How DeFi Works

Basic elements of DeFi system operations: TVL malfunction, circular yields, borrowing volume, and unknown system leverage.

The Fundamental Elements Driving DeFi Systems: TVL Failure, Yield Loops, Borrowing Volume, and Unknown System Leverage.

Written by: @lakejynch

Translated by: AididiaoJP, Foresight News

The DeFi valuation system has already failed, and most of us haven't even noticed. Today, we will examine the application of this metric in the lending sector.

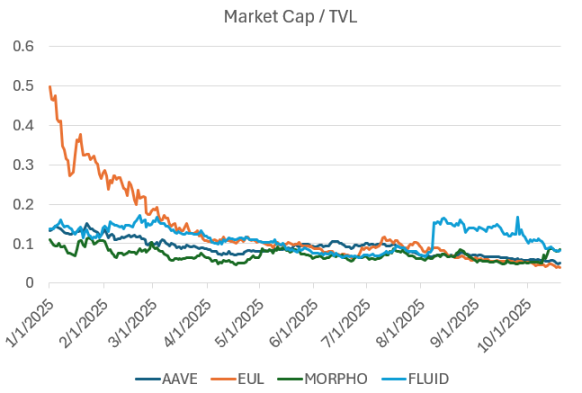

Lending markets trade at a ratio relative to TVL

TVL is used as a proxy metric to evaluate lending protocols. After communicating with most major DeFi lending teams, we believe that TVL conceals more than it reveals.

We attempt to look beyond superficial growth to explore the fundamental elements that truly make DeFi systems work.

Here are our findings:

TVL is a Poor Metric for Lending

In 2019, we used TVL as a benchmark. During the early DeFi experiments (Maker, Compound, Uniswap, Bancor, etc.), Scott Lewis and the DeFi Pulse team invented the TVL metric as a way to compare different projects. In those days, when there were only automated market makers, TVL was a good metric. As the industry matured and we began optimizing for capital efficiency (Uniswap v3, Pendle & Looping, Euler, Morpho), TVL started to lose its comparative value.

In other words, the operating logic of DeFi shifted from "Can we do it?" to "How well can we do it?"; TVL tracks the former, but today we clearly recognize that we need better metrics to measure the latter.

One problem with TVL in lending is that it refers to:

- The total supply of capital, regardless of the percentage borrowed. If there is 1 billion USD in lender capital deposited, the protocol's TVL will show 1 billion USD (regardless of how much is borrowed).

- Total supply of capital minus the borrowed amount. If there is 1 billion USD in lender capital deposited, of which 500 million USD is borrowed, the protocol's TVL will show 500 million USD.

This creates confusion for underwriters. Even between the two examples above, "TVL" could refer to completely different capital bases.

Secondly, both measurement methods are flawed and reveal almost nothing about the protocol's health.

- Total supply does not indicate how much lending the protocol actually facilitates.

- Total supply minus borrowed amount does not indicate capital efficiency; it merely rewards idle capital.

An effective lending protocol is one that can efficiently and at scale match lenders and borrowers, and the existing TVL definitions fail to capture this dynamic.

At best, TVL only gives underwriters a rough approximation of "scale."

Lending Platforms Were Primarily Used for Leveraged Trading and Risk Exposure Management

But this has changed.

Historically, lending markets were used for leveraged long/short risk exposure, but with the introduction of Hyperliquid—a perpetual contract exchange offering no KYC and reduced (though not negligible) counterparty risk—perpetual contracts are now widely used and considered a better tool for expressing directional views.

Lending markets also tend not to add assets with potentially lower ratings. However, decentralized perpetual contract exchanges compete to list these assets as quickly as possible. For traders, not having to manually loop positions and being able to access shiny new assets faster is a significant improvement in user experience.

