Written by: Zuoye

Binance Life is a cover for Aster’s counter-farming, with an extreme wealth creation effect. Even emotions, in the drizzly late autumn, are enough to make people forget about their positions, regardless of being long or short.

Beyond the technical parameters and fee table comparisons, what really intrigues me is why the CLOB architecture (Central Limit Order Book) is suitable for perpetual contracts, and where the limits of CLOB architecture lie.

Assets Determine Price

I was born too late to catch the DeFi Summer era; yet too early to witness CLOB shining in the forex markets.

The history of traditional finance is so long that people have forgotten how markets were actually formed.

In short, finance revolves around trading assets and prices: price (buy/sell, long/short), asset (spot/contract/option/prediction). Cryptocurrency has merely replayed hundreds of years of financial history in just over a decade, adding its own unique needs or improvements along the way.

CLOB is not a simple imitation of Nasdaq or CME. Breaking down the term, Central, Limit, and Order Book each occur on-chain, ultimately creating today’s prosperous scene.

1. Order Book: Mechanism for recording buy/sell prices.

2. On-chain Limit Order Book: A bidding mechanism sorted by both time and price; limit means price is restricted.

3. On-chain Central Limit Order Book: Refers to recording limit orders in a unified system, such as a blockchain—this is what “central” means.

CME, Binance, and Hyperliquid’s BTC contracts can all be CLOBs, but in this article, it specifically refers to CLOB Perp DEXs built on public chains/L2 architectures.

Following the third point, here’s a historical explanation: the technical route debate around 2021 was a continuation of ETH mainnet’s expensive and slow issues. The 2022 FTX collapse delayed the Perp War, which began at the end of DeFi Summer, to 2025.

