ENA has surged on tariff-related headlines and strong on-chain activity, with whales accumulating ETHENA (ENA) and derivatives data signaling mixed momentum. The near-term chart shows resistance near $0.4740, while a potential climb toward $0.60 remains plausible if momentum holds, as investors reassess risk and capital flows.

- Near-term momentum is mounting, but a key resistance around $0.4740 could delay a breakout.

- Whale accumulation, including a 48 million ENA transfer by a founder-associated wallet, signals concentrated confidence.

- Derivatives data show mixed signals: positive long positions exist, but inflows to exchanges suggest potential selling pressure.

ENA price and activity update; Ethena news, macro tariffs, and on-chain signals drive movement in ENA. The latest data combines on-chain action, trader sentiment, and risk-off/risk-on dynamics—COINOTAG provides ongoing coverage.

What is driving ENA’s recent surge?

At press time, ENA has risen sharply as tariff chatter about China renewed risk-on sentiment. The immediate catalyst was a shift in rhetoric around a 100% tariff deadline, which boosted demand and trading activity. The price action reflects a broader risk-on posture, with investors reallocating capital toward assets perceived as high-beta during renewed geopolitical tension. Market participants are watching headline risk closely while balancing on-chain signals from wallets and exchanges.

How does ENA’s on-chain activity relate to investor sentiment?

On-chain data shows a resurgence in token accumulation alongside elevated trading volume. A multisig wallet linked to Ethena’s founder reportedly acquired 48 million ENA over a short window, valued at roughly $20.41 million, indicating confidence despite recent price volatility. This inflow aligns with a broader pattern of interest from long-term holders, even as prices faced intraday pullbacks. On-chain metrics corroborate traders’ belief that the asset is revisiting key resistance levels as confidence swings with macro headlines.

ENA’s current price amid Trump’s tariff update

At press time, ENA’s price has surged over 18% in the past 24 hours, and was trading around $0.45. Trading volume also spiked 45%, reaching $655 million, signaling strong market interest. This rally was sparked by President Trump’s comment about possibly moving up the 100% China tariff deadline from the 1st of November. Trump added,

“China wants to talk. We like talking to China.”

Ethena founder adds 48 million ENA

Whale activity has added fuel to ENA’s upward momentum.

According to crypto tracker Onchain Lens, a multisig wallet associated with Ethena’s founder recently acquired 48 million ENA tokens, valued at $20.41 million, over the past three days from top exchanges like Binance and Bybit. Although this accumulation occurred over the past three days, the price had been declining and struggling to gain momentum.

