Algo slips 0.33% while Allegion and Tractor Supply announce earnings, with technical signals indicating a possible trend reversal

- ALGO fell 0.33% in 24 hours to $0.1808, with 45.95% annual decline and no immediate reversal signs. - Strong earnings from Allegion and Tractor Supply highlighted robust cash flow but did not boost ALGO’s performance. - Technical indicators show ALGO below key moving averages, with RSI in oversold territory and critical support at $0.175. - Market observers monitor if broader equity resilience will stabilize crypto assets like ALGO.

As of October 24, 2025,

Allegion and Tractor Supply’s latest earnings highlight solid cash flow and strategic expansion, but neither company’s results seem to be affecting ALGO’s price movement. Allegion increased its adjusted EPS forecast for 2025 to a range of $8.10–$8.20, citing recent acquisitions and effective management of working capital. Tractor Supply posted a 7.2% increase in Q3 2025 net sales and detailed a disciplined approach to capital returns. Despite these positive updates, ALGO remains near its lowest point in the past year, and investor sentiment is cautious due to weak technical indicators and a lack of clear drivers for a rebound.

Technically, ALGO is trading beneath both its 50-day and 200-day moving averages, signaling a bearish outlook for the near to mid-term. The RSI has dropped to 28, placing it in oversold territory and hinting at the possibility of a short-lived bounce if buyers step in. However, the MACD has yet to show a bullish crossover or divergence, which tempers the strength of any recovery signal. Should the price fall below the key support level at $0.175, further declines could follow, with the next support anticipated around $0.165. Conversely, a sustained move above the 50-day moving average at $0.190 would be necessary to improve the risk/reward balance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

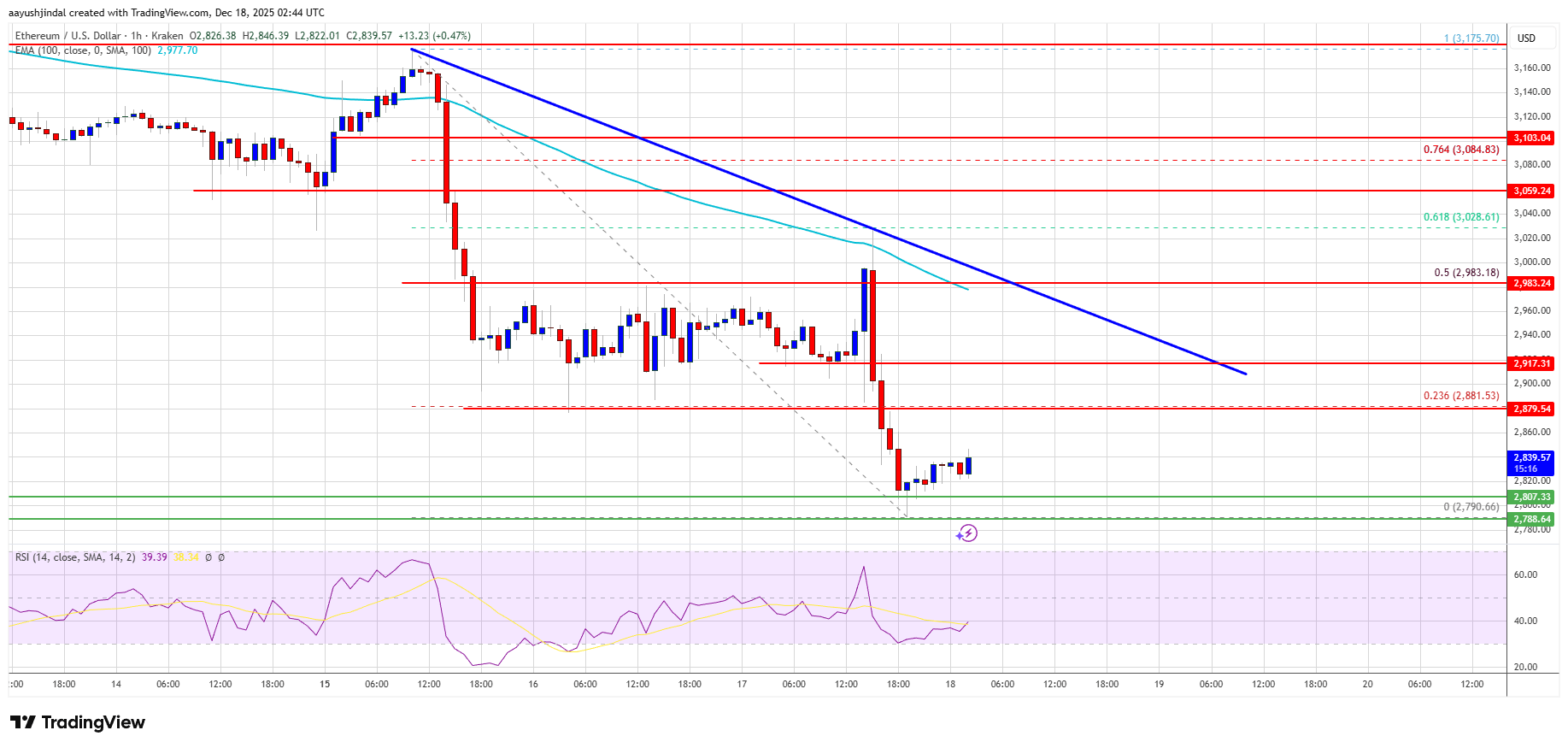

Ethereum Price Continues to Slide—Where Is the Next Support?

Ethereum Whale Sells Entire ETH Position After 1127-Day Hold, Realizes $4.245 Million Profit

Tether’s USDT Payment Stats Show the Real State of Crypto Adoption in 2025

Circle Launches Arc Developer Fund to Accelerate Real-World Finance Apps on Arc Network