Bitcoin’s Hashrate Hits the Stratosphere: Miners Flex 1.164 Zettahash of Pure Power

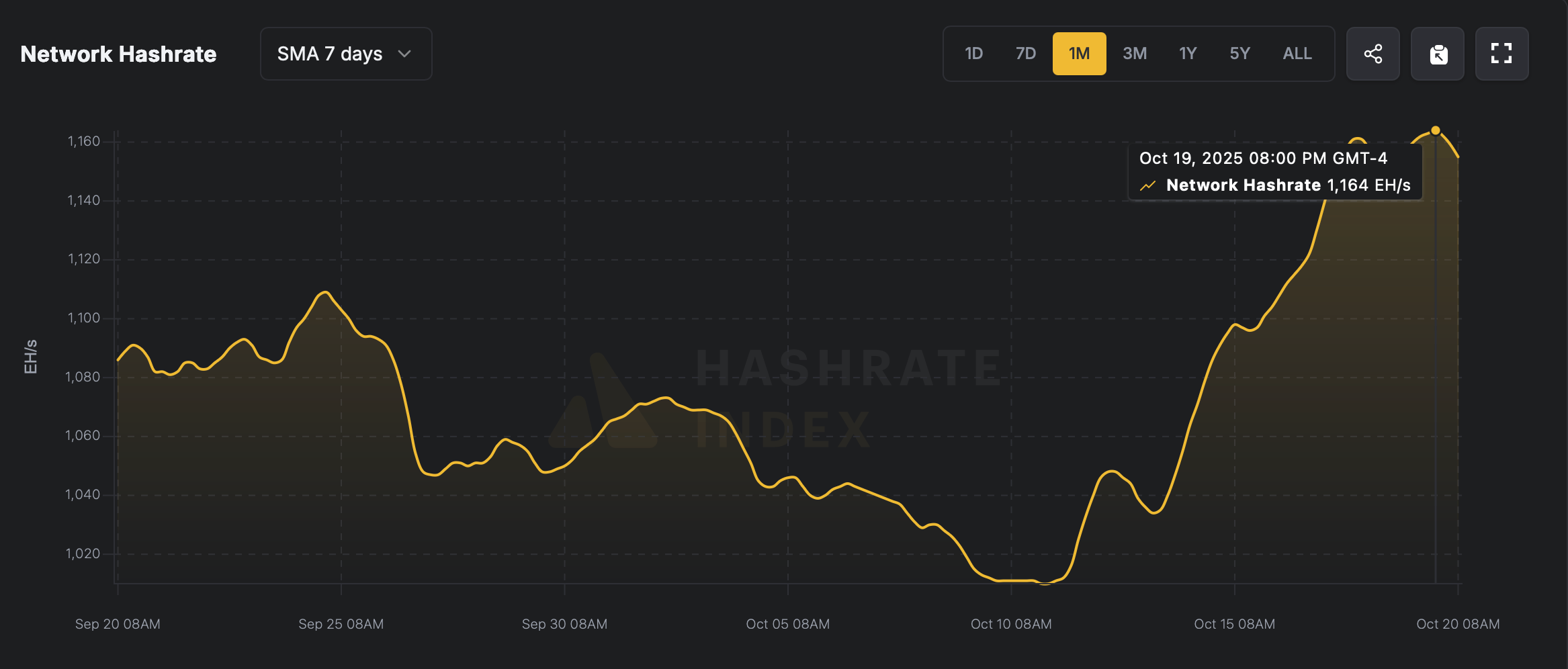

Bitcoin’s hashrate just cranked things up another notch, blasting to 1,164 exahash per second (EH/s) on Sunday at 2:40 p.m. Eastern time.

Bitcoin’s Hashrate Rockets While Revenue Improves

Fresh off its 1,157 EH/s high just two days back, Bitcoin’s hashrate has casually leveled up—adding another 7 EH/s to hit 1,164 EH/s, or for those who love big numbers, a cool 1.164 zettahash per second (ZH/s).