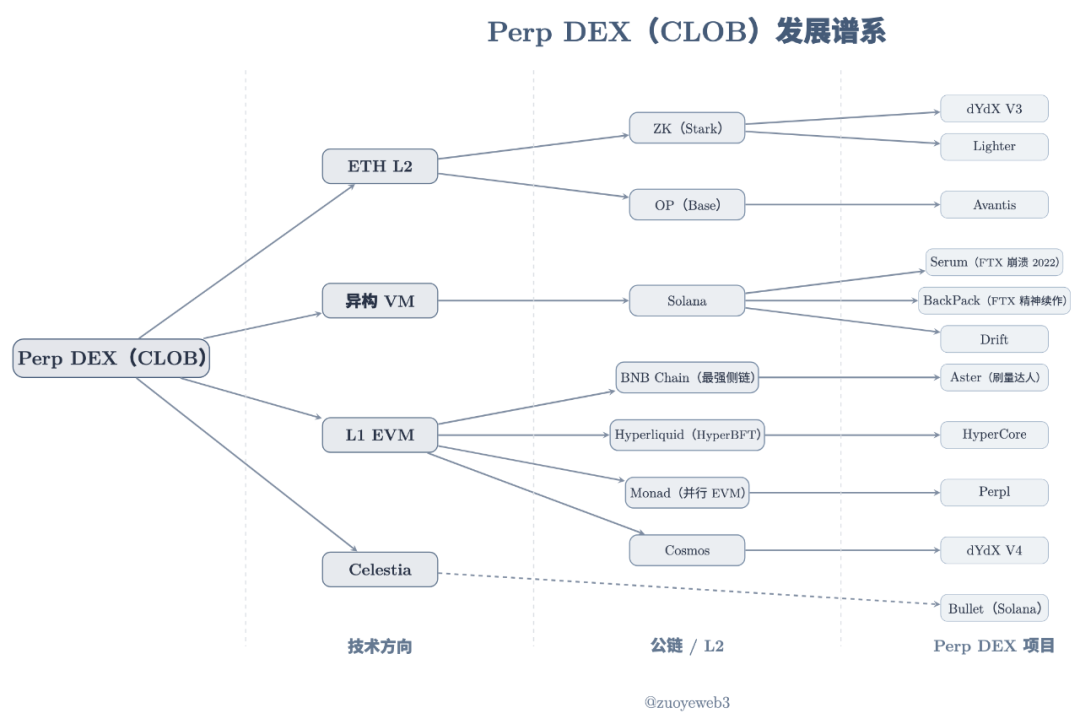

Image description: Perp DEX (CLOB) genealogy

Image source: @zuoyeweb3

Perp DEX projects launched at different times, but can basically be divided into three routes: ETH L2, heterogeneous VM (Solana), and L1 EVM. Celestia is a DA solution that doesn’t rely on a specific VM architecture.

Historical documents are not meaningful in reality. Currently, people don’t care about decentralization, only about trading efficiency, so I won’t compare them here. Whether it’s Hyperliquid’s 4–>16–>24 nodes or the generally single sequencer L2s, it’s hard to say which is faster, more decentralized, or what the point is.

Human sorrow and joy are not connected; I just find their arguments noisy.

Tech investment lags behind. The seeds of 2020’s DeFi Summer were sown in 2017/18. By the end of 2020, Serum had already slow-launched on Solana, with the following features:

1. Liquidity front-end and revenue sharing

2. Expected support for spot trading

3. Relying on Solana’s high-performance matching engine

4. Node locking to earn MegaSerum (MSRM)

5. Collaboration with FTX

6. Partnership with Wormhole for cross-chain support

7. Yield mechanism for cross-chain assets

8. SRM fee discounts

9. SRM buyback and burn mechanism

10. Expected SerumUSD stablecoin product line

Of course, the vast majority of SRM tokens were not distributed but concentrated in FTX or even SBF’s personal hands. The dramatic collapse in 2022 gave Hyperliquid more time to develop itself.

This doesn’t mean Hyperliquid is a copycat of Serum. Every great product is either an engineering combination or an original spirit. Hyperliquid is far superior to Serum in technical choices, joint market making for liquidity, token airdrops, and risk control.

From dYdX/Serum to Hyperliquid, everyone agrees that moving Perp asset types on-chain is feasible. The differences lie in technical architecture, decentralization, and liquidity organization, but the question of what CLOB features lead to this consensus remains unanswered.

So, why does Perp choose CLOB?

The most reasonable answer is that CLOB has stronger price discovery capabilities.

This is still a historical answer and relates to AMM DEXs. From Bancor to Uniswap and Curve, the exploration of on-chain liquidity initialization and applicability around Ethereum has been ongoing.

DEX protocols, together with LPs (liquidity providers), avoid the two major problems of custodial user funds and maintaining liquidity. They only need to focus on protocol security, while LPs, incentivized by fee sharing, deploy liquidity themselves.

Subsequently, LPs ultimately transfer liquidity costs to users, reflected in slippage and fees—this is liquidity creation: DEX protocol to LP, LP to user.

However, two problems remain: LP’s impermanent loss and AMM’s insufficient price discovery.

-

The root of impermanent loss lies in the exchange of two assets. LPs need to add dual assets equally, but their trends are inconsistent. Most are stablecoin pairs to enhance stability.

-

AMM prices are “market prices,” meaning LPs, project teams, and DEX protocols cannot directly define an asset’s price, only intervene through liquidity.

For these two issues, the former is improved by Curve’s USDC/USDT stablecoin trading, minimizing dual asset volatility and relying on increased trading frequency to boost fees. Rather than saying Curve is suited for stablecoin pairs as a feature, it’s more of an inherent flaw. Its latest work, Yield Basis, uses economic design and leverage to “erase” impermanent loss.

The latter’s improvement is CoW Swap’s TWAP (Time-Weighted Average Price), which splits large orders into multiple small ones to reduce the impact on liquidity and achieve optimal execution—Vitalik’s favorite.

But that’s the limit. For on-chain Perp trading, transaction details are open and transparent. If using AMM, adjusting liquidity to manipulate prices is very easy. A 1% price move may be explainable for spot trading, but for Perp, it’s a ticket to heaven.

