Ozak AI’s Blockchain Driven by Artificial Intelligence: Is It Capable of Surpassing the Instability and Hazards of Cryptocurrency?

- Ozak AI's AI-blockchain fusion raises $4M in presale, with $OZ token surging 1,100% to $0.012 in Phase 6. - Project leverages OSN network and DePIN architecture for decentralized data, partnering with Pyth Network and Dex3 to enhance market intelligence. - Analysts forecast $1 by 2026 and $5 by 2027, citing 30% token allocation to community incentives and 962M tokens sold. - Faces risks from crypto volatility, regulatory uncertainty, and competition against AI firms like BigBear.ai and C3.ai.

Ozak AI, a cryptocurrency initiative powered by artificial intelligence and blockchain, has become a prominent choice for investors searching for significant growth prospects in a volatile digital asset landscape. Experts anticipate the token could climb to $1 by the close of 2026 and potentially reach $5 in 2027, based on a

The foundation of Ozak AI’s achievements lies in its seamless blend of AI and decentralized systems, notably through the Ozak Stream Network (OSN), which delivers secure, tamper-resistant financial data from distributed nodes. The platform’s AI-driven predictive agents utilize up-to-the-minute analytics to provide actionable insights, drawing the attention of major industry partners such as

Current market trends further reinforce Ozak AI’s prospects. As

Forecasts for Ozak AI’s price underscore both its volatility and growth potential. Should the token hit $1 by 2026, early backers could realize gains as high as 8,000%. Achieving a $5 price in 2027 would depend on ongoing adoption and institutional engagement, supported by the project’s plans for expanding AI agents and decentralized data-sharing, as discussed in

Nonetheless, reaching these ambitious goals comes with challenges. The unpredictable nature of the crypto sector, shifting regulations, and rivalry from established AI companies like BigBear.ai and C3.ai may influence Ozak AI’s future, as mentioned in a

To sum up, Ozak AI’s integration of artificial intelligence with blockchain, combined with key partnerships, makes it an appealing option for investors prepared to manage the uncertainties of emerging crypto ventures. As we move through 2025 to 2027, the project’s capacity to expand its infrastructure and sustain active community involvement will be vital for achieving its ambitious valuation goals.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Crash Reasons: Here is why Cryptos are Crashing

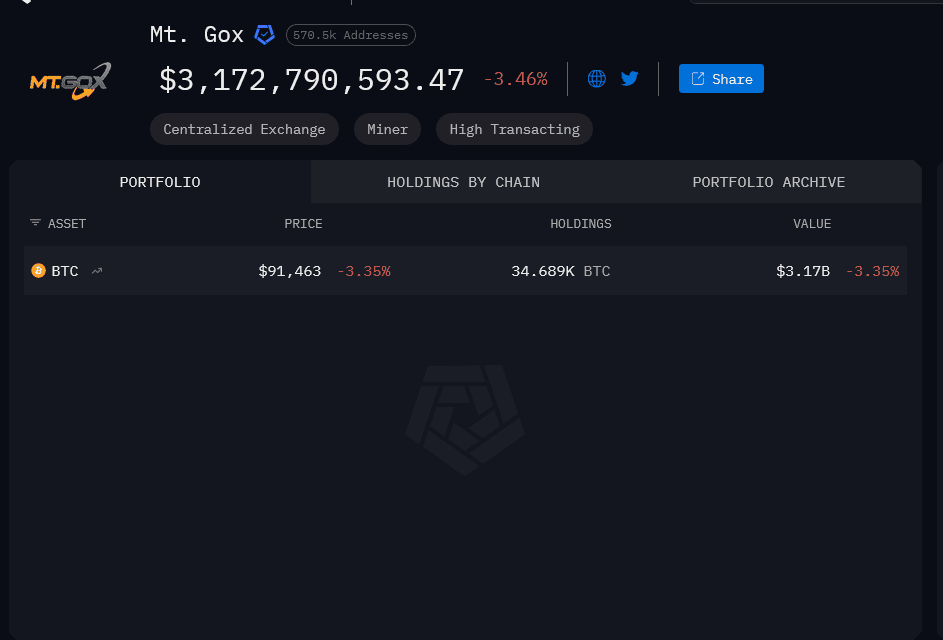

Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Bitcoin News Update: Canaan's Shift Toward Bitcoin Mining Drives 18% Increase and Sets New Record in Holdings

- Canaan Inc. shares surged 18% pre-market after Q3 revenue jumped 104.4% to $150.5M, surpassing estimates. - Bitcoin mining revenue soared 241% to $30.6M, driven by 267 BTC mined and 10 EH/s computing power sold. - Company boosted crypto holdings to 1,610 BTC/3,950 ETH by October 2025 and secured a 50,000-unit mining machine order. - Q4 revenue guidance ($175-205M) exceeds $148. 3M estimates, but risks include U.S. tariffs and regulatory shifts. - Analysts maintain "buy" ratings with a $3.00 price target

BCH Climbs 5.6% Over 24 Hours as Institutions Adjust Their Portfolios

- BCH surged 5.6% in 24 hours to $514.6 amid mixed 1-month (-3.14%) and 1-year (19.29%) performance. - Institutional investors reshaped holdings: Itau Unibanco cut 21.3% stake, while Goldman Sachs and Robeco increased positions. - Analysts raised price targets to $33-$35 with "neutral" ratings, though Zacks upgraded to "strong-buy" amid improved long-term outlook. - BCH maintains 1.24% institutional ownership, 12.92 P/E ratio, and stable financial metrics (quick ratio 1.53, debt-to-equity 2.00).