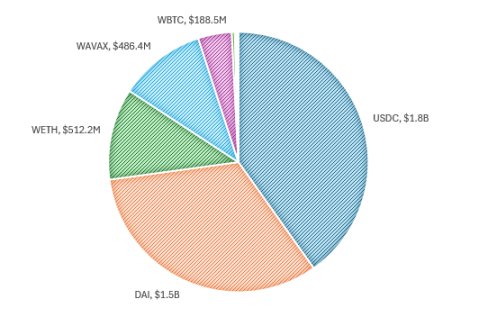

As a comparative example, let's look at Aave's mainstream assets in its early days, at the end of the last cycle.

Aave's top assets, April 26, 2022

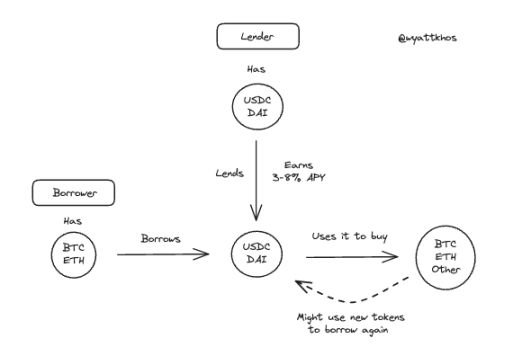

The user pattern at that time was straightforward. Lenders provided stablecoins (mainly USDC and DAI) in exchange for yields, usually between 3-8% APY, depending on market conditions. Meanwhile, borrowers deposited blue-chip assets like BTC or ETH as collateral to borrow stablecoins, either to redeploy funds elsewhere while maintaining risk exposure, or to leverage up and buy more of the same asset.

Early typical Aave user flow

This model still exists, but is less dominant today. Perpetual contracts have become a competitive, arguably better, way to go long/short assets based on collateral, and lending markets have shifted to other uses.

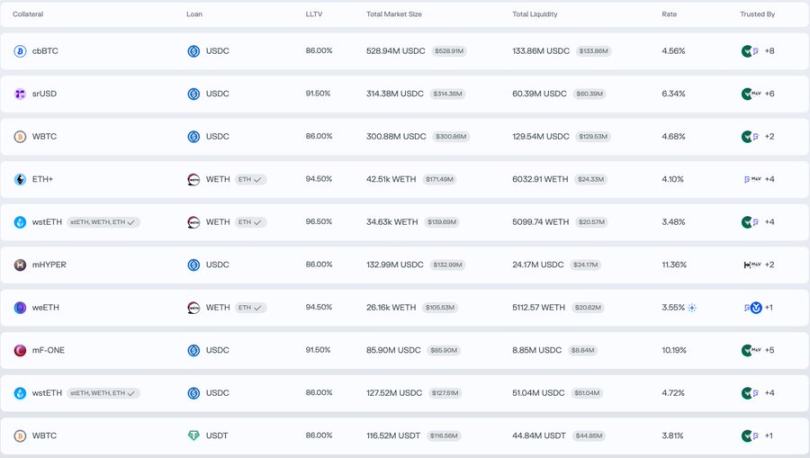

To understand how lending markets are used today, it's helpful to look at the main markets on Morpho. Aside from the large BTC markets (cbBTC and WBTC), the top trading pairs reveal a different activity pattern—one less about directional leverage and more about optimizing yields or liquidity:

- Deposit ETH+, borrow WETH

- Deposit wstETH, borrow WETH

- Deposit mHYPER, borrow USDC

- Deposit mF-ONE, borrow USDC

From this, we learn...