AMM’s flaws mean it cannot, or at least cannot on a large scale, be used for Perp. A technology that controls price without relying on liquidity changes is needed—prices must be preset.

Trades must be executed at quoted prices or not at all, but cannot be discounted, to maintain normal Perp market operations.

Eliminating impermanent loss is just a side effect. Different technical architectures lead to different market-making mechanisms.

Perp’s price sensitivity and CLOB’s precise control are a perfect match—assets determine price changes, and price changes require corresponding technical architectures.

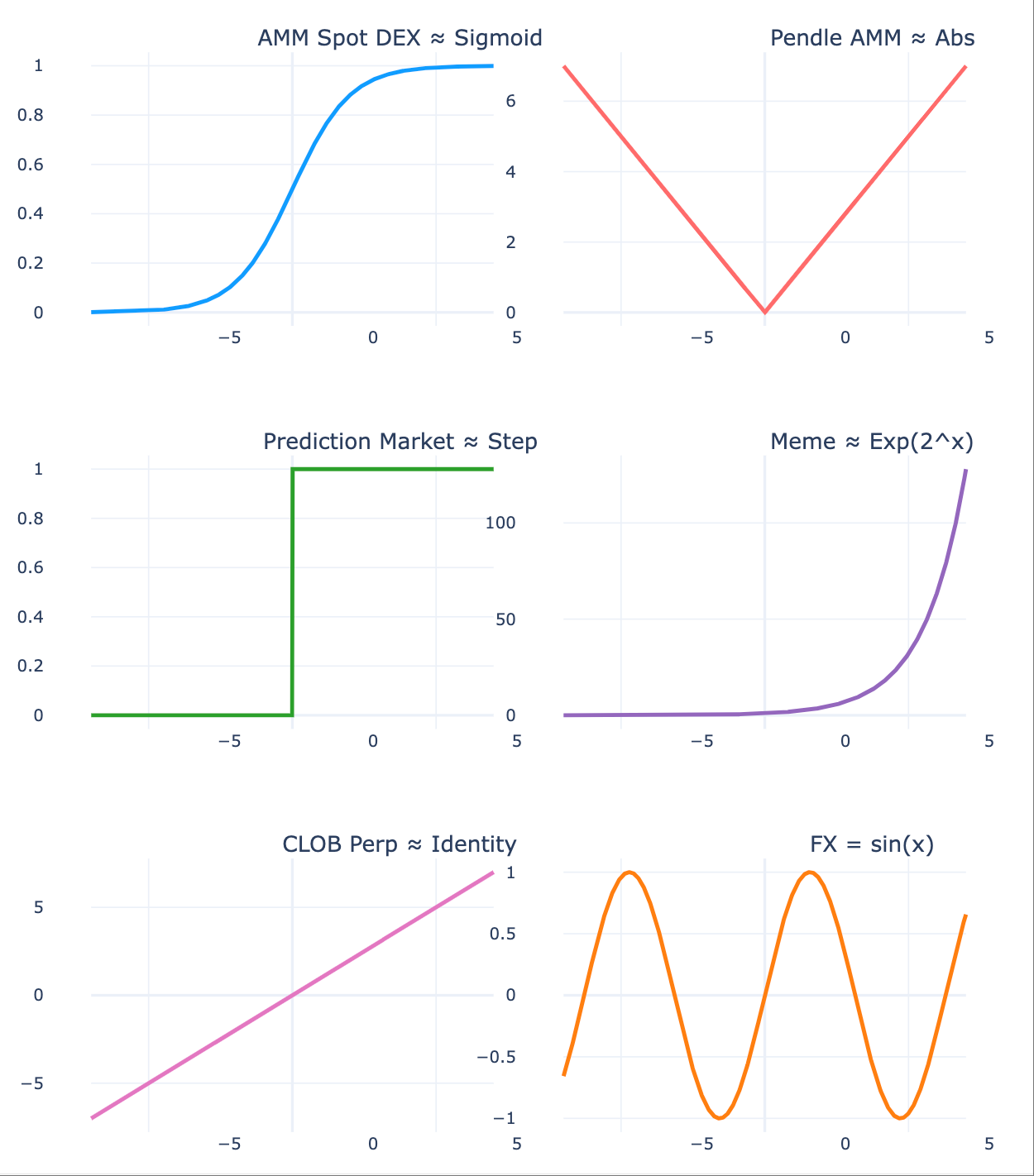

Image description: Assets determine price trends

Image source: @zuoyeweb3

-

Spot price trends are relatively smooth, which is why users can “tolerate” slippage and LPs can “tolerate” impermanent loss—they won’t lose too much.

-

Pendle creates two different price trends by splitting assets by maturity, leading to different market-side liquidity bets.

-

Prediction markets are more extreme, with only (0,1) outcomes—the most discrete existence, where continuous probabilities collapse to 0/1.

-

Meme markets are even more extreme—a few assets experience extreme index changes, while most become illiquid assets tending toward zero, matching the theory of internal and external markets.

-

Perpetual contracts are the most extreme, capable of negative balances, as their price changes are not only drastic but also don’t stop at zero and can extend downward.

-

Forex trading has the smallest price changes, with daily price fluctuations within a range, sometimes even showing patterns, reflecting the stability of major global economies.

AMM created initial on-chain liquidity, cultivated trading habits and capital accumulation. CLOB is better suited for price control and more complex trading setups. Unlike AMM’s market price, CLOB’s time–price sorted bids and asks, supported by efficient algorithms, enable precise price discovery.

