Key takeaways

- XRP is down 1% in the last 24 hours but could rally to the $2.80 level soon.

- Ripple co-founder Chris Larsen reportedly sold roughly $120 million in XRP.

Larsen sells $120M worth of XRP tokens

On-chain data from CryptoQuant reveals that there has been a $120 million outflow from Larsen-linked wallets. This latest development comes as XRP lost 1% of its value in the last 24 hours.

The sell-off also coincides with the ongoing attempt to fund the GTreasury acquisition. Ripple recently announced a $1 billion fundraising aimed at acquiring the treasury management company GTreasury.

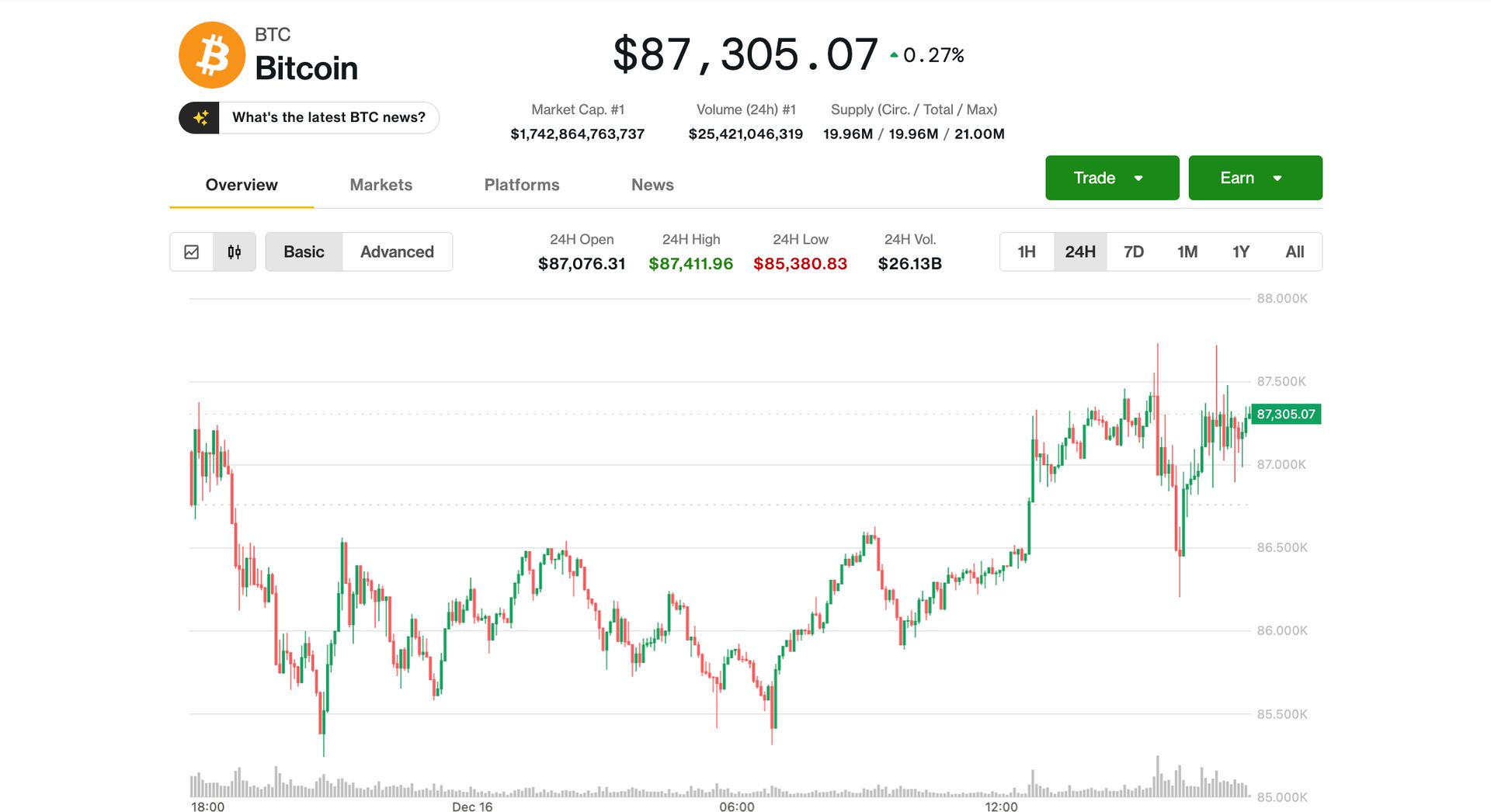

However, the acquisition news hasn’t positively affected XRP’s price as the coin has faced heavy selling pressure in recent weeks. XRP’s loss coincides with a broader decline in risk assets, with Bitcoin and Ether also recording huge losses over the past few weeks.

