From the Courtroom to the White House: CZ’s Pardon Is Far More Than a Presidential Order

Once at the helm of the world’s largest cryptocurrency exchange, Binance founder Changpeng Zhao (CZ) admitted to violating the US Bank Secrecy Act at the end of 2023, receiving a four-month prison sentence for failing to establish an effective anti-money laundering program. After serving his sentence and being released in 2024, this Chinese billionaire experienced a dramatic turn of fate just a year later—a presidential pardon from Donald Trump restored his complete freedom.

For many observers, this pardon was the long-awaited “other shoe to drop”; yet its signing may signal the beginning of even more complex aftershocks.

The Trump administration declared that the “war on crypto is over,” describing the previous Biden administration’s prosecution of CZ as political persecution.

Meanwhile, the incident also revealed the Trump family’s deep and complex interests in the crypto industry—on one hand, Binance led by CZ once suffered setbacks in the US, while on the other, Trump and his children were building a vast empire in the crypto space.

All of this has woven a jaw-dropping real-life drama between Washington and Wall Street: money, power, digital currency, and the trading of interests at the very core of American power.

CZ Convicted: From Investigation and Settlement to Four-Month Sentence

CZ, once one of the most legendary figures in the crypto world, experienced a dramatic downfall under the heavy hand of US regulation.

The US Department of Justice had investigated Binance for years over alleged anti-money laundering and sanctions violations, accusing it of allowing suspicious transactions on its platform, including transfers involving terrorist group Hamas. Under immense legal pressure, CZ reached a plea agreement with the DOJ on November 21, 2023, admitting to failing to establish effective anti-money laundering compliance procedures at Binance, thus violating the US Bank Secrecy Act (BSA).

As part of the agreement, Binance also admitted to related violations, and both parties agreed to pay over $4 billion in fines to settle the case—Binance paid about $4.3 billion, while CZ personally paid a $50 million fine. This made it one of the largest corporate settlements in US history.

The settlement also imposed strict restrictions on Binance and CZ: CZ immediately announced his resignation as Binance CEO, with former Asia-Pacific head Richard Teng taking over, and agreed to a lifetime industry ban, permanently barring him from managing or operating Binance’s global business, especially from holding any executive position at Binance US.

Binance was required to undergo three years of independent compliance monitoring to ensure its operations met legal requirements. Notably, CZ became the first person in US history to be imprisoned solely for a single BSA charge. At the sentencing hearing on April 30, 2024, a federal judge in Seattle sentenced CZ to four months in prison.

Though the sentence seemed short, it was highly symbolic—demonstrating regulators’ determination to bring crypto giants to justice and sending shockwaves through the global crypto industry.

During his sentence, CZ was held in a US federal prison. He was released in September 2024, ending his four-month incarceration.

By this time, CZ no longer held any official position at Binance, and Binance was banned from operating in the US due to its guilty plea and regulatory issues. The once-dominant crypto tycoon had fallen from grace, with both his personal reputation and business empire severely damaged.

CZ After Prison: Quiet or Underlying Currents?

After his release, CZ initially chose to keep a low profile, staying out of the public eye.

But beneath the surface calm, social media and industry rumors indicated he had not completely exited the crypto stage. In early 2025, rumors began to circulate on Twitter (now X) and other platforms that the Trump administration might pardon CZ.

CZ actively responded to media reports and participated in public discussions, showing that his influence had not entirely faded despite his imprisonment.

In March 2025, The Wall Street Journal broke a bombshell: representatives of the Trump family had been in talks with Binance since 2024, discussing the Trump family acquiring a stake in Binance US, and revealing that CZ was seeking a presidential pardon. The report shook the industry and thrust CZ back into the spotlight.

That day, CZ quickly refuted the report on X: “Sorry to disappoint everyone, but The Wall Street Journal got the facts wrong. The truth is: I have not discussed any deal to acquire Binance US with... anyone.” However, he then admitted, “No felon would mind being pardoned, especially since I am the only person in US history to be imprisoned for a single BSA charge.” This was seen as tacit confirmation of his desire for a pardon. CZ further suggested the report was politically motivated, saying it felt like an “attack on President Trump and crypto,” and that “the Biden administration’s war on crypto is still ongoing.”

By early May 2025, CZ began to more openly express his desire for a pardon.

On May 7, he confirmed for the first time on a podcast that he had formally submitted a presidential pardon application to the Trump administration. CZ explained that since mainstream media were already reporting on the matter, “it made sense to just formally make the request.” He revealed the application was submitted between late March and early April, within two weeks of the reports.

