3 Altcoins Whales Are Selling Fast as October Ends

Altcoin whales are exiting fast as October ends. This analysis tracks three major tokens seeing heavy sell pressure — SHIBA INU (SHIB), CARDANO (ADA), and ZORA (ZORA). From SHIB’s stalled triangle breakout to ADA’s fading momentum and ZORA’s profit-taking drop, these coins show how whale exits are reshaping the altcoin market.

Whales are selling several major altcoins fast as October draws to a close. Since October 13, the total altcoin market cap (excluding Bitcoin) has dropped by over 11%, slipping from $1.62 trillion to $1.45 trillion.

The decline isn’t only due to falling prices — large holders have been steadily reducing exposure. While some projects still attract quiet accumulation, there are three altcoins that whales are selling fast. The selling spree comes amid delayed breakouts, profit-taking, and fading confidence.

Shiba Inu (SHIB)

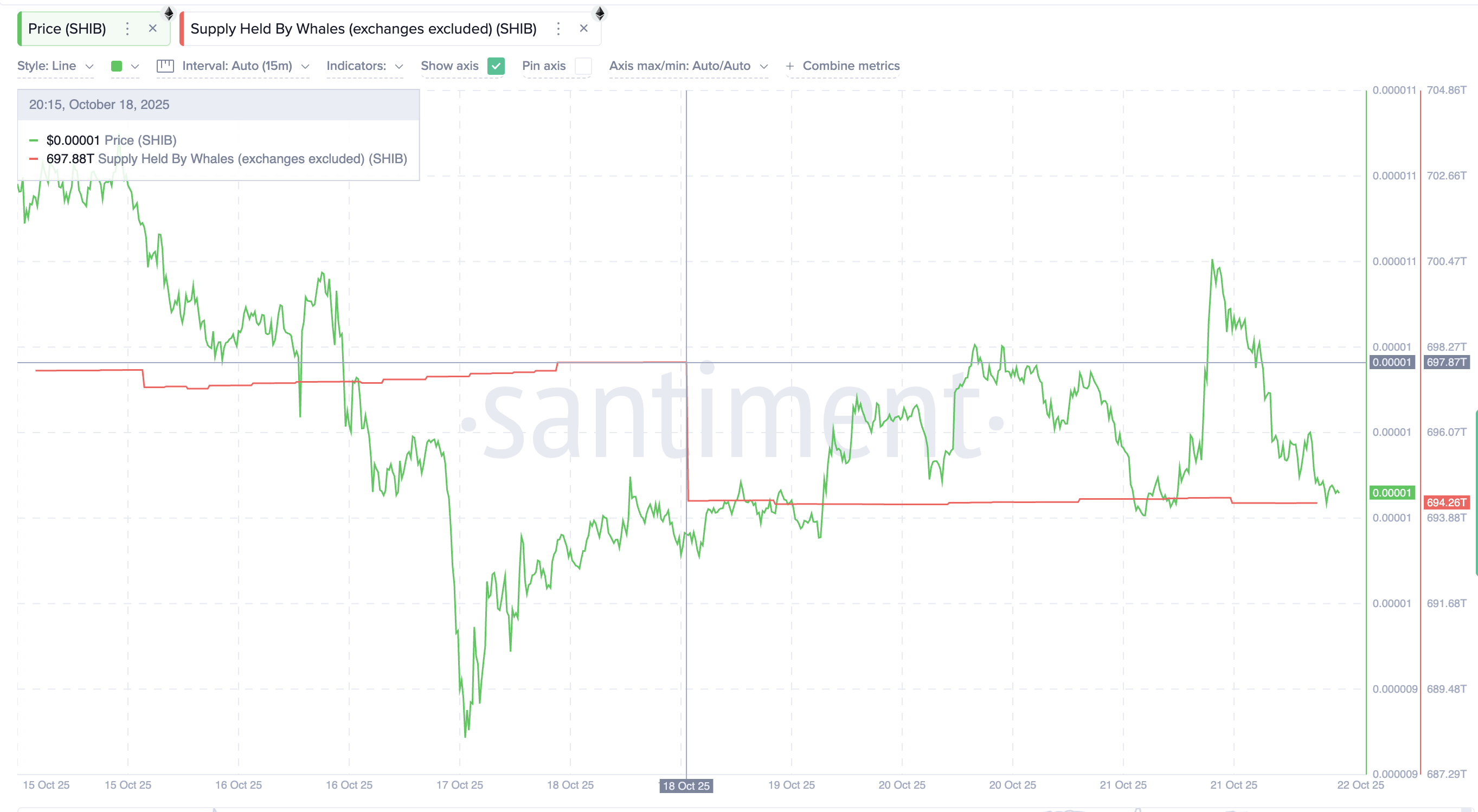

Whales appear to be losing interest in Shiba Inu, steadily offloading their holdings since October 18.

Data shows that wallets dropped their combined stash from 697.88 trillion to 694.26 trillion, a reduction of roughly 3.62 trillion SHIB, worth about $355,000 at the current price of $0.0000098.

SHIB Whales:

SHIB Whales:

This selling aligns with Shiba Inu’s chart setup. The token has been stuck inside a symmetrical triangle pattern since October 10, signaling indecision. Between October 14 and 20, the price formed lower highs while the Relative Strength Index (RSI), which measures price momentum, made higher highs.

This pattern is known as hidden bearish divergence, often signaling that a downtrend will continue.

SHIB Price Analysis:

SHIB Price Analysis:

The broader picture supports that view. SHIBA INU is down 27.2% over the past three months, confirming the ongoing downtrend.

A daily close below $0.0000097 could send it to $0.0000092, while a breakout above $0.000010 might open the door toward $0.000011. For now, however, whales seem unconvinced that such a SHIB price rebound is near.

Cardano (ADA)