Yield Loops Are the Dominant Use Case in Today's DeFi Lending Markets

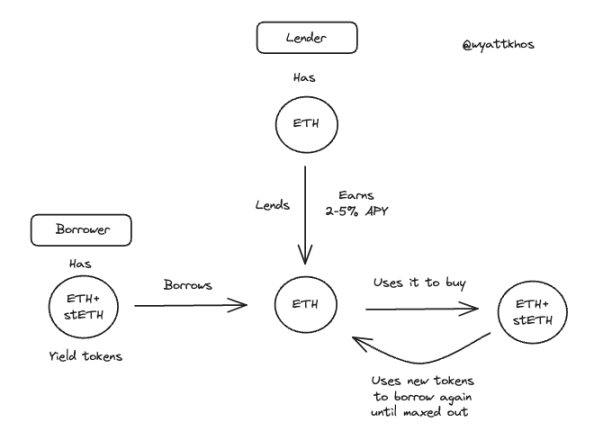

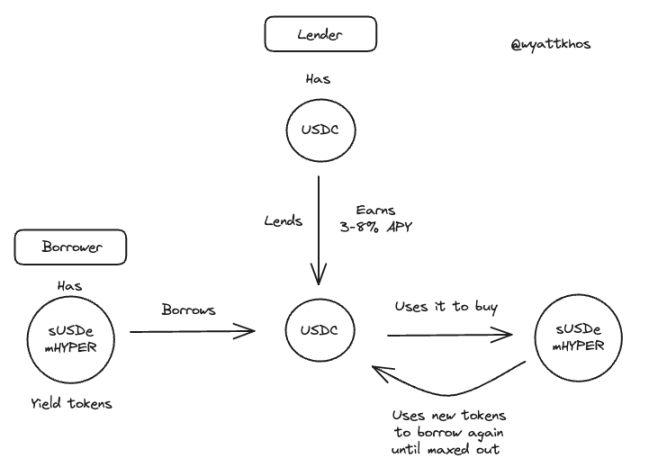

In the Morpho example above, users deposit a yield-bearing asset, borrow a non-yielding corresponding asset, then use the borrowed funds to buy more of the original yield-bearing asset, repeating the process to amplify returns.

Here are a few ongoing loop trading examples.

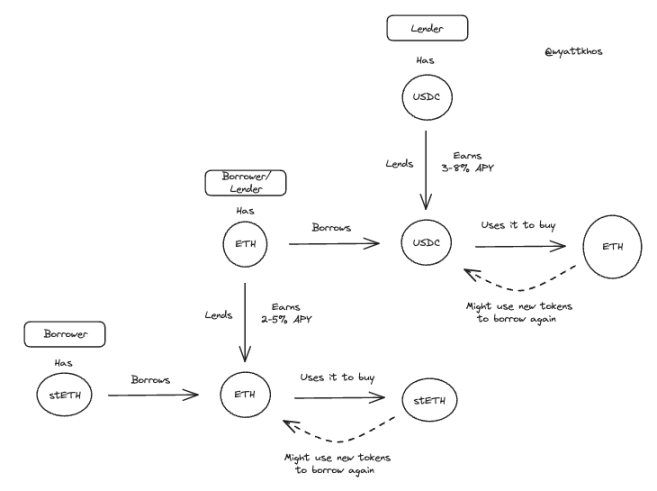

ETH - stETH loop trade

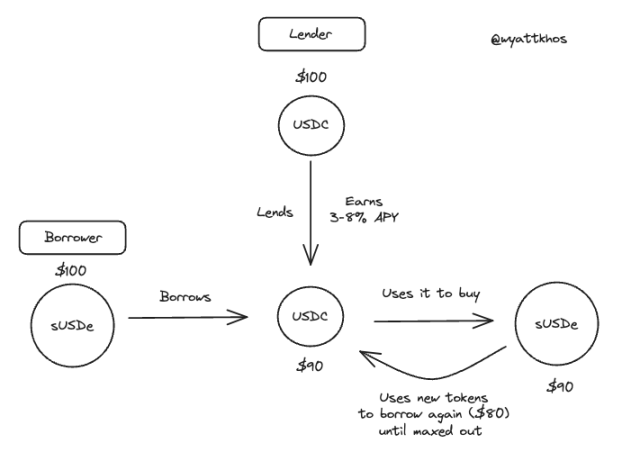

sUSDe/mHYPER - USDC loop trade

Ethena's USDe is a key driver behind the recent surge in yield loop strategies. This now widely used trade mainly relies on Aave and Pendle, though it can be replicated with other yield-bearing assets. The persistence of the strategy depends directly on the quality and stability of the underlying yield. @shaundadevens had a great tweet in August describing this market behavior.

