Cardano Achieves Several Milestone This Month, But Price Remains Depressed

Cardano’s price has stalled even as on-chain activity and staking surge. Analysts point to whale sell-offs, but ADA’s fundamentals and retail backing remain solid, suggesting steady long-term potential.

Cardano’s price has been stagnating for several weeks, but the network has strong retail support. ADA reached 115 million on-chain transactions this week, and the Cardano network avoided any damage from the AWS outages.

There’s still a lot of community support, as evidenced by Cardano’s market cap and high rate of staked tokens. Whale activity may be blunting its forward momentum, but there could be other explanations.

Why is Cardano’s Price Lagging?

Cardano attracts a lot of community hype, and for good reason. In the last few days, the proof-of-stake blockchain network has reached a lot of milestones.

Although ADA’s token price hasn’t reacted much, on-chain analysts noted that Cardano’s user activity is through the roof.

MILESTONE: Cardano $ADA has surpassed 115,000,000 transactions on mainnet.Real transactions from real users.You can view them all on Cexplorer 😎

— Cexplorer.io 🅰️ (@cexplorer_io) October 23, 2025

This activity can be measured in several key ways beyond on-chain transactions. Cardano holders are staking 21.8 billion ADA tokens, which is 57% of the total supply.

In other words, the community has a strong faith in the altcoin, hoping to earn passive income from Cardano in addition to benefiting from price increases.

Furthermore, the recent AWS outages showed that the blockchain has real decentralization. Although major industry leaders like Ethereum and Coinbase saw persistent problems during this period, highlighting their centralized infrastructure, Cardano remained strong:

Congrats Cardano. You passed the test!