XRP’s price could soar higher in the near term as XRP addresses holding over 100 tokens were rising in numbers. This is despite XRP losing 35% of its value since hitting the multi-year high of $3.66 in July.

XRP eyes $2.80 despite bearish conditions

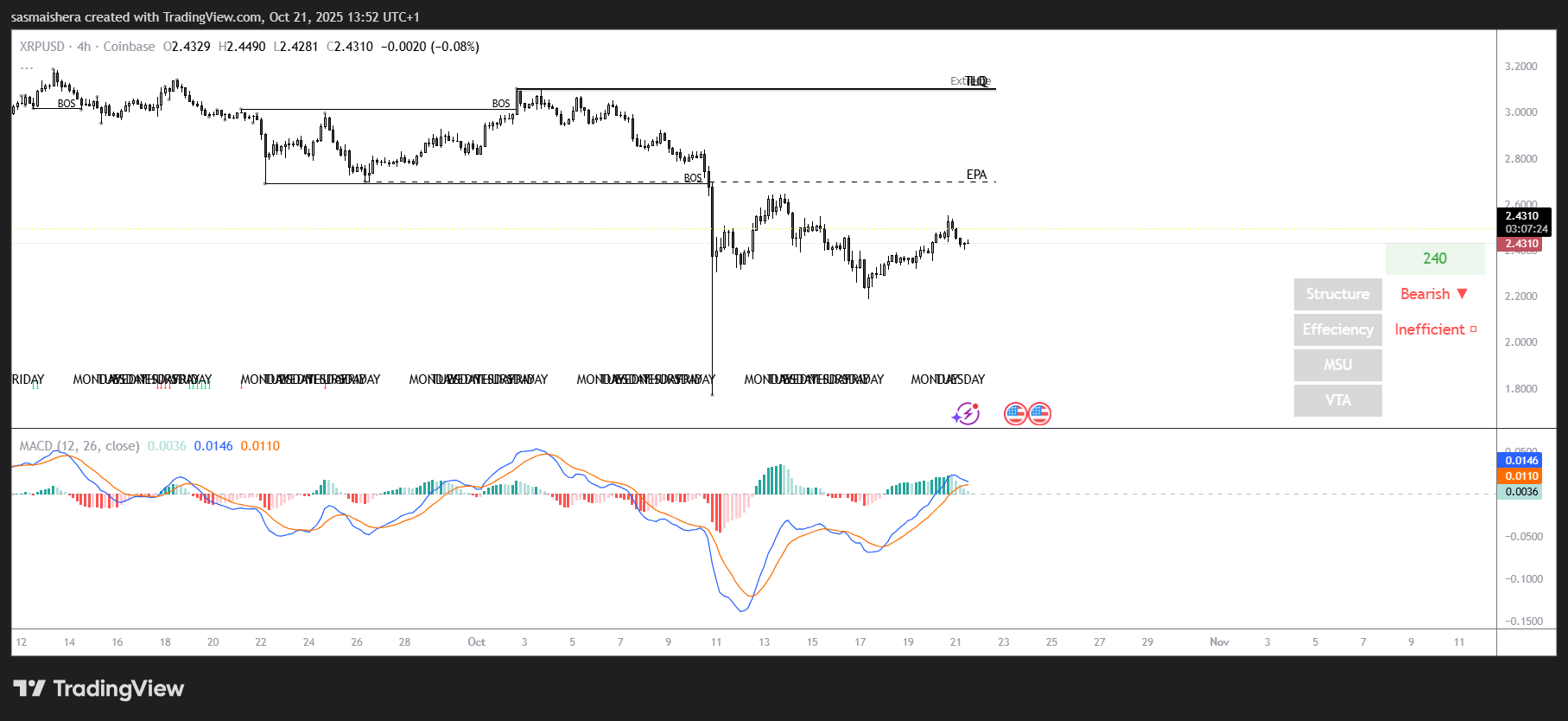

The XRP/USD 4H chart remains bearish and inefficient as the coin has failed to pump following the October 10th crash. Currently, XRP is consolidating inside a descending parallel channel, and could surge towards the $2.80 resistance level in the near term.

The $2.80 resistance level also coincides with the 0.618 Fibonacci retracement line, making it a key area to watch as we approach the end of another month. Breaking above the $2.80 resistance would allow XRP to confirm a bullish reversal pattern and rally towards the $3.05 or even $3.40 levels in the weeks ahead.

The RSI of 52 shows that the bulls are regaining control, with the MACD lines also about to cross into the positive region.

However, failure to sustain a bullish run will see XRP drop lower in the coming weeks. Its performance will depend on the broader risk appetite across crypto and equities. If the bearish trend persists, XRP could drop below the $2.2 support level over the next few hours.