a16z invests twice: How does Daylight use tokens to power a "virtual power plant"?

The last time a16z bet on DePIN was with Helium.

The last time a16z bet on DePIN was with Helium.

Written by: Eric, Foresight News

Last week, the Web3 "virtual power plant" project Daylight announced a new round of financing. In addition to a $15 million equity round led by Framework Ventures and participated in by a16z crypto, it also secured a $60 million project development fund led by Turtle Hill Capital.

Daylight aims to promote the construction of "virtual power plants" through token incentives, allowing users to purchase solar panels, water heaters, and other equipment via Daylight. By building a distributed energy network, Daylight integrates small-scale energy devices from individuals and households into a vast network that can provide stable and efficient electricity without relying on traditional power grids, while also offering token incentives to end users.

In addition, Daylight stated it plans to launch DayFi in the fourth quarter, describing it as a "yield protocol connecting DeFi capital with real-world energy systems," where investors can earn returns supported by electricity revenue from an expanding portfolio of residential solar and storage systems. However, Daylight did not provide detailed information on this part.

Connecting Household Energy Networks

The concept of a "virtual power plant" was first proposed by Dr. Shimon Awerbuch in 1997. In his book "Virtual Utilities: Description, Technology, and Competitiveness of Emerging Industries," he introduced the term "virtual power plant" and defined it as: a flexible cooperation among independent, market-driven entities that do not necessarily own the relevant assets but can provide consumers with the efficient electricity services they need. This definition laid the foundation for the core idea of virtual power plants as platforms for distributed energy aggregation and collaborative optimization.

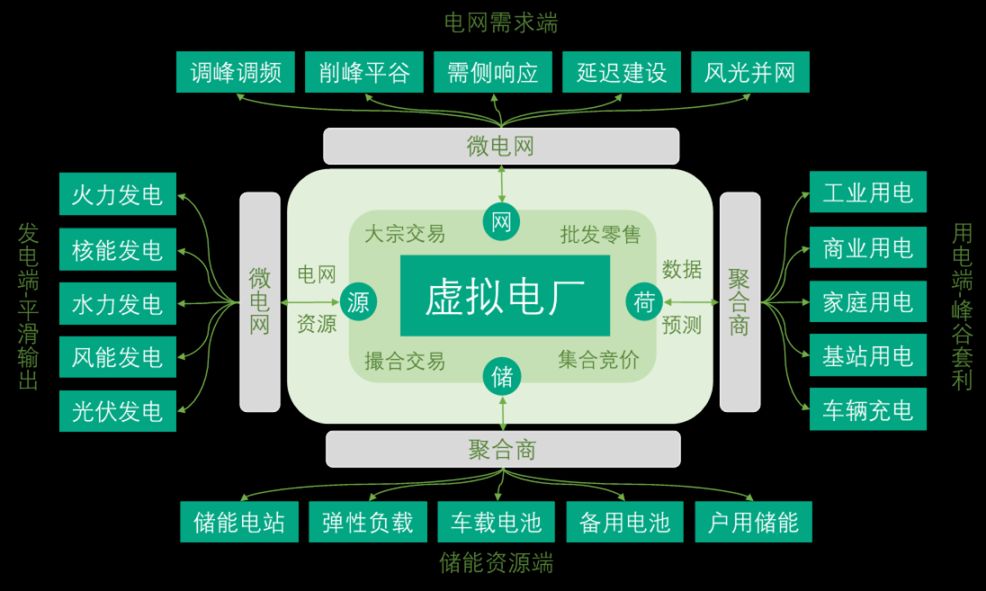

Plug and Play China once published an article explaining the concept of virtual power plants in detail. The article stated, "A virtual power plant is not a traditional power plant in the usual sense. It is an intelligent energy system that aggregates one or more resources such as adjustable (interruptible) loads, energy storage, microgrids, electric vehicles, and distributed energy from different locations, achieving autonomous coordinated optimization and control, and participating in power system operations and electricity market transactions."

Currently, the development of virtual power plants has made the overall system very complex, but in short, it is no longer a simple one-way path from power plants to electrical devices. Instead, technology and data are used on both the supply and demand sides to better balance electricity supply and demand, reducing waste or shortages.

Daylight operates in both the demand and storage sectors and launched a subscription service earlier this month. This service provides households with more affordable and stable electricity. Users can lock in energy prices, save money compared to public utilities, and benefit from Daylight's predictable pricing, making it easier to plan household expenses.

Daylight users can receive free storage batteries and solar panels, with Daylight covering installation, maintenance, and replacement costs. Once installed, users can connect their devices to the Daylight network and use the network's electricity resources. When individual or regional electricity demand surges or supply is insufficient, Daylight will allocate resources accordingly, releasing stored energy to meet demand; conversely, when supply exceeds demand, energy will be stored.

