AAVE up 3.51% over the past week following Aave Labs’ acquisition of Stable Finance to broaden its retail DeFi services

- Aave Labs acquires Stable Finance to expand retail DeFi offerings, enhancing consumer-friendly yield solutions. - Aave (AAVE) rose 3.51% in 7 days despite 17.48% monthly decline, reflecting mixed investor sentiment. - The $37B TVL platform navigates regulatory ambiguity as U.S. lawmakers restrict yield-bearing stablecoins. - Strategic moves like Maple Finance integration and Horizon RWA launch aim to strengthen DeFi market dominance.

As of October 26, 2025,

Aave Labs recently revealed its acquisition of Stable Finance, a San Francisco-based

With total value locked (TVL) exceeding $37 billion, Aave maintains its position as a leading force in DeFi, especially as interest in on-chain yield remains robust despite ongoing regulatory challenges. The Stable Finance acquisition is set to enhance Aave’s presence among retail users, as other industry players like Coinbase and Crypto.com also broaden their DeFi yield offerings.

Although the GENIUS Act was enacted by U.S. lawmakers to limit yield-bearing stablecoins, Aave’s decentralized lending protocols have yet to be directly addressed by regulation, allowing the platform to continue expanding. This regulatory uncertainty has created friction with traditional banks but also paved the way for DeFi to innovate and grow.

This acquisition also reflects a wider movement among DeFi projects to improve their consumer-oriented products in order to attract more retail participants. As more users look for straightforward and accessible ways to earn yield, Aave’s expansion into retail DeFi is viewed as a timely response to shifting market needs.

Backtesting Hypothesis

To evaluate how Aave (AAVE) might perform amid market swings and significant events, one could use a backtesting approach based on defined criteria. For instance, analyzing Aave’s price action after a 10% single-day drop—a typical marker for major market stress—could provide insights.

Such a strategy would treat a 10% decline as a signal and track the subsequent price recovery over periods like 1, 5, and 30 days. Incorporating risk management tools such as stop-loss and take-profit orders would help mimic real trading conditions. By reviewing outcomes after each event, investors can gain a clearer picture of Aave’s historical reactions and its potential to recover from steep declines.

This method fits with Aave’s recent price fluctuations and offers a systematic way to assess the token’s ability to withstand short-term market disruptions. The findings could help guide both tactical trades and longer-term investment choices.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

YouTube Lets U.S. Creators Receive Earnings in PayPal’s PYUSD Stablecoin

Bitget Releases Major Upgrades to GetAgent With Smarter Responses and Free Access for All Users

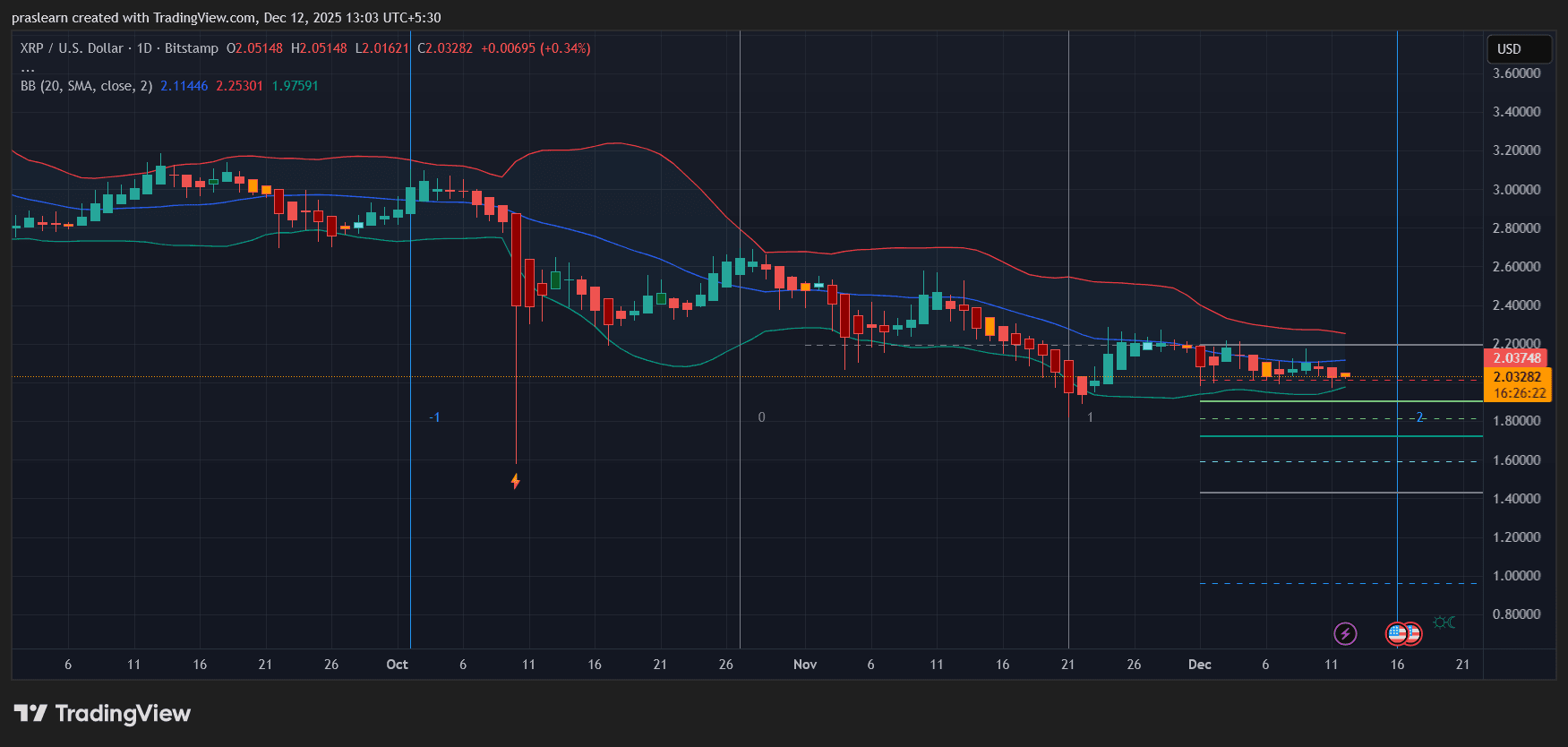

Will Fed Uncertainty Cap XRP’s Upside in 2026?

They already knew the TGA Game of the Year in advance, earning tens of thousands of dollars.

Violating history, yet persisting.