HBAR Price’s Death Cross Could Prevent 17% Rise To This Crucial Level

HBAR’s price faces pressure from a new Death Cross and weak trader activity. If the token breaks $0.178, it could rise 17% to $0.200; otherwise, downside risk persists.

Hedera (HBAR) has struggled to regain momentum as bearish signals intensify across its technical indicators. After several days of sideways movement, the cryptocurrency shows limited growth potential.

The latest development—a Death Cross—suggests that HBAR’s bullish phase may be coming to an end, at least in the short term.

Hedera Technicals Point To Decline

Hedera is currently witnessing a Death Cross, a technical pattern that forms when the 200-day Exponential Moving Average (EMA) crosses above the 50-day EMA. This event marks the conclusion of a three-month bullish streak initiated by a Golden Cross earlier in the year. Such a crossover typically signals a deeper bearish trend ahead.

The previous Death Cross for HBAR lasted less than two months before prices began to recover. Whether history repeats itself remains uncertain, but traders are proceeding cautiously.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

HBAR Death Cross. Source:

HBAR Death Cross. Source:

HBAR Death Cross. Source:

HBAR Death Cross. Source:

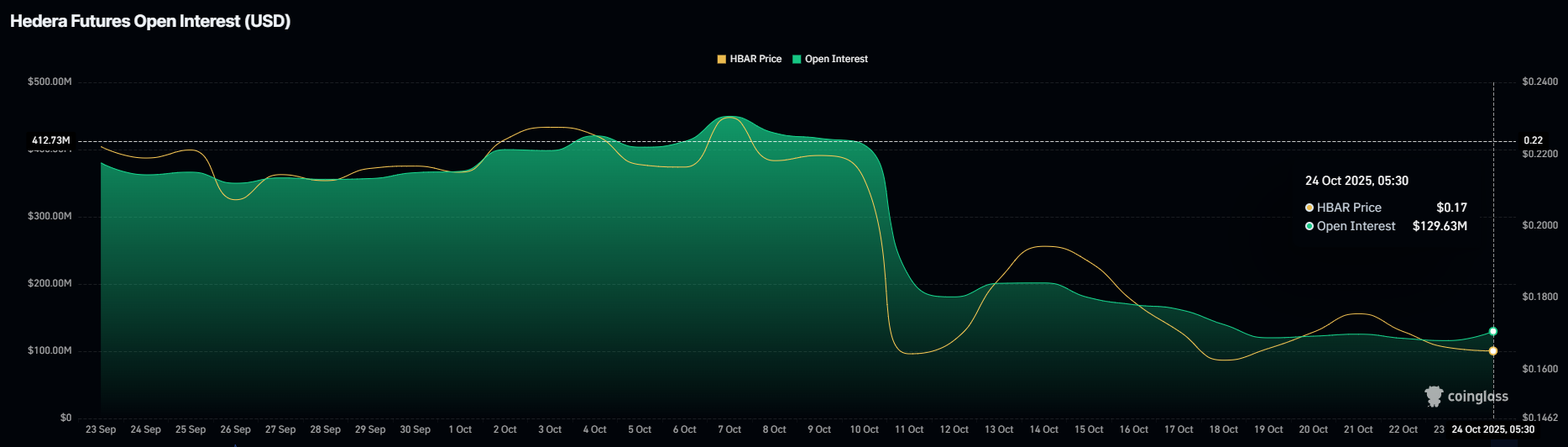

On a macro level, Hedera’s Open Interest (OI) has yet to recover from its earlier slump. Following a $200 million liquidation during the market crash earlier this month, OI has stabilized at around $129 million. The lack of growth suggests traders are hesitating to re-enter leveraged positions, reflecting a cautious stance toward HBAR’s near-term prospects.

This stagnation in Open Interest points to declining speculative activity, often associated with reduced volatility. Without renewed participation from traders, price rallies could remain subdued.