Price Determines Liquidity

They say a lifetime, but if you miss by a year, a month, a day, or an hour, it’s not a lifetime.

After CLOB replaces AMM and completes Perp’s price discovery, market liquidity still needs to be organized. AMM DEXs achieve the normalization of individual LPs through two rounds of transfer (protocol to LP, LP to user).

But between price and liquidity, there’s also Perp’s unique scale phenomenon.

Perp DEX problems are relatively complex. AMM only calculates gains and losses upon final execution; otherwise, both users and LPs have only unrealized P&L. For perpetual contracts, the focus is not on the contract, but on the perpetual nature.

There is a funding rate mechanism between longs and shorts: when the rate is positive, longs pay shorts; when negative, shorts pay longs.

From a price mechanism perspective, this keeps contract and spot prices aligned. If the contract price is below spot, the market is bearish, so longs pay shorts to maintain the market’s existence; otherwise, there would be no shorts and thus no perpetual contract market, and vice versa.

As mentioned earlier, AMM is a trade between two assets, but USDC-margined BTC contracts don’t require both sides to exchange BTC, only their expectations of BTC’s price, conventionally denominated in USDC to reduce volatility.

This expectation requires two points:

1. Spot assets must enable price discovery, e.g., a fully traded BTC market. The more mainstream the coin, the more efficient the price discovery, reducing black swan events.

2. Both longs and shorts must have strong capital reserves to offset extreme events caused by leverage and handle them effectively when they occur.

In other words, Perp’s price mechanism tends to increase market scale, and this scale drives liquidity.

