The old order of Hyperliquid collapses, DeriW reconstructs the future of perpetual DEX.

DeriW may be becoming the starting point of a new round of dividends. In March 2025, Hyperliquid due to ...

DeriW may be the starting point of a new round of dividends.

In March 2025, Hyperliquid was manipulated due to the JELLY perpetual contract, tearing off the "decentralized" veil overnight. In this incident, the attacker was able to distort the mark price of the JELLY token with just a few million dollars, causing large-scale liquidations, and ultimately the liquidity pool was forced to swallow a potential loss of 10.63 million dollars.

To stop the bleeding, Hyperliquid chose to vote to delist the contract and unify liquidations, which the community called a blatant "pulling the plug" operation. This made the market face the cruel reality for the first time: under the so-called decentralized shell, the liquidity pool is the real payer.

Of course, Hyperliquid is not an isolated case. The GLP pool of GMX and the insurance fund of dYdX follow similar logic: when liquidation fails, losses are ultimately transferred to the liquidity pool or fund to cover. On the surface, this is a prudent design, but in extreme market conditions, it means all LPs have to pay for the liquidation of a few positions. This is also the biggest Achilles' heel of the entire perpetual DEX model.

When the previous generation of perpetual contracts could not solve the trilemma between performance, decentralization, and security, DeriW provided another answer.

DeriW's Secret Weapon

DeriW is a new generation perpetual contract DEX built on Arbitrum Orbit. In sharp contrast to the current industry paradigm, it combines the Pendulum AMM (pendulum-style dynamic liquidity pool) with a Layer 3 architecture, not only cutting off risk transmission at the mechanism level, but also further solving a series of stubborn problems exposed by platforms like Hyperliquid under the passive liquidity pool model.

At the same time, DeriW is able to provide a trading experience close to centralized exchanges in terms of speed and smoothness, while retaining the transparency and non-custodial nature of DeFi. It also offers high-leverage trading for hundreds of assets, with a zero gas and ultra-low fee structure, further opening the door for high-frequency and professional users.

Layer 3 + Pendulum AMM Mechanism: Directly Addressing Liquidity Pool Dilemmas

The dilemma of Hyperliquid reveals the essence of the current model: the liquidity pool is the ultimate bearer of all risks. The Pendulum AMM mechanism of DeriW aims to reconstruct the logic of liquidity pools from the source, while its self-developed Layer 3 architecture provides the performance foundation for this.

- Risk Isolation and Pricing

The core innovation of Pendulum AMM is to transform the liquidity pool into a closed-end fund. Each subscription period is locked once full, and funds cannot be freely deposited or withdrawn during the term. At maturity, principal and returns are distributed according to shares. This institutionalized design frees the liquidity pool from the vulnerability of being withdrawn at any time, ensuring stable scale and controllable structure, and making LP returns more predictable.

On this basis, trading volume directly depends on the net floating P&L of both long and short sides. The more intense the game, the more the liquidity pool can automatically expand, releasing carrying capacity beyond the original stock and squeezing limited capital to maximum efficiency. Meanwhile, the system monitors three key parameters in real time—net floating P&L of positions, realized losses of the liquidity pool, and initial capital size. Once they deviate from the safety threshold, the model automatically tightens positions and charges additional management fees to the high-risk side, effectively transferring risk costs back to traders rather than LPs.

More importantly, Pendulum AMM achieves localized handling of shocks through risk isolation and automatic deleveraging mechanisms. Even if a certain asset pool is blown up in extreme market conditions, the risk is locked within a single pool and will not evolve into a platform-level systemic crisis.

- Fair Liquidation

Based on the above mechanism, DeriW's liquidation price is determined by both leverage and margin: 10x leverage has a liquidation rate of 95%, 20x is 90%, and 30x is 85%. Once a position hits the threshold, the system immediately executes liquidation, using margin to absorb losses first, and the liquidity pool only passively intervenes through slippage in extreme imbalances.

This rule not only makes liquidation fairer but also greatly reduces systemic risk. Even in "high leverage + low collateral" manipulation scenarios, the system can rely on dynamic adjustment of rates and thresholds to dismantle shocks, all without community voting or project team intervention. This forms a sharp contrast to Hyperliquid's "pulling the plug" operation in the JELLY incident, highlighting DeriW's decentralized fairness.

At the same time, all trading and liquidation data on DeriW can be transparently executed on Layer 3 and ultimately submitted to Ethereum, inheriting its security and data availability. Users not only have full control over their assets but can also verify on-chain data at any time, and even initiate challenges through Layer 1 fraud proof mechanisms. Such transparency and censorship resistance keep the system free from black-box operations and single-point control.

- Ultimate Experience Brought by Layer 3 Performance

Any complex mechanism requires performance support. DeriW's Layer 3, built on Arbitrum Orbit, not only supports 80,000 TPS throughput and zero gas cost, but also ensures that even in extreme market conditions, liquidations can be executed instantly. For users, this means enjoying speed and smoothness close to centralized exchanges in DeFi, while retaining the security attributes of openness, transparency, and non-custodial control.

It is worth mentioning that DeriW is developed by the established exchange CoinW. The team has eight years of experience in the perpetual contract field and has passed CertiK audit. This background provides real endorsement for the platform's stability and credibility, and is a prerequisite for gaining market trust.

Dimensional Reduction Attack on Trading Efficiency

The shortcomings of the traditional order book model are increasingly apparent:

When liquidity is insufficient, orders are not filled for a long time, and delays and slippage are rampant;

High-frequency traders find it difficult to run strategies, while small users are constantly eaten away by hidden costs.

DeriW, through Pendulum AMM combined with its self-developed Layer 3, can keep the entire process close to CEX speed and smoothness under decentralized and open transparency.

