Infinex founder: The team share of 20% of the total supply will be locked up for 12 months after the TGE and will be linearly vested for 12 months af

On October 24th, Infinex, a cross-chain aggregation DeFi platform, founder kain.mega announced that the Infinex token is about to go online. After careful evaluation, the team unanimously believes that it is unfair to the community to obtain token liquidity before achieving product-market fit. Therefore, the team voluntarily relocks all token shares (20% of the total supply) for 12 months and implements a 12-month linear attribution after unlocking. This decision has been fully endorsed, and we are ready for long-term development.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Market Moves: CFTC Eyes Leveraged Spot Trading, $250M in Shorts Liquidated & Stablecoins Surge

Quick Take Summary is AI generated, newsroom reviewed. The CFTC plans to introduce leveraged spot crypto trading in U.S. exchanges as soon as next month. Over $250 million in short positions were liquidated in the last 24 hours. Ethereum’s stablecoin supply grew by $84.9 billion in the past year, leading all chains. These trends hint at advancing regulation, shifting capital flows, and deeper DeFi infrastructure.References X Post Reference

Jack Dorsey Just Changed Everything! 4 Million Merchants Can Accept Bitcoin

Japan’s Mitsubishi UFJ Boosts MicroStrategy Stake to $29 Million

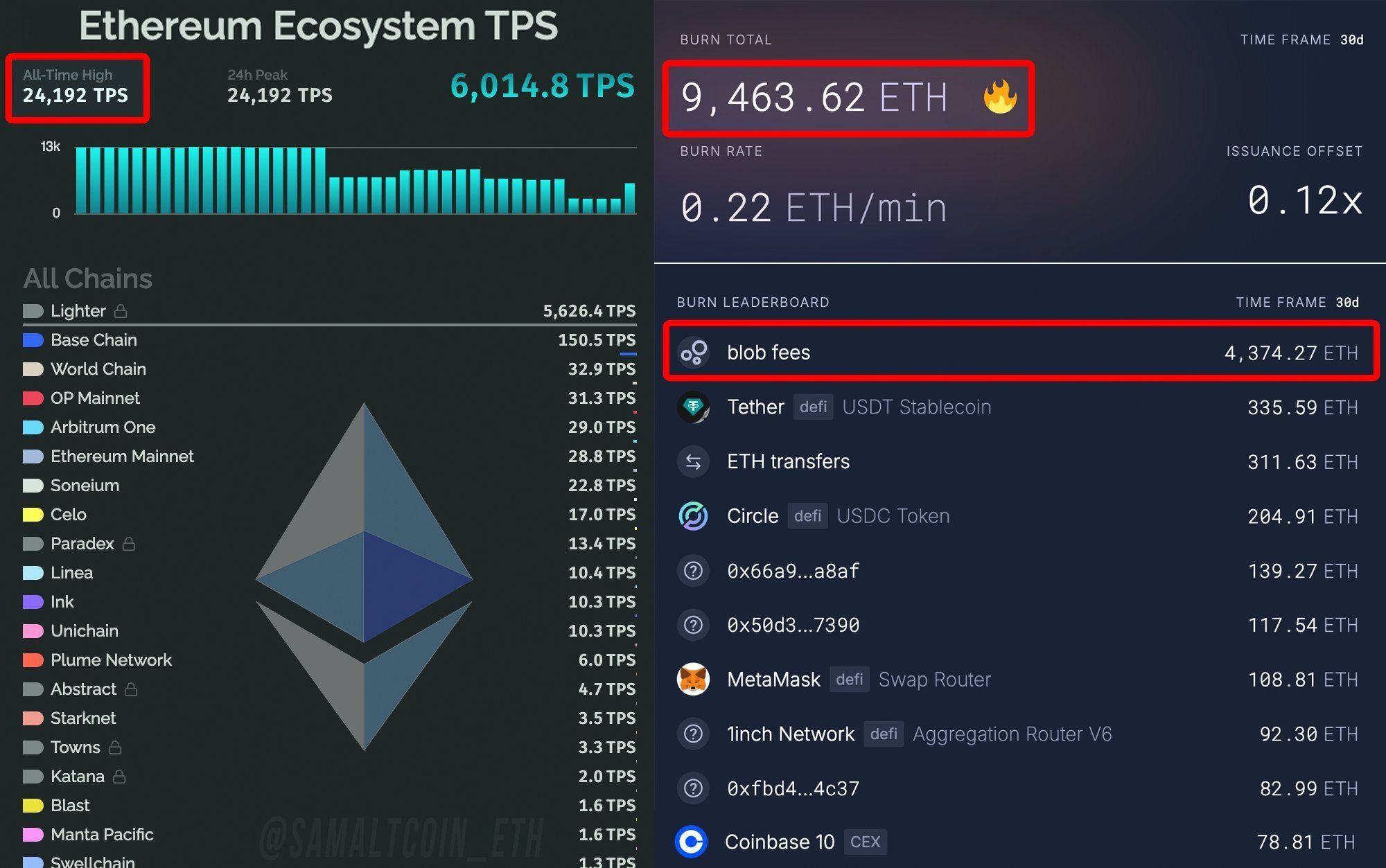

Ethereum Burns $32 Million in ETH as Network Hits Record 24,192 TPS