Is XRP Ready for a Reversal or More Pain Ahead?

XRP price recent performance sits at the intersection of technical fragility and macroeconomic uncertainty. The XRP price daily chart shows the token struggling below its mid-Bollinger band, signaling bearish momentum, while external pressures from the ongoing U.S. government shutdown threaten to weaken broader risk sentiment. Let’s break down what’s happening and where XRP price could head next.

XRP Price Prediction: How the U.S. Shutdown is Weighing on Crypto

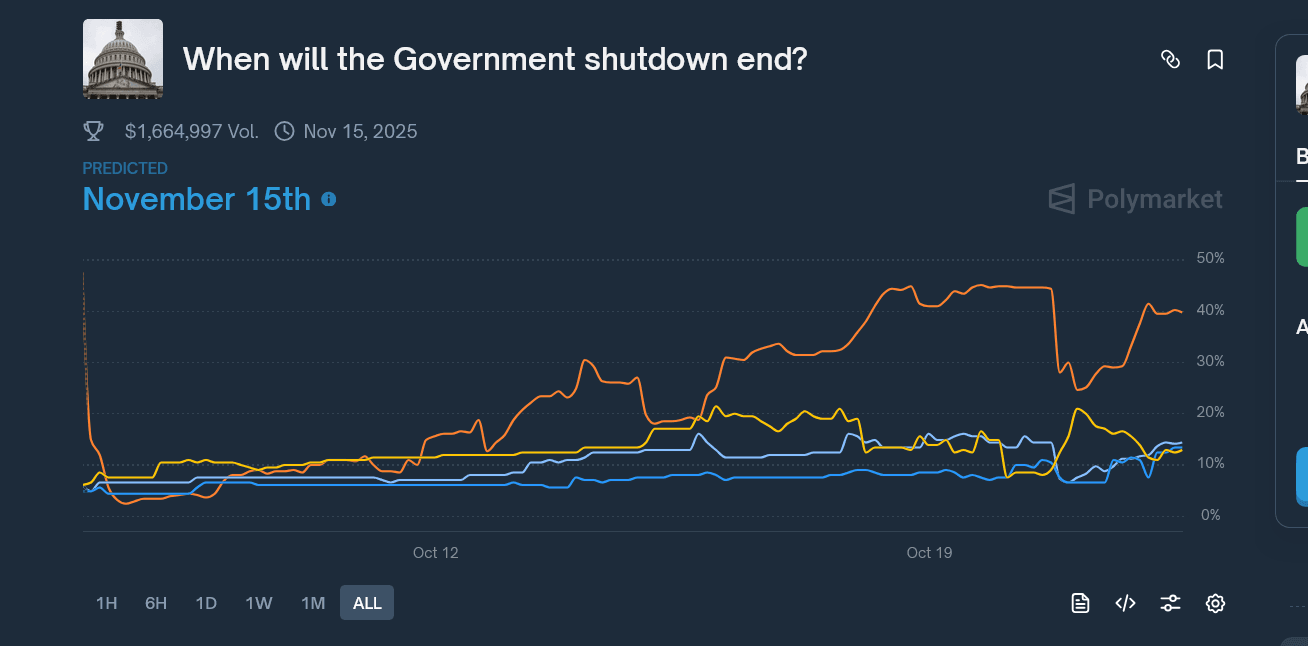

This Polymarket prediction chart shows how traders are betting on when the ongoing U.S. government shutdown will end, with November 15th emerging as the most likely date. The orange line, representing odds for a mid-November resolution, has steadily climbed toward 40–45%, indicating growing confidence that lawmakers might reach an agreement by then. Other dates—shown in blue and yellow—remain flat or declining, meaning fewer traders believe the shutdown will end earlier.

The total trading volume of over $1.6 million highlights how closely the public and markets are tracking this political deadlock. In short, the sentiment points to a prolonged standoff, with the shutdown expected to last several more weeks before resolution.