— Ben ✈️🇰🇷🇻🇳🇸🇬🇯🇵 (@benohanlon) October 21, 2025

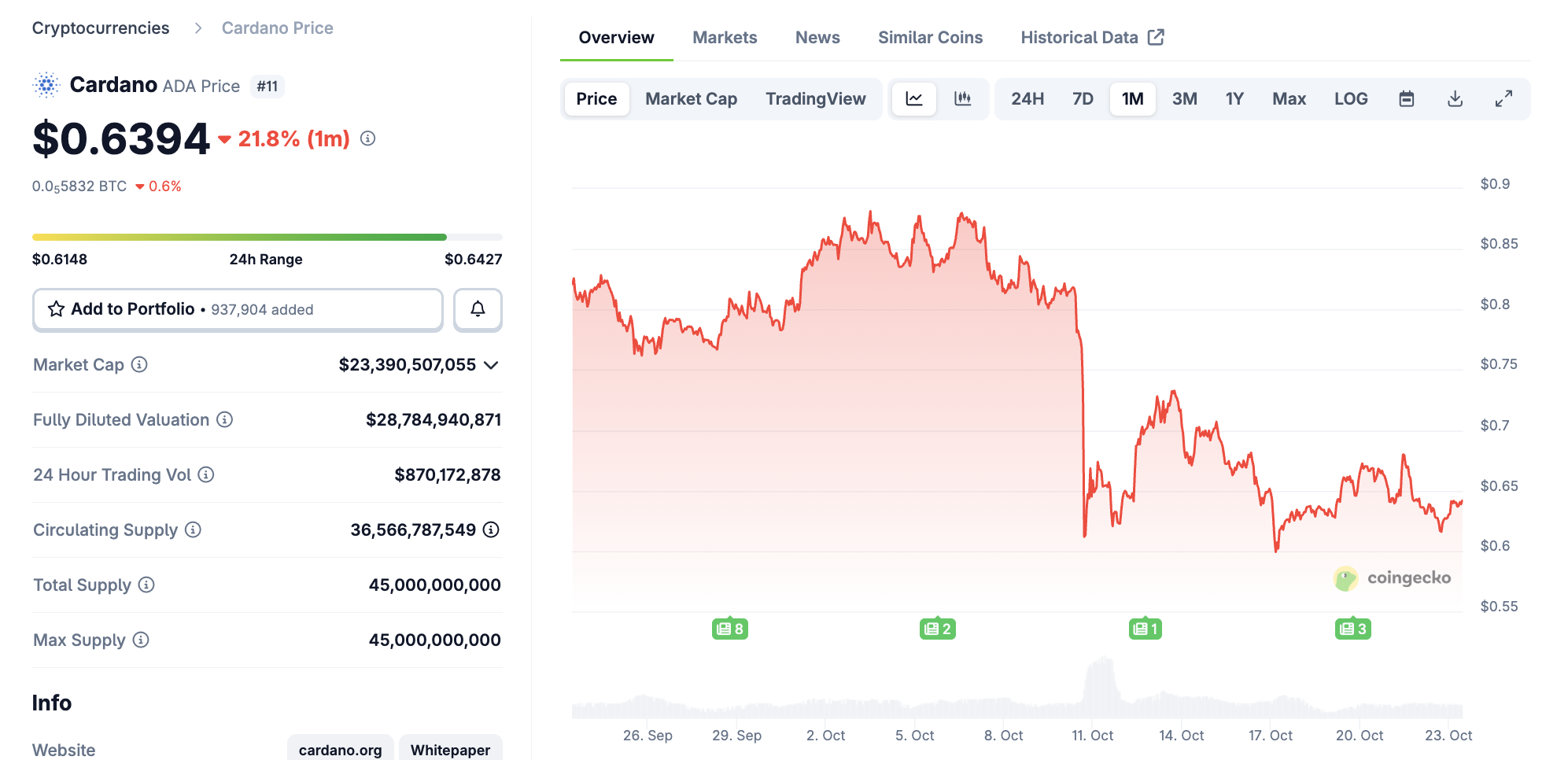

Despite these advantages, we have to talk about the elephant in the room. Although Cardano’s market cap has shown remarkably consistent competitiveness over the last several years, its price has been lagging behind for weeks.

Cardano Price Performance. Source:

CoinGecko

Cardano Price Performance. Source:

CoinGecko

A Case for Whale Activity

A few competing theories have arisen to explain Cardano’s price doldrums. For one thing, large holders can be a mixed bag. Although ADA whales backed the token despite bearish signals, they’ve recently initiated massive sales to block price rebounds. Whenever Cardano gets some forward momentum, rampant profit-taking subsequently blunts it.

Overall, this seems like the most likely hypothesis. Similar behavior has popped up several times in recent months, whereas other explanations involve macroeconomic concerns and other factors.

ADA has also shown some signs of weakening retail interest, even though on-chain transactions and staked tokens remain strong. Ultimately, we can only narrativize the data we have, but market narratives are still crucially important.

Whatever is causing Cardano’s ongoing price woes, the token still has strong support and fundamentals. Although it’s impossible to predict a full rebound, ADA still has strong community support to capitalize on any near-term bullish cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Financial Wellness Aspect: The Influence of Investor Actions on Market Results

- Behavioral economics integrates psychology to explain how emotional, intellectual, and environmental wellness shape investor decisions and market outcomes. - Emotional resilience reduces cognitive biases like loss aversion, while intellectual engagement through AI tools improves long-term investment returns according to 2024-2025 studies. - Environmental factors such as ESG frameworks and workplace wellness programs demonstrate measurable economic benefits, including 20% higher productivity and reduced f

Regulatory Changes in U.S. Agriculture: The Impact of USDA Policy Decisions on Long-Term Investments in Livestock and Poultry Industries

- USDA’s 2023–2025 Organic Livestock and Poultry Standards (OLPS) impose stricter animal welfare rules, with phased compliance until 2029 to ease small producers’ adjustments. - Compliance costs for organic producers are high initially but projected to yield $59.1–$78.1 million annual benefits via enhanced consumer trust and premium pricing. - Investors favor scalable, tech-driven operations amid OLPS-driven capital shifts, though small producers face compliance challenges and market exit risks in poultry

ZK Atlas Enhancement: Marking a Milestone for Scalable Blockchain Frameworks

- ZKsync's 2025 Atlas Upgrade revolutionizes blockchain with 43,000 TPS, $0.0001 per-transaction costs, and sub-second finality via Airbender zkVM. - Modular EVM compatibility attracts Deutsche Bank , Sony , and $15B institutional investment, accelerating DeFi, NFTs, and cross-border payments. - ZK rollups' TVL surges to $28B, with 60.7% CAGR projected through 2031, driven by Bitcoin ETF inflows and $7.59B ZKP market growth by 2033. - Regulatory clarity under U.S. GENIUS Act and EU MiCA accelerates adoptio

ZK (Zero-Knowledge) Technology and Its Rapidly Growing Market Attention

- Zero-knowledge (ZK) technology is revolutionizing blockchain and fintech by enabling scalable, private, and compliant systems, with the ZKP market projected to grow from $1.535B in 2025 to $7.585B by 2033 at 22.1% CAGR. - Institutional adoption by firms like Goldman Sachs , Walmart , and HSBC highlights ZK's role in confidential transactions and supply chain transparency, supported by regulatory frameworks like the U.S. GENIUS Act and EU MiCA. - Enterprise platforms (Quorum, Hyperledger Fabric-X) and inn