Research Report|In-Depth Analysis and Market Cap of aPriori (APR)

Bitget2025/10/24 08:19

By:Bitget

Ⅰ. Project Overview

aPriori is a MEV infrastructure and liquid staking protocol designed for the era of parallel execution, natively built on the Monad blockchain. Positioned as an LST+MEV protocol analogous to Lido on Ethereum and Jito on Solana, aPriori focuses on the high-performance DeFi market.

By integrating an AI-driven order flow coordination layer at the blockchain level, aPriori achieves deep synergy between AI and MEV optimization. Founded by former members of Jump Crypto and Citadel Securities, the project aims to provide Monad with MEV-based liquid staking services that enhance both transaction efficiency and staking yield. Currently, it is integrated with multiple protocols such as AtlantisDEX, ReactorFi, and DemaskFinance, covering LP management, NFT trading, and incentive mechanisms.

On the Monad testnet, aPriori has achieved over 3,000,000 unique addresses and holds the leading position among LST protocols (measured by TVL, holders, and active users). Its core advantage lies in the AI-powered order flow coordination and MEV auction mechanism, which captures and redistributes MEV yield on-chain — directly benefiting stakers while preventing traditional EVM ecosystems’ issue of off-chain MEV extraction by bots. Unlike conventional DEXs, aPriori combines high-frequency trading technology with a parallel execution framework, optimizing DeFi capital efficiency and strengthening LP protection.

In terms of tokenomics, $APR serves as both a governance and utility token, while aprMON represents the liquid staking derivative. Users can stake MON to mint aprMON, which is delegated to high-performance validators to earn emissions and MEV-enhanced rewards. During the testnet phase, tokens have no monetary value and are for testing purposes only. Total supply and detailed allocations are not yet fully disclosed, with the project emphasizing community participation and ecosystem development.

Currently, aPriori’s testnet is live, supporting MON faucet and staking features. The ecosystem dashboard shows high engagement, with over a million unique addresses — underscoring its dominant position and strong adoption within the Monad ecosystem.

Ⅱ. Key Highlights

DeFi Infrastructure with AI and MEV Synergy As an intelligent order flow coordination and high-performance trading infrastructure, aPriori leverages AI and MEV mechanisms atop high-speed Layer-1 blockchains such as Monad. It addresses key DeFi challenges like attack vulnerability and market fragmentation through an end-to-end order flow design. The protocol empowers traders, liquidity providers, and validators with efficient coordination tools, enhancing market speed, efficiency, and fairness while improving LP protection and yield redistribution.

AI-Driven Order Flow Optimization & MEV-Enhanced Staking aPriori’s architecture is an AI-powered DEX aggregator built on Monad. Using AI techniques such as association rule learning (inspired by the Apriori algorithm), it identifies on-chain trading patterns to predict and optimize order flow. When combined with MEV-enhanced liquid staking, users can stake MON to receive aprMON, delegate to high-performance validators, and capture order flow alpha as staking yield — significantly boosting capital efficiency and DeFi flexibility.

Top-Tier Team and Institutional Support The aPriori team consists of experts from Jump Crypto, Pyth, and Wall Street firms such as Jump, Citadel, Amber, and Flow Traders, with deep experience in HFT and blockchain infrastructure. The project has raised $30 million from top-tier investors including Pantera Capital, HashKey Capital, Primitive Ventures, IMC Trading, GEM, Gate Labs, Ambush Capital, and Big Brain Collective — providing strong backing for rapid expansion and ecosystem growth.

Ecosystem Integration and Growth Potential aPriori has integrated with several key Monad ecosystem DeFi protocols — including AtlantisDEX, ReactorFi, DemaskFinance, and Curvance — covering LP management, NFT trading, and incentive distribution. Its testnet results demonstrate strong adoption and practical viability. The project’s long-term vision is to build a full-stack order flow coordination engine supporting autonomous agents and real-time order processing, aligning with the intent-centric infrastructure trend and driving DeFi toward proactive liquidity management and collaborative value creation.

