Mirror Tokens: Where Cryptocurrency Innovation Aligns with Regulatory Frameworks

- SEC faces pressure to regulate tokens via structured frameworks, with Commissioner Peirce advocating "mirror tokens" as compliant innovation. - Coinbase's $375M Echo acquisition and Sonar platform exemplify regulated token sales with KYC measures, mirroring Europe's MiCA framework. - Canadian XXIX Mining's Opemiska project highlights global trends linking tokenization to clean energy incentives and tax credits. - Mirror tokens aim to resolve regulatory ambiguity by aligning digital assets with securities

The U.S. Securities and Exchange Commission (SEC) is facing mounting calls to establish a more organized approach to token oversight, with Commissioner Hester Peirce standing out as a prominent supporter of "mirror tokens" as a possible answer. Peirce, who has consistently championed both investor protection and innovation within the crypto sector, has once again voiced her backing for a system that enables asset tokenization while maintaining transparent regulatory boundaries. This initiative coincides with a wider industry movement toward compliance-focused fundraising, as seen in recent trends in token launches and growing institutional engagement.

The idea of mirror tokens—digital counterparts of conventional assets such as stocks or property—has been gaining momentum as a method to connect traditional finance with blockchain innovation. Peirce has maintained that these tokens could deliver the advantages of tokenization, including fractional ownership and round-the-clock trading, all while fitting into current regulatory systems. "Mirror tokens could open doors for progress without putting investors at risk from unregistered securities," she remarked in a recent address, according to

Peirce’s renewed push comes at a pivotal moment, as the crypto sector is experiencing a revival of structured fundraising strategies. For example, Coinbase’s $375 million purchase of Echo—a platform that facilitates regulatory-compliant token launches—has been described as a spark for a new generation of regulated initial coin offerings (ICOs). Echo’s Sonar tool, which enables founders to conduct public token offerings on blockchains like

At the same time, broader market trends highlight the necessity for a measured strategy. Nasdaq, a major force in both traditional and digital asset trading, reported varied results in October, with its indexes moving in response to strong earnings from established sectors like industrials and finance, as noted by

The momentum for organized tokenization is

Nevertheless, obstacles persist. The SEC’s previous actions against unregistered token offerings—evident in its enforcement against early ICOs—have left numerous projects uncertain about compliance. Peirce’s mirror token initiative aims to resolve this by establishing a parallel structure where digital tokens are purpose-built to meet securities regulations from the outset, a point emphasized in the CryptoNews report. While some critics worry this could hinder innovation by imposing strict standards, supporters argue it would boost investor trust and curb fraudulent activity.

As the SEC continues to balance its responsibilities of safeguarding investors and encouraging innovation, Peirce’s endorsement of mirror tokens signals a growing belief that regulatory clarity, rather than enforcement alone, is essential for the crypto industry’s long-term development. With companies like

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin's Support for ZKsync and Its Influence on Layer 2 Scaling Technologies

- Vitalik Buterin's endorsement of ZKsync in November 2025 boosted its profile as a key Ethereum scaling solution with 15,000+ TPS and near-zero fees. - Institutional partnerships with Deutsche Bank and Sony , plus a 37.5M $ZK staking pilot, strengthened ZKsync's enterprise adoption and tokenomics. - The $0.74 token price surge and $15B capital inflow highlight market confidence in ZK-based infrastructure as Ethereum's primary scaling path. - Upcoming Fusaka upgrade (30,000 TPS) aims to challenge Arbitrum'

CyberCharge and SocialGrowAI Unite to Accelerate Web3 User Growth and Engagement

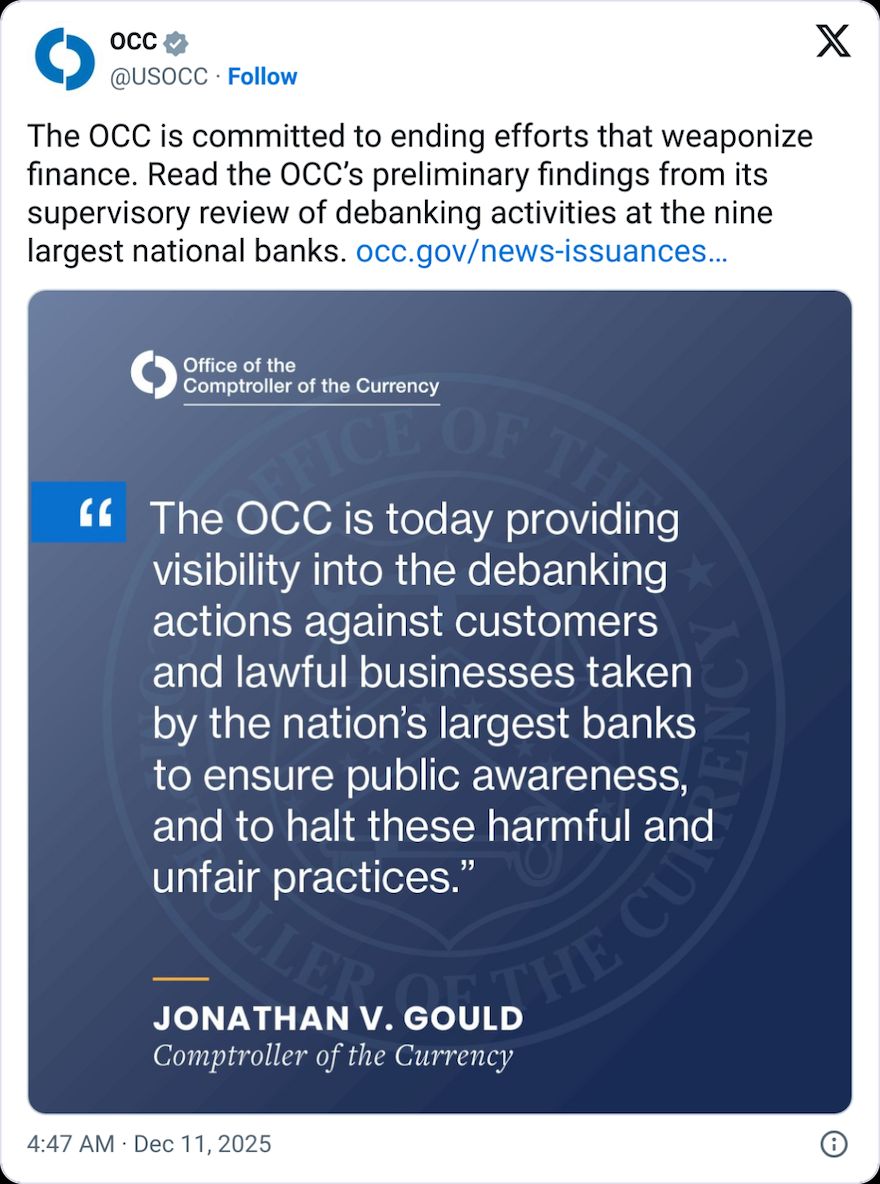

Crypto among sectors ‘debanked’ by 9 major banks: US regulator

Bitcoin Reverses From Channel Resistance as Whale Shorting Intensifies