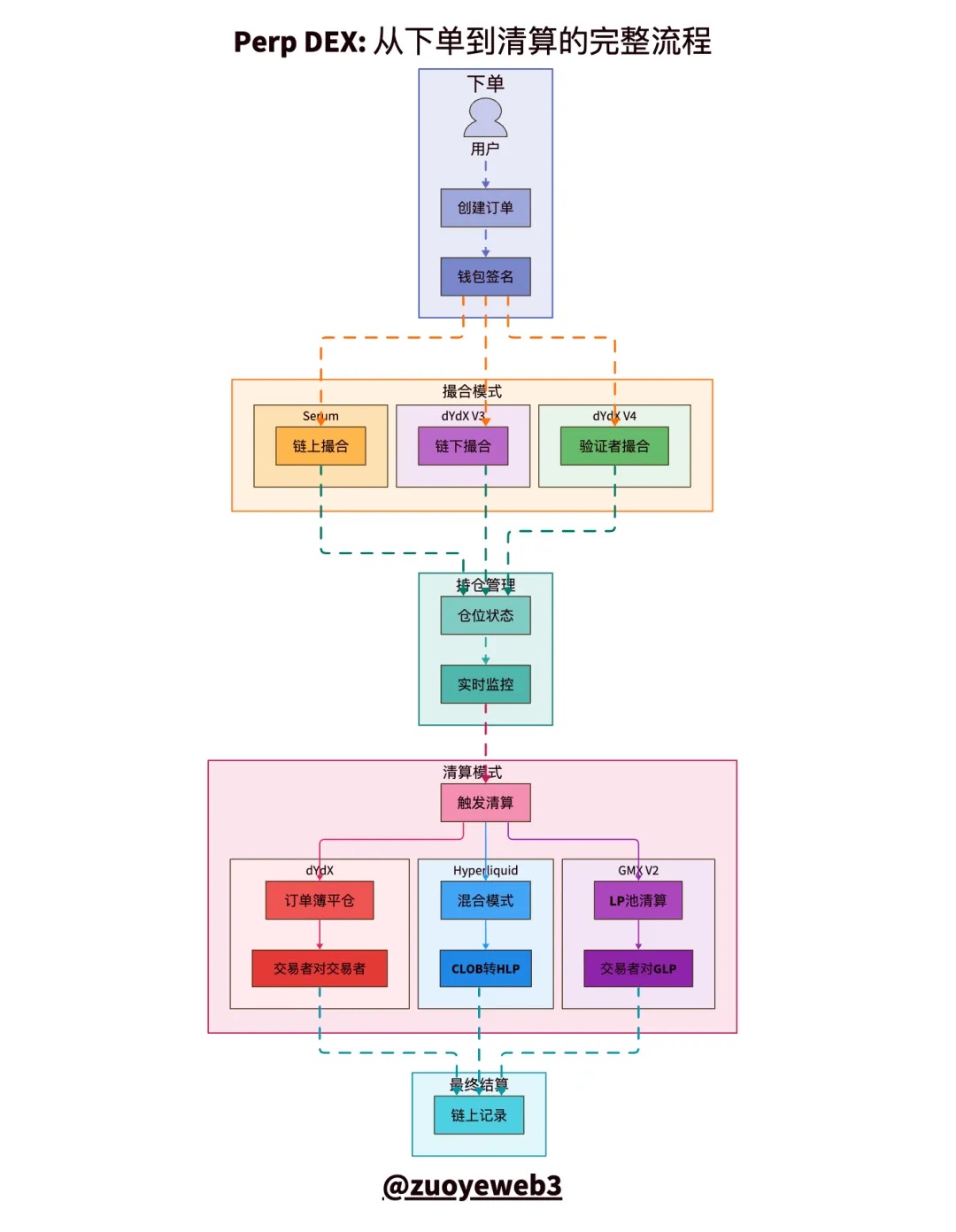

Image description: CLOB clearing and settlement process comparison

Image source: @zuoyeweb3

The entire Perp trading process can be divided into five parts: order placement, matching, position holding, liquidation, and settlement. The most difficult are matching and liquidation mechanisms.

-

Matching is a technical issue—how to match buy/sell orders with maximum efficiency and minimum time. The market ultimately chooses “centralization.”

-

Liquidation is an economic issue. Contracts can be seen as under-collateralized loans; exchanges let you use little capital to leverage large positions—that’s the essence of leverage.

On the surface, exchanges let you amplify leverage with collateral, but in reality, you must pay margin to maintain leverage. Once you fall below the liquidation ratio, the exchange takes your collateral.