Ⅲ. Market Valuation Outlook

As the leading MEV-powered liquid staking protocol in the Monad ecosystem, aPriori combines a real-time order flow classification engine with an on-chain MEV capture mechanism. It has achieved strong testnet traction and institutional backing, with total funding of $30 million. Institutional entry prices range between $0.10–$0.20.

At launch, $APR was

listed on Bitget with an opening-day close of $0.30, an intraday high of $0.747, and a current price of $0.64 — reflecting a circulating market cap of approximately $114 million. For comparison, Lido’s LDO has a circulating market cap of $828 million, while Jito’s JUP stands at $1.148 billion.

Ⅳ. Tokenomics

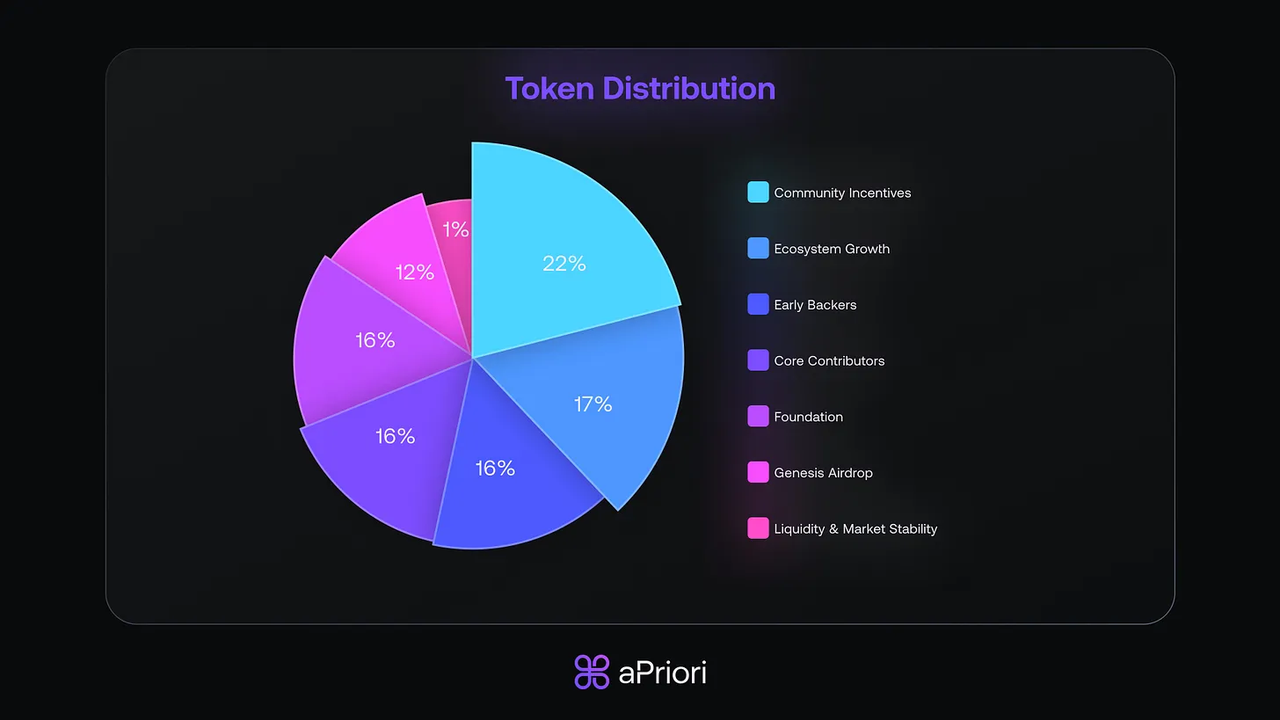

Total Supply: Approximately 1 billion

$APR

Token

Distribution:

Community Incentives — 22%

Ecosystem Growth — 17%

Early Backers — 16%

Core Contributors — 16%

Foundation — 16%

Genesis Airdrop — 12%

Liquidity & Market Stability — 1%

Token

Utility:

Governance: $APR holders can participate in DAO decisions regarding protocol upgrades, MEV distribution, and ecosystem development.

