Low threshold, all-weather: Bitget brings the "iPhone moment" to US stock investment

Investing globally no longer requires a cross-border identity, just a Bitget account.

Written by: OneShotBug

October 2025 marks the US stock earnings season, with the keyword: "Far Exceeding Expectations."

Earnings reports from JPMorgan and Goldman Sachs show that the latest quarterly results from these two Wall Street flagship banks easily surpassed analysts' expectations. JPMorgan's Q3 revenue grew by 9% to $47.12 billion, far exceeding the expected $45.4 billion; Goldman Sachs' Q3 revenue grew by 20% to $15.18 billion, well above the market's expectation of $14.1 billion. Many US stock market participants have thus enjoyed satisfactory returns. Meanwhile, recent trade conflicts and other factors have caused US stocks to fall and then rise, providing investors with more room for maneuver.

However, despite the abundance of investment opportunities in the US stock market, ordinary investors from mainland China have once again been shut out: in September, platforms like Futu and Tiger Brokers announced a complete shutdown, and unless you have overseas permanent residency, mainland Chinese users can no longer freely open accounts.

So, how should ordinary investors in mainland China participate in the US stock investment market now?

My answer is: Bitget.

Not long ago, Bitget exchange announced support for trading hundreds of RWA US stock tokens, requiring neither overseas identity nor complex account opening processes, with a minimum entry of just $30. These stock tokens include core US stocks such as Apple, Tesla, Microsoft, Nvidia, etc., all well-known to the public. They are held by regulated US custodians, their prices are pegged to real stocks, and they can be traded 24/7, five days a week.

This means: investing globally no longer requires cross-border identity, just a Bitget account.

Behind this is their "UEX" concept—Universal Exchange, a panoramic exchange. All-encompassing assets, redefining the boundaries of an "exchange." From on-chain assets, real-world assets (RWA), to AI-powered trading experiences, Bitget has built a unified platform that breaks down the barriers between traditional finance and crypto assets.

The real question we should be asking is: if there is such an entry point that integrates high-quality global assets into your hands, how many more reasons do you need to continue opening accounts the traditional way?

Bitget UEX: A Faster, Cheaper, and More User-Friendly US Stock Channel

In the past, if you wanted to invest in well-known US stocks like Apple, Nvidia, or Tesla, you needed to open an account on platforms like Futu or Tiger Brokers and provide overseas identification. Now, as a UEX, Bitget is offering two more flexible and lower-threshold alternatives.