Based on this, Daylight's network revenue comes not only from subscription users' electricity fees but also from dispatching stored electricity from the Daylight network to the grid during peak demand, earning external payments. According to Daylight, the second part of the revenue will flow back into the Daylight network, further reducing household electricity costs within the network.

As subscription members, users can share data from connected devices such as thermostats and electric vehicles, helping the network operate scientifically and efficiently through data analysis. In return, subscribers will receive Sun Points, which can be redeemed for gift cards, merchandise, etc. In the future, these points will be replaced by tokens. Of course, users can also choose to purchase equipment directly instead of paying a monthly subscription fee, allowing them to use the electricity generated by their own devices for free.

Unfortunately, the project currently operates only in the United States, so it cannot be experienced domestically. According to the official website, Daylight has obtained relevant licenses in Illinois, Massachusetts, and Connecticut. Local readers in the U.S. can try applying on the official website to see if their location supports joining the network established by the project.

A Team from Investment Banks and Renewable Energy Companies

To date, Daylight has completed three rounds of financing. The $4 million seed round took place in 2022, but there was no public report on this round. Known investors include IoTeX and FutureMoney Group. The Series A round occurred in August 2024, with $9 million led by a16z crypto and participation from Framework Ventures, Lattice Fund, Escape Velocity, and Lerer Hippeau. Including the previously announced third round, Daylight's total financing has reached nearly $100 million.

Daylight's founding team consists of four people. Co-founder and CEO Jason Badeaux graduated from Louisiana State University and previously worked as an analyst at investment bank Piper Sandler and as a senior associate at Bernhard Capital Partners, which focuses on infrastructure and energy investments. Co-founder and CTO Udit Patel was a senior analyst at U.S. energy giant Consolidated Edison.

Another co-founder, Dallas Griffin, was formerly a managing director at Piper Sandler and has since left Daylight. The last co-founder, Evan Caron, is an experienced entrepreneur and investor. While serving as a Daylight co-founder, he is also a founding partner at storage company HGP Storage and a strategic advisor to Haven Energy and Amperon. In 2019, Evan Caron was a director at RiverStone Ventures, which focuses on energy investments, and in 2023, he co-founded Montauk Capital as CIO.

"Virtual Power Plants" Still Need Market Validation

In the traditional electricity sector, many industries and companies have emerged around "virtual power plants," but in the Web3 space, similar concepts to Daylight are not uncommon, and there do not seem to be many cases that have undergone market validation. Whether Daylight's solution of connecting household electricity networks and generating power with solar devices can produce significant electricity, whether surplus electricity will be stored as claimed, and whether the stored electricity can fill gaps in special situations all require further testing.

Technically, the Daylight network itself is more specialized in the energy sector, with its integration with Web3 being more economic than "Web3 Native." Its target market may never include China. In many countries, including the U.S., because not all power companies are state-owned and power supply in non-core areas is unstable, there is enough room for virtual power plants to develop. Daylight's main task going forward is to expand its network as much as possible, and its "Ambassador Program" is also aimed at getting more households to join.

For domestic investors, if you want to invest in the project's token after its issuance, you may need to pay more attention to the development of the U.S. energy industry and the project's own operations. In addition, the not-yet-detailed DayFi may be a new asset area worth exploring.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETH price fluctuates violently: the hidden logic behind the plunge and future outlook

Bitcoin risks return to low $80K zone next as trader says dip 'makes sense'

Bitcoin ‘risk off’ signals fire despite traders’ view that sub-$100K BTC is a discount

Trending news

MoreETH price fluctuates violently: the hidden logic behind the plunge and future outlook

[Bitpush Daily News Highlights] Texas Lieutenant Governor officially announces the purchase of bitcoin, aiming to build America’s digital future hub; Economists expect the Federal Reserve to cut interest rates in December, with two more possible cuts in 2026; Circle has issued an additional 10 billions USDC in the past month; Sources: SpaceX is in talks over share sales, with valuation possibly soaring to 800 billions USD.

![[Bitpush Daily News Highlights] Texas Lieutenant Governor officially announces the purchase of bitcoin, aiming to build America’s digital future hub; Economists expect the Federal Reserve to cut interest rates in December, with two more possible cuts in 2026; Circle has issued an additional 10 billions USDC in the past month; Sources: SpaceX is in talks over share sales, with valuation possibly soaring to 800 billions USD.](https://img.bgstatic.com/multiLang/image/social/dd58c36fde28f27d3832e67b2a00dab41764952203123.png)