"If he (Powell) is still there when I take office, he will not stay." This statement by U.S. President Trump has sent shockwaves through global financial markets. The Federal Reserve, the "heart" of the global financial system, has always had its chair's independence regarded as a cornerstone of market stability. Now, that cornerstone has been shaken. This concerns not only the dollar and U.S. stocks, but will also profoundly reshape the future landscape of the cryptocurrency market.

I. From Distant Criticism to Direct "Dismissal"

The incident originated from a clear statement Trump made during an interview. He not only reiterated his intention to remove Powell but also criticized the Federal Reserve for having "hardliners" and for keeping interest rates too high, which he claims is hindering economic development.

This turmoil did not arise out of nowhere. Looking back at Trump’s first term, although he personally nominated Powell to replace Yellen, during the subsequent rate hike cycle, Trump repeatedly criticized Powell publicly on social media, calling him "crazy," "ridiculous," and "the biggest threat to the economy." The current statement is the ultimate eruption of this years-long conflict. As early as April 17 this year, Trump posted three consecutive messages angrily denouncing Powell, with emotions escalating: first accusing "Powell's April 16 report is another mess. He should have lowered rates like the European Central Bank long ago, but he is always too late and makes mistakes," then bluntly stating "Powell should step down as soon as possible," and finally escalating to a threat: "If I want him to leave, he will leave soon. I am not satisfied with him."

Can the President arbitrarily dismiss the Federal Reserve Chair? This is highly controversial in U.S. law and practice. According to the Federal Reserve Act, the terms of Fed governors are strictly protected, and the President can only remove them "for cause." Historically, no president has ever successfully dismissed a Fed chair. Therefore, this turmoil is more likely a high-intensity political pressure campaign aimed at influencing the future direction of monetary policy. A former Fed official, speaking anonymously to Bloomberg, said, "This is an unprecedented public challenge to the Fed's independence, aimed at shaping a more obedient central bank."

II. Instant Market Reaction: Intertwining Panic, Opportunity, and Uncertainty

1. Traditional Markets: Dollar and U.S. Treasuries Bear the Brunt

The U.S. Dollar Index fell by 0.5%, indicating shaken market confidence in the dollar's future. Meanwhile, the volatility of the U.S. 10-year Treasury yield, the anchor of global asset pricing, rose significantly, showing that the bond market is repricing for future policy uncertainty.

2. Cryptocurrency: Short-Term Panic and Long-Term Narrative Reinforcement

Bitcoin experienced a brief period of sharp volatility after the news broke, first plunging quickly to test support, then rebounding just as rapidly. This "V-shaped" movement perfectly illustrates the market's conflicted mindset: short-term panic selling coexisting with long-term value buying.

On-chain data shows that, according to reports, within 24 hours of the news fermenting, the net outflow of bitcoin from centralized exchanges reached about 12,000 coins. This means that a large number of investors are choosing to transfer assets to private wallets for hoarding, rather than engaging in short-term trading.

III. The Crypto Market May Be at a Turning Point of Fate

| Impact Dimension | Potential Opportunity | Potential Risk |

| Price and Trading | Policy uncertainty boosts bitcoin's "safe haven" demand | May lead to large-scale liquidation of high-leverage positions |

| Capital and Liquidity | If the successor implements loose monetary policy, it will bring massive liquidity to the market | Damage to dollar credibility could trigger a global liquidity crisis |

| Industry and Regulation | The "bankless" narrative of DeFi is reinforced, attracting new users and capital | The new chair may take a tougher regulatory stance on the crypto industry, setting barriers for institutional entry |

| Market Sentiment | "FOMO" sentiment may spread, driving a massive influx of funds and fueling a bull market | Uncertainty leads mainstream market sentiment to turn "wait-and-see," trading volume shrinks, and the market stagnates |

IV. How Does the Market Interpret This Storm?

Analysts and institutions in the market are significantly divided, mainly into the following camps:

1. "Independence Doubters"

"This is not just a personnel change; it shakes the foundation of the modern central banking system. If the Fed's decisions become politicized, global trust in dollar assets will be greatly diminished. Bitcoin's long-term value as a non-sovereign store of value will be infinitely magnified in such an environment."

2. "Policy Doves"

"The market should focus on who the successor will be. A politically appointed dovish chair means lower interest rates and a larger balance sheet. This would be the perfect macro environment that cryptocurrencies and all risk assets have long dreamed of."

3. "Reality Constraints"

"The market is overreacting. Under legal and institutional constraints, directly dismissing Powell is almost an impossible task. This is more likely a political show that will eventually evolve into a long tug-of-war, with its actual impact on monetary policy likely much less than the market is currently pricing in."

V. Investor Action Guide

Potential risks to be wary of:

* Extreme uncertainty in policy path: The future interest rate path can no longer be predicted by traditional models, and the market may enter a sustained "news-driven" state, with volatility becoming the norm.