1. US Stock Perpetual Contracts

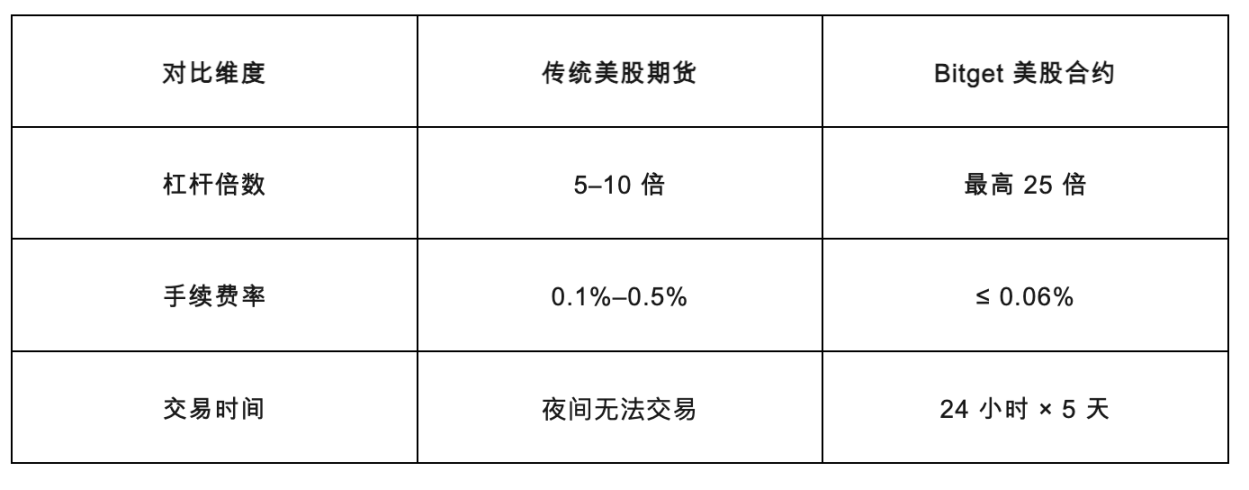

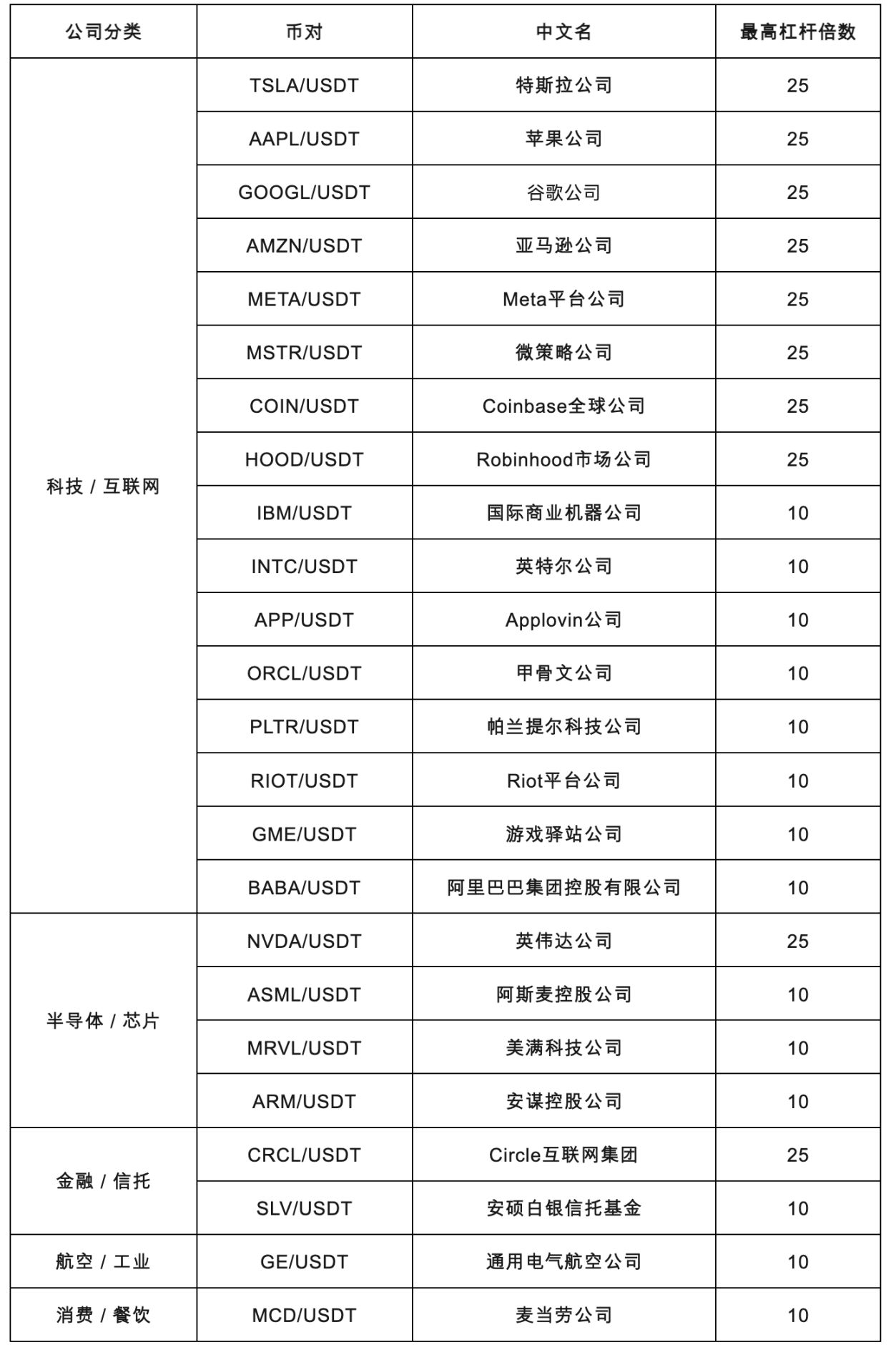

Users only need to download the Bitget App, deposit USDT into their contract account, and they can directly enter the "Stocks - Contracts" section to trade 25 USDT-margined US stock perpetual contracts covering popular sectors such as technology, chips, aviation, finance, and consumer goods. This trading method not only has a low threshold but also offers flexibility that traditional platforms can hardly match:

Other advantages include:

- Trading is possible with just a phone number or email registration

- Open a position with as little as $1

- Flexible leverage, take-profit and stop-loss settings, convenient for different market strategies

- Risk control: dynamic adjustment of leverage multiples for different assets to ensure trading safety and liquidity

The currently available products include:

2. RWA US Stock Tokens (Tokenized Stocks)

If you prefer a long-term holding approach to US stock allocation, Bitget has also partnered with Ondo Finance to launch a batch of on-chain versions of US stock assets, including hundreds of well-known company stocks and mainstream index funds such as Apple, Tesla, Microsoft, Amazon, Nvidia, etc. These can be traded via the "Stocks" section - "Stock Tokens" on the Bitget App homepage.

All assets are actually held by regulated US custodians. The tokens reflect the price fluctuations and dividend yields of the underlying assets, with a minimum investment threshold of $30. All assets are denominated in US dollars and support 24/5 trading, providing users with a more convenient experience than traditional brokers and banks.

You can think of this as a combination of "US Stock Connect + Crypto Account"—a new generation of cross-border wealth management that truly maps global assets.

For most investors who once opened accounts with Futu or Tiger Brokers but are now locked out, Bitget's two methods provide a real choice: use the tools you are familiar with to invest in global markets with greater freedom.

Investing in US Stocks with Bitget: AI-Powered Smart Analysis and Strategy Assistance

