Canada’s Anti-Money Laundering Watchdog Levies Record $126M Fine on Cryptomus

What to know:

- Vancouver-based Cryptomus is said to have ignored over 1,000 suspicious transactions linked to a range of serious crimes.

- The fine is the largest issued by Canada’s anti-money laundering agency.

The Financial Transactions and Reports Analysis Centre of Canada (Fintrac) said it fined Xeltox Enterprises Ltd. (which operates as cryptocurrency platform Cryptomus), a record C$176.96 million ($126 million) for widespread compliance failures under federal anti-money laundering and counter-terrorist financing laws.

The fine related to over 1,000 suspicious transactions and more than 1,500 large virtual currency transactions that Canada’s anti-money laundering agency said Vancouver-based Cryptomus failed to report between July 1 and July 31, 2024.

Investigators said the unreported activity included transactions tied to child sexual abuse material, fraud, ransomware payments and sanctions evasion.

Cryptomus, previously known as Certa Payments Ltd., also failed to keep its compliance policies updated, assess risks of illicit finance and report key business changes as required by law, according to a press release.

“Given that numerous violations in this case were connected to trafficking in child sexual abuse material, fraud, ransomware payments and sanctions evasion, Fintrac was compelled to take this unprecedented enforcement action,” Sarah Paquet, the regulator's CEO, said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin's Support for ZKsync and Its Influence on Layer 2 Scaling Technologies

- Vitalik Buterin's endorsement of ZKsync in November 2025 boosted its profile as a key Ethereum scaling solution with 15,000+ TPS and near-zero fees. - Institutional partnerships with Deutsche Bank and Sony , plus a 37.5M $ZK staking pilot, strengthened ZKsync's enterprise adoption and tokenomics. - The $0.74 token price surge and $15B capital inflow highlight market confidence in ZK-based infrastructure as Ethereum's primary scaling path. - Upcoming Fusaka upgrade (30,000 TPS) aims to challenge Arbitrum'

CyberCharge and SocialGrowAI Unite to Accelerate Web3 User Growth and Engagement

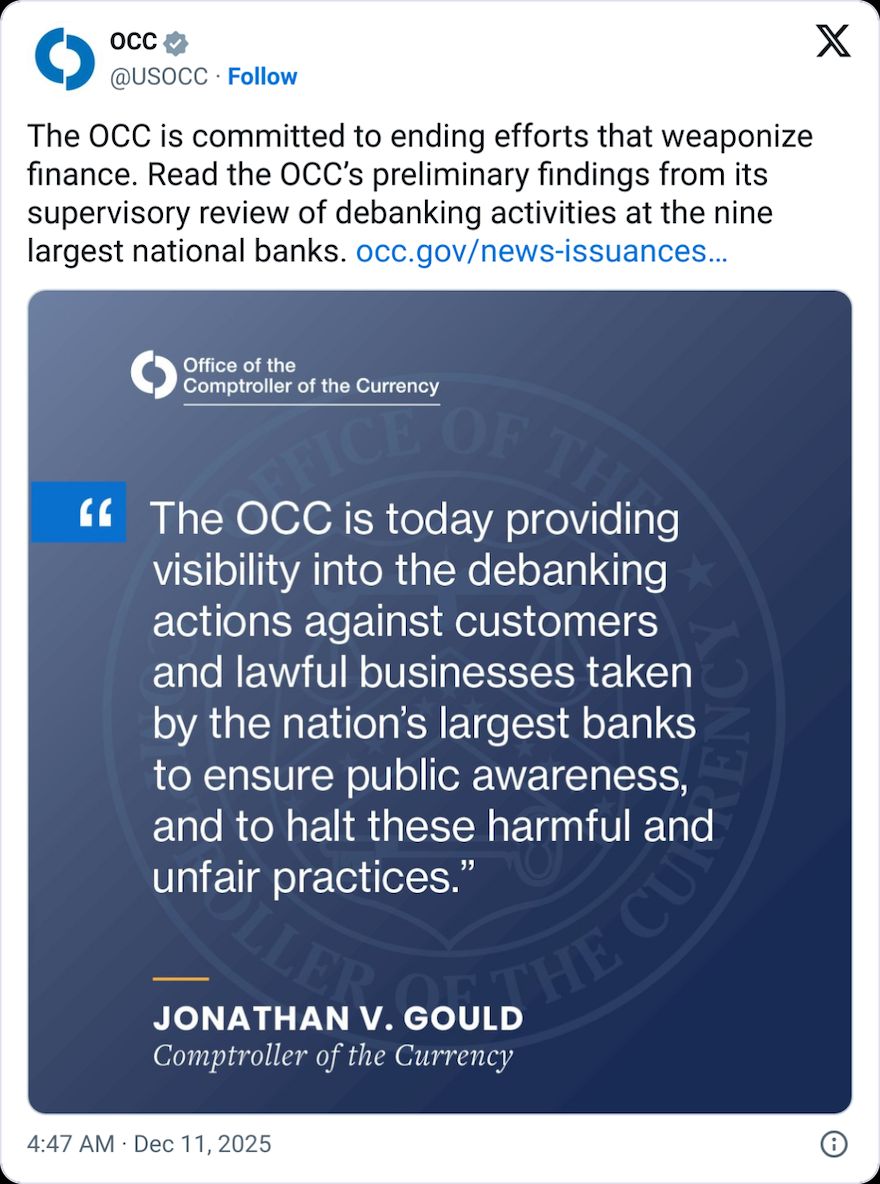

Crypto among sectors ‘debanked’ by 9 major banks: US regulator

Bitcoin Reverses From Channel Resistance as Whale Shorting Intensifies