During this period, keen observers also noticed that CZ quietly removed “former @Binance CEO” from his social media bio—seen as a hint at a possible change in his future identity, sparking speculation about a comeback.

In August 2025, US media further revealed CZ’s efforts to obtain a pardon: on August 13, he hired lobbyist Ches McDowell, who has close ties to Donald Trump Jr., to lobby for the pardon in Washington. This confirmed suspicions that CZ was actively working behind the scenes.

Meanwhile, attention to CZ’s fate peaked in the crypto community: on the decentralized prediction market Polymarket, bets on “whether CZ would be pardoned” surged, with the probability of a successful pardon reaching 64% in mid-October. Some in the crypto world even created memes like “Binance Life,” joking that if CZ regained freedom, he would continue his inseparable journey with Binance.

Trump’s Sudden Pardon: White House Intervention and Political Storm

On October 22, 2025, President Trump signed a pardon for CZ at the White House, announcing the decision to the public the next day. White House Press Secretary Karoline Leavitt stated: “The President has exercised his constitutional authority to pardon Mr. CZ, who was prosecuted during the Biden administration’s war on crypto. The Biden administration’s war on crypto is over.”

This move by the Trump administration effectively declared an official end to the previous administration’s harsh regulation of the crypto industry and publicly exonerated CZ. Trump himself was reportedly sympathetic to claims that CZ and others in the industry had been “persecuted,” with several sources close to Trump saying he believed the case against CZ was “very weak and should never have risen to the level of felony charges and imprisonment.”

The pardon immediately triggered fierce political reactions in Washington. Supporters saw it as evidence of Trump’s embrace of innovation and determination to correct the previous administration’s mistakes, while critics condemned it as a blatant exchange of interests, seriously undermining the rule of law and ethical norms. Democrats were especially outraged. Senior Senate Banking Committee member Elizabeth Warren and other Democratic senators quickly issued a joint statement after the pardon, accusing the Trump administration of condoning crypto crime and weakening financial regulation. As early as May, when the Trump family’s crypto business was involved in massive transactions with Binance, Warren warned: “A foreign government-backed fund announced a $2 billion deal using Trump’s stablecoin, while the Senate is preparing to pass the so-called ‘GENIUS Act’—this stablecoin legislation will make it easier for the President and his family to profit. This is corruption, and no senator should support it.” In her view, Trump’s pardon of CZ implied huge transfers of interests and conflicts.

The Republican camp generally welcomed the move, seeing the Biden-era handling of CZ as an example of over-enforcement.

Trump administration officials and supporters emphasized that CZ’s crime would not normally result in jail time for other financial industry executives, arguing that the Biden administration “chose to enforce” out of political hostility toward the crypto industry, and that Trump was merely correcting this injustice. Trump’s new Treasury Secretary even said in an interview: “The war on crypto is over; America will strive to become the global crypto capital.” The market responded swiftly: after the pardon was announced, Binance’s BNB token price surged from 1083 USDT to 1160 USDT within hours, a 6.7% increase.

It can be said that this pardon sparked a political storm and caused ripples in the capital markets.

Legally, a presidential pardon means CZ’s federal conviction is wiped out, and related penalties and restrictions may also be nullified. Legal experts point out that the President enjoys the highest pardon authority under the US Constitution, able to pardon federal crimes and penalties. Thus, Trump’s pardon not only frees CZ from further legal consequences but may also lift several restrictions he agreed to in his plea deal with the DOJ. This theoretically gives CZ the chance to regain control of the crypto empire he built—something that excites supporters but worries hardline regulators.

The Trump Family’s Crypto Empire: NFTs, Tokens, and Hidden Interest Networks

Behind the twists and turns of the CZ case, the Trump family’s rapid rise in the crypto space has been a constant undercurrent.

Although Trump publicly stated in 2019 that he was “not interested” in bitcoin, in the years after leaving the White House he transformed into an active participant in the crypto world. Especially during his 2024 campaign to return to politics, Trump dramatically changed his stance, openly embracing digital currency: he not only declared that the US government’s bitcoin holdings would never be sold and that bitcoin would be listed as a national strategic reserve asset, but also announced on his official website that he would accept crypto donations for his campaign. More importantly, the Trump family began to commercialize the “Trump” brand, embedding it deeply into a series of NFT and crypto token projects, building a crypto business empire spanning both politics and business.

