Solana Company allows early investors to unlock PIPE financing round shares ahead of schedule, a certain exchange's stock price plunges 60%

Jinse Finance reported that digital asset treasury company Solana Company (HSDT) announced on Monday the early unlocking of $500 million PIPE financing round shares, which were sold in September at a price of $6.881 per share, allowing early investors to sell their shares ahead of schedule. The company described this move as a "rip off the band-aid" strategy aimed at building a long-term shareholder base. Following the announcement, HSDT's stock price has dropped to around $6.50, plunging nearly 60% over three consecutive trading days, with a 17% drop on Monday alone. PIPE financing (Private Investment in Public Equity) has become the preferred method for emerging digital asset treasury companies to quickly raise funds for purchasing cryptocurrencies. However, as several companies have seen their stock prices crash after the unlocking period, the sustainability of this model in the crypto market is being questioned.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cathie Wood: The crypto market may have bottomed out, Bitcoin remains the top choice for institutions

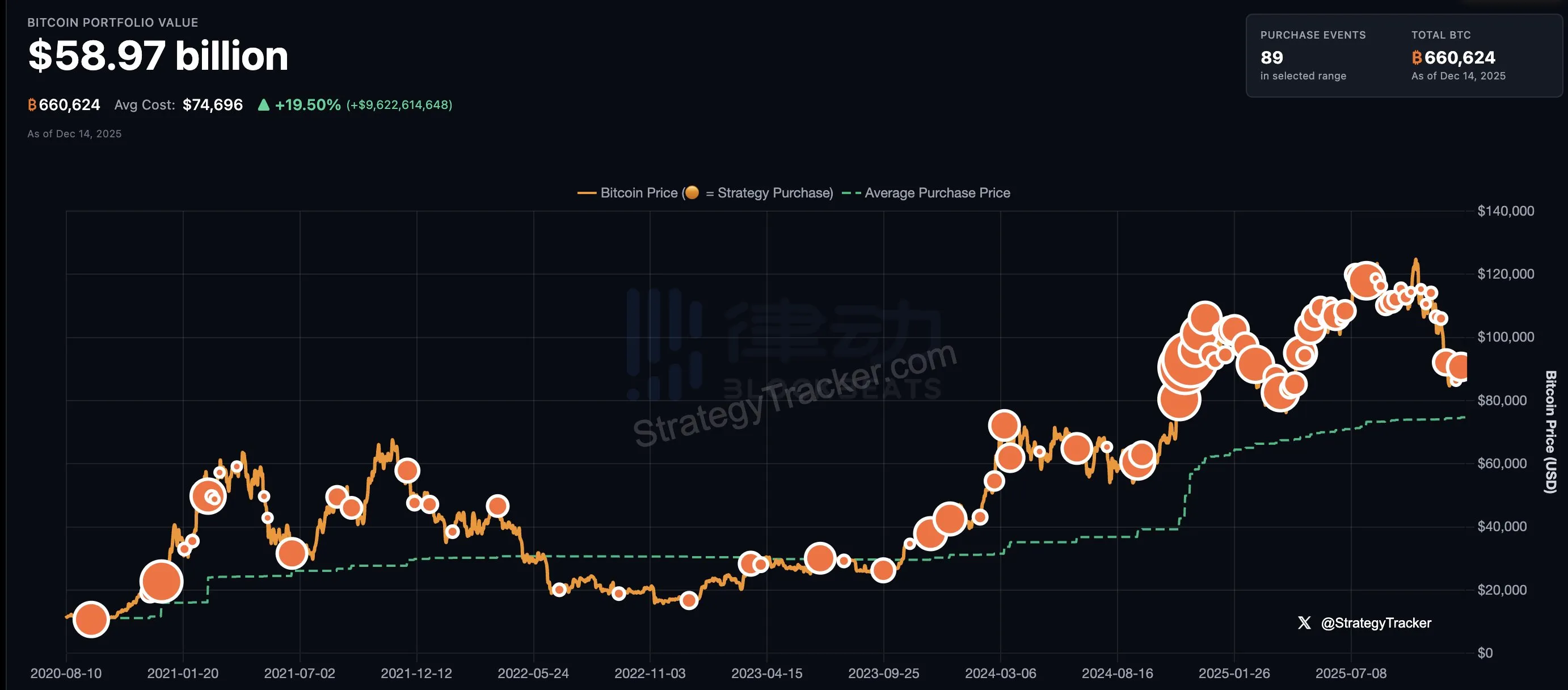

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC accumulation

Analyst: Bitcoin’s key support level is at $86,000; a breach could trigger a deeper correction

Aevo confirms that the old Ribbon DOV vaults were attacked and lost $2.7 million, and will compensate active users.