Digital autonomy and expanded access to financial services are fueling a transformative change in the world economy

- Adrian Wall emphasized digital sovereignty and financial inclusion at a UN event, stressing data control and literacy for sustainable development. - JPMorgan and Blockchain.com advance crypto adoption, with Bitcoin collateral and EU regulatory licenses reflecting institutional confidence. - African nations like Ghana and Burkina Faso tokenize resources and expand cross-border payments, leveraging blockchain for sovereign economic strategies. - U.S. lawmakers near crypto bill approval, balancing regulatio

Adrian Wall, representing the Digital Sovereignty Alliance (DSA), highlighted the pressing need for digital sovereignty and broader financial access at a prominent UN General Assembly roundtable held in New York on October 22, 2025, as reported by

This dialogue reflects a wider movement toward digital asset integration worldwide.

Across Africa, where digital sovereignty remains a key topic, ABSA and Ripple have joined forces to improve cross-border payments, as detailed in

In the United States, regulatory progress is also underway, with lawmakers aiming to pass a comprehensive crypto bill by year’s end, according to

On the global stage, countries like Burkina Faso are turning to blockchain for economic advancement. A significant agreement with Palm Promax Investments will see the tokenization of Burkina Faso’s gold and mineral assets, setting a precedent for sovereign digital finance, as stated in

With digital sovereignty and financial inclusion gaining momentum, the intersection of policy, technology, and market trends is driving a significant transformation in the global economy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Litecoin Holds $100 Base as Chart Signals 2025 Recovery

Stablecoins Gain Popularity in Venezuela as Hyperinflation and Sanctions Persist

Fed Rate Cut Triggers Mixed Crypto ETF Performance as Bitcoin, XRP ETFs Post Inflows, Ether Outflows

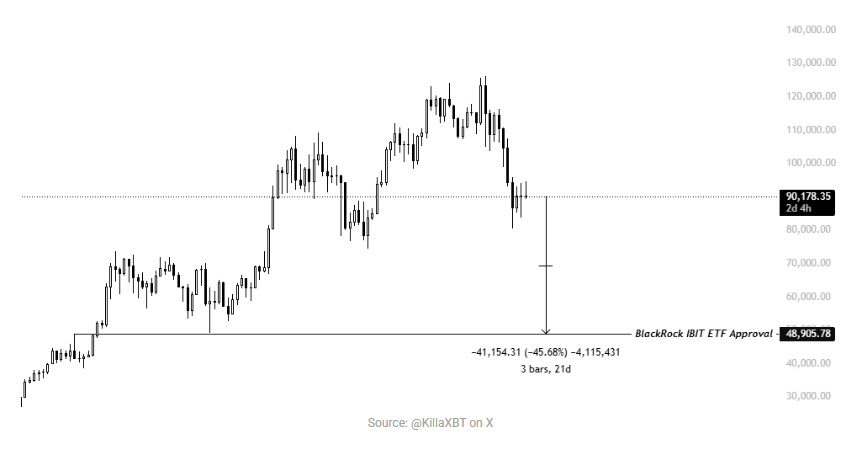

Bitcoin To Retest $85,000 Mark In Coming Days – Here’s Why