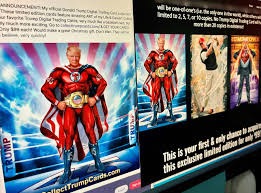

First, in the NFT field. In December 2022, Trump launched his first personal NFT series—the “Trump Digital Trading Cards,” each priced at $99.

These NFT cards, featuring Trump as a superhero, astronaut, cowboy, and other exaggerated personas, sold out within 18 hours, generating $4.455 million in sales. Encouraged by this success, Trump subsequently released four NFT series, selling over 200,000 digital collectible cards in total, with direct sales revenue exceeding $22 million; combined with secondary market royalties, it is conservatively estimated that his NFT projects have brought Trump over $8 million in net profit. Trump successfully turned his personal IP into a blockchain bestseller, not only enriching himself but also cultivating a large crypto supporter community.

However, compared to NFTs, the Trump family’s ventures in tokens and crypto finance have had even greater impact. In September 2024, Trump’s sons Donald Trump Jr. and Eric Trump announced their entry into the digital asset market, founding a crypto company called World Liberty Financial (WLF). In October, the company launched its first cryptocurrency—WLFI token—boasting that it was endorsed by the Trump family and would grant holders “shareholder-like” rights to participate in company decisions. Although initial sales were modest, with only $2.7 million worth of WLFI sold by the end of October 2024,

Fortunes changed: after Trump won the presidential election in November 2024, demand for WLFI soared. Riding the wave of Trump’s victory, WLF attracted multiple rounds of large-scale financing and token subscriptions in early 2025. Data shows WLF has conducted eight rounds of private fundraising, raising at least $590 million, with the fully diluted market cap of WLFI tokens reaching as high as $123 billion in OTC trading.

One key reason for WLF’s sky-high valuation is its secret channel between the White House and the crypto world: Trump’s status as sitting president gave this family business unparalleled “policy endorsement.” According to WLF disclosures and media investigations, Trump personally holds 60% of WLF’s equity through a family trust and enjoys 75% of the company’s token sales revenue.

Trump’s two sons directly participate in management and operations, serving as “Web3 Ambassadors” and co-leading daily business with several veteran crypto entrepreneurs. Even more striking, WLF locked in family interests by reserving a huge number of tokens: the Trump family and affiliates were directly allocated 22.5 billion WLFI tokens (22.5% of the total supply). In less than a year, The New Yorker estimated the Trump family had profited about $412.5 million from this project. In short, the Trump family has transformed the political influence of the White House “First Family” into the hottest “primary capital” in the crypto world.

In addition to issuing WLFI tokens, WLF launched a dollar-pegged stablecoin, USD1, in March 2025, claiming it was 100% backed by US Treasury bonds and cash assets.

Just over a month after Trump returned to the White House, this stablecoin made its debut in a major international transaction: Abu Dhabi National Security Advisor Tahnoun bin Zayed’s sovereign investment firm MGX announced it would use $2 billion worth of USD1 to acquire a stake in Binance! WLF co-founder Zach Witkoff excitedly announced the news at a Dubai crypto conference, saying “USD1 has been chosen as the official stablecoin for MGX’s $2 billion investment in Binance.”

Notably, Zach is the son of Trump’s Middle East envoy and old friend Steven Witkoff. Also on stage with Zach were Eric Trump and Asian crypto tycoon and Tron founder Justin Sun.

The MGX deal sparked strong doubts in US political circles: on one hand, a UAE sovereign fund with foreign government backing injected huge capital into Binance, which had been penalized for money laundering, using a stablecoin issued by the Trump family business; on the other, the Trump administration almost simultaneously approved the export of hundreds of millions of dollars’ worth of advanced chip equipment to Tahnoun’s company, despite national security agencies’ concerns that the chips might end up in China.

Such coincidences prompted media and watchdogs to question—was the Trump administration trading national interests for family business gains? The New York Times’ in-depth investigation described WLF’s business as “breaking the boundaries between private enterprise and government policy, unprecedented in modern US history.” The report revealed that WLF had secretly accepted large sums from foreign investors and crypto exchanges in exchange for access to Trump, and noted that at least one investigation into related parties was dropped after payment was made. For example, Chinese crypto tycoon Justin Sun invested at least $75 million in WLF and became an advisor in early 2025; soon after, the US Securities and Exchange Commission (SEC) suspended its investigation into Sun’s companies. Such intertwined interests have cast a thick shadow of conflict of interest over the Trump family’s crypto empire.

