After experiencing the "century liquidation" on October 11, everyone must have gained a deeper understanding of the risks of contract trading. The sudden plunge was so fierce that even low-leverage positions, which many investors considered relatively safe, were not spared and were liquidated one after another. This inevitably made me ponder: in the crypto world, where is the way out for ordinary people?

Figure 1: The moment BTC flash crashed (data source: AiCoin News)

Recently, the post "Life Cheating Rules" has gone viral on Twitter, and I think it answers this question very well. The main idea of the answer is: first, study digital currencies, accumulate funds by hunting for airdrops through Alpha, then open a SafePal card to use the money earned from airdrops for daily expenses, then choose an indicator like AHR999 to regularly invest in BTC, and invest the remaining money in suitable targets. Today, we will introduce regular investment and how to use the AHR999 indicator, so you can gradually become wealthy and no longer be troubled by liquidations!

Figure 2: Source of the Life Cheating Rules (from Zhihu @Diarriker)

1. How to Find the Right Time to Buy?

The pioneer of coin hoarding and the author of the AHR999 indicator, Jiushen, expressed the following views in his article "Hoarding Bitcoin: Finding the Right Time to Buy": First, the statement "you can buy bitcoin at any time" is both correct and incorrect. From a long-term perspective, it is correct—even if you bought at the peak of the last bull market, as long as you held until now, you would still have gained several times your investment; but from the perspective of a hoarder with limited funds, it is incorrect—if you can control your average cost at a lower level through regular investment, you can hold several times more coins than buying at the peak, and may even achieve financial freedom one cycle (4 years) earlier, which is crucial.

Regarding how to judge the timing of buying, Li Xiaolai proposed in "A Concise Survival Guide to the Bitcoin World" that "in the long run, the miner cost can be regarded as the fundamental." Historically, the price of bitcoin has never fallen below the electricity cost of mainstream mining machines at the time; otherwise, there would be large-scale shutdowns of mining machines, a drop in hash rate, and a subsequent decrease in mining difficulty. Therefore, "electricity cost is the hard support for bitcoin price" has held true in history. As mining difficulty continues to rise, BTC price also rises accordingly, so each bear market low should be higher than the previous one.

Figure 3: Bitcoin mining difficulty (data source: AiCoin Index)

However, from an economic perspective, this phenomenon is not reasonable, as prices are usually determined by demand and have nothing to do with cost. Facing the contradiction between theory and reality, Jiushen gave his own explanation: Bitcoin is very special. Anyone preparing to hold it will consider its production cost—because there are two ways to obtain bitcoin: "buying coins" and "mining". If you can mine at a cost of $5,000, you wouldn't buy at $6,000.

Bitcoin is fundamentally different from products like iPhones or wine, where people care more about quality, while with bitcoin, people care more about cost. Although everyone's mining cost is different (for example, some may have a mining cost as high as $10,000, making direct purchase more cost-effective for them), there will always be large capital holders with access to mining machines or electricity resources who can achieve low costs; once the bitcoin price approaches the lowest cost line, funds originally intended for mining will shift to buying bitcoin, which explains why the price has never fallen below the electricity cost of mainstream mining machines.

Based on this, we can conclude that "the lower limit of bitcoin price is the electricity cost of current mainstream mining machines." But what if the price rebounds before falling to the cost line—wouldn't you miss out? Therefore, people must buy some bitcoin when the price is relatively low, then keep some funds or earn more, waiting for that rare, excellent opportunity—this is the right timing for regular investment.