HBAR Open Interest. Source:

HBAR Open Interest. Source:

HBAR Open Interest. Source:

HBAR Open Interest. Source:

HBAR Price Needs A Boost

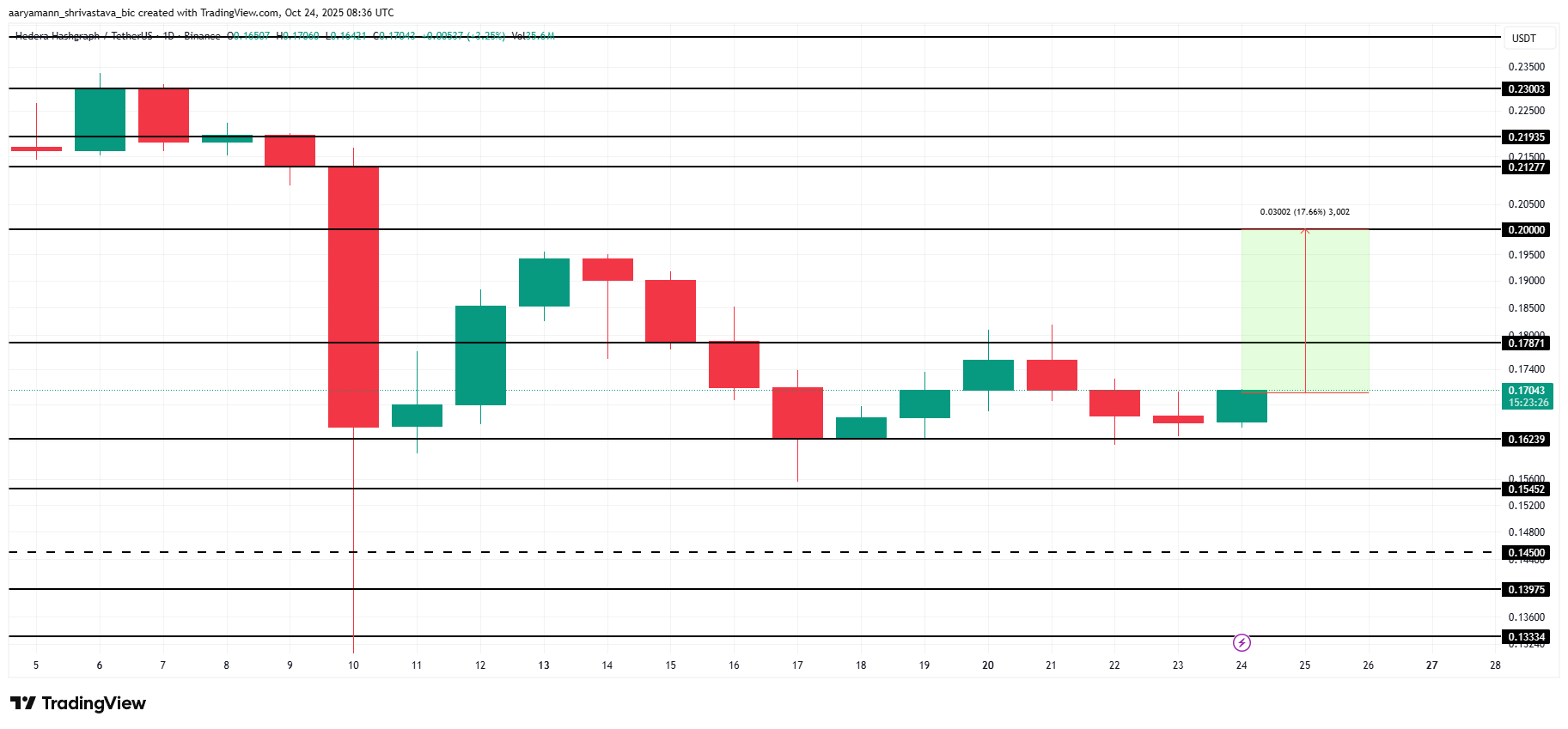

HBAR trades at $0.170 at the time of writing, fluctuating within a narrow range between $0.178 and $0.162. The altcoin’s sideways trend highlights the ongoing indecision among investors as they await clearer technical signals.

Given the prevailing bearish indicators, HBAR could either continue consolidating or slip below $0.162. A drop to $0.154 or lower would extend losses and confirm downside pressure.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

Conversely, if investors regain confidence and inflows return, HBAR could break past $0.178. A sustained rally from that level could push the token toward $0.200. This would marking a potential 17.6% rise and fully invalidating the current bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Rate Hike in Japan: Will Bitcoin Resist Better Than Expected?

Crucial Decision: Trump’s Final Interviews for Federal Reserve Chair Could Reshape Markets