Ripple CEO Brad Garlinghouse revealed how people still confuse Ripple with XRP. The Ripple CEO noted that Ripple is the company, while XRP is a token, which they happen to hold a lot of. This has usually led to criticisms that XRP is centralized because of the significant amount of XRP Ripple holds.

Paydax Is Uniting RWAs And Crypto Over Ripple’s XRP

Paydax Protocol (PDP) enables users to lend, borrow, and earn with both real-world assets (RWAs) and crypto assets. On the P2P lending platform, market participants, including XRP holders, can lend their assets and earn up to 15.2% annual percentage yield (APY). Paydax has also taken necessary steps to provide adequate protection for lenders.

-

Overcollateralized loans

-

Redemption Pool that repays lenders in the event of a default

-

Onfido’s verification system ensures that all borrowers are legitimate

-

Immutable smart contracts that eliminate the need for middlemen

A Loan-To-Value (LTV) Ratio Of Up To 97%

Paydax Protocol’s (PDP) P2P lending offers borrowers loan-to-value ratios of up to 97% for both RWA and crypto loans. This means that, for example, an XRP holder with up $1 million worth of XRP can unlock $970,000 in fresh liquidity, which they can use for other opportunities in the crypto space. Paydax boasts several notable features that make it more appealing to users than other DeFi platforms.

-

Transparent fee structures

-

Automated safeguards to reduce liquidation risks

-

Broad collateral support, including blue-chip cryptos such as Bitcoin and XRP, and RWAs such as gold.

-

Fixed interest rates of between 5% and 7%

-

Simple vault system for borrowers to access instant liquidity

Borrowing on Paydax is very straightforward. Borrowers simply deposit their collateral into the LendingPool and then borrow against it. For RWAs, Paydax collaborates with Sotheby’s and Brinks to bring these assets on-chain and use them as collateral.

An Opportunity To Earn Yields

In addition to borrowing and lending, Paydax Protocol (PDP) enables users to earn competitive yields.

-

Protocol staking (up to 6% APY)

-

DeFi vault staking (up to 6% APY)

-

Redemption pool staking (up to 15.2% APY)

-

Leveraged yield farming (up to 41.25% APY)

The PDP Token Provides Access

-

Access to lower borrowing rates

-

Fee sharing, with 40% of fees distributed to PDP stakers

-

Stability Pool rewards for those who stake in the Pool

-

Direct access to P2P lending opportunities

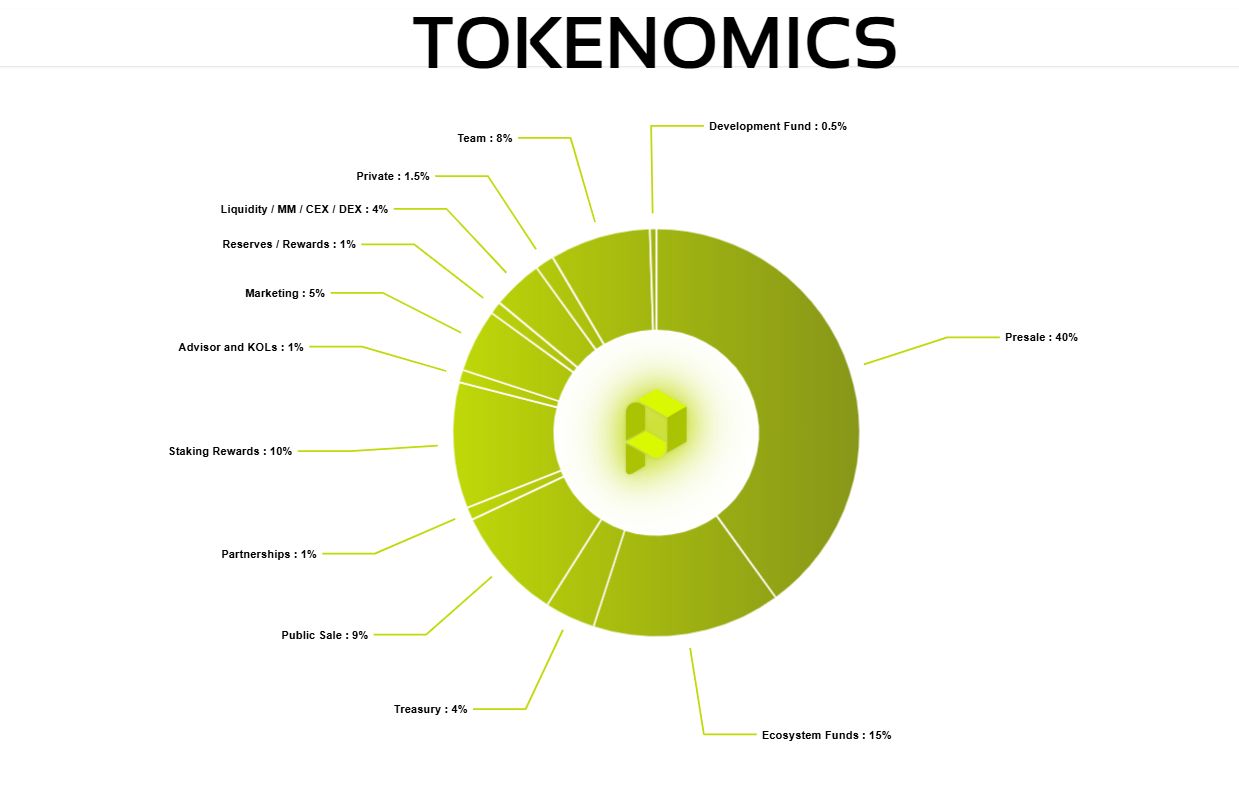

Meanwhile, it is worth noting that the PDP token is well decentralized and unlike XRP, which Ripple has majority control over. Most of the tokens will be community-owned, as 40% of the token’s 10 billion supply is allocated给社区用户。只有8%的代币分配给团队。

The Paydax Protocol (PDP) token also has a more limited supply than the likes of XRP, which could easily create a supply shock as PDP’s demand skyrockets. With Paydax building the first fully on-chain financial system, there is no doubt about the PDP’s utility and its upside trajectory.