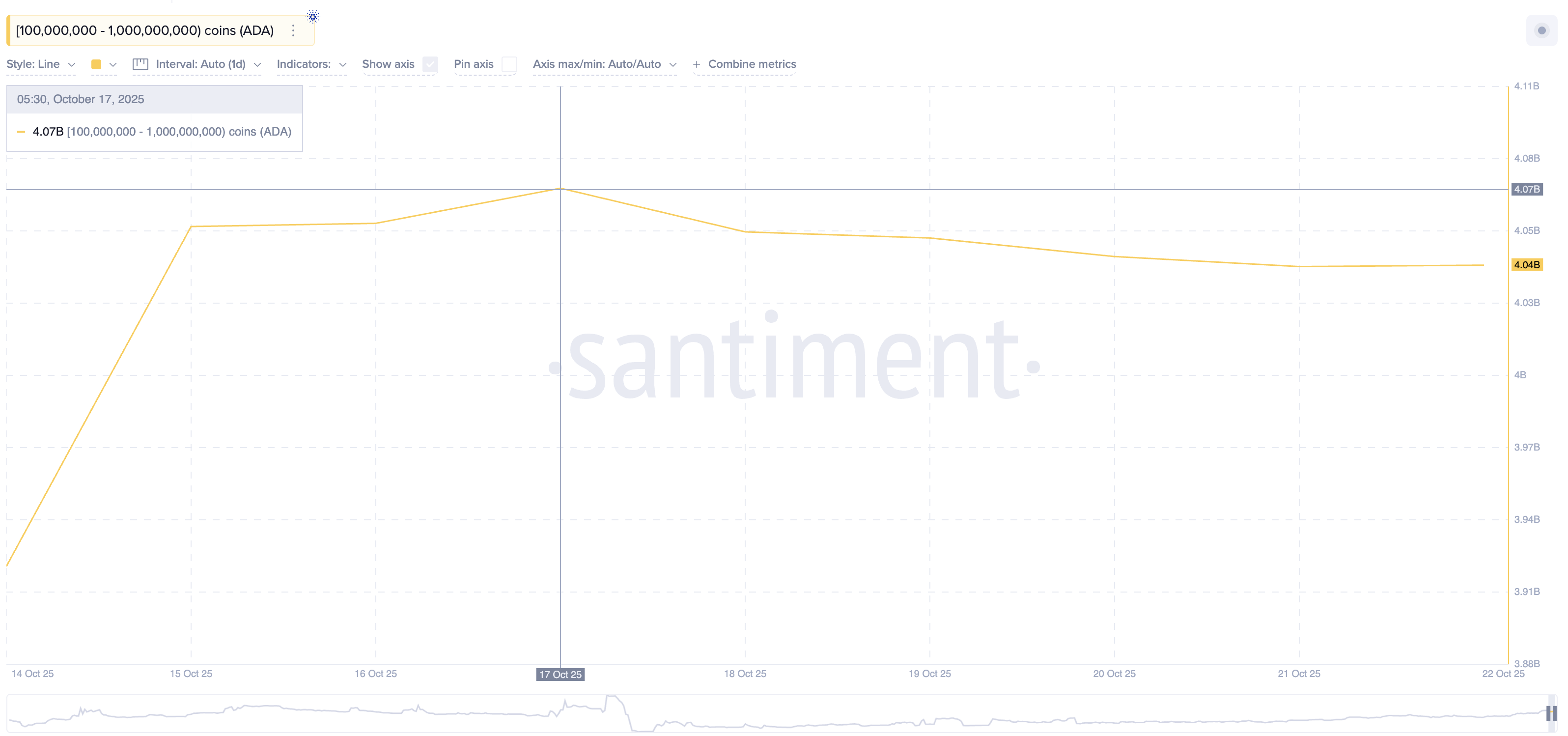

Crypto whales holding ADA between 100 million and 1 billion tokens have started trimming their positions since October 17. Their combined holdings fell from 4.07 billion ADA to 4.04 billion ADA, a reduction of about 30 million ADA, worth nearly $19 million at the current price of $0.63.

Cardano Whales Offloading:

Cardano Whales Offloading:

The timing of this sell-off is important. On October 17, ADA briefly broke below the ascending channel’s lower trendline, which has only two touchpoints and is structurally weak. The breakdown seems to have triggered mild panic among whales.

Although ADA prices recovered later, selling hasn’t stopped, suggesting confidence remains low.

Between October 13 and 20, the price made a lower high while the Relative Strength Index (RSI) formed a slightly higher high, indicating a hidden bearish divergence. This pattern usually points to trend continuation (21% down over the past three months) rather than reversal. If ADA fails to hold $0.61, it could slide toward $0.59 or even $0.50.

Cardano Price Analysis:

Cardano Price Analysis:

To invalidate this bearish outlook, ADA must clear $0.86, a resistance level, 36% higher than the current level. This level has capped multiple Cardano rallies before. Until then, the upside target near $1.12 (channel breakout point) remains unlikely — at least for now.

Zora (ZORA)