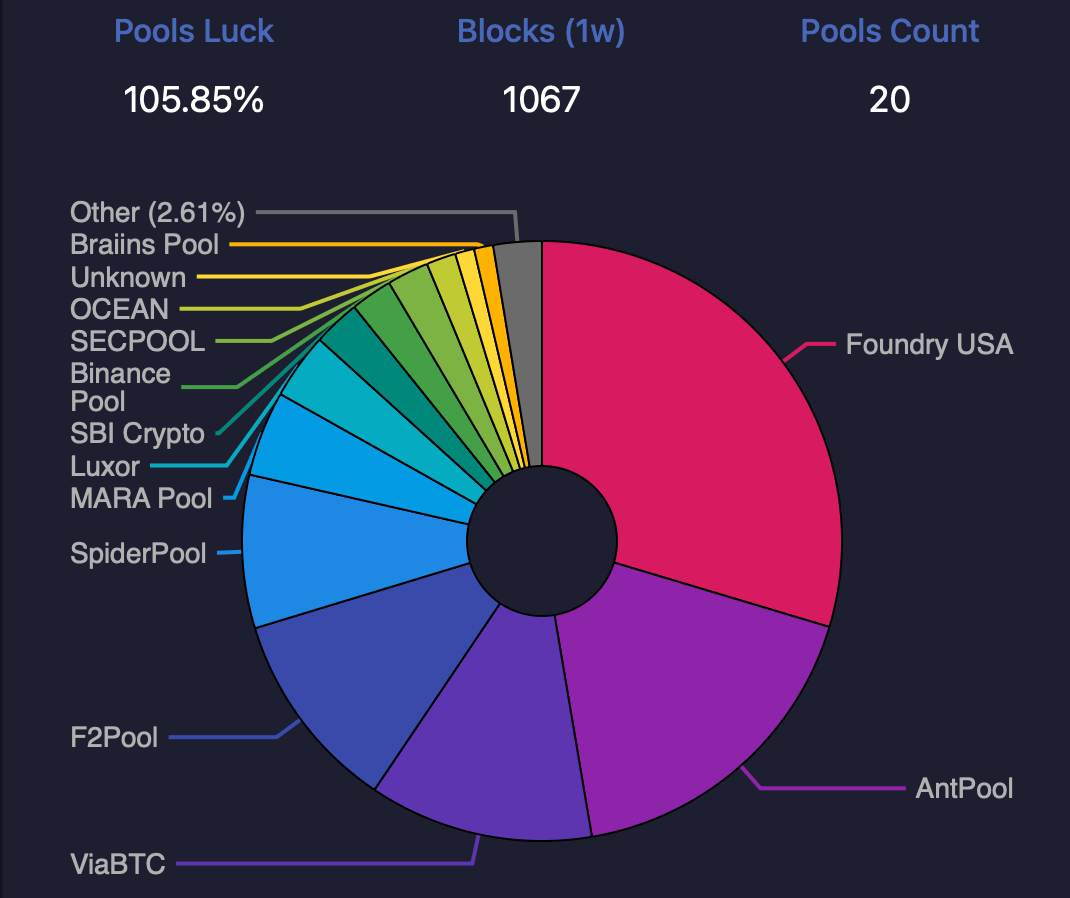

According to current hashrate stats, as of 11:45 a.m. on Oct. 20, Bitcoin’s hashrate is cruising at 1,154.16 EH/s. Leading the charge is Foundry USA, mempool.space metrics show, flexing 334.18 EH/s—roughly 28.96% of the entire network’s muscle.

Antpool’s holding steady with about 199.24 EH/s, making up 17.26% of Bitcoin’s total hashrate. Together with Foundry, this powerhouse duo controls a hefty 46.22% of the network.

Coming in third is ViaBTC with 135.99 EH/s, roughly 11.78% of the total, while F2pool and Spiderpool round out the top five at 122.29 EH/s and 92.77 EH/s, respectively. With BTC’s price on the upswing, hashprice—the estimated value of one petahash per second (PH/s)—has inched higher too.

In just 24 hours, the hashprice climbed 3.14%, rising from $46.51 to $47.97 per PH/s. Even so, the hashprice remains 6.89% below its Sept. 20, 2025 level. Over the past day, miners have been raking in an average of 3.14 BTC per block—though just 0.60% of that comes from onchain fees.

Bitcoin’s mining game is firing on all cylinders, with hashrate milestones stacking up and hashprice ticking higher in step with BTC’s price climb. Foundry and Antpool continue to dominate the charts, while 84 distinct smaller pools keep the competition lively.

Despite hashprice trailing its Sept. 20 level, miners remain locked in and laser-focused, proving once again that Bitcoin’s network isn’t just strong—it’s relentlessly pushing the limits of digital grit and computational endurance.

FAQ 🧭

- What is Bitcoin’s current hashrate?

As of Oct. 20, Bitcoin’s hashrate is cruising near 1,154 EH/s after recently touching 1.164 zettahash per second (ZH/s). - Which mining pools dominate the Bitcoin network?

Foundry and Antpool lead the pack, jointly controlling about 46% of Bitcoin’s total SHA256 hashrate. - How has Bitcoin’s hashprice changed recently?

The hashprice climbed 3.14% in 24 hours, rising from $46.51 to $47.97 per PH/s. - Are miners earning more from block rewards?

Miners earned an average of 3.14 BTC per block over the past day, which means only 0.60% stemmed from onchain fees.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KITE Price Forecast Post-Listing: Understanding Institutional Attitudes and Market Fluctuations

- KITE's post-IPO price fell 63% by Nov 2025 amid divergent institutional strategies and retail sector uncertainty. - Analysts split between "Buy" ($30 target) and "Hold" ratings, citing operational gains vs. macro risks like the $3.4T deficit bill. - Q3 net loss (-$0.07 EPS) and 5,400% payout ratio highlight structural risks despite industrial real estate pivots and 7.4% dividend hike. - Institutional trading directly impacted price swings, with COHEN & STEERS' stake increase briefly stabilizing shares be

The Financial Wellness Factor: An Overlooked Driver of Sustainable Wealth Building

- Financial wellness combines objective financial health and subjective well-being to drive long-term wealth creation, beyond mere asset accumulation. - Behavioral traits like conscientiousness correlate with disciplined investing habits, while neuroticism increases impulsive decisions during market volatility. - Studies show financially literate investors maintain portfolios during downturns, with 38% of "content" quadrant participants achieving superior risk-adjusted returns. - Debt management and saving

Aster DEX’s Latest Protocol Update and What It Means for DeFi Liquidity Providers

- Aster DEX's v2 upgrade enhances capital efficiency and privacy for liquidity providers (LPs) through ASTER token collateral and leveraged trading features. - The "Trade & Earn" functionality boosted TVL to $2.18B by November 2025, leveraging yield-bearing assets as trading margin. - However, 300x leverage and reduced tick sizes increase liquidation risks during volatility, while fee stagnation below $20M contrasts with $2B daily trading volumes. - Upcoming Aster Chain's privacy tools aim to attract insti

PEPE Steadies at $0.054711 With Narrow Range Shaping Short-Term Outlook