These loop strategies typically combine three components:

- A yield-bearing "stablecoin"

- Pendle, for yield stripping

- A lending market for leverage

However, two key constraints limit the scale of this trade.

1. Liquidity of ordinary assets

There must be enough stablecoin liquidity available to borrow.

2. The strategy's yield must exceed the borrowing rate

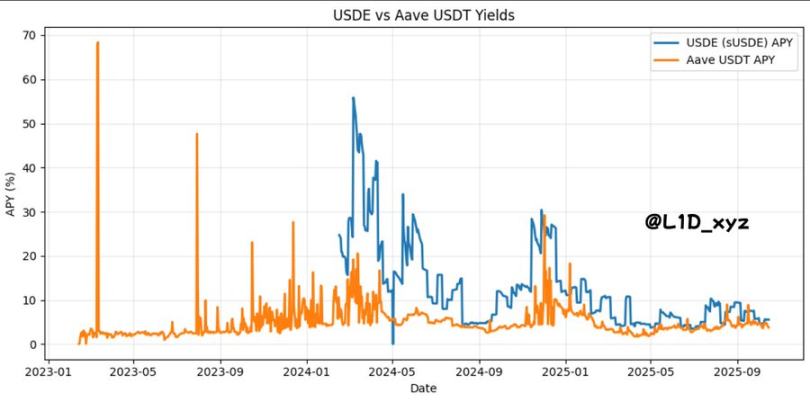

If borrowing costs approach or exceed the underlying yield, the strategy collapses. Thus, any new loop strategy must generate a yield higher than USDe. Why? Because, as shown in the chart below, the USDe yield has effectively become DeFi's cost of capital, or risk-free rate. Similarly, ETH's risk-free rate tracks the most reliable ETH yield source, usually staking rewards.

The impact of these interrelated rates on the design space available in DeFi should not be underestimated.

In other words, I know some of you may find this hard to accept, but for now, you can view the USDe yield as our industry's treasury yield.

There is indeed poetry in this: our digital nation is built on speculation, so our version of the treasury yield should be a proxy for speculation, derived from the rich profits of basis trading, which makes sense.

As long as lending protocols maintain sufficient supply of "ordinary assets" (such as stablecoins like USDC, USDT, and DAI, as well as base assets like ETH and wBTC), loop strategies can achieve rapid TVL expansion.

This leads to a problem with TVL as a metric for lending protocols. Borrowers deposit an asset as collateral to borrow, then redeposit the borrowed funds, typically repeating this loop five to ten times according to loan-to-value limits. The result is inflated TVL data: the protocol counts the original lender capital, the borrower's initial deposit, and every subsequent redeposit during the loop.

sUSDe - USDC loop trade (example with 100 USD)

In this case, before the trade occurs, the borrower's 100 USD deposit into the lending protocol will be worth 100 USD in TVL.

However, after the trade occurs, i.e., after the borrower loops their deposited 100 USD, the TVL will look like this:

Although TVL is a proxy metric for the supply on the platform, supply itself is not a good metric. Instead, what really matters is:

Borrowing Volume and Ordinary Asset Supply Are the Best Ways to Measure Lending Market Success

If an asset is not borrowed, its supply does not drive revenue; only borrowed assets do.

The job of an underwriter is to understand the revenue drivers of the business and the bottlenecks for those drivers. In lending markets, borrowing drives business through origination and service fees, while the supply of ordinary assets is the bottleneck.

More ordinary assets, especially more stablecoins, are the core metric for lending market success.