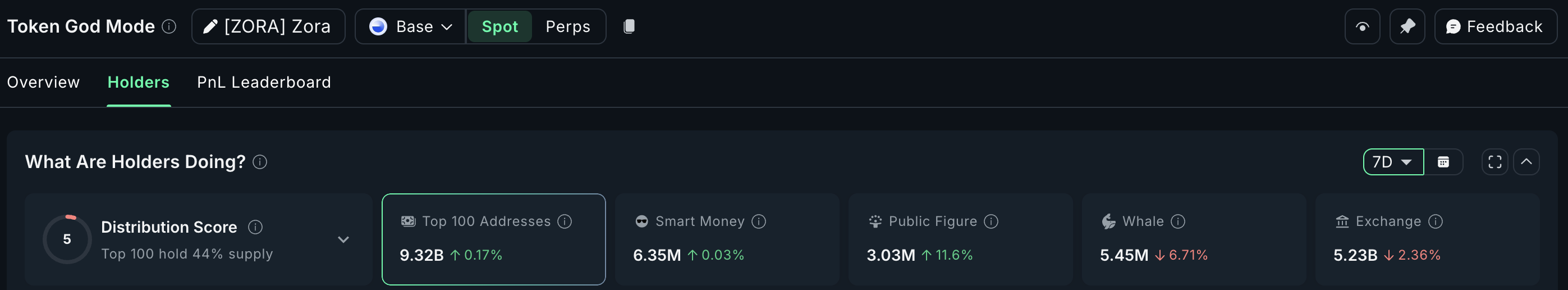

ZORA whales are cashing out. They are likely taking profits after their strong monthly rally. The token has gained over 61% in the past 30 days but has slipped 15.6% in the last week as large holders started selling.

Whale wallets have reduced their holdings by 6.71%, cutting their collective stash to 5.45 million ZORA. That means roughly 390,000 ZORA tokens have been sold in the past seven days.

ZORA Whales:

ZORA Whales:

