Institutions Adjust Investments: Shifting from TD Bank to Tokenized Assets and Dividend Exchange-Traded Funds

- Institutional investors are shifting portfolios toward tokenized funds and dividend ETFs amid evolving market dynamics. - Keystone Financial Planning sold 95% of TD Bank shares, reallocating to Schwab ETFs as part of risk-mitigation strategy. - Schwab's $1.5B TD Bank stock repurchase highlights growing institutional confidence in traditional banking sector recovery. - Laser Digital's $200M Tokenized Carry Fund bridges traditional finance and digital assets through regulated alternative investments. - TD

As market conditions shift, institutional investors are actively adjusting their holdings, revealing significant changes in both conventional and digital asset classes. While established financial institutions remain central, there is growing interest in innovative products such as tokenized funds and structured investment vehicles.

Keystone Financial Planning has recently sold off more than 95% of its shares in TD Bank (NYSE:TD), amounting to 114,695 shares worth $8.4 million, as reported by

At the same time,

Within the digital asset sector, Laser Digital has introduced the

TD Asset Management has also emphasized income-oriented strategies, announcing February payouts for its ETFs, such as the TD Canadian Bank Dividend Index ETF (TBNK), which distributes $0.10 per unit, as detailed in a

Analyst opinions on TD Bank remain divided, with a

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan’s Analyst Says Bitcoin Needs to Hit $170k to Match Gold’s Private Investment Value

Samourai Wallet Developer Sentenced to 5 Years and Fined $250k; Can He Appeal After Clarity Act?

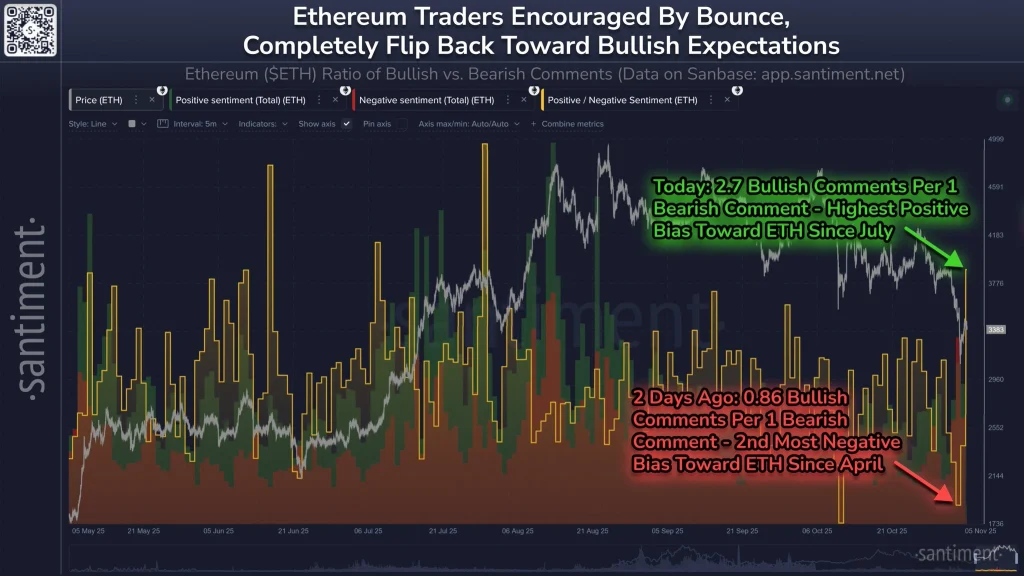

Ethereum Traders Pivot to Extreme Bullish Amid Renewed Whale Demand; Is ETH Price Rebound Next?

Asia Morning Briefing: Bitcoin Stabilizes as Altcoins Flash Early Strength