JPMorgan to Accept Bitcoin and Ether as Loan Collateral

- JPMorgan introduces crypto collateral loans for institutions.

- Launch targeted by late 2025.

- Impacts on Bitcoin, Ether markets expected.

JPMorgan Chase & Co. announced an upcoming initiative to permit institutional clients globally to use Bitcoin and Ether as collateral for loans, scheduled for late 2025 implementation.

The move signifies a pivotal integration of cryptocurrencies with traditional banking, potentially accelerating institutional adoption and affecting market dynamics for Bitcoin and Ether.

JPMorgan Integrates Crypto as Loan Collateral

JPMorgan Chase & Co. is set to enable its institutional clients to use Bitcoin (BTC) and Ether (ETH) as collateral for loans. This marks a substantial step toward integrating crypto assets with traditional banking services. The implementation is anticipated by 2025.

The initiative involves key figures such as Jamie Dimon, CEO of JPMorgan, known for his modified stance on cryptocurrencies. While no official statements have been made, this move could significantly affect the adoption of digital assets by institutions. JPMorgan’s Insights on Blockchain and Asset Tokenization

The financial impact could be considerable, potentially propelling institutional Bitcoin and Ether adoption. Increased demand for secure custody solutions and a shift towards more extensive use of crypto collateral in banking are foreseeable outcomes.

This program will necessitate dependable third-party custodians, stirring interest in institutional-grade custody solutions. With the launch by late 2025, observable changes in total value locked (TVL) and institutional DeFi activity are anticipated.

Historical precedents with firms like BNY Mellon and Morgan Stanley showcased increased capital flows into Bitcoin and Ether upon similar product introductions. Future trends are likely to echo these past movements post-launch.

The regulatory landscape remains unchanged for now, with no updates from bodies like the SEC or CFTC. However, the institutional adoption of crypto lending could pressure agencies to provide clearer guidelines, impacting regulatory and compliance frameworks.

“No official statement found regarding the collateral program for Bitcoin and Ether.” – Jamie Dimon, CEO, JPMorgan Chase & Co.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From the Grey Area to the Mainstream Track? The Legalization Battle and Future Landscape of Sports Prediction Markets

Prediction market platforms Kalshi and Polymarket are rapidly expanding in the sports sector and have reached a partnership with the NHL. However, they face skepticism from leagues such as the NBA and NFL, as well as strong opposition from the gambling industry, while also becoming embroiled in regulatory and legal disputes. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

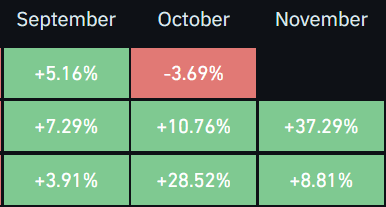

Crypto Market Performance: Why November Could Become the Next Key Month

The crypto market has turned bullish again. Here’s why November 2025 could be another strong month for bitcoin and other cryptocurrencies.

Vitalik Buterin Praises ZKsync’s Atlas Upgrade for Ethereum Scaling

Quick Take Summary is AI generated, newsroom reviewed. Vitalik Buterin praised ZKsync's Atlas upgrade as "underrated and valuable" for Ethereum scaling. The upgrade is cited to enable over 15,000 TPS, one-second finality, and near-zero transaction fees. Atlas fundamentally changes L2s' relationship with L1 by using Ethereum as a real-time, shared liquidity hub. This innovation strengthens Ethereum's backbone for institutional use cases like Real-World Assets (RWA).References ZKsync has been doing a lot of