Internally, liquidation is a natural behavior between longs and shorts in normal times. But as mentioned, Perp prices can go below zero indefinitely, and with leverage, debts can far exceed collateral value.

If the market cannot clear bad debt, manual margin replenishment, forced trade cancellation, or insurance funds are needed to cover losses. But essentially, this is socializing debt—everyone bears it together.

Perp liquidity is a necessary pursuit to maintain scale, but individual LPs in AMM cannot accomplish this. Besides capital limitations, high-frequency professional market making is needed.

The logic is simple: individual LPs on AMM DEXs don’t need frequent operations, but Perp DEXs must always monitor leverage extremes.

In normal trading, as long as extreme events don’t occur, there are AMM-like LP incentives for trading volume. For example, GMX imitates AMM DEX’s LP mechanism, using its own token to incentivize LP trading activity, developing its own GLP pool for users to add liquidity and earn fees and rewards.

This is actually a very “innovative” mechanism, allowing individual LPs to participate in Perp market making for the first time.

This wash trading mechanism leads to abnormally high Perp trading volume (Volume), but OI (Open Interest) drops after token issuance as LPs withdraw, eventually entering a death spiral of declining token price and liquidity.

Another conclusion: LPs must passively bear final liquidation. This is a key difference between Perp and AMM. AMM users buy and leave, LPs bear their own P&L, but Perp LPs have to take on the project’s liquidation function, which cannot be transferred to users.

The so-called insurance mechanism protects the project, not the LPs themselves.

GMX and Aster’s wash trading ends quickly. Hyperliquid’s HLP runs stably in daily operations, but when facing $JELLYJELLY, HLP still bears the loss, essentially proving the unreliability of this liquidity creation and insurance mechanism.

As mentioned, over 92% of HyperCore’s fees are used for $HYPE buybacks, and 8% for HLP revenue sharing, indicating Hyperliquid doesn’t value the future of HLP and similar mechanisms. HyperCore’s liquidity is mainly maintained by professional market makers, who care about node revenue sharing and $HYPE appreciation.

The insurance vault mechanism can be seen as an appendix Perp learned from AMM. Directly pulling the plug or increasing trading depth is more effective.