Another intriguing chapter in the Trump family’s crypto journey is Trump’s personal meme coin. Just before his second inauguration, Trump’s team unexpectedly launched a meme coin called $TRUMP on January 17, 2025. The token was issued on the Solana chain, with a total supply of 1 billion, 20% sold publicly via ICO, and the remaining 80% held by Trump family companies. Within a day of launch, $TRUMP’s market cap soared to $27 billion, making Trump’s holdings worth over $20 billion.

Although this valuation was unsustainable, according to the Financial Times, the project still brought Trump at least $350 million in real profits within a few months. More notably, after returning to the White House, Trump repeatedly touted the value of $TRUMP and took administrative measures to boost its price, directly increasing his personal net worth. Ethicists harshly criticized this, saying that as president, Trump was promoting private crypto projects and manipulating policy to benefit his own tokens, constituting an unprecedented conflict of interest. Trump’s spokesperson argued, however, that the president’s business assets were managed by his children, so “there is no conflict of interest.”

Pardon Controversy: Vote Trading or Money Transfer?

All signs suggest that Trump’s pardon of CZ was not simply based on policy philosophy, but likely involved calculations of vote trading and interest transfer. In the 2024 election, crypto industry practitioners and investors were seen as an emerging political force that could not be ignored. The Biden administration’s strict regulation of the crypto market angered many in the crypto community, and Trump keenly seized on this sentiment, branding himself as the “crypto president” and promising to unleash crypto productivity if elected. Reports indicate that Trump’s campaign not only received donations from some crypto whales and institutions, but also sent goodwill signals to the crypto community by actively engaging in NFTs and tokens.

In his first month back in the White House, Trump signed several executive orders favorable to the crypto industry, such as promoting the “GENIUS Act” in Congress to relax stablecoin regulation, and inviting the Winklevoss twins and other well-known crypto entrepreneurs to the White House for a “US Crypto Renaissance” event. In this context, pardoning CZ further cemented Trump’s reputation and support in the crypto world. With a massive global fan and customer base, Trump’s pardon of CZ was seen as a friendly signal to the entire crypto community, aiming to win over this emerging voter group.

On the other hand, the potential interests of Trump family’s overseas backers in the CZ case cannot be ignored. As a global trading platform, Binance has countless international capital connections, including the aforementioned Abu Dhabi MGX fund and overseas investors like Justin Sun.

These individuals are both key partners in CZ’s business empire and honored guests of Trump’s crypto enterprises. From MGX investing in Binance with Trump’s stablecoin, to the Trump administration exporting high-tech chips to the UAE, to Justin Sun investing in Trump’s company in exchange for leniency from the SEC, the chain of interest exchange is clear. Trump’s pardon of CZ was likely a key link in this transnational game of interests: once CZ regained his freedom, his influence and resources would return to the market, indirectly benefiting overseas capital allied with the Trump family. Some speculate that these behind-the-scenes stakeholders actively lobbied or even pressured Trump, leading to the final decision to pardon CZ.

There is currently no direct evidence that Trump accepted money in exchange for the pardon, but the many details have raised public vigilance. The House Minority Leader has called for an investigation into Trump’s decision to pardon CZ, to examine whether there was abuse of power or exchange of interests. Government ethics watchdogs have also demanded transparency regarding the Trump family’s crypto investments and decision-making process, to clarify whether the president’s actions were influenced by private business interests. The CZ pardon has thus transcended the judicial realm, becoming a test of the integrity and rule of law in American politics.

Regulatory Shock and Global Landscape: Where Is the Crypto Industry Headed?

The aftermath of the CZ case and Trump’s pardon is profoundly affecting the regulatory direction and market landscape of the US and global crypto industry. In the US, Trump’s rise to power marked a 180-degree shift in federal crypto policy: agencies like the Securities and Exchange Commission (SEC) have slowed or even withdrawn lawsuits against crypto companies. For example, the SEC filed a civil suit against Binance in 2023, but dropped the case soon after Trump took office. Regulatory leaders have mostly been replaced with crypto-friendly figures, and terms like “safe harbor” and “exemption” have become keywords. This has brought relief to US crypto companies previously anxious about compliance. According to Forbes, several crypto exchanges (such as Gemini and Bullish, founded by the Winklevoss twins) successfully went public in 2025, joining Coinbase. Bitcoin prices repeatedly hit new highs in 2025, once surpassing $126,000, with market participants declaring “the winter is over, the bull market is back.” In short, Trump’s administration and a series of friendly measures have brought a long-awaited revival to the US crypto industry.

However, this sudden change in regulatory environment has also led to complex shifts in compliance trends.