"If we receive 200 million USD in new USDC today, it will be borrowed out by tomorrow."

Thus, deep supply—mainly USDC, followed by large-cap assets like ETH and those with staking yields—is the main value lending markets can offer users and what they pursue. More stablecoins allow for more loops, more activity, and more fees. If lending markets can attract more ordinary assets, they can create more borrow/lend matches, attract more users, earn more revenue, and so on.

Conversely, long-tail assets do little for lending markets, except add risk to an already complex machine. While these assets may attract users less sensitive to fees, there is no such thing as a free lunch.

How do they attract more ordinary assets?

Better distribution and higher yields for these ordinary assets.

What creates higher yields for ordinary assets?

This comes back to where borrowers earn their yields and what the market recognizes as the "safe" yield rate.

In many modern lending markets, the asset used as collateral to borrow another asset (e.g., sUSDe deposited as collateral to borrow USDC) can subsequently be used as loan capital for other users to borrow. Depending on what the collateral asset is, it may be generally useful to another user (e.g., if it's ETH) or not (e.g., if it's stETH).

For example, on Euler, we see that ordinary stablecoins (RLUSD, USDC) have relatively high utilization rates, while long-tail yield derivative assets see almost no borrowing.

If a lending market is characterized by too many long-tail tokens and relatively few ordinary assets, this indicates a generally low supply of available assets and suggests the presence of mining or incentivized idle liquidity.

So how can protocols become more efficient in their supply and borrowing of assets and the trades they favor?

Linking Assets Together (Rehypothecation) Is Useful

For lending markets, certain trading pairs are more useful or "profitable" than others. Let's discuss a few examples.

Suppose User 1 deposits stETH (staked ETH) to borrow ETH and buys more stETH. This is a very good trade; if the user can borrow ETH at a rate lower than the stETH reward, it should happen. However, other users are unlikely to want to borrow the stETH supplied by User 1. This is good business for the lending protocol, but in this example, the chain stops here.

Alternatively, suppose User 2 deposits ETH to borrow USDC and buys more ETH. This example is more profitable for the lending protocol. Why? User 1's entire trade can be completed using the ETH deposited by User 2. So, User 2's trade opens up available ETH for an entirely additional loop trade. In a world where ordinary assets are scarce, you can see it this way: User 2's behavior allows a lending protocol to facilitate 2 complete loop trades, while User 1's behavior only allows 1.

Demonstrative lending flows for Users 1 and 2

This is what truly drives "capital efficiency" and utilization. Overall, if protocols can generate more activity between ordinary assets—deposit BTC, borrow USDC, deposit ETH, borrow USDC, and so on—this is extremely valuable for them, enabling even more activity on top.

System Leverage Is Almost Impossible to Identify, and This Is Dangerous

In summary, and perhaps our most concerning finding, is that amid all the intertwined borrowing, linking, and looping, it seems very difficult to identify how much leverage the entire system is using.

For example, if a protocol has 1 billion USD in stETH, allocated at a 75% loan-to-value ratio. Is that 500 million USD initially deposited stETH and 500 million USD borrowed? 300 million USD initially deposited and 700 million USD borrowed? We don't have a good answer for how to judge, so we can only guess how much would be liquidated in the event of mass liquidations or a widespread market downturn that causes people to withdraw assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bankless | Hyperliquid's Battle for Supremacy in 2025: Can It Hold On in 2026?

How does x402 V2 make autonomous payments by AI agents possible?

![[Bitpush Daily News Selection] JPMorgan issues Galaxy short-term bonds on the Solana network; New York court sentences Terraform Labs founder Do Kwon to 15 years in prison; US Financial Stability Oversight Council (FSOC) annual report removes digital asset risk warning; OpenAI launches a more advanced model, GPT-5.2, to compete with Google](https://img.bgstatic.com/multiLang/image/social/35029d7d430a8303837232285bb190721765555021864.jpg)