue, with only 11 surpassing $100K weekly thresholds, highlighting structural inefficiencies and speculative challenges. - Lumint's hybrid staking model combines AI-driven tools with decentralized rewards to address PoW/PoS flaws, aiming for sustainability and reduced energy waste. - Bitcoin rebounded to $87,000 amid 2% market growth, but extreme fear persists (index at 20), with $380M in liquidations and mixed retail sentiment. - Hybrid solutions like Lumint priori

DASH drops 4.37% within 24 hours following Australian wage agreement

- DoorDash's stock fell 4.37% in 24 hours amid a 25% wage hike agreement for Australian delivery workers, including mandatory accident insurance. - The deal raises near-term cost concerns as operating margins stand at 5.5%, but reflects improved labor standards and regional commitment. - Institutional ownership rose to 90.64% with major investors increasing stakes, signaling long-term confidence despite recent volatility. - Analysts maintain a "Moderate Buy" rating ($275.62 target) as DoorDash shows strong