Stablecoin $825M Pre-Deposit Flash Loan, Whale Entrance with $700M Before Official Announcement?

In reality, only 274 addresses participated, and the community questioned the "serious whale wallet" practice.

Original Title: "Stable's First Round of $825 Million Sold Out Instantly, $700 Million Released First Before Announcement?"

Original Author: Asher, Odaily Planet Daily

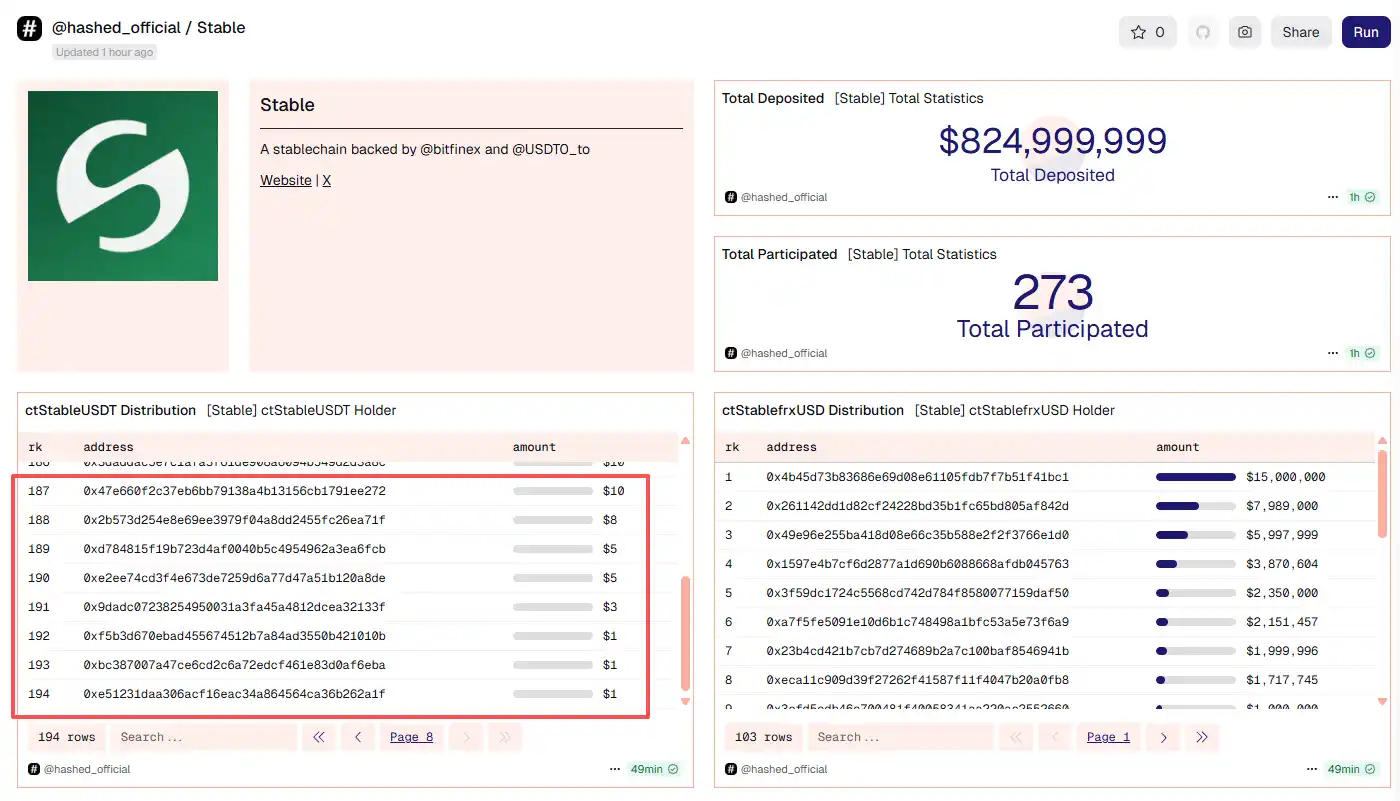

The project Stable, which has been a hot topic in the community recently, announced this morning on the X platform that the first phase of its activity has reached the $825 million upper limit.

"What? I just rang the bell, and as soon as I opened the page, there was no quota left?" — This was a true reflection of many users who tried to participate for the first time this morning. Below, Odaily Planet Daily will take you to learn about the Stable project and review the whole process of this morning's "$825 million sold out instantly."

Stable: A Layer1 Blockchain Designed Specifically for USDT

Stable is a high-performance Layer1 blockchain designed specifically for USDT, aiming to provide a fast, low-cost, low-latency stablecoin transaction network. Unlike general-purpose blockchains, Stable focuses on the payment and settlement functions of USDT, hoping to make USDT have a cash-like experience on-chain, suitable for cross-border payments, e-commerce payments, and corporate settlements.

In terms of technical design, Stable adopts an independent blockchain architecture, supports EVM compatibility and sub-second transaction confirmation, and plans to introduce a gas-free USDT0 transfer mode, as well as provide institutions with apply-for exclusive block space and compliance-friendly privacy transaction support. These features are designed to lower the barriers for enterprises and end-users to use blockchain payments and enhance stablecoin transaction efficiency. The core technical framework of the project has been basically completed, but the launch dates for the testnet and mainnet have not been announced yet.

It is worth noting that Stable has received investments from well-known institutions including Bitfinex, Hack VC, and Franklin Templeton, and has been endorsed by Tether officially, with Tether CEO Paolo Ardoino also publicly supporting the project. These funds are mainly used for network infrastructure construction and global USDT payment ecosystem expansion.