On one hand, US deregulation has unleashed dividends, attracting capital and projects back, with crypto entrepreneurship and investment activity surging. Statistics show that in Q3 2025 alone, global crypto M&A transactions exceeded $10 billion, a 30-fold year-on-year increase. Many Wall Street giants (such as JPMorgan, BlackRock, etc.) have seized the opportunity to enter the crypto market, launching regulated bitcoin funds, spot ETFs, and other products. The easing of regulatory barriers and policy endorsement have encouraged these financial institutions to participate deeply in crypto, further driving industry consolidation. Asset managers like 21Shares have been acquired, and native crypto firms are also launching acquisition waves to strengthen their moats. Overall, under Trump’s leadership, the US is striving to become the “global crypto capital,” seeking to concentrate compliant capital and technology domestically to take the lead in the next wave of innovation.

On the other hand, the sudden relaxation of US regulation has raised concerns about risk control and regulatory arbitrage.

Some countries in Europe and Asia have chosen to remain cautious or even tighten regulatory fences to guard against speculative risks from the US policy shift. For example, the EU’s MiCA regulatory framework, launched in 2024, is still strictly enforced, with no relaxation on capital requirements for stablecoin issuers or operational standards for exchanges. In contrast, US enforcement against large crypto companies has clearly weakened, with even someone like CZ—convicted of anti-money laundering violations—quickly pardoned and allowed to return. Critics call this “a historical regression.” Financial crime experts warn that America’s softer stance may foster a sense of impunity in the industry, with some companies relaxing internal compliance because they see that even crossing the line may result in escaping sanctions or even being exonerated through political means. This poses a potential threat to global anti-money laundering and anti-terrorism financing systems, and other jurisdictions may have to “go their own way” on crypto regulation, making global regulatory coordination more difficult.

For international platforms like Binance, the US policy shift is undoubtedly a major turning point. Although Binance suffered a major setback and exited the US market in 2023, Trump’s pardon and regulatory easing may give it a chance to make a comeback. Analysts point out that Binance US was previously paralyzed, but may now see investment from the Trump family, achieving a “backdoor rescue.” More importantly, CZ’s personal freedom of action has greatly increased. If he truly wants to return to an industry leadership role, Trump’s pardon has removed the main legal obstacles. Of course, this depends on CZ’s future relationship with US regulators: under the Trump administration, he may rise smoothly, but if the administration changes again, he and Binance could still face a reckoning. This uncertainty also reflects the politicization of US crypto regulation—companies’ fortunes are closely tied to the White House, which is not conducive to long-term industry stability.

In the global market landscape, the CZ case and Trump’s pardon have also triggered chain reactions. Asian and Middle Eastern capital are actively seizing this opportunity to accelerate their global crypto strategies. Institutional investors in Abu Dhabi, Singapore, Hong Kong, and elsewhere, who previously kept their distance from Binance for fear of crossing US red lines, may now be emboldened to cooperate due to Trump’s change in attitude.

Binance itself may seek a new balance between compliance and the gray area: with the US market showing new promise, Binance is sure to invest resources in rebuilding its compliance image and repairing relations with US regulators, while consolidating its dominance in non-US markets. As US exchanges like Coinbase and Gemini expand overseas thanks to favorable policies, if Binance can regain some US market access, it will undoubtedly strengthen its position as a global leader.

Conclusion

CZ’s story seems to have reached a pause, but the discussions it has sparked are far from over.

After this incident, everyone sees more clearly. US regulatory logic is not set in stone; it can shift in power struggles and adjust under industry pressure. The crypto world is no longer an isolated island; it must learn to survive in policy gaps and even actively participate in rulemaking.

Trump’s pardon is less an endpoint than a brand new beginning. It has shown the market the enormous influence of politics on the crypto industry and made regulators worldwide realize that a more flexible approach may be needed for this emerging field.

CZ has regained his freedom, but the long process of integration between the crypto world and mainstream society is far from over. The only certainty is that every future technological breakthrough and policy adjustment will continue to test everyone’s wisdom. Where this road leads, no one can spoil in advance.

Author: Seedly.eth

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin bounces on Fed rate cut with bigger rally ahead predicted

From the Only Survivor of Crypto Social to "Wallet-First": Farcaster’s Misunderstood Shift

Wallets are an addition, not a replacement; they drive social interaction, not encroach upon it.

a16z: 17 Major Potential Trends in Crypto Forecasted for 2026

Covers intelligent agents and artificial intelligence, stablecoins, tokenization and finance, privacy and security, and extends to prediction markets, SNARKs, and other applications.