Many people think that to invest in assets on a crypto platform, you need to understand blockchain, learn how to use wallets, or even know how to code. But Bitget is trying to break this stereotype and make complexity "conversational." Here, we introduce how to operate trading commands as easily as sending a WeChat message, and how the system intelligently selects the most efficient and low-cost path.

1. AI Assistant GetAgent: Analyze Assets and Place Orders Like Chatting on WeChat

On traditional trading platforms, placing an order requires users to:

- Select market type (spot / contract)

- Select trading pair

- Set price and quantity

- Place buy/sell order

- Manage positions, take-profit, stop-loss, etc.

This entire process is not only cumbersome but also discourages many new users.

Bitget's GetAgent completely reconstructs the trading experience. You only need to say one sentence:

"Help me buy $100 worth of Nvidia." "I want to short Tesla with $50, 5x leverage."

The execution mechanism behind this is very complex, including:

- Intent recognition (what asset the user wants to trade, long or short)

- Asset matching (which market and which product is optimal)

- Automatic order placement and matching (using smart routing algorithms)

- Risk control checks (whether leverage/position requirements are met)

- Order execution feedback (confirmation to the user)

But for users, all of this is just a matter of saying one sentence.

This truly makes trading "conversational" and "humanized," rather than a high-barrier technical interface.

2. Smart Routing: Efficient Trading and Fee Optimization

Bitget also integrates smart routing in the background. When trading assets, the platform will:

- Estimate the optimal path (for example, if you want to buy a new token on the Base chain, it will determine whether it's cheaper to swap USDT for ETH first, then swap ETH for the token)

- Estimate gas fees and slippage, and automatically execute the most economical path

- Integrate multiple on-chain DEX liquidity pools to optimize prices

This means users no longer need to understand on-chain mechanisms, gas fee logic, or bridging processes themselves, but can enjoy an almost CEX-level operating experience, all completed on-chain.