2. The Current BTC Cost in 2025

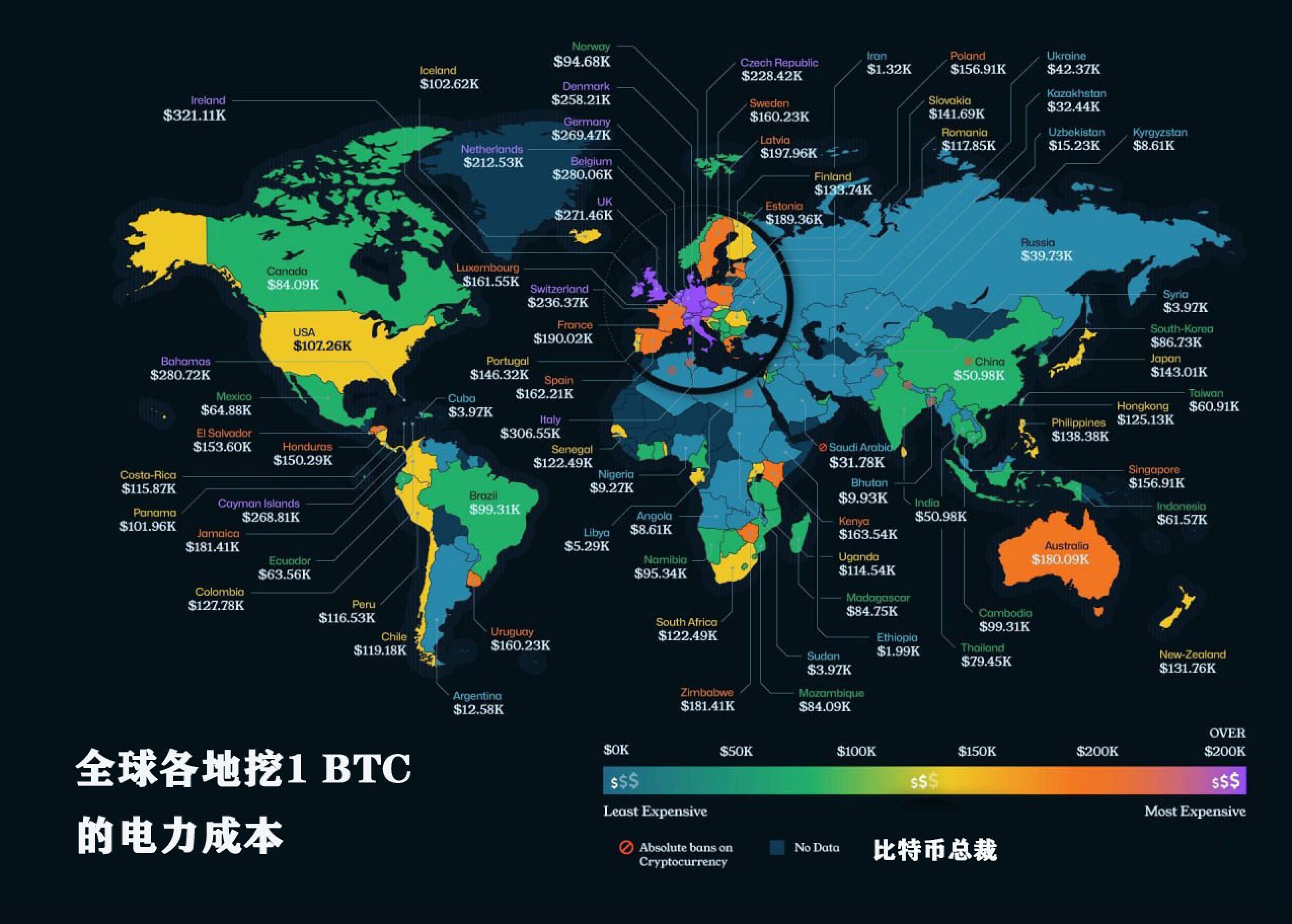

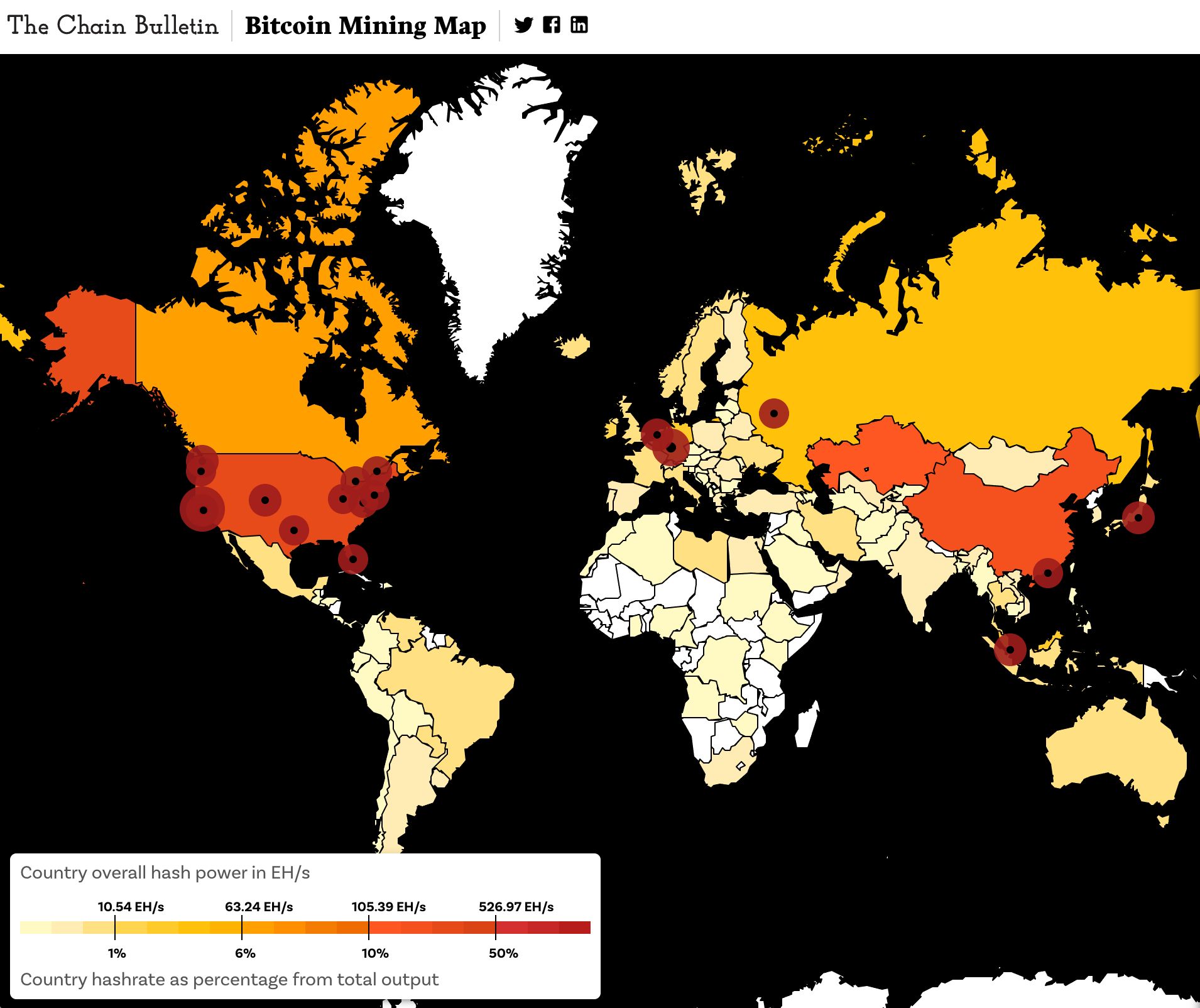

According to Jiushen's view that "the lower limit of bitcoin price is the electricity cost of current mainstream mining machines", let's break down the approximate cost of 1 BTC now: Based on the cost of mining 1 BTC in various regions and the proportion of bitcoin mining in each region, we can calculate the global average cost of BTC. China accounts for about 20% of global hash rate, Kazakhstan about 15%, Russia about 5%, the US about 40%, Canada about 5%, and other regions about 15%. Multiplying the hash rate proportion by the electricity cost in each region gives a global BTC average cost of about 70,000. Below this price, most mining machines worldwide will shut down and switch to buying BTC.

Figure 4: Electricity cost of 1 BTC (source: Twitter @Bitcoin President)

Figure 5: Bitcoin mining map (data source: chainbulletin)

Therefore, we can make large purchases to bottom fish when BTC approaches 70,000, which is also why the lowest point in April appeared around 70,000. But such opportunities are rare, so we need a more universal indicator to guide our regular investment in BTC—the AHR999 indicator.

