BNB News Update: CZ’s Pardon Signals End to Crypto Conflict, Markets Rally Amid Eased Regulations

- U.S. President Trump's pardon of Binance founder CZ triggered a crypto market surge, with BNB rising 3.3% to $1,126 and altcoins like WLFI (+12%) and ASTER (+20%) gaining traction. - The move, framed as ending the "crypto war," eased regulatory pressures on Binance, though its early listing of WLFI highlighted concerns over market influence and project visibility. - Meme coins like BullZilla and DOGE saw speculative gains, driven by social media momentum and renewed institutional interest amid lingering

The recent decision by U.S. President Donald Trump to pardon Binance founder Changpeng Zhao (CZ) has sparked a rally in the cryptocurrency market, with Binance Coin (BNB) and a number of alternative coins posting notable price increases.

The positive momentum also spread to altcoins, with

Elsewhere, the

The crypto market's response to CZ's release highlights the significant impact of geopolitical events on digital asset trends. Binance's BNB token saw its trading volume jump 35% above its weekly average, with investors buying at key resistance points, as noted by Yahoo Finance. David Namdar, CEO of CEA Industries, pointed to BNB's solid fundamentals, such as its extensive global user base and its role in both DeFi and CeFi platforms.

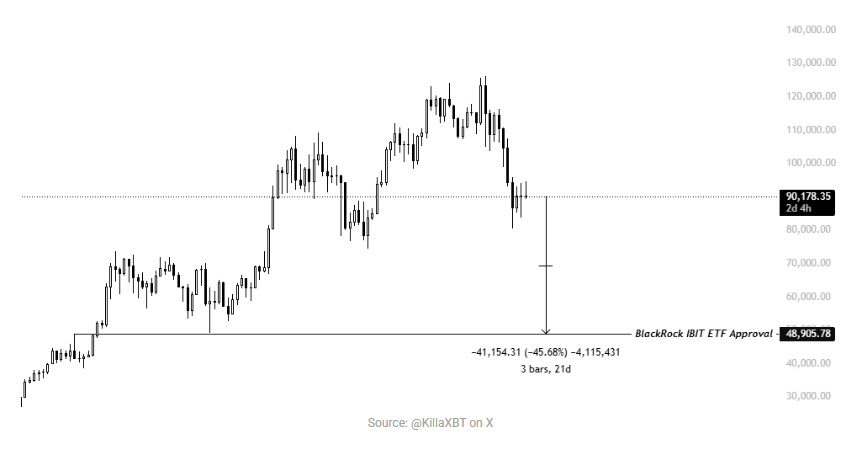

Despite the recent upswing, the overall crypto market remains unpredictable. A $19 billion crash earlier this year has dampened some enthusiasm, but analysts like Cointelegraph's Finance Redefined believe

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Litecoin Holds $100 Base as Chart Signals 2025 Recovery

Stablecoins Gain Popularity in Venezuela as Hyperinflation and Sanctions Persist

Fed Rate Cut Triggers Mixed Crypto ETF Performance as Bitcoin, XRP ETFs Post Inflows, Ether Outflows

Bitcoin To Retest $85,000 Mark In Coming Days – Here’s Why