Experts’ prediction for ENA

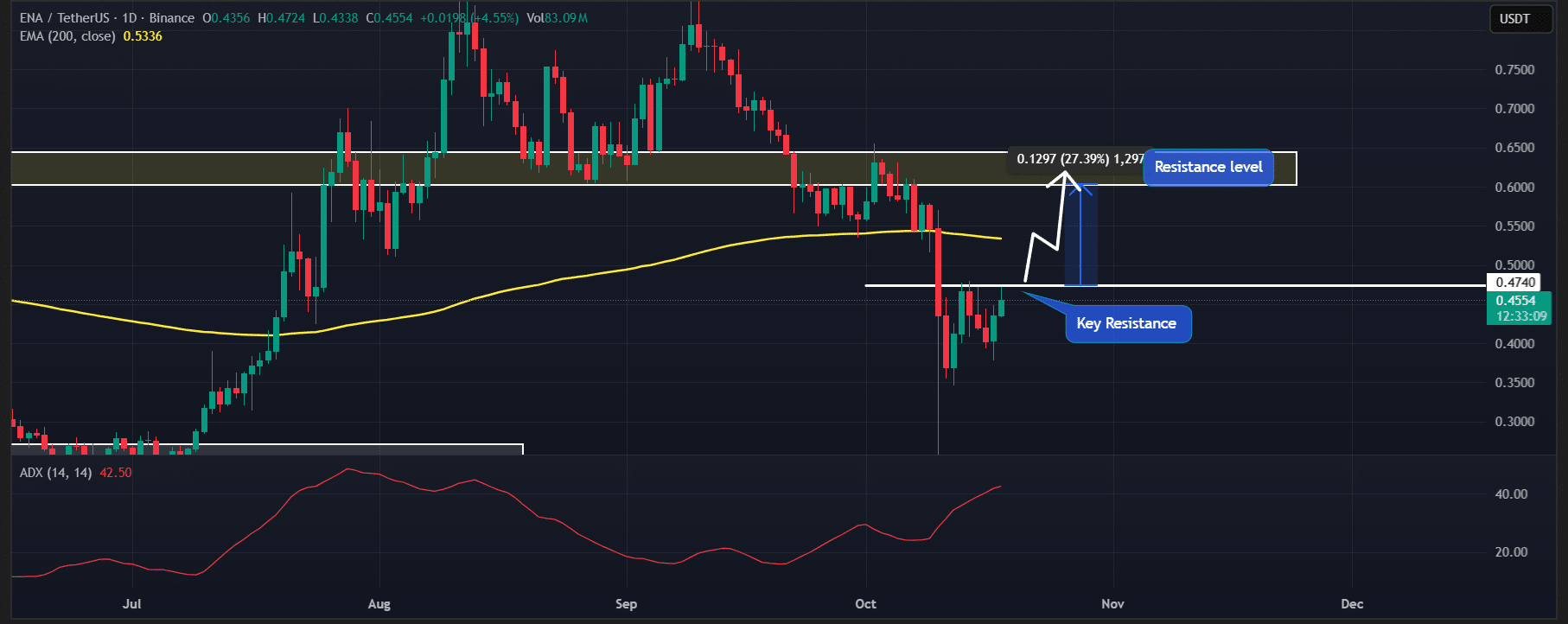

Considering the current market sentiment and ENA’s upward momentum, several bold predictions have recently surfaced on X, with some suggesting that ENA could reach the $1.40 level, while others predict $1.30. These predictions have gained widespread attention from crypto enthusiasts, especially ENA holders. Despite these projections, technical analysis on the daily time frame indicates that ENA remains in a downtrend with resistance near $0.4740 persisting for multiple sessions.

Source: TradingView

Based on the current price action, if the momentum continues and ENA breaks out above this resistance level, there is a strong possibility of a 27% price surge toward the next resistance at $0.60.

However, if it fails to break above this level, there is also a possibility that the ENA price could move sideways or continue its downward momentum.

At press time, the Average Directional Index (ADX) value stood at 41, well above the key threshold of 25, indicating that the asset has strong directional momentum.

Derivative tool hints at mixed signals

Looking at the current market sentiment, investors and traders appear divided; some see this as a time to sell, while others are betting on long positions.

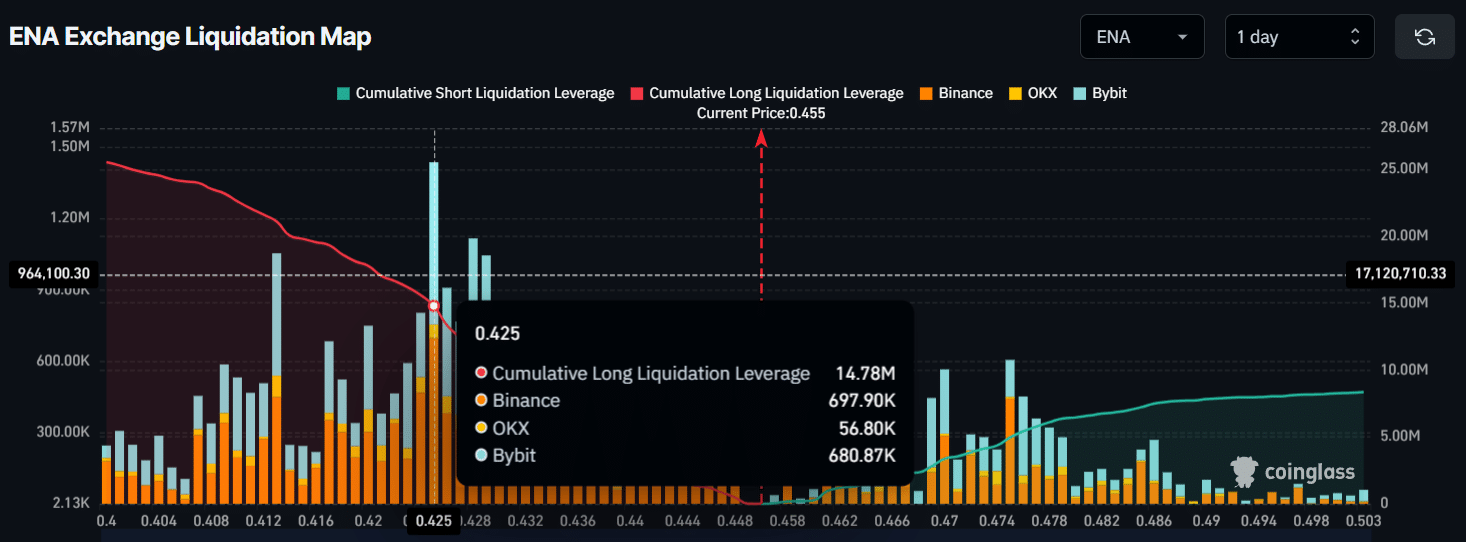

Derivatives platform CoinGlass reveals that, over the past 24 hours, exchanges have recorded an inflow of $1.74 million worth of ENA tokens.

This inflow, indicating a movement of assets from wallets to exchanges, suggests potential dumping activity.

Source: CoinGlass

During the same period, traders have shown strong interest in long positions.

At press time, ENA’s major liquidation levels stand at $0.425 on the lower side and $0.475 on the upper side, with $14.78 million in long positions and $4.95 million in short positions built at these levels.

Source: CoinGlass

When combining these metrics with the whales’ recent accumulation, it appears that the overall ENA market sentiment is bullish.

However, some investors took advantage of the recent price jump by selling their holdings, which may be due to the heavy volatility in the market.

COINOTAG remains committed to independent coverage, using official data and verifiable market metrics to inform readers about ENA and the broader crypto landscape. The team will continue to monitor price action, on-chain signals, and macro developments that could shape ENA’s trajectory.

Author: COINOTAG