CZ: Kyrgyzstan has established a national cryptocurrency reserve, which includes BNB

Binance founder CZ stated that the stablecoin of Kyrgyzstan has been launched on BNB Chain. Central Bank Digital Currency (CBDC) is ready to be launched, and CBDC will be used for Kyrgyzstan government-related payments and other scenarios. The national cryptocurrency reserve has been established, including BNB.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Cycles, Volatility Triggers, and What’s Coming Next

Bitcoin Price Prediction: Bounce Ahead or One Last Dip?

These Five Key Drivers Could Boost XRP To $5 By 2026, Claims Top Analyst

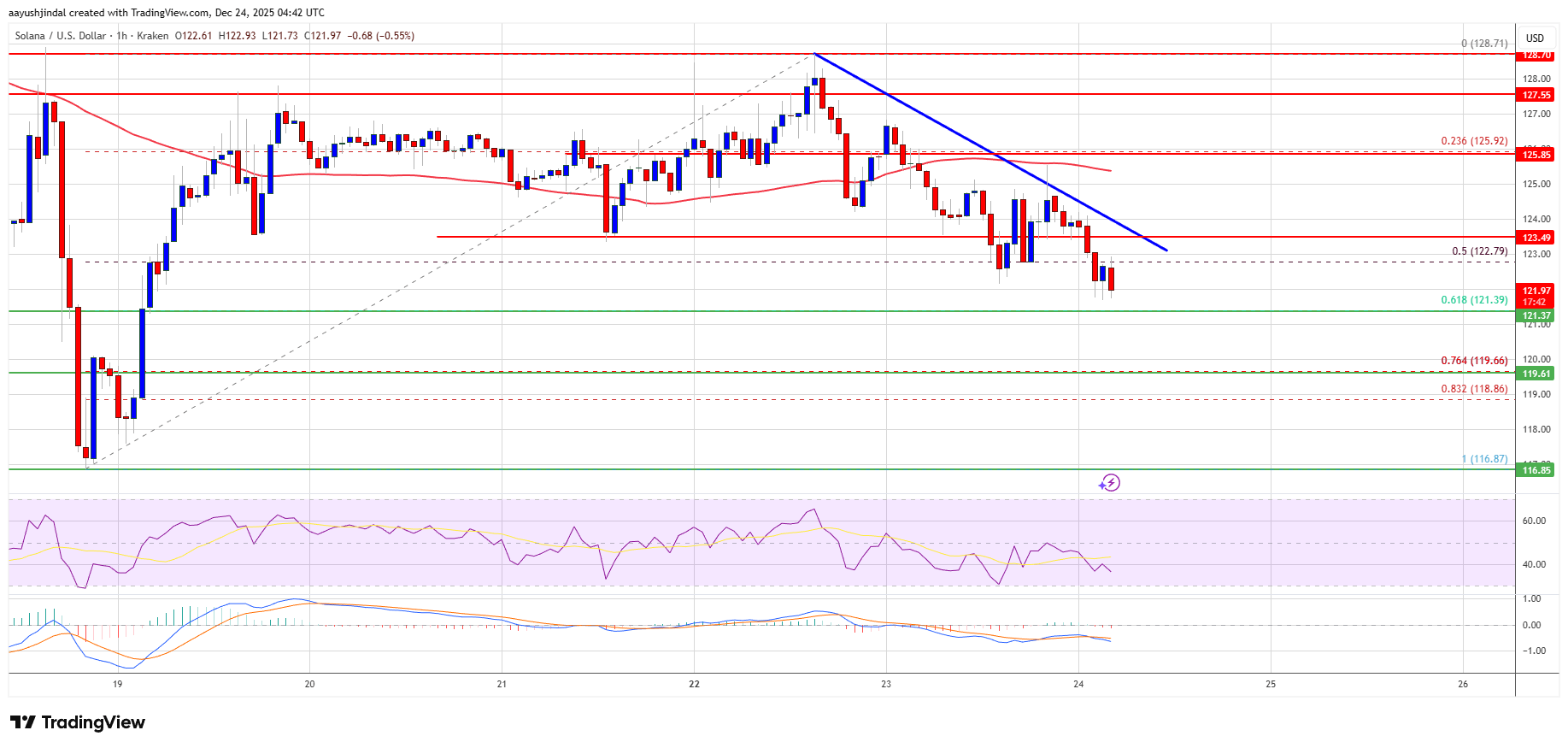

Solana (SOL) At Risk of Fresh Bearish Wave, Traders Turn Cautious