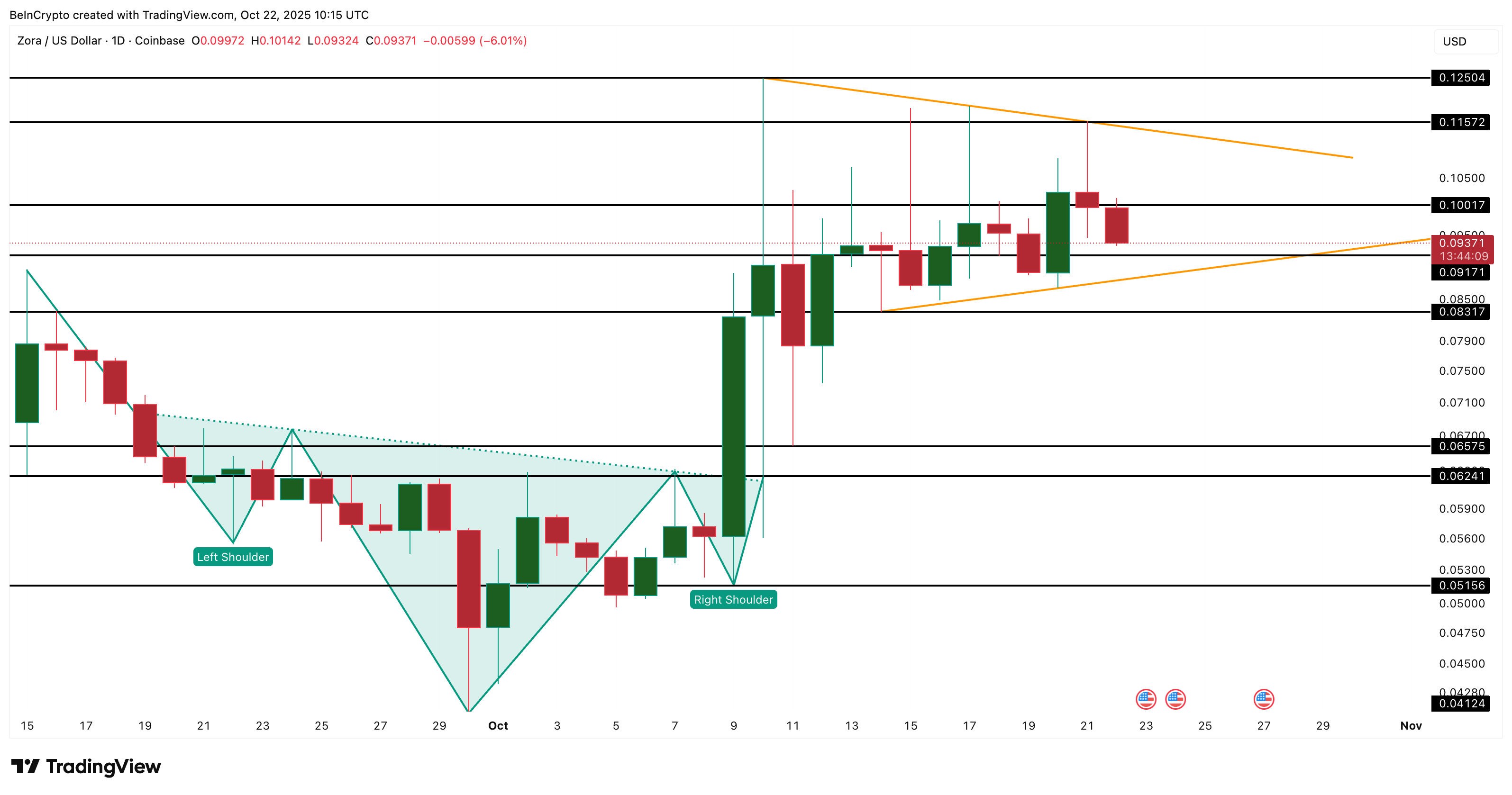

ZORA’s price action reflects this cooldown. After breaking out of an inverse head-and-shoulders pattern as predicted earlier this month, it’s now consolidating inside a symmetrical triangle, showing a pause in momentum.

If $0.091 fails to hold, a deeper correction toward $0.083 or even $0.065 could follow.

ZORA Price Analysis:

ZORA Price Analysis:

Still, this looks more like a profit-booking phase than a full trend reversal. A daily close above $0.10 and then $0.11 would invalidate the short-term bearish setup, opening room for another push higher — and possibly reviving whale interest.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Do Kwon to Serve 15 Years Behind Bars for the $40B LUNA Fraud

VIPBitget VIP Weekly Research Insights

Global risk assets are entering a phase where multiple catalysts are aligning, driving a new wave of momentum in technology and growth stocks. Trump has revived his "tariff dividend" proposal (a $2000 check per person), the U.S. government shutdown crisis is nearing resolution (with fiscal spending expected to resume before December 11), and the probability of a Fed rate cut in December has surged to 95% (with markets even partially pricing in a 50-basis-point cut). Expectations of ample liquidity are rising across the board. U.S. tech stocks and high-beta growth names are positioned to benefit first. Themes such as AI infrastructure, retail brokers (supported by the convergence