* Risk of regulatory stance shift: Under Powell's leadership, the Fed has maintained a relatively open research attitude toward cryptocurrencies. The new chair's stance is a complete unknown and could deal a fatal blow to crypto institutions seeking compliance.

Key developments to track going forward:

1. Official White House actions and Fed responses: Closely monitor whether the White House will formally submit a new chair nomination to Congress, as well as the policy background of the nominee. At the same time, any public response from Powell or other Fed officials will be key to assessing the seriousness of the situation.

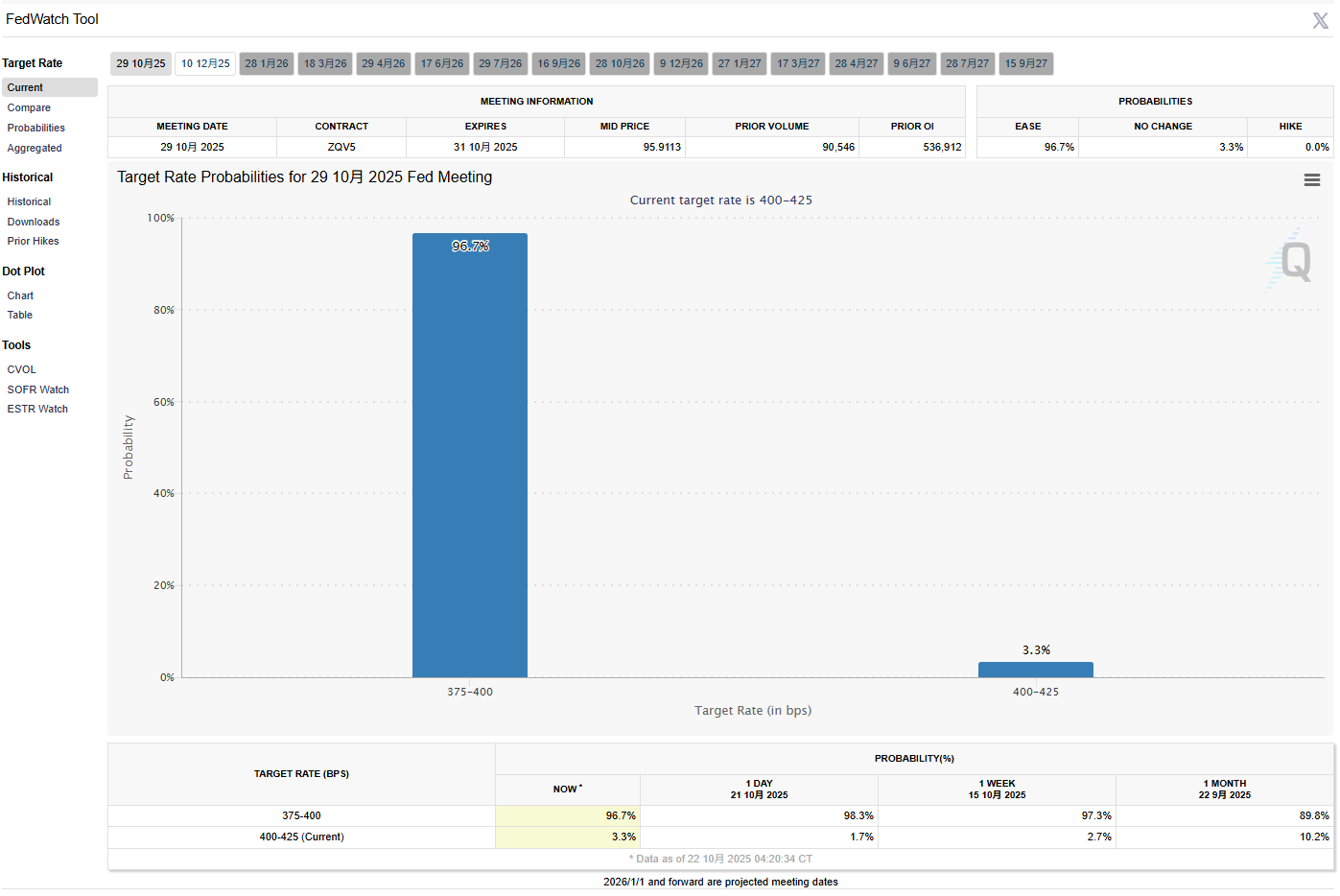

2. Interest rate expectations and the trend of the U.S. Dollar Index: Use tools to monitor market predictions for rate cuts and keep a close eye on the Dollar Index (DXY). The direction of the Dollar Index is a core indicator for judging whether capital will flow from the traditional system to the crypto market.

For the cryptocurrency world, this is both an unprecedented test and a historic opportunity to prove itself as an alternative to the traditional financial system. In the storm, the only certainty is uncertainty itself, and those who can weather the cycles are always the investors who focus on long-term value and have robust risk management in place.