UEX: Not Just a US Stock Trading Platform, But a Gateway to Global Assets

If Bitget offers a "US stock contract + US stock token" combo, the real problem it wants to solve is: why are you still using tools from ten years ago to invest in today's market?

Traditional investors have long been accustomed to managing different assets on multiple platforms and accounts:

- Trade US stocks with brokers;

- Allocate gold at banks;

- Buy some crypto assets on exchanges;

- Go back to spreadsheets for asset allocation and summary.

This fragmentation not only keeps investment thresholds high but also makes switching between different markets costly, inefficient, and a poor experience for ordinary investors.

Similar problems actually exist in the crypto world. UEX is a future-oriented solution, whether for TradFi (traditional finance), CeFi (centralized crypto finance), or DeFi (decentralized crypto finance).

You will find that many crypto exchanges, including CEX (centralized exchanges) and DEX (decentralized exchanges), are trying RWA products and on-chain fusion products. The industry's trend is: traditional assets are being tokenized, and on-chain assets are becoming more controllable. Bitget has simply closed the loop earlier and named the direction sooner.

Just like before the term "smartphone" was coined, iPhone was already in practice; UEX may be the prototype of the future "super app platform" in crypto finance.

Risks, Challenges, and Future Predictions

Of course, UEX is not a panacea. To truly become an industry standard, it still faces many real-world issues:

1. Regulatory Challenges Are the Biggest Variable

Although Bitget introduces US stock assets through tokenization and claims they are managed by "US compliant custodians," regulatory compliance standards for RWA assets still vary across countries.

Especially for platforms offering securities-like trading services, will they be further defined as "brokers" by regulators such as the SEC in the future? Will additional licenses be required? These questions remain unanswered.

If Bitget wants to become the "global asset circulation center," it must continue to invest in compliance—this will determine whether UEX can go the distance.

2. User Education and Conversion Still Need Time

For many traditional users, "an exchange that can trade US stocks, traditional finance, crypto exchange, and on-chain assets" sounds more like a "scam platform." It will take time for users to accept this super asset aggregation model conceptually.

Bitget still has tasks to complete in this regard, such as:

- Strengthening educational content production

- Providing beginner product packages (such as "newbie asset allocation portfolios")

- Launching new features such as regular investment tools and low-risk portfolio simulation trading

How far is the road to panoramic trading?

As the US stock earnings season arrives, the market focus is once again on tech stocks and the financial sector, with investors swinging between valuations and profit expectations. Bitget's "UEX" concept provides a new investment perspective in such a market environment: making investment in high-quality global assets more convenient and exploring how to break the barriers between traditional investment methods and crypto finance.

This is not only an innovation for trading platforms but also a challenge to the entire industry—how to break the limitations of traditional finance and provide a truly open investment space in an era of highly interconnected information and increasingly global asset flows.

Today, as traditional broker thresholds tighten, exchange competition converges, and user experience bottlenecks frequently appear, Bitget has given its own answer: break asset isolation; integrate technology, AI, and wallets; turn financial complexity into operational simplicity.

In the future, will all trading platforms, whether traditional finance or crypto asset exchanges, become "UEX-ified"? Perhaps.

But the more important question is: when assets can truly flow freely, is your investment mindset ready to break out of the boundaries of the old era?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wall Street interprets the Federal Reserve decision as more dovish than expected

The market originally expected a "hawkish rate cut" from the Federal Reserve, but in reality, there were no additional dissenters, no higher dot plot, and the anticipated tough stance from Powell did not materialize.

The Federal Reserve cuts rates again but divisions deepen, next year's path may become more conservative

Although this rate cut was as expected, there was an unusual split within the Federal Reserve, and it hinted at a possible prolonged pause in the future. At the same time, the Fed is stabilizing year-end liquidity by purchasing short-term bonds.

Betting on LUNA: $1.8 billion is being wagered on Do Kwon's prison sentence

The surge in LUNA’s price and huge trading volume are not a result of fundamental recovery, but rather the market betting with real money on how long Do Kwon will be sentenced on the eve of his sentencing.

What is the overseas crypto community talking about today?

What have foreigners been most concerned about in the past 24 hours?