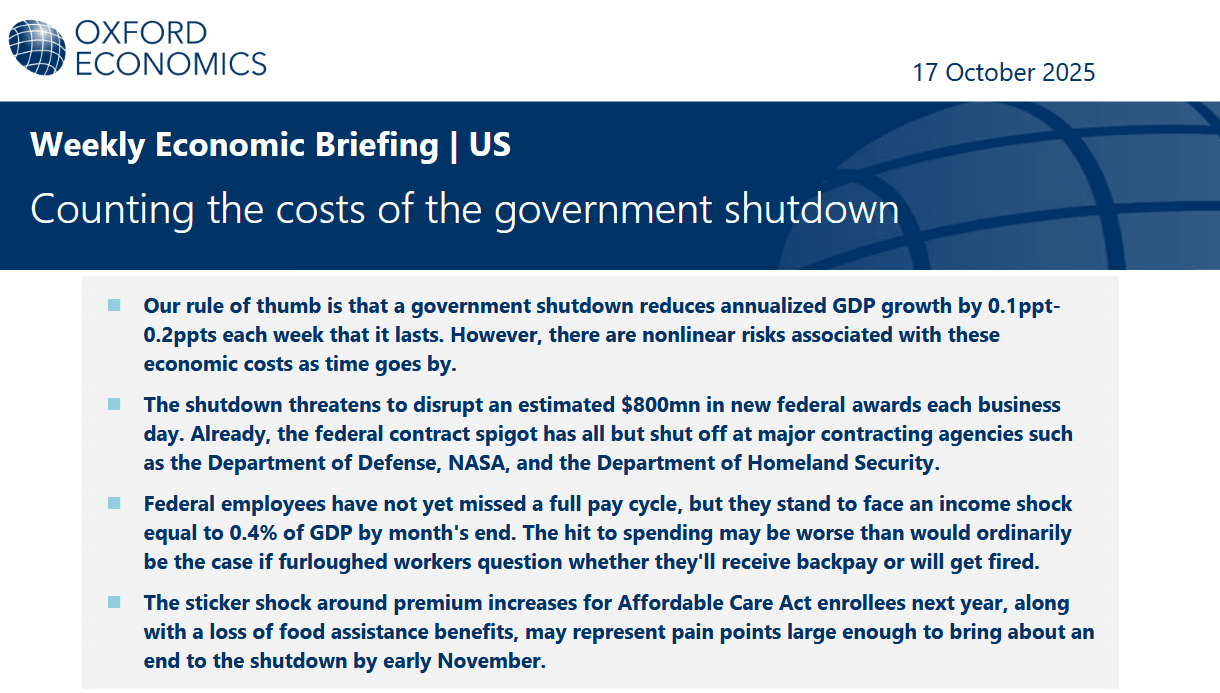

Markets hate uncertainty, and the U.S. government shutdown is a masterclass in it. Economists warn that the longer it drags on, the greater the hit to GDP, small business liquidity, and consumer confidence. Historically, short shutdowns have been shrugged off. But this one, now entering its fourth week, is different: missed paychecks, halted contracts, and political deadlock are fueling real economic drag.

Crypto investors read that as “liquidity squeeze.” When federal spending stalls, risk appetite falls, and speculative assets like XRP price take the first hit. On-chain data has already shown declining activity as traders move to defensive positions. The macro message is clear: until Washington resolves this, crypto’s upside momentum will stay capped.

