Oracle Network Chainlink Declared Top Project on Santiment’s Real-World Asset Development Rankings

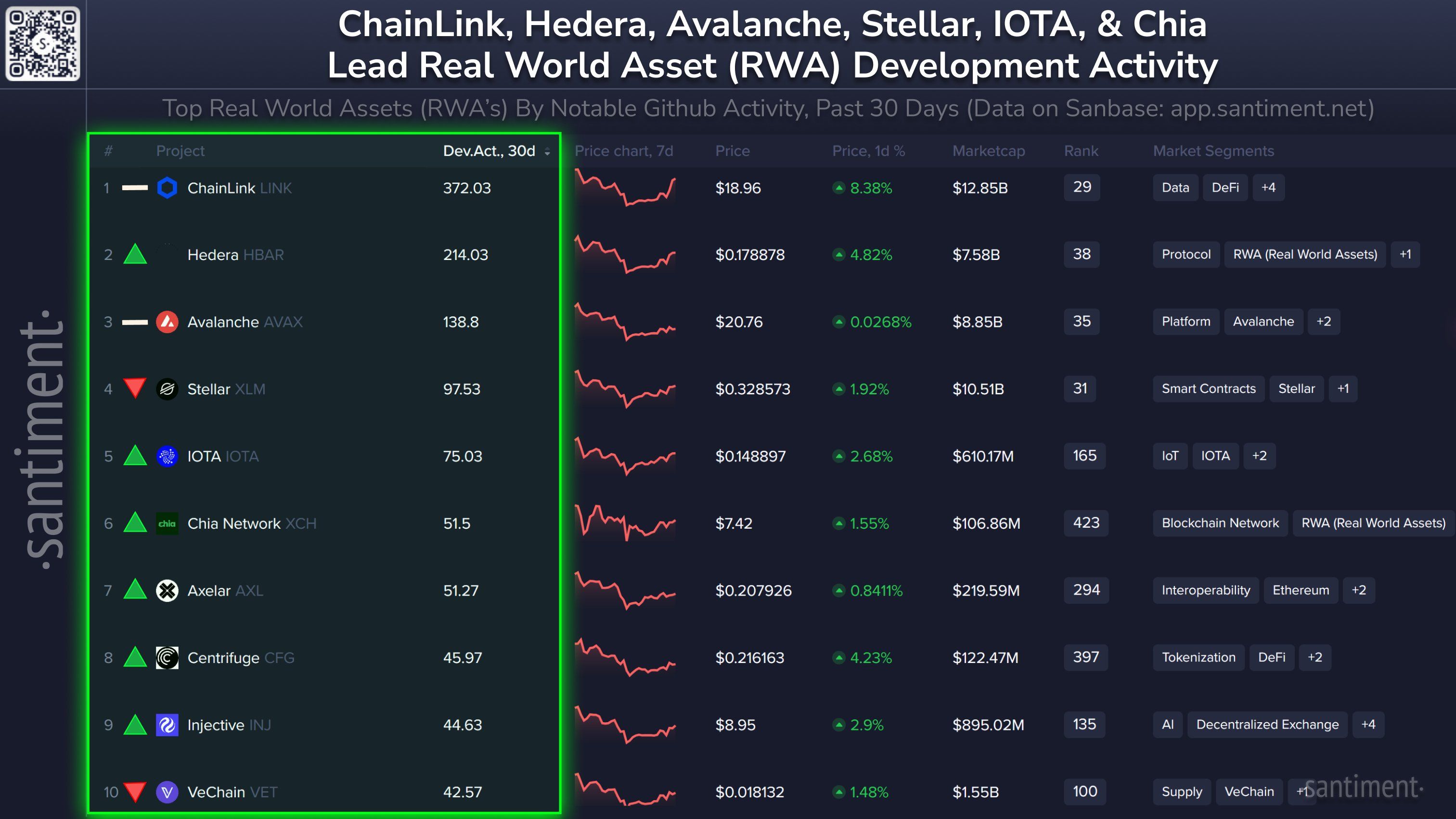

The decentralized oracle network Chainlink ( LINK ) is continuing its streak at the top of crypto’s real-world asset (RWA) sector in terms of recent development activity, per new research from the analytics firm Santiment.

Santiment notes in a new post on the social media platform X that Chainlink registered 372 notable GitHub events in the past 30 days.

The figure far exceeds the second-ranked RWA project, the layer-1 blockchain Hedera ( HBAR ), which clocked 214 GitHub events in the past month.

The Ethereum ( ETH ) rival layer 1 blockchain Avalanche ( AVAX ) was third, with 138, and peer-to-peer payments project Stellar ( XLM ) was fourth with 97.

Source: Santiment/X

Source: Santiment/X

Chainlink has occupied the top spot on Santiment’s list all year, often clocking multiple times the number of GitHub events as the second-ranked project.

The analytics firm notes that it doesn’t count routine updates and relies on a “better methodology” to collect data for GitHub events based on a backtested process.

Santiment has previously explained that crypto projects with lots of development could soon be shipping new features and are less likely to be exit scams.

LINK is trading at $18.80 at time of writing. The top-ranked crypto oracle and 16th-ranked crypto asset by market cap is up nearly 3% in the past 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Leverage Liquidation and Potential Dangers of Excessive Exposure in 2025

- 2025 crypto market saw $1B+ leveraged liquidations as Bitcoin fell from $126k to $92k amid Fed policy uncertainty and geopolitical tensions. - Retail traders suffered disproportionately from 10x-20x leverage during price corrections, while institutions used ETFs and hedging to mitigate risks. - Derivatives market vulnerabilities exposed include liquidity crunches, algorithmic feedback loops, and cross-market contagion risks via crypto-treasury overlaps. - Post-2025 lessons emphasize 3x-5x leverage caps,

The Recent Fluctuations in the Solana Network and What They Mean for Blockchain Investors

- Solana's 2025 volatility highlights risks for blockchain investors from market psychology and infrastructure flaws. - November 2025 saw 6.1% price drops driven by leverage, Fed rate uncertainty, and plummeting on-chain activity metrics. - $3.1B in DeFi losses from smart contract exploits and AWS outage risks exposed technical vulnerabilities despite decentralization gains. - Investors must balance sentiment indicators (fear/greed index) with technical metrics (TVL, DEX volume) to navigate Solana's instab

Entrée Capital Introduces $300M Fund With Focus on AI Agents, DePIN

Ethereum Price Explodes Back Above $3,200: Bigger Moves Coming?