Figure 6: Bitcoin's April low (data source: AiCoin)

3. Principle and Usage of the AHR999 Indicator

We need an indicator that can quantify the market's hot or cold state, so that ordinary investors can have a sense of direction in the face of volatility. This is the significance of the AHR999 indicator. It was proposed by Jiushen, a representative of the coin hoarding faction, to measure the relative long-term valuation of bitcoin. It can be understood as a "sentiment thermometer" or "value anchor".

On the AiCoin platform, ordinary investors can intuitively view the real-time dynamics and historical trends of the AHR999 index.

How to view: Open AiCoin - search for the ahr999 index

ahr999 index = (bitcoin price/200-day DCA cost) * (bitcoin price/index growth valuation)

AHR999 actually combines two key variables: one is the ratio of the current bitcoin price to the 200-day DCA cost, reflecting the short-term temperature of the market; the other is the deviation of the current bitcoin price from the long-term growth curve, representing how far the market is from its long-term fair value.

Multiplying these two gives AHR999. Jiushen's logic is: prices always fluctuate around the long-term growth trend. When the price is far below the trend line, it's a long-term layout opportunity—intensify your DCA; when the price is far above the trend line, it often means market sentiment is overheated, and risk outweighs reward—stop DCA or even sell.

1. How to Read AHR999?

According to historical data, AHR999 roughly has the following reference ranges:

Figure 7: AHR999 indicator ranges

In past cycles, AHR999 < 0.45 almost always corresponded to excellent long-term buying opportunities (such as the lows at the end of 2015, 2018, and 2022); while when AHR999 exceeds 2.0, it is often accompanied by overheated market sentiment and bull market peaks.

Figure 8: AHR999 bottom-fishing range (data source: AiCoin)

2. Example of AHR999 DCA Strategy

If you are an ordinary investor and don't have time to watch the market every day, you can refer to the following approach:

When AHR999 < 0.45: Double your purchase, for example, if you usually DCA 100U, buy 300U now;

When AHR999 is between 0.45–1.2: Maintain your original DCA pace;

When AHR999 > 1.2: Pause or halve your DCA, gradually accumulate cash positions;

When AHR999 > 2.0: Take profits in batches or exit at highs.

The benefit of this approach is: you won't go all-in at the top, nor will you hesitate and miss out at the bottom. By executing on a fixed schedule (such as daily or weekly), you leave "timing anxiety" to the data, not your emotions.

3. Why is AHR999 Especially Suitable for Ordinary People?

In this information-overloaded market, the vast majority of people are not day-trading experts, nor do they have high-frequency trading systems. What we really need is a tool that can "save you from mistakes" over the long cycle.

The significance of AHR999 is that—with its extremely simple quantitative logic, it converts complex market sentiment into an intuitive number. When everyone is fearful, it tells you to "buy"; when everyone is greedy, it reminds you "it's time to stop". Backtesting past cycles shows that if you keep DCA-ing or even bottom-fishing when AHR999 < 1.2, and gradually take profits when > 2.0, your long-term returns will be significantly higher than simply holding coins or randomly chasing highs and selling lows. For ordinary people, this is more realistic than frequent trading and helps you survive longer.

Conclusion

This "century liquidation" once again reminds us:

In a high-leverage, high-volatility market, no one can always get the timing right. The root cause of liquidation is not poor skills, but unstable methods and excessive emotions.

The value of the AHR999 indicator is not only in helping us find "buy points", but more importantly, it allows ordinary people to find a sense of order in the midst of massive noise. It makes you understand: wealth accumulation is not about getting rich quickly in the short term, but about long-term execution.

The market will have countless crashes and countless rebounds. But as long as you stick to your DCA plan during fear and remain disciplined during greed, you have already outperformed 90% of people.

The story of bitcoin is always repeated in cycles, but each cycle rewards those who are disciplined and know how to wait. In the crypto world, the real "life cheating rule" is not insider information, but using knowledge and systems to overcome human nature.