XRP Price Prediction: What the Chart is Saying Right Now

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

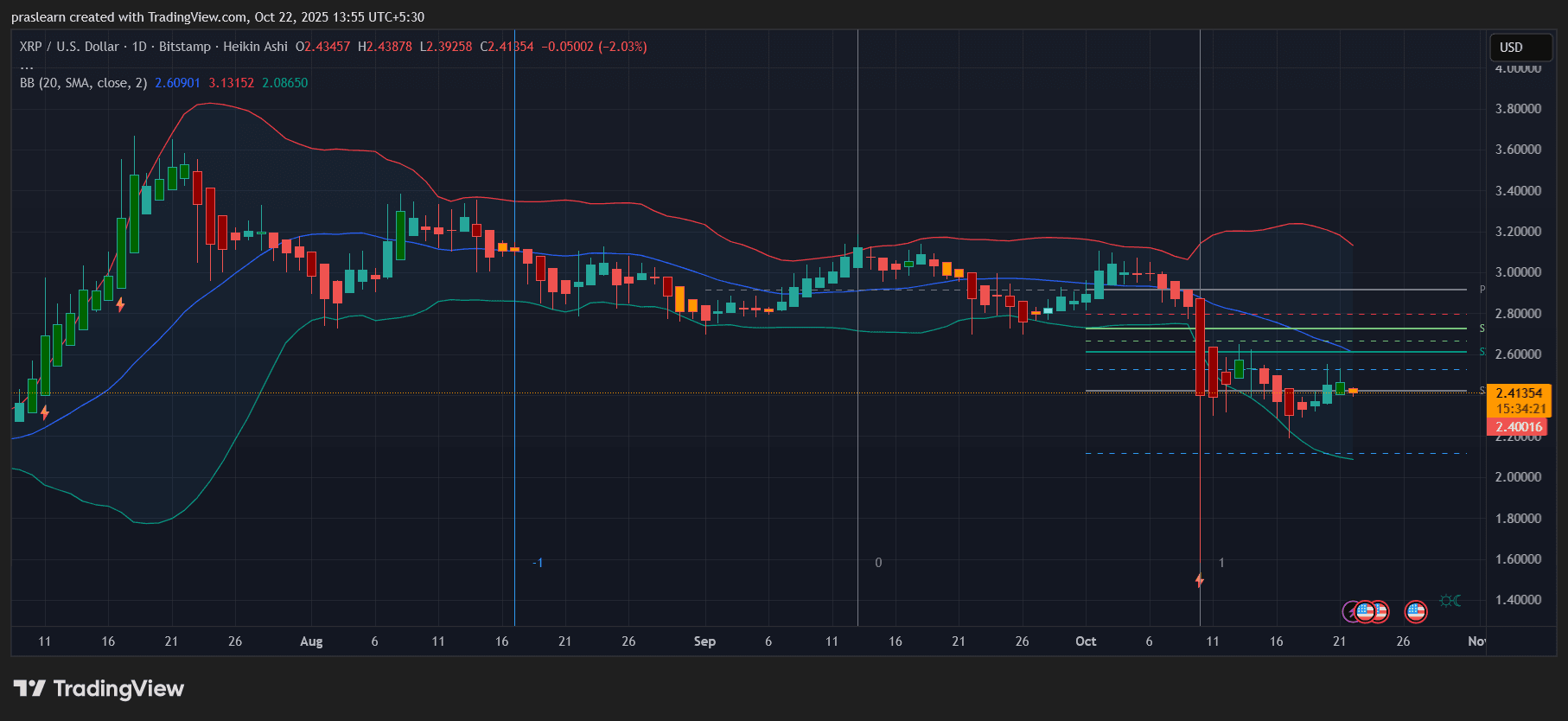

The XRP/USD daily chart paints a cautious picture. Prices hover around 2.41 after failing to hold above the midline of the Bollinger Bands (currently near 2.60). The upper band sits near 3.13, showing that volatility remains high, but price action is leaning toward the lower band around 2.08—a bearish sign in Heikin Ashi structure.

The recent bounce from 2.00 shows some short-term accumulation, but each candle since then has been capped near the 20-day simple moving average, suggesting sellers still dominate rallies. Volume has not supported any breakout attempts, and resistance layers at 2.60 and 2.80 remain untested.

Support sits at 2.08; if XRP price closes below that level, a retest of 1.85–1.90 becomes probable. Conversely, a clean break above 2.65 could attract fresh buyers and push the token toward 3.00.

Sentiment and Liquidity Outlook

Investor sentiment is muted. With uncertainty over U.S. fiscal operations and ongoing inflation pressures, traders are avoiding aggressive long positions. Stablecoin inflows into exchanges have slowed, while Bitcoin dominance has ticked higher—a sign that traders are consolidating into safer crypto majors.

This liquidity drain has particularly impacted altcoins like XRP. If the shutdown extends into November, economists expect it could shave up to 0.2% off weekly GDP—exactly the kind of macro stress that keeps institutional crypto flows on pause.

What to Watch This Week

- Shutdown Resolution or Escalation: Any credible sign of a political compromise could trigger a short-term relief rally across risk assets, including XRP.

- Bollinger Band Compression: XRP is nearing the lower band. If volatility squeezes further and price holds above 2.30, it could signal an accumulation zone.

- Volume Spike Confirmation: Watch for a surge in buy volume above 2.65. Without that, every uptick will likely fade.

- Macro Data Delays: With the shutdown, key U.S. economic indicators are frozen, adding to uncertainty and indirectly suppressing speculative momentum.

XRP Price Prediction: Slow Grind Before Direction

Unless the U.S. shutdown ends soon or macro sentiment shifts, XRP price chart suggests consolidation between 2.10 and 2.70. The Heikin Ashi candles are yet to print consistent green bodies, indicating buyers remain cautious.

If risk appetite returns—perhaps through a government resolution or dovish Fed tone—XRP could rally back toward 3.00. But if the shutdown persists and global risk-off mood deepens, a dip toward 1.90–2.00 can’t be ruled out.

What this really means is $XRP is stuck in a holding pattern: the next major move depends less on crypto sentiment and more on Washington politics.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin profit metric eyes 2-year lows in 'complete reset:' BTC analysis

Mars Morning News | After the Ethereum Fusaka upgrade, the blob base fee surged by 15 million times

Multiple blockchain industry updates: a Bitcoin OG wallet transferred 2,000 BTC; Cloudflare outage was not caused by a cyberattack; the DAT bubble has burst; Ethereum Fusaka upgrade fees have surged; LUNC has risen over 80% intraday. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Drones, Fake Birdsong, and Broken Glass Traps: Malaysia is Undergoing an Unprecedented "Bitcoin Crackdown"

The Malaysian government is intensifying its crackdown on illegal bitcoin mining, utilizing technologies such as drones and sensors to uncover numerous operations, with electricity theft causing significant losses. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still in the process of iterative improvement.

Bitwise CIO: Stop Worrying, MicroStrategy Won't Sell Bitcoin

There are indeed many concerns in the crypto industry, but MicroStrategy selling bitcoin is definitely not one of them.