Staking & Rewards: Used for staking to earn MEV yield, liquidity mining, and validator participation on Monad.

Platform Utility: Serves as payment for platform fees, premium features (e.g., order flow data access), and collateral usage.

On-Chain MEV Optimization: Supports high-frequency trading, reduces slippage, and optimizes execution efficiency.

Liquid Staking Integration: Enables staking MON to receive aprMON, allowing yield accrual without sacrificing liquidity.

Deflationary Mechanisms: Includes token burns, fee buybacks, and dynamic adjustments to ensure economic sustainability.

NFT Integration & Asset Utility: Expands token usability across NFT and cross-asset applications.

Ⅴ. Team and Funding

The aPriori team is composed of veterans from Jump Trading, Coinbase, Citadel Securities, Amber, and Flow Traders — with deep expertise in blockchain infrastructure and high-performance financial systems. Initially focused on Monad-based liquid staking and MEV capture, the project continues to expand its institutional-grade DeFi and intelligent order flow optimization capabilities.

aPriori has raised a cumulative $30 million from leading investors, including Pantera Capital, HashKey Capital, Primitive Ventures, CMS Holdings, and Ambush Capital.

Seed Round (July 2024): $8 million led by Pantera Capital at a $100 million valuation, focused on developing MEV and liquid staking tools.

Subsequent Round (August 2025): $20 million to support on-chain trading expansion and Monad ecosystem integration. The FDV after this round increased significantly, with adjustments based on market conditions.

Ⅵ. Potential Risks

The cryptocurrency market is highly volatile, and the sustainability of aPriori’s economic model depends on the maturity of the Monad ecosystem. If network activity and adoption fall short of expectations, the utility of $APR and its MEV-related yield potential may be constrained, negatively impacting token performance.