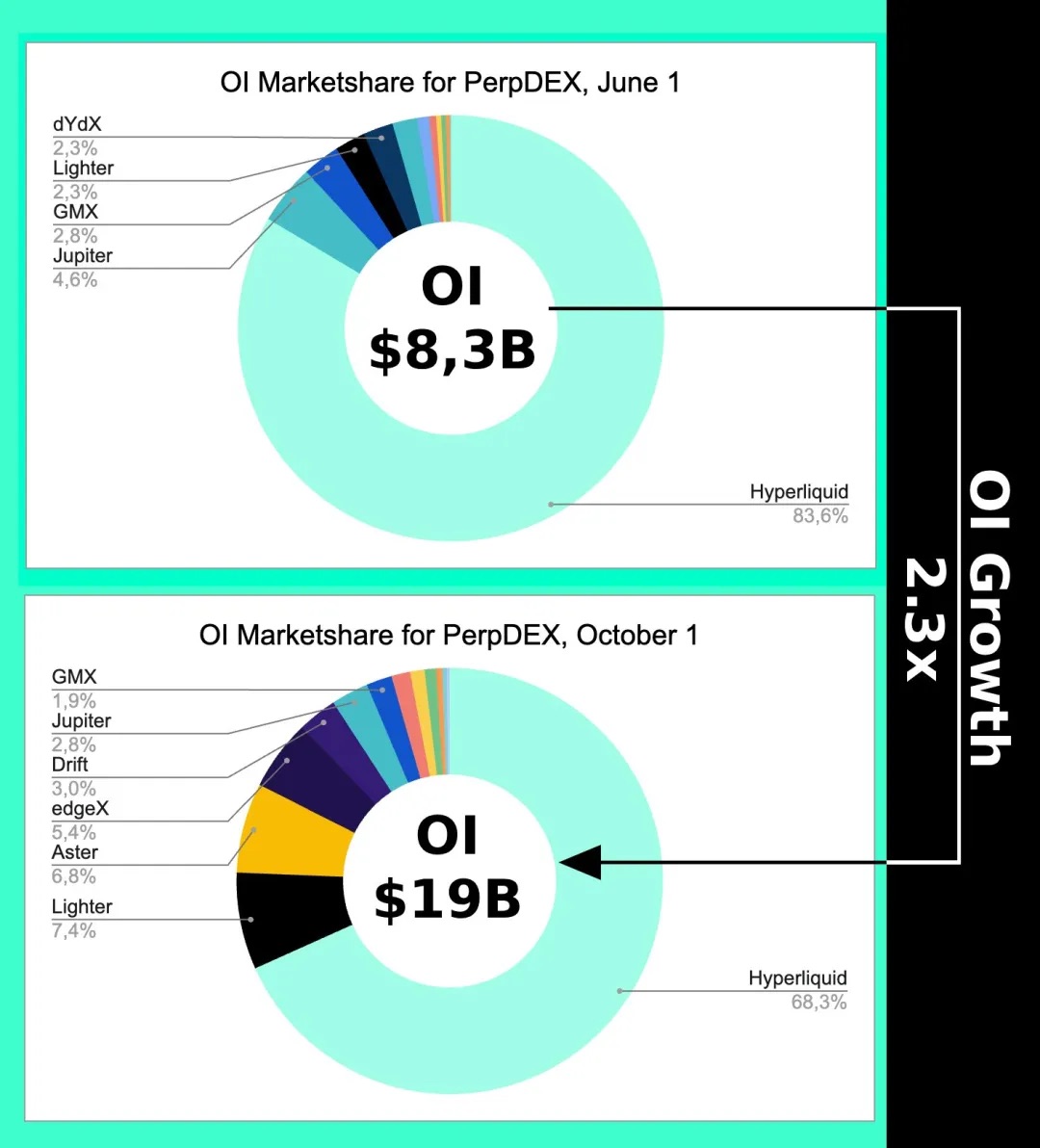

Image description: OI trend

Image source: @Eugene_Bulltime

Even at the peak of Aster’s Perp DEX war in early October, Hyperliquid’s market share only dropped by about 15%, while Volume was overtaken by Aster several times. This shows that CLOB’s price mechanism triggers a scale effect, and the resulting liquidity mainly refers to open interest, not trading volume.

This also indirectly explains why Hyperliquid is developing Unit cross-chain bridges and BTC spot trading markets—not for fees, but for price accuracy, to ultimately break away from reliance on Binance’s quotes.

CLOB can also be used for spot trading, and AMM modified by AC can also be used for perpetual contracts.

Focus on the fit between price and assets, don’t get lost in technical parameters.

Conclusion

Life will find its way out.

Binance’s annual $15 trillion is basically the upper limit for Perp trading, but the forex market’s daily trading volume is about $10 trillion, with annual volume 300 times that of Perp. Hyperliquid’s architecture is also migrating to HyperEVM, especially with HIP-3/4 and other expected developments in forex, options, and prediction markets.

It can be understood that Perp will eventually reach its ceiling. In the competition between assets and prices, new technical architectures more suitable for next-generation asset price discovery, such as RFQ, will emerge.

But there is no doubt, it will no longer be a debate about blockchain centralization. The 2021 tech debate was just a boring callback. Focusing on blockchain technical architecture is essentially living in the past and unable to extricate oneself.

Whether OI or trading volume continues to grow, the CLOB debate is over. 2018 was DeFi Summer, 2022 saw Hyperliquid’s victory. Next, we’ll see if HyperEVM can make it to the final public chain dinner. It remains to be seen if Monad will still exist after its token launch, and whether HyperEVM can achieve an ecological closed loop—that’s what’s truly interesting.