In terms of cost, it directly sets the funding rate to zero, and market balance is borne by the dynamic slippage built into the AMM, only triggered in cases of severe long-short imbalance. The trading fee is fixed at 0.01%, among the lowest in the industry. Compared to mainstream platforms that often charge 0.02%–0.05%, this combination of low fees and zero funding rate significantly reduces the friction cost of long-term positions and high-frequency trading.

The combined advantages of efficiency and cost are enabling DeriW to deliver a true dimensional reduction attack in the highly homogeneous perpetual DEX market, gradually building its own moat.

Deeper Strategic Layout

Beyond the mechanism innovations mentioned above, DeriW's potential also comes from its parent ecosystem CoinW. In terms of branding and market expansion, CoinW is also expanding its influence through cross-industry collaborations in sports and fashion: from LaLiga and the East Asian Football Cup to GQ STYLE FEST, these moves are rapidly bringing crypto brands into the mainstream and opening up broader external markets for DeriW.

In addition, DeriW has already partnered with Dubai's Zand Bank, planning to jointly issue an on-chain stablecoin to provide users with a more reliable financial gateway. This means that DeriW's growth path comes not only from internal competition within the track, but also further provides DeFi users with a trustworthy financial entry point, laying the foundation for DeriW's narrative reshaping.

With the growth of mainnet data and the approach of TGE, the narrative of technology and ecosystem overlay is expected to gradually help DeriW converge into market consensus and become a mainstay in the next industry cycle of perpetual DEXs.

DeriW TGE Node

As DeriW's mainnet continues to heat up, the community's focus is gradually shifting to its upcoming TGE event.

In terms of data, DeriW had over 200,000 active users during the testnet phase alone, and since the mainnet launch on August 4, cumulative trading volume has exceeded 190 million dollars. It is highly favored by high-frequency and professional traders, and DeriW's "zero fees + high performance" has become a significant attraction.

Meanwhile, the Supernova+ incentive program is warming up for TGE. Users accumulate DER+ points through trading and referrals, which can be used for quota redemption or airdrop allocation in the future. A trading volume of 50 dollars earns 5 points, referral rewards bring an additional 300% bonus, and old testnet users enjoy an extra 5-20% reward. This "trade while mining" model is continuously heating up TGE.

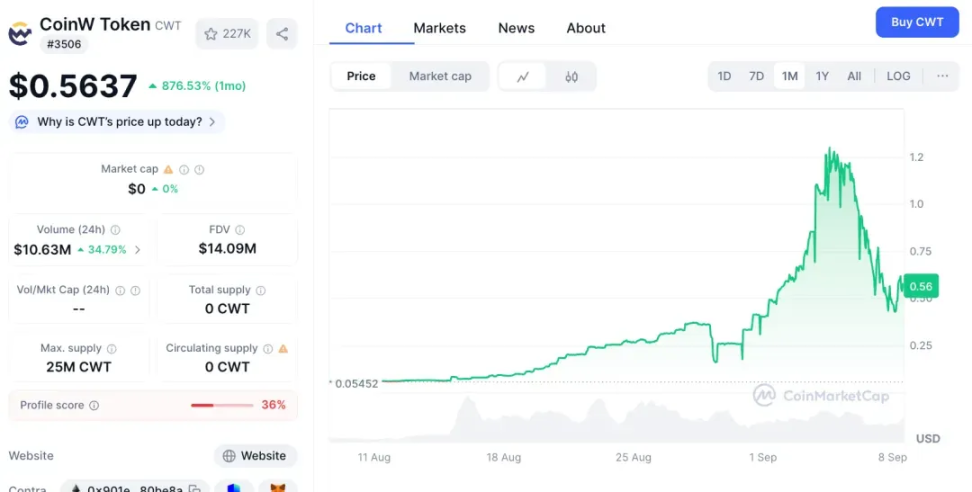

On the other hand, the rapid expansion of DeriW's parent ecosystem CoinW is also boosting expectations. Its platform token CWT recently hit a historical high of 1.32 dollars, with a monthly increase of over 20 times, providing strong endorsement for DeriW's narrative.

Combined with the strategic cooperation with Dubai's Zand Bank, DeriW is gradually entering the stablecoin and RWA fields, connecting traditional financial assets with the on-chain derivatives market and unleashing new imagination.

Given the early data and growth momentum shown by DeriW on both testnet and mainnet, the market generally expects that after TGE, it is likely to quickly benchmark the market cap level of leading perpetual DEXs. As a reference, Hyperliquid's current market cap has exceeded 18 billion dollars, and with the combined push of technology, ecosystem, and narrative, DeriW is being seen as the next challenger with the potential to shake up the top ranks.

Summary

As the market enters a new stage, perpetual contract DEXs are standing at a watershed. Practice has proven that the model purely relying on liquidity-driven growth has reached its limit, and the Hyperliquid case clearly reveals the limitations of the old paradigm. DeriW is reshaping the rules and establishing a new system through a series of technological innovations, breaking the trilemma between performance, decentralization, and security, and providing a brand new approach for the sustainable development of this field.

In the last cycle, Hyperliquid seized the liquidity dividend and rose rapidly; in the new market stage, DeriW is achieving breakthroughs in technology and system, better meeting the market's demand for security and capital efficiency, and is expected to usher in a new round of on-chain derivatives paradigm shift.

The old market dividends have been exhausted, and DeriW may be the starting point of a new round of dividends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Conflicted Fed cuts rates but Bitcoin’s ‘fragile range’ pins BTC under $100K

Fed rate cut may pump stocks but Bitcoin options call sub-$100K in January

"Validator's Pendle" Pye raises $5 million, enabling SOL staking yields to be tokenized

There are truly no creative bottlenecks in the financialization of Web3.

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.