Token

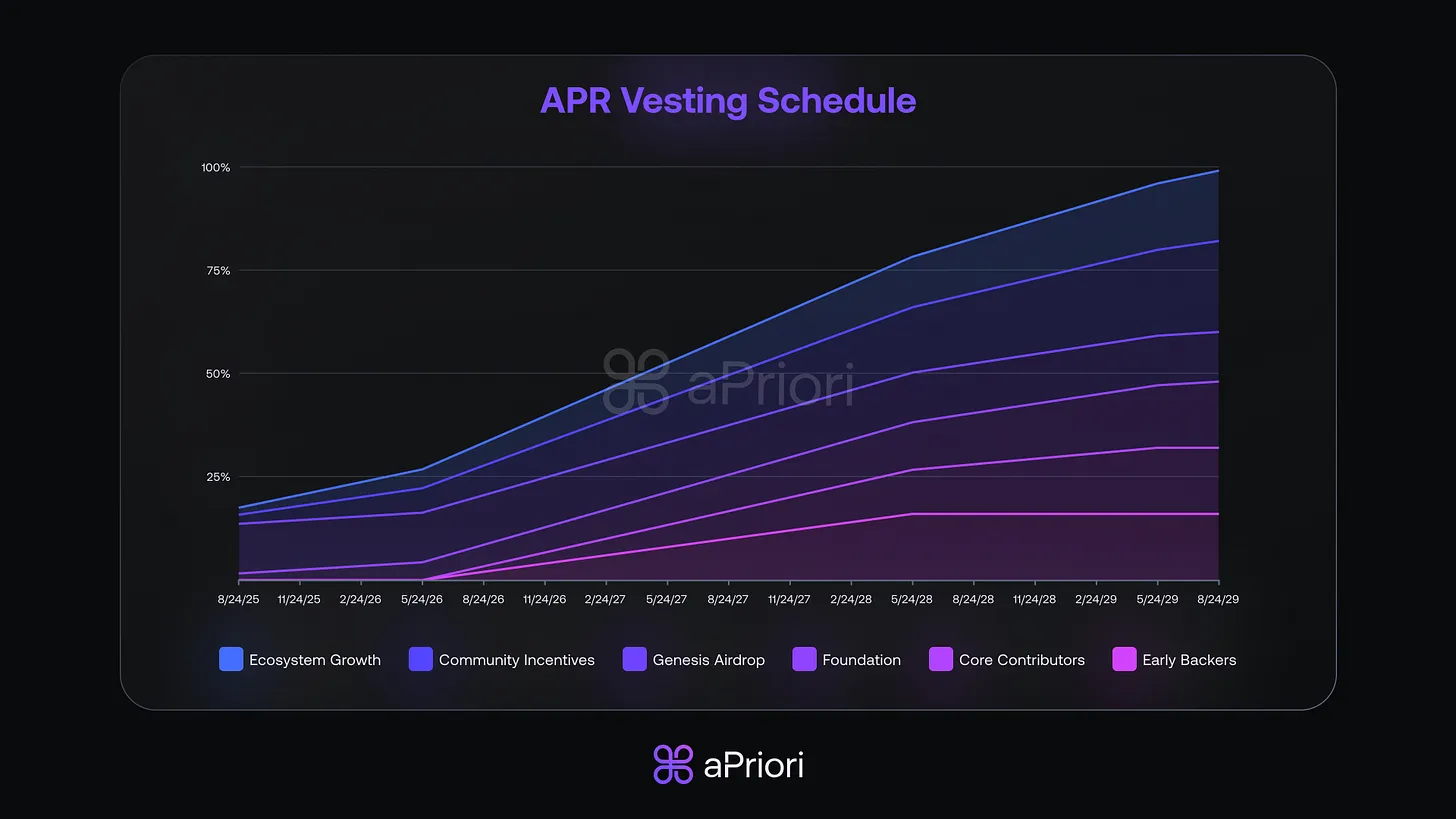

Unlock and Selling Pressure Risk: The $APR vesting schedule spans from 2025 to 2029, following a linear release pattern but with phases of concentrated token unlocks, creating multiple potential points of selling pressure.

Early Phase (H2 2025 – mid-2026): Although the total amount unlocked in this period remains relatively low, the

Genesis Airdrop (12%) and

Community Incentives (22%) are likely to be distributed early to stimulate user participation and ecosystem growth. If a portion of recipients choose to liquidate their holdings quickly while market demand is still developing, this could lead to short-term selling pressure and price volatility.

Risk level: Medium-High.

Mid Phase (2026 – 2027): As

Core Contributors and

Early Backers begin their vesting periods, profit-taking may occur if mainnet adoption, staking use cases, or MEV yields do not meet market expectations. This stage represents a crucial test of whether the project can absorb liquidity and maintain a sustainable cycle.

Risk level: High (depending on ecosystem progress).

Late Phase (2028 – 2029): If the ecosystem achieves maturity—with strong staking participation and consistent MEV-driven incentives—the newly released supply can likely be absorbed gradually, reducing selling pressure. Conversely, weak adoption could lead to prolonged downward pressure on the token.

Risk level: Medium (dependent on adoption and network demand).

Ⅶ. Official Links

Website:

https://www.apr.io

Twitter:

https://x.com/aPriori

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.

4

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Ethereum Staking Weekly Report December 8, 2025

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker Ethereum staking annual yield: 3.27% 2️⃣ stET...

Ebunker•2025/12/09 21:32

Crypto: Polygon Deploys the Madhugiri Hard Fork to Speed Up its Network

Cointribune•2025/12/09 21:18

BlackRock Enters Ethereum Staking With a First-of-Its-Kind ETF

Cointribune•2025/12/09 21:18

Dogecoin ETF Launch Disappoints Investors

Cointribune•2025/12/09 21:18

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$93,143.05

+2.27%

Ethereum

ETH

$3,332.7

+5.88%

Tether USDt

USDT

$1

+0.01%

XRP

XRP

$2.11

+1.53%

BNB

BNB

$908.53

+0.96%

Solana

SOL

$139.9

+4.83%

USDC

USDC

$1

+0.02%

TRON

TRX

$0.2833

+0.04%

Dogecoin

DOGE

$0.1497

+4.23%

Cardano

ADA

$0.4758

+9.41%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now