Stable's Activity Faces Criticism

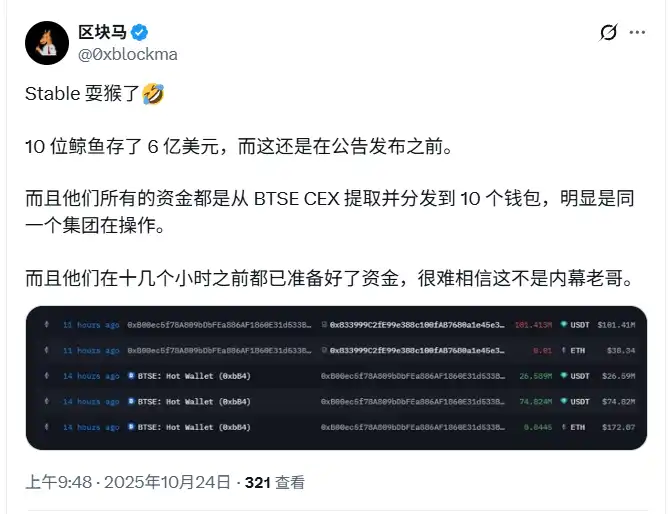

The first phase of Stable's USDT activity quickly sparked a huge controversy after it opened, with a large number of community users questioning serious "insider trading" operations. According to the official timeline, Stable officially tweeted to announce the opening of the activity at 9:10 am 东八区, but on-chain data shows that people had already deposited funds as early as 8:48, which was significantly earlier than the official time.

Official Announcement: Large Funds from Multiple Addresses Participated in Activity

On-chain data shows that the $825 million amount for this event had already been "sold" for $700 million before the public announcement. Among them, 10 whale addresses collectively deposited around $600 million USDT, and all funds originated from the same wallet address, which was split and filled to the limit within 10 seconds. Further analysis revealed that these funds were all withdrawn from the BTSE CEX before being dispersed into different wallets for participation in the activity, indicating a unified operation likely conducted by the same capital group. In addition, the funds from these addresses had completed preparation and layout hours before the start of the activity, further fueling community dissatisfaction.

Prior to the event, 10 whale addresses with the same source of funds collectively deposited 600 million USDT

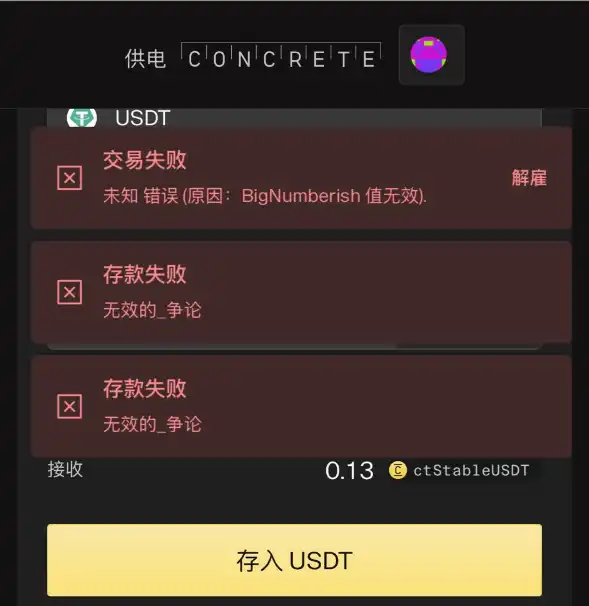

Relatively speaking, ordinary users had little to no participation space. Many users reported that upon entering the official website, they either encountered authorization failures or their transactions were delayed in packaging, and by the time they saw the official tweet, only 0.13 USDT was left on the page to deposit, indicating that while a small amount of allocation appeared available, retail investors were practically unable to participate.

Community Feedback: Upon the official announcement, only 0.13 USDT was left to deposit on the page

According to Dune data, the $825 million event had only 273 addresses participating, with the participation ratio of ordinary users being almost negligible. More notably, among all participating addresses, nearly 40 addresses had deposits lower than 500 USDT, and there were even extremely small deposits of 1 USDT, 3 USDT, 5 USDT, or tens of USDT, leading the community to sarcastically label these small addresses as mere props used to inflate the number of participants, devoid of any real sense of participation.

Stablecoin Data

Overall, the first phase of the $825 million Stablecoin activity quickly reached its limit. However, community sentiment was highly negative, being described as an "epic-level frontrunning" and an "event that was predetermined in advance".

Summary

"Insults aside, we still gotta make money." Although the first phase of the Stable project was heavily controversial due to serious "insider trading" issues, considering its endorsement by Tether official and support from top-tier capital, the project still possesses strong market influence and sustained tracking value.

What is more worth paying attention to next is actually the activities related to centralized exchanges, especially whether Binance will launch a deposit or participation activity for Stable. Previously, Binance had launched the Plasma (XPL) deposit activity, with the first phase's individual deposit limit as high as $100,000, and subsequent batches could also deposit up to $50,000. Since it is a stablecoin deposit participation, with no principal loss, the yield from selling immediately after XPL's listing reached an annualized rate of up to 79%, becoming one of the highest-yielding projects listed on CEX this year.

From this perspective, Stable is still a project of high priority for attention. While on-chain activities may have already been consumed by large funds, the CEX phase may be the participation window suitable for ordinary retail investors.

Original Article Link

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PEPE Holds $0.054322 Support as Price Trades in a Tight Range

Avalanche (AVAX) Falls 21% in a Month While GeeFi (GEE) Surpasses 24M Tokens Sold, Showing Massive Growth

Explosive 168% Surge: Euro Stablecoin Supply Skyrockets This Year