of crypto and U.S. stock trading), and digital-asset infrastructure are likely to lead the rally. The Nasdaq index is expected to see further upside in the near term, while select quality stocks offer notable rebound potential. As a globally leading Universal Exchange (UEX), Bitget has fully integrated tokenized stocks and futures products, bridging traditional finance with the wider digital-asset ecosystem. Through strategic partnerships with institutions such as Ondo Finance, Bitget Onchain now supports on-chain tokenized trading for more than 100 stocks and ETFs. Users can trade tokenized stocks—including NVDA, HOOD, TSLA, MSTR, COIN, META, and other popular names—directly in the spot market, and also access perpetual futures on individual stocks within Bitget's futures section.

Investing in Health-Focused Industries: A Strategic Transformation in Consumer and Business Practices

- Global wellness economy is transforming through health, financial , and environmental priorities, driven by consumer demand, corporate innovation, and policy shifts. - Health wellness market projected to grow from $3.8T to $5.27T by 2033, fueled by AI adoption, wearables, and preventive care advancements. - Sustainable living sector will expand 3.8x to $29.97B by 2033, accelerated by green tech (23.1% CAGR) and corporate net-zero commitments. - Financial wellness tech grows at 10.25% CAGR, with AI-driven

YouTube Lets U.S. Creators Receive Earnings in PayPal’s PYUSD Stablecoin